AI overview of Active Noise and Vibration Control System Market

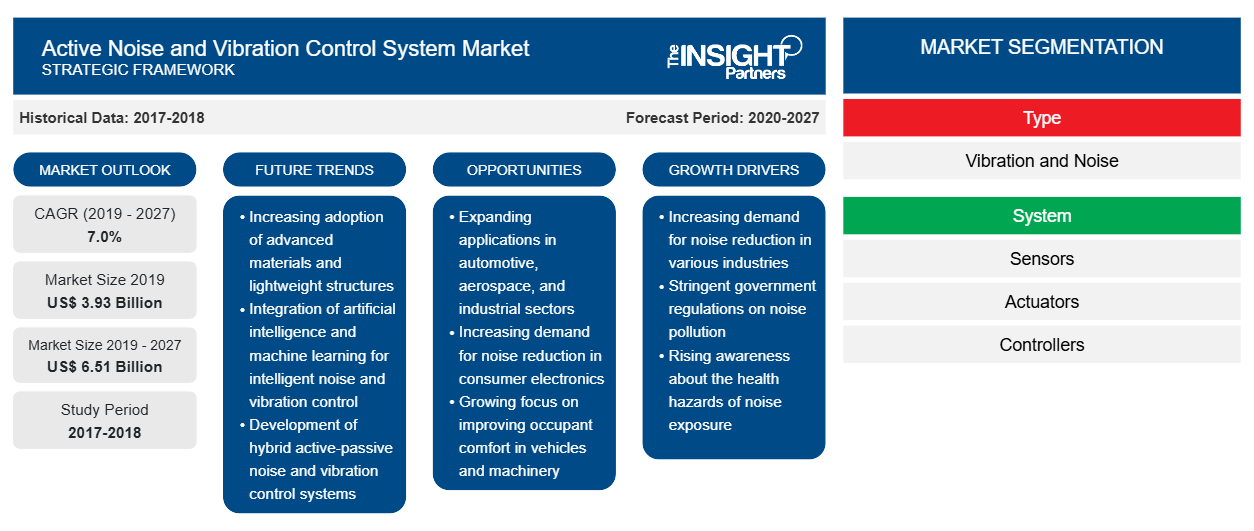

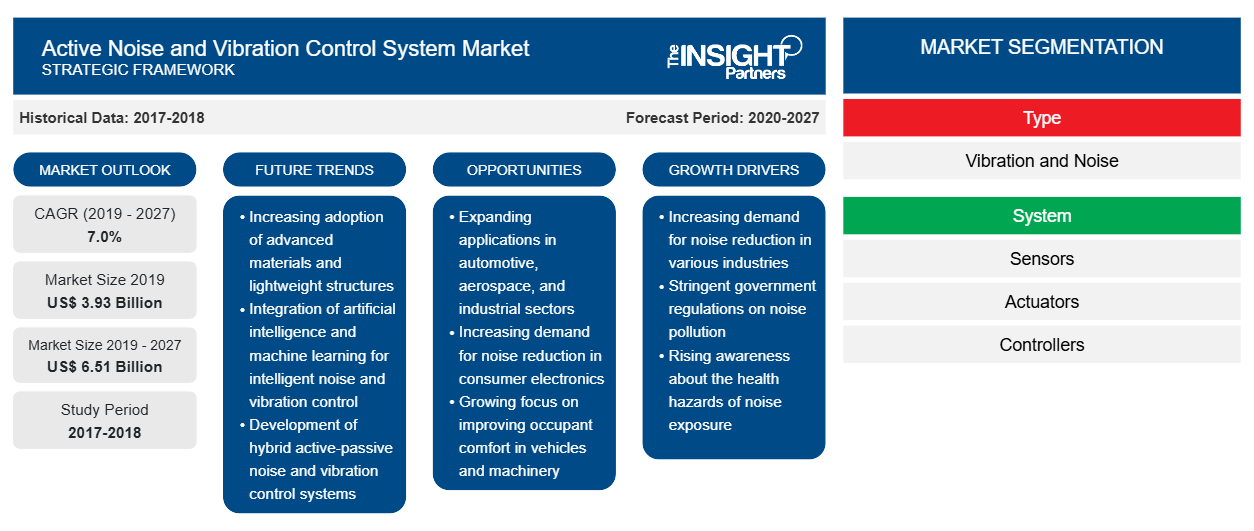

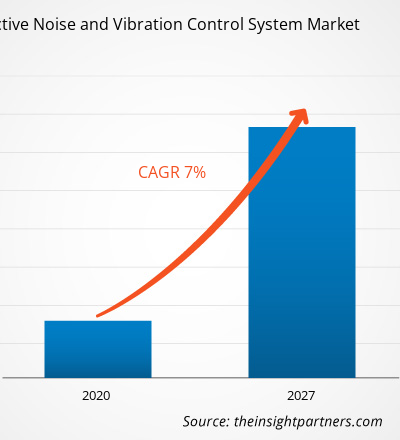

The Active Noise and Vibration Control System Market is projected to grow significantly, reaching a market size of US$ 6.51 billion by 2027, up from US$ 3.93 billion in 2019, with a robust CAGR of 7.0% from 2019 to 2027. This growth is driven by increasing demand for noise reduction across various sectors, including aerospace and consumer electronics, alongside stringent regulations on noise pollution. Key trends include the integration of artificial intelligence for smarter control solutions and the development of lightweight materials for enhanced performance. As industries prioritize occupant comfort and health, the Active Noise and Vibration Control System Market is poised for substantial expansion, presenting numerous opportunities for innovation and collaboration.

In terms of revenue, the global active noise and vibration control system market was valued at US$ 3,925.61 million in 2019 and is projected to reach US$ 6,505.28 million by 2027; it is expected to grow at a CAGR of 7.0% during the forecast period from 2020 to 2027.

The active noise and vibration control system market is broadly segmented into five major regions—North America, Europe, APAC, MEA, and SAM. The aerospace and defense industry in North America is matured with the existence of a large number of aircraft manufacturers, and continuous support from the US DoD. The demand for advanced technologies is tremendous in the region, with all the end users mentioned above are well aware of newer technologies. The US DoD continuously invests time and amounts towards the advancements of existing fleet and development of robust technology ground armored vehicles as well as marine vessel with an objective to maintain a mission-ready force. The presence of a large number of active noise and vibration control system manufacturers in the region is supporting the ever-rising demand, which is thereby boosting the active noise and vibration control system market

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Active Noise and Vibration Control System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Active Noise and Vibration Control System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights–Active Noise and Vibration Control System Market

Increasing Adoption of Active Systems in Railway Manufacturing

The railway industry across the world is growing at a considerable rate over the years, with several on-going technological advancements reflecting safer and comfortable journeys. The railway equipment (bogies and load carts) experience significant vertical vibrations and noise, which increase several types of risk while in operations. To suppress the vibrations and noise, several railway equipment manufacturers are increasingly focusing on the adoption of noise and vibration control systems. The passive noise and vibration control is prevalent among the railway manufacturers as these systems allow the manufacturers to offer their customers with safer and comfortable products. However, the majority of the passive systems are hydraulic systems, and in recent years, the railway equipment manufacturers are emphasizing electronically/electrically controlled systems, which is reflecting rise in attraction toward active noise and vibration systems. An active system with inertial mass actuators mounted on the bogies can control low frequency noise and vibrations inside the compartments. In addition, the active systems are generally electromechanical systems, which is the becoming the key preference among the railway equipment manufacturers. This factor is expected to generate significantly higher demand for active systems among the railway equipment manufacturers, thereby catalyzing the active noise and vibration control system market.

Type Segment Insights

Based on type, the vibration segment dominated the global active noise and vibration control system market in 2019. Active vibration control systems are isolation systems that dynamically respond to external vibrations. These systems are used to reduce friction and control vibrations in moving or static machines.

System Segment Insights

Based on system, the actuators segment dominated the global active noise and vibration control system market in 2019. Actuators are integrated into the active noise and vibration control systems to control various forces inside the plant to enhance the overall operation. These actuators use different technologies such as piezoelectric, electrodynamics, and hydraulic electrodynamics.

Industry Segment Insights

Based on industry, the aerospace segment dominated the global active noise and vibration control system market in 2019. The aerospace industry is flourishing at an exponential rate over the years with a large number of productions and deliveries. The aircraft manufacturers and component manufacturers are witnessing significant pressures from the commercial aviation sector end users to deliver higher numbers of aircraft.

The market players focus on new product innovations and developments by integrating advanced technologies and features in their products to compete with the competitors.

- In 2019, Creo Dynamics announced its majority stakes acquisition by Faurecia, to combine the company's competence in automotive active Noise Control and acoustics with Faurecia and develop unique new solutions to the market.

- In 2019, Terma announced that it has signed a contract with UASF to provide 3D-Audio systems for A-10 aircraft.

- In 2018, Vicoda GmbH announced that it has delivered tuned mass dampers for footbridges in Gent to control and reduce pedestrian-induced vibrations and offers comfort requirements by preventing “lock-in” effect.

The global active noise and vibration control system market has been segmented as follows:

Active Noise and Vibration Control System Market Regional Insights

The regional trends and factors influencing the Active Noise and Vibration Control System Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Active Noise and Vibration Control System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Active Noise and Vibration Control System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 3.93 Billion |

| Market Size by 2027 | US$ 6.51 Billion |

| Global CAGR (2019 - 2027) | 7.0% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Active Noise and Vibration Control System Market Players Density: Understanding Its Impact on Business Dynamics

The Active Noise and Vibration Control System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Active Noise and Vibration Control System Market top key players overview

Active Noise and Vibration Control System Market – By Type

- Vibration

- Noise

Active Noise and Vibration Control System Market – By System

- Sensors

- Actuators

- Controllers

- Dampers

Active Noise and Vibration Control System Market – By System

- Aerospace

- Fixed Wing

- Rotary Wing

- Defense

- Ground Vehicle

- Naval Vessels

- Railway

- General Industries

- Manufacturing

- Energy & Power

Active Noise and Vibration Control System Market – By System

- Sensors

- Actuators

- Controllers

- Dampers

Active Noise and Vibration Control System Market- By Region

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

- South America (SAM)

- Brazil

- Rest of SAM

Active Noise and Vibration Control System Market – Companies Profiles

- FABREEKA

- Honeywell International Inc.

- HUTCHINSON

- Terma A/S

- Moog Inc.

- Parker Hannifin

- Faurecia Creo AB

- Supashock

- Trelleborg AB

- VICODA GmbH

Frequently Asked Questions

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Active Noise and Vibration Control System Market

- Honeywell International Inc.

- Fabreeka International Inc.

- Moog Inc.

- Parker Hannifin Corporation

- Faurecia Creo AB

- Supashock Advanced Technologies

- Trellborg AB

- Hutchinson

- Terma A/S

- Vicoda GmbH

Get Free Sample For

Get Free Sample For