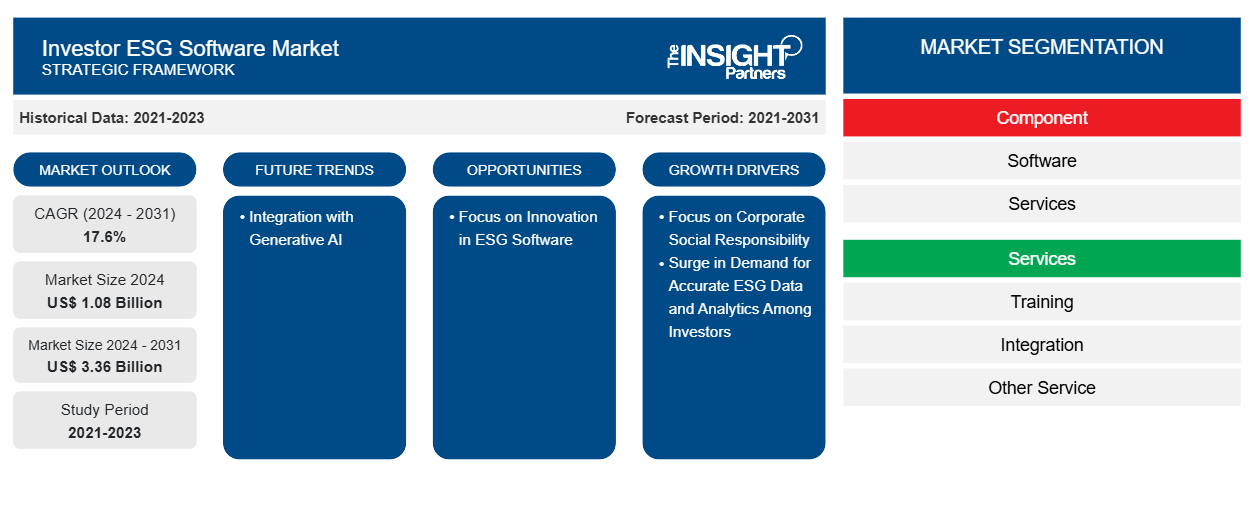

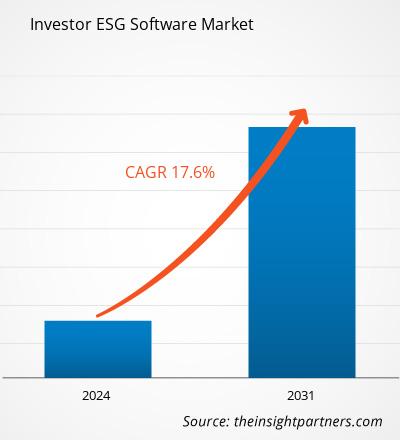

قُدِّر حجم سوق برمجيات ESG للمستثمرين بنحو 1.08 مليار دولار أمريكي في عام 2024، ومن المتوقع أن يصل إلى 3.36 مليار دولار أمريكي بحلول عام 2031؛ ومن المتوقع أن يسجل معدل نمو سنوي مركب بنسبة 17.6% من عام 2024 إلى عام 2031. ومن المرجح أن يُؤدي دمج برمجيات ESG مع الذكاء الاصطناعي التوليدي إلى ظهور اتجاهات جديدة في السوق في السنوات القادمة.

تحليل سوق برامج المستثمر ESG

شهد سوق برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) نموًا ملحوظًا نتيجةً للطلب المتزايد على الاستثمار المسؤول، وتزايد المخاوف بشأن تغير المناخ، والقضايا الاجتماعية، وممارسات الحوكمة، بالإضافة إلى الحاجة إلى الشفافية والامتثال لمعايير الحوكمة البيئية والاجتماعية وحوكمة الشركات العالمية المتطورة. ويعزى الطلب على برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) إلى سعي المستثمرين المؤسسيين، ومديري الأصول، والمؤسسات المالية إلى دمج هذه العوامل في عمليات صنع القرار. كما أن عوامل مثل التركيز على المسؤولية الاجتماعية للشركات، وتزايد طلب المستثمرين على بيانات وتحليلات دقيقة حول هذه البرمجيات، تُسهم في نمو سوق برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) للمستثمرين. علاوةً على ذلك، يُتيح التركيز على الابتكار في برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) ودمجها مع الذكاء الاصطناعي المُولّد فرصًا مربحة لنمو الشركات الفاعلة في سوق برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) للمستثمرين خلال فترة التوقعات.

نظرة عامة على سوق برامج المستثمر ESG

تستخدم المؤسسات برامج ESG للمستثمرين لتصميم الاستبيانات وتبسيط عملية جمع البيانات، مما يتيح تجميع مقاييس أداء ESG دقيقة وقابلة للمقارنة. تُعزز هذه المنصة، التي تُقدم خدمات برمجية، مبادرات ESG، مما يُساعد الشركات على تعظيم قيمتها وتقييم استثماراتها. يُركز الاستثمار في ESG، أو الاستثمار المستدام، على تحديد العوامل التي تُحدد الاستثمارات المسؤولة أو المستدامة أو الأخلاقية. يستخدم كل من المستثمرين وشركات أسواق رأس المال برامج ESG لتقييم سلوكيات الشركات، مما يُوفر رؤىً ثاقبة للتنبؤ بالأداء المالي المستقبلي. تُطبق العديد من الشركات هذه الحلول البرمجية للتخفيف من المخاطر المتعلقة بعملياتها وعلاقاتها التجارية وأصولها واستثماراتها.

تدعم منصات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) تحليلات الاستثمار، مما يوفر قرارات استثمارية أكثر استنارة واستراتيجية. صُمم برنامج Investor ESG خصيصًا لمساعدة المستثمرين على تقييم أداء محافظهم الاستثمارية وقراراتهم الاستثمارية من حيث الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) وتتبعه وإدارته. توفر هذه المنصات رؤى وتحليلات وتقارير قائمة على البيانات حول مختلف مقاييس الحوكمة البيئية والاجتماعية وحوكمة الشركات، مما يُمكّن المستثمرين من مواءمة استراتيجياتهم الاستثمارية مع أهداف الاستدامة والمتطلبات التنظيمية.

قم بتخصيص هذا التقرير ليناسب متطلباتك

ستحصل على تخصيص لأي تقرير - مجانًا - بما في ذلك أجزاء من هذا التقرير، أو تحليل على مستوى الدولة، وحزمة بيانات Excel، بالإضافة إلى الاستفادة من العروض والخصومات الرائعة للشركات الناشئة والجامعات

سوق برمجيات ESG للمستثمرين:

- احصل على أهم اتجاهات السوق الرئيسية لهذا التقرير.ستتضمن هذه العينة المجانية تحليل البيانات، بدءًا من اتجاهات السوق وحتى التقديرات والتوقعات.

محركات وفرص سوق برمجيات ESG للمستثمرين

التركيز على المسؤولية الاجتماعية للشركات

يمثل سن توجيه إعداد تقارير استدامة الشركات (CSRD) تحولاً تنظيمياً رئيسياً يدفع بشكل كبير الطلب على برنامج Investor ESG. يوسع توجيه CSRD، الذي حل محل توجيه التقارير غير المالية (NFRD) في يناير 2023، نطاق تقارير ESG الإلزامية بشكل كبير داخل الاتحاد الأوروبي. بموجب NFRD، كان مطلوبًا من حوالي 11000 شركة كبيرة الإفصاح عن معلومات ESG. ومع ذلك، فإن CSRD يوسع هذا الالتزام ليشمل ما يقرب من 50000 شركة، وهو ما يمثل حوالي 75٪ من إجمالي مبيعات جميع شركات الاتحاد الأوروبي. وهذا يشمل الشركات الكبيرة وكذلك الشركات الصغيرة والمتوسطة المدرجة (SMEs)، مما يوسع بشكل كبير نطاق إفصاحات ESG ومتطلبات الامتثال. يفرض توجيه CSRD على الشركات الإفصاح عن معلومات اجتماعية وبيئية وحوكمة مفصلة، تغطي مجالات مثل حقوق الإنسان ومخاطر المناخ والتنوع البيولوجي وشفافية سلسلة التوريد. يضمن إطار إعداد التقارير الشامل هذا أن تعالج الشركات الآثار البيئية وحقوق الإنسان السلبية وتخفف منها داخل أوروبا والمناطق الأخرى. ومن خلال تطبيق هذه القواعد الجديدة، تهدف اللجنة إلى تعزيز الاتساق والمقارنة والموثوقية لبيانات الحوكمة البيئية والاجتماعية والمؤسسية، مما يجعلها أكثر شفافية ويمكن الوصول إليها للمستثمرين والهيئات التنظيمية وعامة الناس.

التركيز على الابتكار في برمجيات ESG

من المتوقع أن يُتيح التركيز على الابتكار في برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) فرصًا عديدة لنمو سوق برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) للمستثمرين خلال فترة التوقعات. ومع استمرار تزايد الطلب على بيانات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) الشفافة والدقيقة والقابلة للتنفيذ، يعتمد المستثمرون بشكل متزايد على حلول برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات المتقدمة لاتخاذ قرارات استثمارية مدروسة. يتطلب المشهد المتطور للعوامل البيئية والاجتماعية وحوكمة الشركات (ESG) من المستثمرين الوصول إلى رؤى شاملة وفورية لا يمكن توفيرها إلا من خلال أدوات برمجية مبتكرة. يتضمن الابتكار في برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) دمج التقنيات المتطورة مثل الذكاء الاصطناعي (AI)، والتي تُعيد تشكيل طريقة جمع بيانات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) ومعالجتها وتحليلها. على سبيل المثال، في أبريل 2024، أعلنت شركة ESGgo، مُزودة حلول بيانات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG)، عن إطلاق تقرير الاستدامة بنقرة واحدة، وهي أداة مدعومة بالذكاء الاصطناعي مُصممة لمساعدة الشركات على إنشاء تقارير الاستدامة بسهولة بما يتماشى مع الأطر التنظيمية وتوقعات أصحاب المصلحة. تُشير ESGgo إلى أن هذا الحل الجديد يُبسط عملية إعداد تقارير الاستدامة للمؤسسات، مما يضمن الامتثال للمعايير المتطورة. يعالج محرك البيانات المُدار بالذكاء الاصطناعي في المنصة المعلومات الرقمية والنصية، ويحسب الانبعاثات، ويُجمّع مجموعات البيانات لإنشاء تقارير استدامة مُخصصة. تُمكّن هذه التطورات المستثمرين من مراقبة أداء الشركة في مجال الاستدامة بكفاءة أكبر، بالإضافة إلى التنبؤ بمخاطر وفرص الحوكمة البيئية والاجتماعية والمؤسسية المستقبلية بناءً على بيانات آنية. تُعدّ القدرة على معالجة كميات هائلة من البيانات، والتي غالبًا ما تأتي من مصادر مُختلفة، وتجميعها في مقاييس الحوكمة البيئية والاجتماعية والمؤسسية قابلة للتنفيذ، ميزةً كبيرةً للمستثمرين الذين يبحثون عن الشفافية والموثوقية.

تقرير تحليل تجزئة سوق برامج ESG للمستثمرين

القطاعات الرئيسية التي ساهمت في استنتاج تحليل سوق برمجيات ESG للمستثمرين هي المكونات والخدمات وحجم المؤسسة.

- بناءً على مكوناته، ينقسم سوق برمجيات ESG للمستثمرين إلى برمجيات وخدمات. وقد هيمن قطاع البرمجيات على السوق في عام ٢٠٢٤.

- من حيث الخدمات، يُقسّم سوق برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) للمستثمرين إلى خدمات التدريب والتكامل وخدمات أخرى. وقد استحوذ قطاع الخدمات الأخرى على الحصة الأكبر من السوق في عام 2024.

- بناءً على حجم المؤسسة، يُقسّم سوق برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) للمستثمرين إلى شركات كبيرة وأخرى صغيرة ومتوسطة. وسيُهيمن قطاع الشركات الكبيرة على السوق في عام 2024.

تحليل حصة سوق برامج ESG للمستثمرين حسب المنطقة الجغرافية

- يُقسّم سوق برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) للمستثمرين إلى خمس مناطق رئيسية: أمريكا الشمالية، وأوروبا، وآسيا والمحيط الهادئ (APAC)، والشرق الأوسط وأفريقيا (MEA)، وأمريكا الجنوبية والوسطى. وقد هيمنت أمريكا الشمالية على السوق في عام 2024، تلتها أوروبا وآسيا والمحيط الهادئ.

- من المتوقع أن ينمو سوق برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) للمستثمرين في أمريكا الشمالية خلال فترة التوقعات، وذلك بفضل المتطلبات القانونية المتزايدة، مثل إفصاحات المناخ المقترحة من هيئة الأوراق المالية والبورصات الأمريكية (SEC). تُشكل هذه الالتزامات القانونية ضغطًا على مديري الأصول والمستثمرين المؤسسيين لمعالجة مخاوف وقواعد الحوكمة البيئية والاجتماعية وحوكمة الشركات في عمليات صنع القرار. علاوة على ذلك، فإن التركيز المتزايد على الاستدامة وتنامي مخاوف تغير المناخ يُعززان الطلب على برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات بين المستثمرين وأصحاب المصلحة، للحصول على رؤى واضحة قائمة على البيانات. تُساعدهم هذه الرؤى في تقييم أداء الشركات في هذا المجال بفعالية. كما يُعزز البرنامج مساءلة الشركات من خلال إتاحة تقارير الحوكمة البيئية والاجتماعية وحوكمة الشركات في الوقت الفعلي، وتتبع الامتثال، وتقييم المخاطر.

- تتخذ حكومات دول أوروبية مختلفة تدابير، مثل لائحة الإفصاح عن التمويل المستدام (SFDR) ولائحة تصنيف الاتحاد الأوروبي، لتعزيز الاستدامة في العمليات التجارية. تُلزم هذه المتطلبات مديري الأصول والمستثمرين المؤسسيين بالإفصاح عن أثر استثماراتهم على الحوكمة البيئية والاجتماعية والمؤسسية وتقييمه، مما يُعزز اعتماد برامج الحوكمة البيئية والاجتماعية والمؤسسية المتقدمة تقنيًا، والتي تُمكّن من الامتثال وإدارة البيانات. علاوة على ذلك، وسّع المستثمرون الأوروبيون نطاق استثماراتهم المستدامة لدعم أهداف الصفقة الخضراء في المنطقة، مما يزيد الطلب على برامج الحوكمة البيئية والاجتماعية والمؤسسية للمستثمرين، والتي تُساعد على إدارة البيانات واتخاذ قرارات مدروسة.

رؤى إقليمية حول سوق برمجيات ESG للمستثمرين

قام محللو إنسايت بارتنرز بشرح شامل للاتجاهات والعوامل الإقليمية المؤثرة في سوق برمجيات المستثمر ESG خلال فترة التوقعات. ويناقش هذا القسم أيضًا قطاعات سوق برمجيات المستثمر ESG ونطاقها الجغرافي في أمريكا الشمالية، وأوروبا، وآسيا والمحيط الهادئ، والشرق الأوسط وأفريقيا، وأمريكا الجنوبية والوسطى.

- احصل على بيانات إقليمية محددة لسوق برامج ESG للمستثمرين

نطاق تقرير سوق برامج ESG للمستثمرين

| سمة التقرير | تفاصيل |

|---|---|

| حجم السوق في عام 2024 | 1.08 مليار دولار أمريكي |

| حجم السوق بحلول عام 2031 | 3.36 مليار دولار أمريكي |

| معدل النمو السنوي المركب العالمي (2024 - 2031) | 17.6% |

| البيانات التاريخية | 2021-2023 |

| فترة التنبؤ | 2021-2031 |

| القطاعات المغطاة | حسب المكون

|

| المناطق والدول المغطاة | أمريكا الشمالية

|

| قادة السوق وملفات تعريف الشركات الرئيسية |

|

كثافة اللاعبين في سوق برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG): فهم تأثيرها على ديناميكيات الأعمال

يشهد سوق برمجيات الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) نموًا سريعًا، مدفوعًا بتزايد طلب المستخدمين النهائيين نتيجةً لعوامل مثل تطور تفضيلات المستهلكين، والتقدم التكنولوجي، وزيادة الوعي بمزايا المنتج. ومع تزايد الطلب، تعمل الشركات على توسيع عروضها، والابتكار لتلبية احتياجات المستهلكين، والاستفادة من الاتجاهات الناشئة، مما يعزز نمو السوق.

تشير كثافة اللاعبين في السوق إلى توزيع الشركات العاملة في سوق أو قطاع معين. وتشير إلى عدد المنافسين (اللاعبين في السوق) الموجودين في سوق معين نسبةً إلى حجمه أو قيمته السوقية الإجمالية.

الشركات الرئيسية العاملة في سوق برمجيات المستثمر ESG هي:

- مؤشر مورغان ستانلي كابيتال إنترناشيونال

- شركة ووركيفا

- شركة مورنينج ستار

- مجموعة بورصة لندن

- شركة كوريتي للبرمجيات

- شركة بروفيكس للبرمجيات

إخلاء المسؤولية : الشركات المذكورة أعلاه ليست مرتبة بأي ترتيب معين.

- احصل على نظرة عامة على أهم اللاعبين الرئيسيين في سوق برمجيات ESG للمستثمرين

أخبار سوق برمجيات ESG للمستثمرين والتطورات الأخيرة

يتم تقييم سوق برمجيات ESG للمستثمرين من خلال جمع بيانات نوعية وكمية بعد البحث الأولي والثانوي، والتي تشمل منشورات الشركات المهمة، وبيانات الجمعيات، وقواعد البيانات. فيما يلي بعض التطورات في سوق برمجيات ESG للمستثمرين:

- أعلنت شركة كوريتي أن جميع العملاء الذين يستفيدون من أحد حلول الاستدامة الخاصة بها سيتم ترقيتهم إلى منصة CorityOne المتكاملة والقائمة على SaaS في عام 2025. وببناءً على التكنولوجيا الحالية التي وثق بها العملاء لإدارة الاستدامة لأكثر من عقد من الزمان، ستوحد هذه الترقية حلولاً متعددة في تجربة مستخدم سلسة ومحسنة مع وظائف متطورة، مما يؤدي إلى تبسيط العمليات بشكل أكبر وتحسين تكامل البيانات.

(المصدر: شركة Cority Software Inc، بيان صحفي، أغسطس 2024)

- أعلنت شركة Sphera عن استحواذها على SupplyShift، وهي شركة متخصصة في برمجيات استدامة سلاسل التوريد، تُمكّن الشركات من بناء سلاسل توريد شفافة ومسؤولة ومرنة. يُعزز هذا الاستحواذ خدمات سلسلة التوريد التي تقدمها الشركة الرائدة في مجال الحوكمة البيئية والاجتماعية والمؤسسية (ESG)، من خلال توسيع نطاق قدرات رسم خرائط الموردين وتسجيلهم وتتبعهم، مما يُمكّن العملاء بشكل أكبر من بناء سلاسل توريد مستدامة.

(المصدر: Sphera Solutions, Inc.، بيان صحفي، يناير 2024)

تغطية تقرير سوق برامج الحوكمة البيئية والاجتماعية وحوكمة الشركات (ESG) للمستثمرين والمنتجات النهائية

يوفر "حجم سوق برمجيات ESG للمستثمرين وتوقعاته (2021-2031)" تحليلاً مفصلاً للسوق يغطي المجالات المذكورة أدناه:

- حجم سوق برامج ESG للمستثمرين وتوقعاتها على المستويات العالمية والإقليمية والوطنية لجميع قطاعات السوق الرئيسية التي يغطيها النطاق

- اتجاهات سوق برامج ESG للمستثمرين، بالإضافة إلى ديناميكيات السوق مثل المحركات والقيود والفرص الرئيسية

- تحليل مفصل لـ PEST و SWOT

- تحليل سوق برامج المستثمر ESG الذي يغطي اتجاهات السوق الرئيسية والإطار العالمي والإقليمي والجهات الفاعلة الرئيسية واللوائح والتطورات الأخيرة في السوق

- تحليل المشهد الصناعي والمنافسة الذي يغطي تركيز السوق، وتحليل خريطة الحرارة، واللاعبين البارزين، والتطورات الأخيرة لسوق برامج ESG للمستثمرين

- ملفات تعريف الشركة التفصيلية

- التحليل التاريخي (سنتان)، السنة الأساسية، التوقعات (7 سنوات) مع معدل النمو السنوي المركب

- تحليل PEST و SWOT

- حجم السوق والقيمة / الحجم - عالميًا وإقليميًا وقطريًا

- الصناعة والمنافسة

- مجموعة بيانات Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

الأسئلة الشائعة

Focus on corporate social responsibility, and surge in demand for accurate ESG data and analytics among investors are the major factors that propel the global investor ESG software market.

The global investor ESG software market is expected to reach US$ 3.36 billion by 2031.

The global Investor ESG software market was estimated to be US$ 1.08 billion in 2024 and is expected to grow at a CAGR of 17.6% during the forecast period 2025 – 2031.

The key players holding majority shares in the global investor ESG software market are MSCI, FactSet, Workiva Inc., SAP SE, and Bloomberg Finance L.P.

The incremental growth expected to be recorded for the global investor ESG software market during the forecast period is US$ 2.27 billion.

Integration with Generative AI is anticipated to play a significant role in the global investor ESG software market in the coming years.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Investor ESG Software Market

- MSCI

- Workiva Inc.

- Morningstar Sustainalytics

- London Stock Exchange Group plc

- Cority

- Prophix Software Inc.

- SAP SE

- Sphera

- FactSet

- Bloomberg Finance L.P.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

احصل على عينة مجانية لهذا التقرير

احصل على عينة مجانية لهذا التقرير