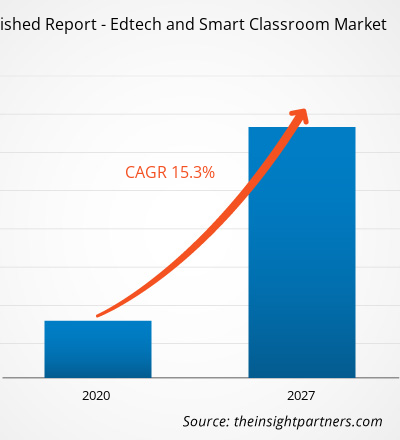

[Research Repor] The edtech and smart classroom market is expected to grow from US$ 75.24 billion in 2019 to US$ 234.41 billion by 2027; it is estimated to grow at a CAGR of 15.3% from 2020 to 2027.

Analyst Perspective:

IT systems, especially cloud-based platforms, are more important than ever because of the growing emphasis on digital lesson planning and remote learning. Potentially, the cloud is a technological innovation that encourages transformation for its users. Through the use of distant servers, networking, database systems, analytics, storage systems, software, and other digital resources, cloud computing is an information technology paradigm that provides computing services via the Internet. For higher education, cloud computing offers substantial advantages, especially for K -12 university students. Educators may effortlessly conduct virtual lessons and include their pupils in diverse online assignments and programs by leveraging cloud computing in the classroom. Thus, the growing use of virtual lessons is propelling the growth of the edtech and smart classroom market

Projectors are output devices that take the display from a computer screen and project a larger version of it on a flat surface. Along with this, from being used in classrooms during lectures, they are also employed for a home theater experience and presentation projection in business settings. Users can interact with the image that is projected on the screen using projectors. Users can actively interact with the projected image. On any other surface where the image is projected, interactive projectors duplicate the capability of an interactive whiteboard. This allows the presenter to use a mechanical or electronic stylus, or even just their finger, to interact with the projected display. Advanced capabilities in certain interactive projectors allow user-generated content to be recorded, re-played, printed, or duplicated with or without the original projected image. These features, which provide multi-touch facilities where kids may collaborate on group projects and play mini-games to improve their cognitive learning abilities, help keep the audience interested, especially in the academic end-user sector. Projectors are utilized for presentations in the enterprise market, and they do not limit the presenter to a particular meeting space. To add more information to the presentation, the presenter can easily write on the stuff that is displayed on the screen. After the class, students can electronically share their notes by using an interactive projector to display presentations and information. The rise in popularity of simple puzzle games can be attributed to social media and smartphone technology. Because interactive projectors like smartphones and tablets support multi-touch, several pupils can collaborate to solve a puzzle, propelling the growth of the edtech and smart classroom market.

Market Overview:

The cloud is the most extensively used technology due to its adaptable storage and usage methods, strong security features, and simplicity of use. Educators can take advantage of the cloud for low-cost online learning, file sharing, and storing massive files in a variety of formats.

Because of this, almost all EdTech businesses and educational organizations favor using the cloud. Learning through gamification is another inventive fad. Regarding educational technology, Conventional educational methods are laborious and need intense focus gamification; however, they turn learning into an enjoyable endeavor. Through gamification, students can compete with a timer or with each other, view their progress in real-time on leaderboards, and receive prizes for high scores. For today's users, this has increased the excitement and enjoyment of learning. Many significant firms have used gamification as a marketing trend in response to this edtech and smart classroom trend.

Basic primary education and education are part of the K -12 educational system, and students typically range in age from four to eighteen. Every country has a varied level of these. The introduction and widespread use of technology has made the next generation of students tech-savvy people across the globe. With the aid of interactive animation, videos, and audio elements, EdTech and smart classroom solutions are anticipated to provide educational institutions with additional benefits in addition to quick and dynamic instruction. Large-scale solution implementation has begun in schools and other institutions in industrialized nations like the US, Canada, France, and Singapore. Thus, growing edtech implementation on a large scale propels the growth of the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Published Report - Edtech and Smart Classroom Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Published Report - Edtech and Smart Classroom Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rising Mobile Device Penetration Drive Growth of the Market

Mobile penetration is highest among those with lower incomes. AT&T has offered US $100 million to give mobile connectivity and gadgets to 50,000 students in low-income and rural locations, according to Saperstein. India, the world's second most populous country, with 18 billion people (World Bank), may overtake China to become the most populated country by 2024 (UN Report).

In addition, India has one of the youngest populations, with nearly 30% of India's population aged between 18 to 34 and 260 million school children. As of 2022, stated by the Project Tomorrow report, 33% of US high school students and 31% of middle and elementary school students have school-issued mobile devices. As a result of the widespread use of mobile devices, gamification, virtual classrooms, and e-learning are on the rise, which is driving the growth of the edtech and smart classroom market.

Segmental Analysis:

Based on components, the edtech and smart classroom market is segmented into hardware software. The hardware segment held the largest share of the market in 2022. In contrast, the software segment is estimated to register the highest CAGR in the edtech and smart classroom market during the forecast period. Based on end-user edtech and smart classroom market is segmented into K-12 and higher education. The K-12 segment held the largest share of the edtech and smart classroom market in 2022.

In contrast, the higher education segment is estimated to register the highest CAGR in the market during the forecast period. Assignments, home study, and tutorials are a few strategies that many educational institutions in these countries employ. In recent times, several emerging economies, including Brazil, India, and China, have been experimenting with EdTech solutions. The governments of these countries have pushed the introduction of affordable devices and encouraged mobile learning initiatives. Thus, propelling the growth of the higher education segment in the market.

In the same way, children's lives are greatly impacted by technology since it has taken over many of their daily activities. According to a recent survey, over 62% of the 1,000 pupils in the two to seven age group have access to computers at home. Technology may be easily incorporated into kindergarten classrooms to benefit both teachers and pupils. Their learning methods are heavily influenced by this educational technology, which makes them engaged learners. One of the main trends in the edtech business is providing appealing online degrees from reputable Indian and international universities and institutes, especially for working professionals. Thus, such instances propelled the growth of the market.

Regional Analysis:

The Asia Pacific market was valued at US$ XXX billion in 2019 and is projected to reach US$ XXX billion by 2027. The market is expected to grow at a CAGR of XXX% during the forecast period. China has made substantial investments in ICT infrastructure and educational resources over the last few years, which has advanced the integration of technology in education. In China, online learning has gained popularity in recent years. Users of eLearning are becoming more and more prevalent. For example, the area offers a number of eLearning systems, including online learning, VIPKid, and an education platform that offers Chinese kids between the ages of 4 and 15 one-on-one English lessons. Chinese people. Since the 1990s, when eLearning first emerged, the government has placed a great deal of emphasis on its development because of the execution of many policies. As a result, the area has accomplished a great deal in the eLearning field, which is propelling the growth of the edtech and smart classroom market.

India is a country that adopts cutting-edge technology quickly, and the Indian government is instrumental in encouraging this adoption of technology in a variety of businesses. To encourage the use of technology in India, the government launched the Digital India program in July 2015. The. LMS is used by the Digital India Initiative's eGovernment initiative to teach people about eGovernment. Ministry of Information and IT and the Indian government are also providing funding to academics and research and development projects for eLearning and HR development training, which is anticipated to generate profitable prospects for learning management suppliers in the Indian edtech and smart classroom market in the future. Japan was among the first countries to use technology in the media and entertainment, healthcare, and education sectors (BFSI). The nation is renowned for having a large number of highly competitive and effective businesses in a variety of industry sectors. One of the main reasons behind Japan's embrace of EdTech and smart classroom solutions is the state of the advanced education system solution landscape. The edtech and smart classrooms market in this region is expected to rise due to a number of factors, including increased R&D efforts and rapid technical improvements. Japan is adopting education system solutions quickly because of its benefits, which include the ability to access material conveniently from any location, a range of possibilities, including news, music, sports, and games, and control over the content. Thus, such instances propelled the growth of the edtech and smart classroom market.

Key Player Analysis:

The edtech and smart classroom market analysis consists of players such as Apple Inc., Blackboard Inc., Cisco Systems, Inc., D2L Corporation, IBM Corporation, Lenovo Group Limited, Microsoft Corporation, Oracle Corporation, SAP SE, and SMART Technologies.

Edtech and Smart Classroom Published Report - Edtech and Smart Classroom Market Regional Insights

The regional trends and factors influencing the Published Report - Edtech and Smart Classroom Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Published Report - Edtech and Smart Classroom Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Published Report - Edtech and Smart Classroom Market

Published Report - Edtech and Smart Classroom Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 75.24 Billion |

| Market Size by 2027 | US$ 234.41 Billion |

| Global CAGR (2019 - 2027) | 15.3% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

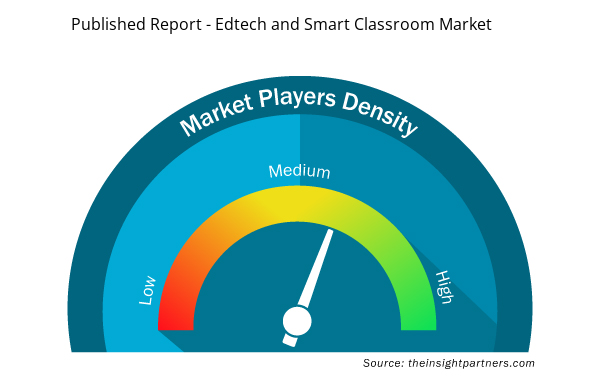

Published Report - Edtech and Smart Classroom Market Players Density: Understanding Its Impact on Business Dynamics

The Published Report - Edtech and Smart Classroom Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Published Report - Edtech and Smart Classroom Market are:

- Apple, Inc.

- Blackboard Inc.

- Cisco Systems, Inc.

- D2L Corporation

- IBM Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Published Report - Edtech and Smart Classroom Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the edtech and smart classroom market. A few recent market developments are listed below:

- In July 2022, Blackboard Inc. announced the release of the Reporting Tier for the Blackboard Data platform, which will provide institutions with reports geared to provide perceptions on the use of learning tools within the Blackboard SaaS EdTech ecosystem.

- In September 2022, Cisco launched Webex Classrooms, which securely connect teachers, students, and parents in a single area, regardless of their physical location.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component , Deployment Type , and End-User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The hardware segment led the market in 2019 with highest share and is expected to continue its dominance during the forecast period. Hardware is a broad category of components of edtech and smart classrooms, and it includes projectors; sensors; recognition systems; interactive displays; interactive whiteboards; tablets; printers; notebooks; and e-book readers such as kindle, smartphones, and audio equipment.

The growing popularity of cloud computing and cloud-based solutions among various industry sectors and its potential to accelerate the development andadoption of innovative technology solutions and services for enhanced user experience & improved operational productivity, is one of the key factors driving the demand of cloud-based solutions across education industry stakeholders worldwide. With increasing number of companies offering cloud-based solutions for education sectorsuch as Citrix Systems, Inc., IBM Corporation, Microsoft Corporation, and Oracle among others, the demand for cloud-based solutions over on-premises is anticipated to grow at an impressive rate over the forecast period of 2020 to 2027.

The Asia Pacific (APAC) region in expected to be the fastest growing region, in terms of global edtech and smart classroom market revenue over the forecast period of 2020 to 2027. The high focus on education in APAC countries, rising young population, huge demand of smart and connected devices among students, and growing number of edtech startups are some of the factors that are driving the demand for education technology solutions in this region.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Edtech and Smart Classroom Market

- Apple, Inc.

- Blackboard Inc.

- Cisco Systems, Inc.

- D2L Corporation

- IBM Corporation

- LENOVO GROUP LIMITED

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SMART TECHNOLOGIES

Get Free Sample For

Get Free Sample For