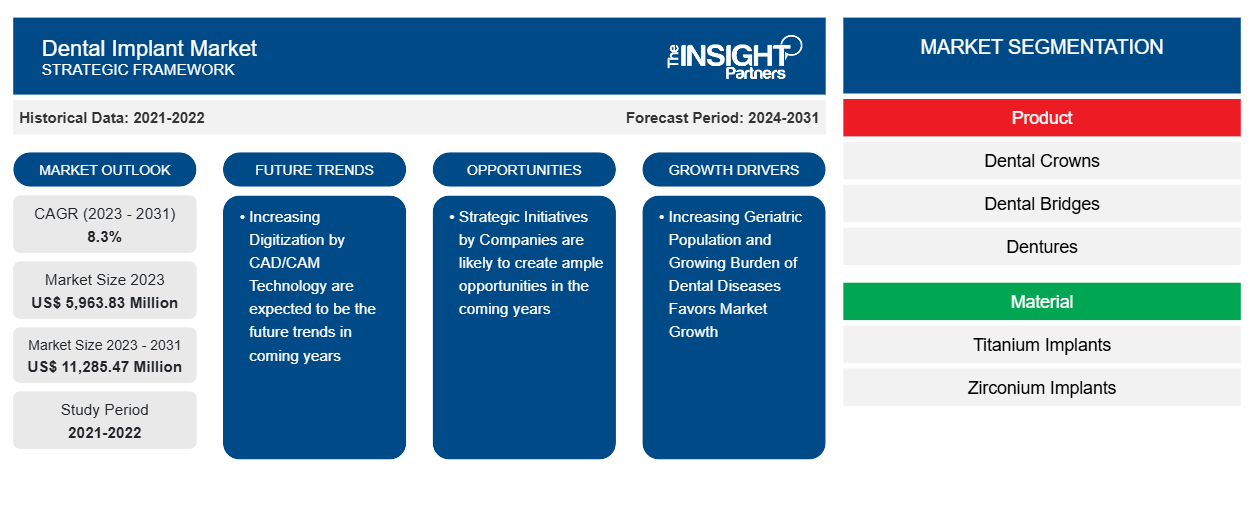

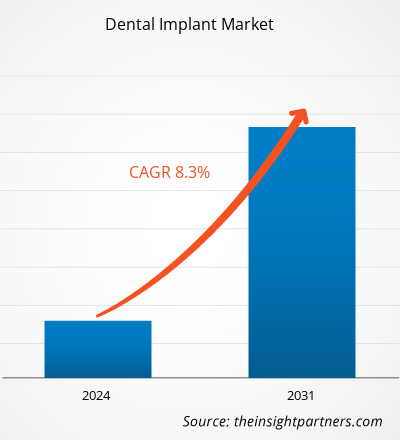

The dental implant market size is projected to reach US$ 11.28 billion by 2031 from US$ 5.96 billion in 2023. The market is expected to register a CAGR of 8.3% during 2023–2031. Increasing digitization through the use of CAD/CAM technology is likely to bring new trends in the dental implant market in the coming years.

Dental Implant Market Analysis

The factors driving the dental implant market include the increasing geriatric population and the growing burden of dental diseases, followed by the surging demand for cosmetic dentistry. Additionally, increasing medical tourism and surging awareness about dental diseases and oral health due to the various government campaigns and initiatives are expected to amplify the market growth. Moreover, increasing strategic initiatives among market players, such as product launches, product approvals, mergers, collaborations, and acquisitions, are expected to create ample opportunities in the coming years.

Dental Implant Market Overview

The market growth is ascribed to the increasing geriatric population, the growing burden of dental diseases, and the surging demand for cosmetic dentistry. North America is expected to dominate the dental implant market. Asia Pacific is anticipated to register a significant growth rate owing to the surging medical tourism and increasing prevalence of dental diseases and tooth loss. China accounts for the major market share. India is likely to register a significant growth rate. India has emerged as a hub for dental tourism. People from different parts of the world prefer to perform their dental procedures in India owing to the significant cost difference, high-quality care, and skilled dentists available in the country. According to FMS Dental, dental treatment costs in India are lower by at least 60–80% when compared to similar procedures in the US and the UK through internationally acclaimed dental facilities using advanced and latest technologies. In India, the price of a complete denture ranges from US$ 300 to US$ 1,500, and the price of a partial denture ranges from US$ 200 to US$ 1,000. The low cost in the Indian market attracts people from other countries to undergo dental procedures.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Dental Implant Market Drivers and Opportunities

Increasing Geriatric Population and Growing Burden of Dental Diseases

As people age, they are more likely to encounter dental issues, including tooth loss, which increases the demand for dental implants. The rate at which the world's population is aging is unparalleled. According to the WHO facts published in October 2022, one in six individuals worldwide will be aged 60 or over by 2030. By then, the number of people aged 60 and above will increase from 1 billion in 2020 to 1.4 billion. The population of people aged 60 years and above will quadruple to 2.1 billion by 2050. Furthermore, it is anticipated that the population of those aged 80 or older will triple between 2020 and 2050, reaching 426 million. The rate of gum disease increases with age, and adults aged 65 years and above have some form of gum disease. As per the Centers for Disease Control and Prevention, in the US, ~70.1% of adults over the age of 65 had periodontal disease in 2020. Hence, the need for dental procedures rises as people get older and experience dental problems, increasing the demand for dental implants.

Dental diseases often necessitate the need for dental implants. Dental implants are a popular and effective long-term solution for individuals who lose one or more teeth due to periodontal disease, injury, or other reasons. The increase in the burden of dental diseases globally and the rise in the geriatric population boost the demand for dental implants, thereby driving the market.

Strategic Initiatives by Companies

Companies operating in the dental implants market constantly focus on strategic developments such as product development, collaborations, agreements, and new product launches, which help them improve their sales, increase their geographic reach, and improve their capacities to cater to a larger customer base. A few strategic initiatives taken by key players operating in the dental implants market are mentioned below:

- BioHorizons introduced Tapered Pro Conical, its first dental implant with a deep conical connection, in June 2024. Tapered Pro Conical leverages the unique and successful Tapered Pro macro design with the proven and patented CONELOG connection to provide clinicians with a predictable solution for rapid treatment options, from single tooth to entire arch. The novel implant reflects the company's commitment to developing advanced products that improve clinical performance and workflow efficiency.

- ZimVie Inc. launched the TSX Implant in Japan in February 2024. The immediate extraction, standard loading protocols, implantation predictability, and primary stability in soft and dense bone are all features of TSX implants. The implant delivers peri-implant health, crestal bone maintenance, long-term osseointegration, and prosthetic stability by incorporating features based on more than two decades of real-world clinical data. The introduction of TSX in Japan helps the company compete head-to-head with superior market leaders in the dental implant industry.

- Straumann acquired GalvoSurge, a Swiss medical device manufacturer in the dental field, in May 2023. The acquired company specializes in implant care and maintenance solutions, offering a novel concept to support the treatment of peri-implantitis. Through the acquisition, Straumann serves patients globally, regardless of the implant system, and delivers innovative care for peri-implantitis conditions.

Therefore, strategic initiatives by various companies focusing on the development of advanced implants are likely to offer growth opportunities to the dental implants market in the coming years.

Dental Implant Market Report Segmentation Analysis

Key segments that contributed to the derivation of the dental implant market analysis are product, material, and end user.

- Based on product, the dental implant market is categorized into dental crowns, dental bridges, dentures, abutments, and others. The dental crowns segment held the largest share of the market in 2023 and is expected to register the highest CAGR in the market during 2023–2031.

- By material, the dental implant market is segmented into titanium, zirconium, ceramic, and others. The titanium segment accounted for the largest share of the market in 2023. The zirconium segment is projected to register the highest CAGR in the market during 2023–2031.

- In terms of end user, the dental implant market is segmented into hospitals and clinics, dental laboratories, and others. The hospitals and clinics segment dominated the market in 2023 and is anticipated to register the highest CAGR during 2023–2031.

Dental Implant Market Share Analysis by Geography

The geographic scope of the dental implant market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America held a significant share of the market in 2023. The growth of the market in this region is attributed to the increase in prevalence of dental diseases, wide acceptance of technological advancements in dental implants, and an surge in number of dental visits. In addition, the rising government support regarding dental coverage for dental services across the countries also favors the growth of the dental implant market. The US is expected to account for the largest market share. As per the American Academy of Cosmetic Dentistry, ~US$ 2.75 billion is spent annually on cosmetic dentistry in the US. Moreover, numerous private and government organizations provide reimbursement policies to raise awareness of oral and dental care in the country. For instance, the American Academy of Pediatric Dentistry, an authority on children's oral health, provides a policy on third-party reimbursement to enhance medical care and manage patients with special healthcare needs. In addition, the CDC provides a Dental Public Health Residency Program to develop skilled specialists in dental public health. This residency program offers lucrative opportunities for dental participants to achieve improved oral health and guided practice in collaboration with public health.

Dental Implant Market Regional Insights

The regional trends and factors influencing the Dental Implant Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Dental Implant Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Dental Implant Market

Dental Implant Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.96 Billion |

| Market Size by 2031 | US$ 11.28 Billion |

| Global CAGR (2023 - 2031) | 8.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

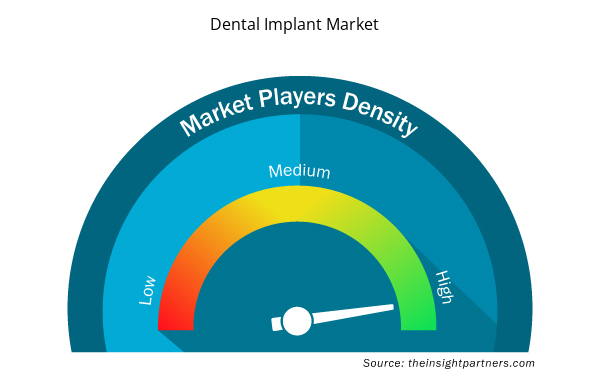

Market Players Density: Understanding Its Impact on Business Dynamics

The Dental Implant Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Dental Implant Market are:

- DentiumUSA

- Dentsply Sirona Inc

- Bicon, LLC

- ZimVie Inc

- BEGO GmbH & Co. KG

- BioHorizons Inc,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Dental Implant Market top key players overview

Dental Implant Market News and Recent Developments

The dental implant market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the dental implant market are listed below:

- The BEGO Group launched the Semados Esthetic Line. Under the motto "Perfection down to the smallest detail," this innovative product line represents a significant advancement in dentistry. The Semados Esthetic Line is distinguished by its revolutionary concave design of the prosthetic components. This design is key to achieving long-term stable and aesthetically outstanding results. (Source: BEGO Group, Company Website, April 2024)

- ZimVie Inc. introduced the TSX Implant in Japan. As ZimVie's largest dental implant market in APAC and the fifth largest market globally, Japan is strategically important to ZimVie. The launch of TSX in the country allows the company to compete head-to-head with premium market leaders in the dental implant space. (Source: ZimVie Inc., Company Website, February 2024)

Dental Implant Market Report Coverage and Deliverables

The "Dental Implant Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Dental implants market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Dental implants market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Dental implants market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the dental implant market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Material, and End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global dental implant market is estimated to register a CAGR of 8.3% during the forecast period.

The dental implant market is estimated to reach US$ 11.28 billion by 2031.

DentiumUSA; Dentsply Sirona Inc; Bicon, LLC; ZimVie Inc; BEGO GmbH & Co. KG; BioHorizons Inc; Nobel Biocare Services AG; MEGA'GEN IMPLANT CO., LTD; LYRA ETK; and Institut Straumann AG are among the key players operating in the dental implant market.

North America dominated the dental implant market in 2023.

Increasing geriatric population, growing burden of dental diseases, and surging demand for cosmetic dentistry are the most influential factors responsible for the market growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Dental Implants Market

- DentiumUSA

- Dentsply Sirona Inc

- Bicon, LLC

- ZimVie Inc

- BEGO GmbH & Co. KG

- BioHorizons Inc

- Nobel Biocare Services AG

- MEGA’GEN IMPLANT CO.,LTD

- LYRA ETK

- Institut Straumann AG

Get Free Sample For

Get Free Sample For