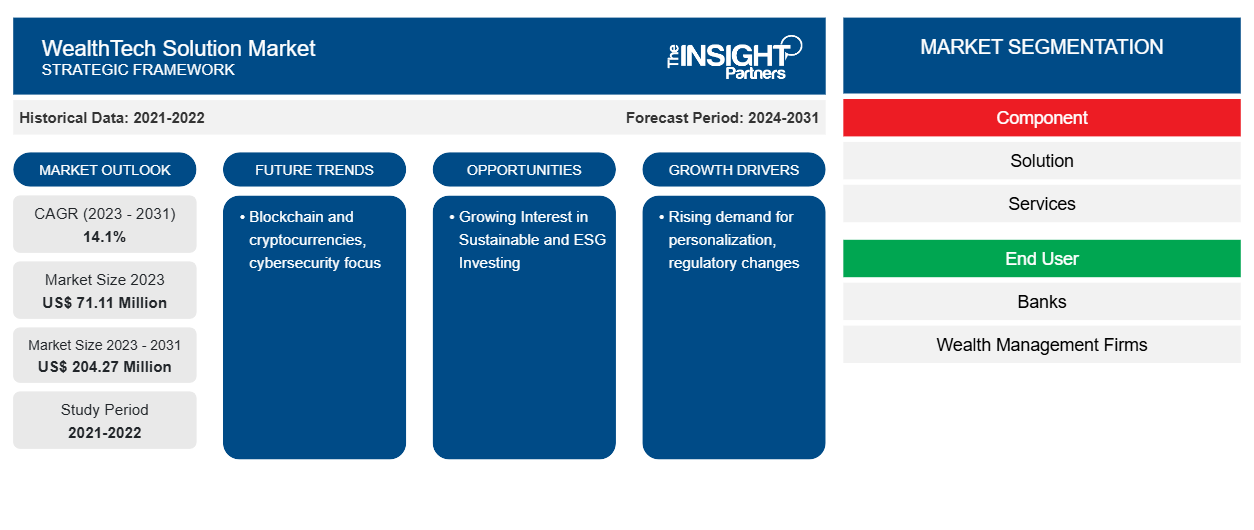

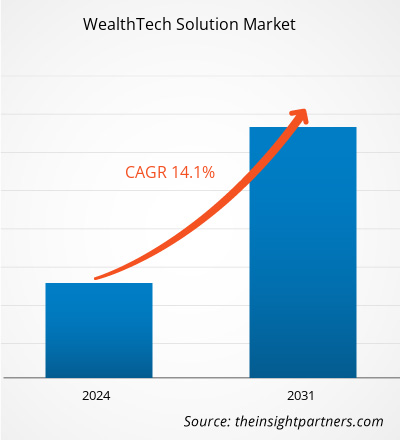

The wealthTech solution market size is projected to reach US$ 204.27 million by 2031 from US$ 71.11 million in 2023. The market is expected to register a CAGR of 14.1% during 2023–2031. Blockchain and cryptocurrencies and cybersecurity focus are likely to remain a key trend in the market.

WealthTech Solution Market Analysis

Emerging technologies like blockchain, AI, and machine learning are causing a tremendous disruption in the financial services sector. A new era in finance known as WealthTech, or wealth management technology, is being ushered in by this wave of innovation. Its goal is to improve financial advising and asset management services by utilizing these technologies.

WealthTech Solution Market Overview

WealthTech transforms the way assets and finances are managed by fusing technology and wealth management. It enhances investing and personal finance by utilizing advancements like blockchain, machine learning, and artificial intelligence. WealthTech developers create software that uses artificial intelligence (AI) to generate personalized financial suggestions and automate laborious asset management procedures.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

WealthTech Solution Market Drivers and Opportunities

Rising Demand for Personalization to Favor the Market

WealthTech solutions can offer customized product recommendations and portfolio allocations that are in line with each investor's financial objectives, risk tolerance, and liquidity requirements thanks to sophisticated algorithms and large datasets. By adding even more personalization to the experience, contextual cues and notifications improve user engagement. Regarding FinTech within the wealth management ecosystem, these technologies provide investors a substantial chance to leverage data to make better decisions.

Growing Interest in Sustainable and ESG Investing

For many customers, governments, and companies, environmental, social, and governance (ESG) is at the top of their list of priorities. ESG issues have grown in importance as efforts are made around the globe to promote a more equitable and sustainable environment that benefits everyone. In the wealth management industry, ESG investing is beginning to gain traction due to new laws and client demand. WealthTech has made investing more accessible to the general public. Investments were thought to be reserved for the wealthy, but WealthTech has brought the process closer to the general public, enabling everyone to make as much money as they can. WealthTech has expanded access to ESG-based portfolios and made retail investing more accessible to a larger audience.

WealthTech Solution Market Report Segmentation Analysis

Key segments that contributed to the derivation of the wealthTech solution market analysis are XX.

- Based on the component, the wealthTech solution market is divided into solution and services. The solution segment held the largest share in 2023.

- Based on the end user, the market is divided into banks, wealth management firms, and others.

- Based on the organization size, the market is divided into large enterprises and small and medium-sized enterprises.

- Based on the deployment mode, the market is divided into cloud-based and on-premises.

WealthTech Solution Market Share Analysis by Geography

The geographic scope of the wealthTech solution market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America holds a significant share of the wealthTech solution market in 2023. The region is home to major financial hubs. Also, the technological landscape in countries like the US and Canada is well established. Wealth managers are rapidly changing their strategies to integrate technological advancements into their wealth management solutions. This is leading the growth of the market in the region.

WealthTech Solution Market Regional Insights

The regional trends and factors influencing the WealthTech Solution Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses WealthTech Solution Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for WealthTech Solution Market

WealthTech Solution Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 71.11 Million |

| Market Size by 2031 | US$ 204.27 Million |

| Global CAGR (2023 - 2031) | 14.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

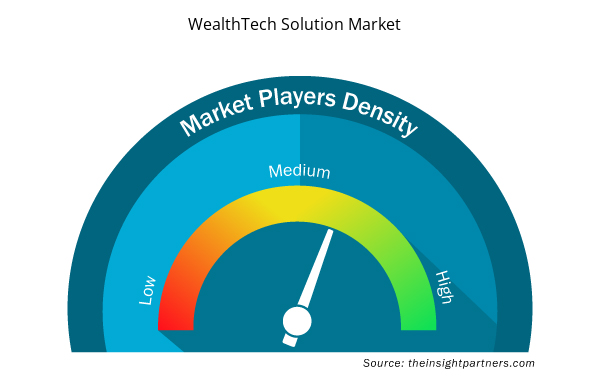

WealthTech Solution Market Players Density: Understanding Its Impact on Business Dynamics

The WealthTech Solution Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the WealthTech Solution Market are:

- FinMason, Inc.

- aixigo AG

- InvestCloud, Inc.

- WealthTechs Inc.

- Valuefy Solutions Private Limited

- 3rd-eyes analytics AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the WealthTech Solution Market top key players overview

WealthTech Solution Market News and Recent Developments

The wealthTech solution market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the wealthTech solution market are listed below:

- FinMason announced that it had been chosen to provide fixed-income risk estimates by RiskPro, a cutting-edge risk profile and portfolio creation technology that assists Financial Advisors in enhancing the investor experience. (Source: FinMason, Press Release, May 2020)

- Synechron, Inc., a leading global digital transformation consulting firm focused on financial services and technology organizations, announced its acquisition of Dreamix, a custom software development company founded in 2006. Dreamix, headquartered in Sofia, Bulgaria, is a bespoke end-to-end software engineering and digital product/application development company. Dreamix caters to the customized needs of an array of globally renowned enterprise clients across key industries, including Aviation, Transportation, RegTech, FinTech, ESG and Healthcare. The acquisition of Dreamix was completed on March 26, 2024. (Source: Synechron, Press Release, April 2024)

WealthTech Solution Market Report Coverage and Deliverables

The “WealthTech Solution Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- WealthTech solution market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- WealthTech solution market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- WealthTech solution market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the wealthTech solution market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Advanced Planning and Scheduling Software Market

- Diaper Packaging Machine Market

- Medical Audiometer Devices Market

- Ceiling Fans Market

- Batter and Breader Premixes Market

- Aesthetic Medical Devices Market

- Surety Market

- Smart Locks Market

- Lymphedema Treatment Market

- Emergency Department Information System (EDIS) Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component , End User , Organization Size , and Deployment Mode Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Austria, BeNeLux, Brazil, Canada, China, France, Germany, India, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Switzerland, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America dominated the wealthTech solution market in 2023.

Rising demand for personalization and regulatory changes are expected to drive the wealthTech solution market.

Blockchain and cryptocurrencies and cybersecurity focus are likely to remain key trends in the market.

FinMason, Inc., aixigo AG, InvestCloud, Inc., WealthTechs Inc., Valuefy Solutions Private Limited, 3rd-eyes analytics AG, BlackRock, Inc., Synechron, Wealthfront Inc., InvestSuite are among the leading payers operating in the wealthTech solution market.

The wealthTech solution market size is projected to reach US$ 204.27 million by 2031

The wealthTech solution market is expected to register a CAGR of 14.1% during 2023–2031

Get Free Sample For

Get Free Sample For