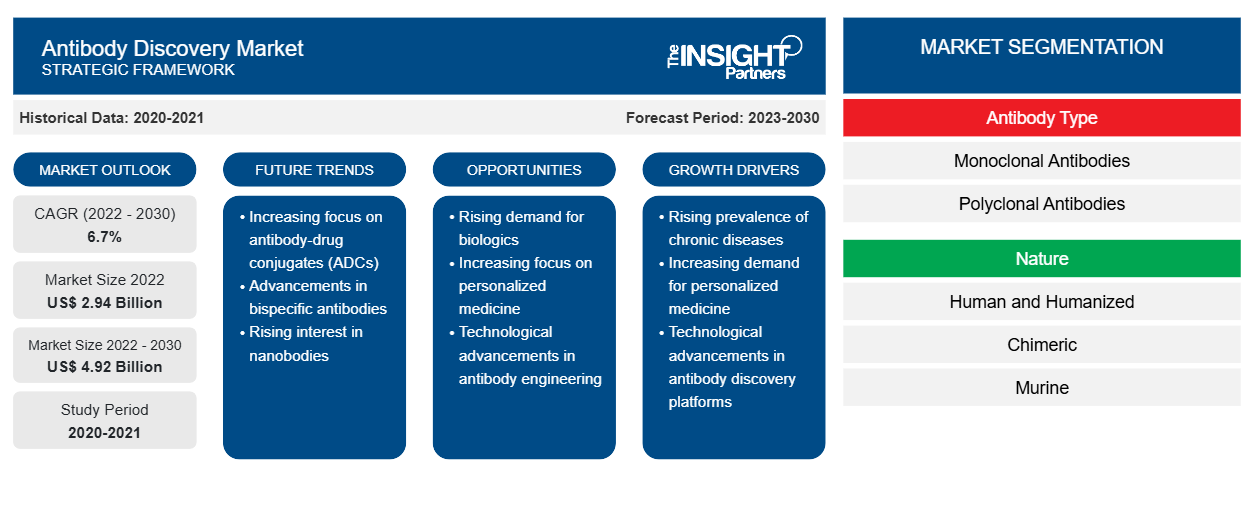

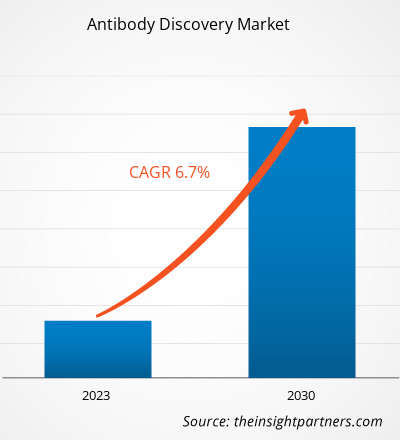

[تقرير بحثي] من المتوقع أن يرتفع حجم سوق اكتشاف الأجسام المضادة من 2.94 مليار دولار أمريكي في عام 2022 إلى 4.92 مليار دولار أمريكي بحلول عام 2030؛ ومن المتوقع أن ينمو السوق بمعدل نمو سنوي مركب قدره 6.7٪ خلال الفترة 2022-2030.

وجهة نظر المحلل:

يتضمن التقرير آفاق النمو بسبب اتجاهات سوق اكتشاف الأجسام المضادة الحالية وتأثيرها المتوقع خلال فترة التنبؤ. تعمل عوامل مثل الانتشار المتزايد للأمراض المزمنة في جميع أنحاء العالم والطلب المتزايد على الطب الشخصي على تغذية نمو سوق اكتشاف أدوية الأجسام المضادة. يتعرض كبار السن لخطر كبير للإصابة بأمراض مزمنة مثل السرطان وأمراض المناعة الذاتية والأمراض المعدية، مما يعكس الحاجة إلى المواد البيولوجية والأدوية للعلاج.

بالإضافة إلى ذلك، هناك تركيز متزايد على تطوير أجسام مضادة أكثر أمانًا. على سبيل المثال، يعد Humira جسمًا مضادًا بشريًا أقل عرضة للتسبب في آثار جانبية من الأجسام المضادة التقليدية للفئران. ومن المتوقع أن تصبح هذه الأجسام المضادة الأكثر أمانًا أكثر شيوعًا مع التركيز المتزايد على سلامة الأدوية. ومع ذلك، فإن نمو سوق اكتشاف الأجسام المضادة محدود بسبب السياسات التنظيمية الصارمة والطلب المتزايد على الأدوية البديلة مثل العلاج الجيني والأدوية الجزيئية الصغيرة. بالإضافة إلى ذلك، فإن التطورات التكنولوجية مثل عرض البكتيريا، والفحص عالي الإنتاجية، والمعلوماتية الحيوية تسهل اكتشاف وتطوير أجسام مضادة جديدة. ويؤدي هذا إلى عملية تطوير أدوية أكثر كفاءة وفعالية من حيث التكلفة ويخلق فرص نمو مربحة للسوق.

نظرة عامة على السوق:

يؤدي توسع صناعة المستحضرات الصيدلانية الحيوية ، والتي تركز بشكل كبير على المواد البيولوجية، إلى زيادة الطلب على خدمات أبحاث الأجسام المضادة أكثر من ذي قبل. كما تعمل زيادة التعاون بين الجهات الفاعلة في الصناعة والمؤسسات الأكاديمية على تسهيل تبادل الموارد وتسريع اكتشاف الأجسام المضادة. كما يعمل التحول نحو تطوير الأدوية التي تركز على المريض، مع التركيز على الطب الشخصي وتفضيلات المريض، على تعزيز سوق اكتشاف الأجسام المضادة.

وقد أدت التطورات التكنولوجية المستمرة مثل الفحص عالي الإنتاجية وعرض البكتيريا والتسلسل الجيني للجيل التالي إلى تحسين كفاءة وسرعة عمليات اكتشاف الأجسام المضادة. كما تعمل زيادة التمويل لأنشطة البحث والتطوير من المنظمات الحكومية والشركات الخاصة على تحفيز مبادرات اكتشاف الأجسام المضادة. تكتسب الأجسام المضادة وحيدة النسيلة شعبية في التطبيقات العلاجية بسبب خصوصيتها وفعاليتها في استهداف مستضدات معينة، مما يؤدي إلى زيادة الطلب على خدمات أبحاث الأجسام المضادة. لذلك، من المرجح أن يكون للطلب المتزايد على العلاجات القائمة على الأجسام المضادة والتفضيل للاستعانة بمصادر خارجية تأثير كبير على توقعات سوق اكتشاف الأجسام المضادة في السنوات القليلة المقبلة.

قم بتخصيص هذا التقرير ليناسب متطلباتك

ستحصل على تخصيص لأي تقرير - مجانًا - بما في ذلك أجزاء من هذا التقرير، أو تحليل على مستوى الدولة، وحزمة بيانات Excel، بالإضافة إلى الاستفادة من العروض والخصومات الرائعة للشركات الناشئة والجامعات

- احصل على أهم اتجاهات السوق الرئيسية لهذا التقرير.ستتضمن هذه العينة المجانية تحليلاً للبيانات، بدءًا من اتجاهات السوق وحتى التقديرات والتوقعات.

محرك السوق:

زيادة الاستثمارات في البحث والتطوير تدفع نمو السوق

وتجد الأجسام المضادة، بما في ذلك الأجسام المضادة وحيدة النسيلة والمتعددة النسائل، تطبيقات في المعاهد والمنظمات الأكاديمية والبحثية والصيدلانية، حيث تُستخدم في العديد من أنشطة البحث والتطوير المتعلقة بتطوير الأدوية والعلامات الحيوية ، وتطوير منتجات علاجية وتشخيصية سريرية أخرى. وتركز الشركات الصغيرة والمتوسطة الحجم على زيادة استثماراتها في البحث والتطوير كل عام. ففي أبريل/نيسان 2020، خصصت الحكومة الفيدرالية الأمريكية 3.5 مليار دولار أمريكي لهيئة البحث والتطوير الطبي الحيوي المتقدم (BARDA) بموجب قانون المساعدة والإغاثة والأمن الاقتصادي لفيروس كورونا (CARES) لتقديم الدعم المالي لتصنيع وإنتاج وشراء اللقاحات والتشخيصات والعلاجات والمكونات الصيدلانية النشطة ذات الجزيئات الصغيرة (APIs)، من بين أمور أخرى. على سبيل المثال، في سبتمبر/أيلول 2022، أعلنت شركة Abzena (الشركة الرائدة في مجال المواد البيولوجية ومقترنات الأدوية المضادة) عن نيتها توسيع قدراتها في البحث والتطوير في كامبريدج للمساعدة في اكتشاف الأجسام المضادة بسرعة. علاوة على ذلك، توفر شركة Bio-Rad للأدوية 10000 جسم مضاد، إلى جانب المستضدات والكواشف والمحاليل، لتطوير اختبارات التشخيص المختبرية . وبالتالي، فإن الاستثمارات المتزايدة من قبل شركات الأدوية في أنشطة البحث والتطوير المتعلقة باكتشاف الأجسام المضادة لتطوير خيارات علاج أفضل لمختلف الأمراض تدفع نمو سوق اكتشاف الأجسام المضادة.

التحليل القطاعي:

تم إجراء تحليل سوق اكتشاف الأجسام المضادة من خلال النظر في القطاعات التالية: نوع الجسم المضاد، والطبيعة، والخدمات، والمستخدم النهائي.

بناءً على نوع الأجسام المضادة، يتم تقسيم سوق اكتشاف الأجسام المضادة إلى أجسام مضادة وحيدة النسيلة وأجسام مضادة متعددة النسائل وغيرها. احتل قطاع الأجسام المضادة وحيدة النسيلة أكبر حصة في السوق في عام 2022. علاوة على ذلك، من المتوقع أن يسجل نفس القطاع أعلى معدل نمو سنوي مركب بنسبة 6.9٪ خلال الفترة 2022-2030. تم تصميم الأجسام المضادة وحيدة النسيلة (mAbs) للتفاعل بشكل خاص مع الخلايا المريضة دون الإضرار بالخلايا السليمة. يعد علاج السرطان أحد مجالات التطبيق المهمة التي تُستخدم فيها الأجسام المضادة وحيدة النسيلة. هذه هي المواد البيولوجية المقبولة على نطاق واسع ومن المتوقع أن تقدم فرصة بمليار دولار لمصنعي الأدوية خلال فترة التنبؤ. علاوة على ذلك، أصبح المرضى والأطباء على دراية متزايدة بتطبيقات علاج الأجسام المضادة وحيدة النسيلة. ونتيجة لذلك، من المتوقع أن يؤدي اعتماد الأجسام المضادة وحيدة النسيلة كعلاجات فعالة لمؤشرات مختلفة إلى تفضيل سوق اكتشاف الأجسام المضادة خلال فترة التنبؤ. وقد وافقت إدارة الغذاء والدواء الأمريكية على أدوية مثل أفاستين، وهيرسبتين، وريميكاد، وريتوكسان لعلاج السرطان، والتهاب المفاصل الروماتويدي، ومرض كرون، والتهاب القولون التقرحي، وما إلى ذلك.

السوق، استنادًا إلى الطبيعة، مقسمة إلى بشرية ومؤنسنة، وهجينة، وفئران. احتلت شريحة البشر والمؤنسنة أكبر حصة في سوق اكتشاف الأجسام المضادة في عام 2022، ومن المتوقع أن تسجل نفس الشريحة معدل نمو سنوي مركب أعلى خلال فترة التوقعات. يتم هندسة الأجسام المضادة البشربشربشرية والمؤنسنة وراثيًا عن طريق تطعيم مناطق تحديد التكامل (CDRs) من جسم مضاد غير بشري مع خصوصية ربط المستضد المرغوبة في مناطق تحديد التكامل المقابلة لجسم مضاد آخر، والذي يتم اشتقاقه بشكل أكثر بروزًا من البشر. تكتسب هذه الأجسام المضادة قبولًا وشعبية كبيرين نظرًا لخصوصيتها واستقرارها الأعلى وتكاليفها الأقل. بالإضافة إلى ذلك، أظهرت الأجسام المضادة البشربشربشرية والمؤنسنة فعالية سريرية جذابة في الدراسات السريرية.

ينقسم سوق اكتشاف الأجسام المضادة، بناءً على الخدمة، إلى عرض البكتيريا، والهجين، والحيوانات المعدلة وراثيًا، وعرض الخميرة، والخلية الفردية. هيمنت شريحة عرض البكتيريا على حصة السوق في عام 2022، ومن المتوقع أن تسجل نفس الشريحة أعلى معدل نمو سنوي مركب بنسبة 7.3٪ خلال فترة التنبؤ. تُستخدم تقنية عرض البكتيريا لاختيار الأجسام المضادة في المختبر. تُستخدم الفيروسات التي تصيب البكتيريا بشكل أساسي كناقلات جينية للتعبير عن شظايا الأجسام المضادة (البروتينات)، والتي تكون عادةً شظايا متغيرة أحادية السلسلة (scFv) أو شظايا Fab موجودة على الفيروس. يمكن بعد ذلك فحص شظايا الأجسام المضادة المعبر عنها للارتباط بهدف محدد ذي أهمية. تعد السرعة والبساطة والفعالية من حيث التكلفة المرتبطة بعملية تحديد المواد الرابطة من بين المزايا الرئيسية لتقنية عرض البكتيريا.

بناءً على المستخدم النهائي، ينقسم سوق اكتشاف الأجسام المضادة إلى شركات الأدوية والتكنولوجيا الحيوية ومختبرات الأبحاث وغيرها. احتل قطاع شركات الأدوية والتكنولوجيا الحيوية أكبر حصة في سوق اكتشاف الأجسام المضادة في عام 2022، ومن المتوقع أن يسجل نفس القطاع معدل نمو سنوي مركب أعلى بنسبة 7.2٪ خلال الفترة 2022-2030. تمثل شركات الأدوية والتكنولوجيا الحيوية جزءًا كبيرًا من عملية اكتشاف الأجسام المضادة بسبب قدراتها على تحديد الأجسام المضادة لأي مرض محدد وإنتاجها على نطاق تجاري. إن الطلب المتزايد على الأجسام المضادة عالية الخصوصية لاكتشاف الأدوية وتطويرها؛ والبحث المتزايد في مجالات تحليل البروتينات والجينوم؛ والحاجة المتزايدة للأجسام المضادة لتحديد أهداف واختبارات جديدة؛ وأنشطة البحث والتطوير المتزايدة في العديد من المجالات العلاجية مثل السرطان وفيروس نقص المناعة البشرية / الإيدز وأمراض نقص المناعة واضطرابات الدم هي العوامل الحاسمة التي تدفع الطلب على منتجات وحلول وخدمات اكتشاف الأجسام المضادة في شركات الأدوية والتكنولوجيا الحيوية.

التحليل الإقليمي:

يشمل نطاق تقرير سوق اكتشاف الأجسام المضادة أمريكا الشمالية وأوروبا ومنطقة آسيا والمحيط الهادئ والشرق الأوسط وأفريقيا وأمريكا الجنوبية والوسطى. بلغت قيمة السوق في أمريكا الشمالية 1.29 مليار دولار أمريكي في عام 2022 ومن المتوقع أن تصل إلى 2.20 مليار دولار أمريكي بحلول عام 2030؛ ومن المتوقع أن تسجل معدل نمو سنوي مركب بنسبة 6.8٪ خلال الفترة 2022-2030. ينقسم سوق أمريكا الشمالية إلى الولايات المتحدة وكندا والمكسيك. يتم تحديد نمو السوق في المنطقة من خلال زيادة انتشار السرطان والحضور القوي لصناعة أبحاث الأجسام المضادة والتقدم التكنولوجي في قطاع البحث والتطوير.

وفقًا للجمعية الأمريكية للسرطان، تم تشخيص حوالي 1.8 مليون حالة إصابة جديدة بالسرطان وتم تسجيل حوالي 606520 حالة وفاة مرتبطة بالسرطان في الولايات المتحدة في عام 2020. وهذا يعزز الحاجة إلى الأجسام المضادة العلاجية، وبالتالي تغذية نمو السوق. ومن المتوقع أن تسجل منطقة آسيا والمحيط الهادئ أعلى معدل نمو سنوي مركب خلال الفترة 2022-2030. ينقسم سوق اكتشاف الأجسام المضادة في منطقة آسيا والمحيط الهادئ إلى الصين واليابان والهند وكوريا الجنوبية وأستراليا وبقية منطقة آسيا والمحيط الهادئ. احتلت الصين أكبر حصة سوقية في عام 2022، ومن المتوقع أن تظهر الهند معدل نمو كبير في السوق. تشهد صناعة المستحضرات الصيدلانية الحيوية في الصين تحولًا هائلاً، حيث تطورت من مشهد يركز على الأدوية الجنيسة إلى مركز ابتكار مزدهر. بالإضافة إلى ذلك، يساهم التقدم في التصنيع وتطبيق الأدوية الجديدة والأجهزة الطبية المتطورة والتقنيات في نمو السوق في الصين. علاوة على ذلك، فإن العدد المتزايد من اللاعبين في السوق الذين يركزون على دول منطقة آسيا والمحيط الهادئ من أجل التوسع الجغرافي واستراتيجيات النمو الأخرى، والعدد المتزايد من مراكز الأبحاث، والزيادة الملحوظة في التمويل الحكومي، تعمل على تغذية سوق اكتشاف الأجسام المضادة في منطقة آسيا والمحيط الهادئ.

رؤى إقليمية حول سوق اكتشاف الأجسام المضادة

لقد قام المحللون في Insight Partners بشرح الاتجاهات والعوامل الإقليمية المؤثرة على سوق اكتشاف الأجسام المضادة طوال فترة التوقعات بشكل شامل. يناقش هذا القسم أيضًا قطاعات سوق اكتشاف الأجسام المضادة والجغرافيا في جميع أنحاء أمريكا الشمالية وأوروبا ومنطقة آسيا والمحيط الهادئ والشرق الأوسط وأفريقيا وأمريكا الجنوبية والوسطى.

- احصل على البيانات الإقليمية المحددة لسوق اكتشاف الأجسام المضادة

نطاق تقرير سوق اكتشاف الأجسام المضادة

| سمة التقرير | تفاصيل |

|---|---|

| حجم السوق في عام 2022 | 2.94 مليار دولار أمريكي |

| حجم السوق بحلول عام 2030 | 4.92 مليار دولار أمريكي |

| معدل النمو السنوي المركب العالمي (2022 - 2030) | 6.7% |

| البيانات التاريخية | 2020-2021 |

| فترة التنبؤ | 2023-2030 |

| القطاعات المغطاة | حسب نوع الجسم المضاد

|

| المناطق والدول المغطاة | أمريكا الشمالية

|

| قادة السوق وملفات تعريف الشركات الرئيسية |

|

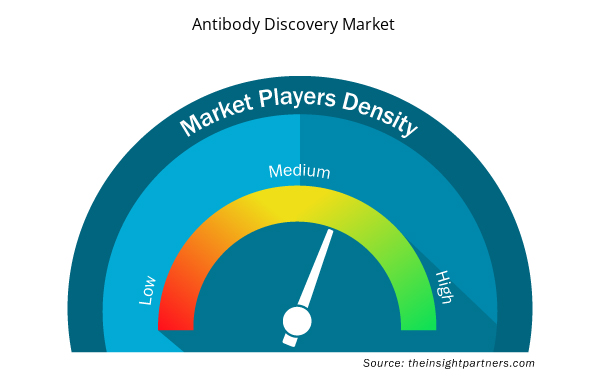

كثافة اللاعبين في سوق اكتشاف الأجسام المضادة: فهم تأثيرها على ديناميكيات الأعمال

يشهد سوق اكتشاف الأجسام المضادة نموًا سريعًا، مدفوعًا بالطلب المتزايد من المستخدم النهائي بسبب عوامل مثل تفضيلات المستهلكين المتطورة والتقدم التكنولوجي والوعي الأكبر بفوائد المنتج. ومع ارتفاع الطلب، تعمل الشركات على توسيع عروضها والابتكار لتلبية احتياجات المستهلكين والاستفادة من الاتجاهات الناشئة، مما يؤدي إلى زيادة نمو السوق.

تشير كثافة اللاعبين في السوق إلى توزيع الشركات أو المؤسسات العاملة في سوق أو صناعة معينة. وهي تشير إلى عدد المنافسين (اللاعبين في السوق) الموجودين في مساحة سوق معينة نسبة إلى حجمها أو قيمتها السوقية الإجمالية.

الشركات الرئيسية العاملة في سوق اكتشاف الأجسام المضادة هي:

- مختبرات بيولوجية إبداعية

- إيفوتيك

- بيودورو-سونديا

- تحليل الخلايا بروكر

- بيوسايتوجين

إخلاء المسؤولية : الشركات المذكورة أعلاه ليست مرتبة بأي ترتيب معين.

- احصل على نظرة عامة على أهم اللاعبين الرئيسيين في سوق اكتشاف الأجسام المضادة

تحليل اللاعب الرئيسي:

تعد Creative Biolabs وEvotec وBioDuro-Sundia وBruker Cellular Analysis وBiocytogen وCharles River Laboratories وAragen Life Sciences Pvt. Ltd وTwist Bioscience وNanoCellect Biomedical وSartorius AG من بين اللاعبين الرئيسيين الذين تم تحديدهم في تقرير سوق اكتشاف الأجسام المضادة.

التطورات الأخيرة:

تتبنى الشركات العاملة في سوق اكتشاف الأجسام المضادة مبادرات استراتيجية مثل عمليات الدمج والاستحواذ والشراكات وما إلى ذلك. وفيما يلي قائمة ببعض التطورات الأخيرة في السوق:

- في يناير 2024، أطلقت شركة Biocytogen Pharmaceuticals Co Ltd علامة تجارية فرعية جديدة باسم RenBiologics لتمثل قسم أعمال اكتشاف الأجسام المضادة الخاص بالشركة. ومن المتوقع أن يغطي نشاط RenBiologics الترخيص الخارجي/التطوير المشترك لمكتبة الشركة الواسعة من الأجسام المضادة البشرية بالكامل، بالإضافة إلى ترخيص RenMice، وهي منصة اكتشاف الأجسام المضادة البشرية بالكامل/مستقبل الخلايا التائية من Biocytogen Pharmaceuticals.

- في ديسمبر 2023، أعلنت شركة Biocytogen Pharmaceuticals Co Ltd عن اتفاقية تقييم واختيار وترخيص للأجسام المضادة مع شركة Ona Therapeutics لتصميم المستحضرات الصيدلانية الحيوية ضد أنواع السرطان المتقدمة. وبموجب شروط الاتفاقية، منحت شركة Biocytogen Pharmaceuticals Co Ltd شركة Ona حق الوصول لتقييم الأجسام المضادة البشرية الكاملة المشتقة من RenMice ضد هدف ورم محدد، مع خيار ترخيص الأجسام المضادة المختارة حصريًا لتطوير وتصنيع وتسويق مركبات الأجسام المضادة الدوائية (ADCs) في مؤشرات وأقاليم متفق عليها بشكل متبادل.

- في يونيو 2022، أعلنت شركة Evotec SE عن تعاونها مع شركة Janssen Pharmaceutica NV، إحدى شركات Johnson & Johnson لاكتشاف الأدوية. بموجب هذا التعاون، تهدف شركة Evotec SE إلى تقييم منصات TargetAlloMod الخاصة بها لاكتشاف المرشحين العلاجيين الأوائل في فئتهم بطرق عمل جديدة، وستقوم شركة Janssen Pharmaceutica NV بتسهيل ذلك.

- في أغسطس 2021، دخلت شركة Sartorius AG في شراكة مع جامعة ماكماستر لتحسين عمليات تصنيع الأجسام المضادة وغيرها من العلاجات القائمة على الفيروسات لأمراض مثل COVID-19 والسرطان والاضطرابات الوراثية. أدت هذه الشراكة مع جامعة ماكماستر إلى أبحاث مؤثرة جعلت العلاجات المهمة متاحة على نطاق أوسع.

- التحليل التاريخي (سنتان)، السنة الأساسية، التوقعات (7 سنوات) مع معدل النمو السنوي المركب

- تحليل PEST و SWOT

- حجم السوق والقيمة / الحجم - عالميًا وإقليميًا وقطريًا

- الصناعة والمنافسة

- مجموعة بيانات Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

الأسئلة الشائعة

Charles River Laboratories and Evotec are the top two companies that hold huge market shares in the antibody discovery market.

Global antibody discovery market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The North America regional market is expected to grow with a CAGR of 6.8% during 2022–2030. Market growth in this region is attributed to the increasing prevalence of cancer, the strong presence of the antibody research industry, and technological advancements in the R&D sector help in the market expansion. An upsurge in funding further enables the development of new technologies, pooling of resources and expertise across countries and organizations, and conducting research work into existing antibody treatments. This has led to a better understanding of the immune system, and the development of effective and targeted antibodies. Additionally, the increased funding allows scientists to conduct large-scale clinical trials that are mandatory to evaluate the effectiveness of a particular antibody. The Asia Pacific molecular spectroscopy market is expected to grow at the highest CAGR of 7.3% during 2022–2030. China is predicted to hold the largest share of the market in 2022, and India is expected to show a significant growth rate in the market. China is predicted to hold the largest market share in 2022, and India is expected to show a significant growth rate in the market. The biopharmaceutical industry in China is undergoing a tremendous shift, evolving from a generics-focused landscape to a thriving innovation hub. Additionally, progress in industrialization, and the application of novel drugs, high-end medical devices, and techniques contribute to the antibody discovery market growth in China. Further, the growing number of market players focusing on countries in Asia Pacific for their geographic expansion and other growth strategies, the rising count of research centers, and a notable increase in government funding fuel the antibody discovery market growth in Asia Pacific.

Antibody discovery, a nuanced endeavor, refers to the complicated process of discovering novel antibodies. This endeavor involves the search for antibodies that recognize and bind to specific targets, with applications extending to diagnostics and therapy. Antibody discovery methods such as phage display and hybridoma technology are widely used. Their use is essential to the search for antibodies that recognize and bind to specific targets, paving the way for applications in diagnostics and therapeutic interventions. The resulting outcome of this process plays a crucial role in developing novel drugs, vaccines, diagnostics, and various therapeutic modalities. By enabling researchers to produce antibodies tailored to recognize and target precise antigens, the scale of antibody discovery is of paramount importance.

Key factors that are driving the antibody discovery market are the increasing investments in research & development and the rising incidence of cancer.

The CAGR value of the antibody discovery market during the forecasted period of 2022-2030 is 6.7%.

The monoclonal antibodies segment held the largest share of the market in the global antibody discovery market and held the largest market share of 82.6% in 2022.

The phage display segment dominated the global antibody discovery market and held the largest market share of 35.8% in 2022.

The molecular spectroscopy market majorly consists of the players such Creative Biolabs, Evotec, BioDuro-Sundia, Bruker Cellular Analysis, Biocytogen, Charles River Laboratories, Aragen Life Sciences Pvt. Ltd, Twist Bioscience, NanoCellect Biomedical, and Sartorius AG.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Antibody Discovery Market

- Creative Biolabs

- Evotec

- BioDuro-Sundia

- Bruker Cellular Analysis

- Biocytogen

- Charles River Laboratories

- Aragen Life Sciences Pvt. Ltd

- Twist Bioscience

- NanoCellect Biomedical

- Sartorius AG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

احصل على عينة مجانية لهذا التقرير

احصل على عينة مجانية لهذا التقرير