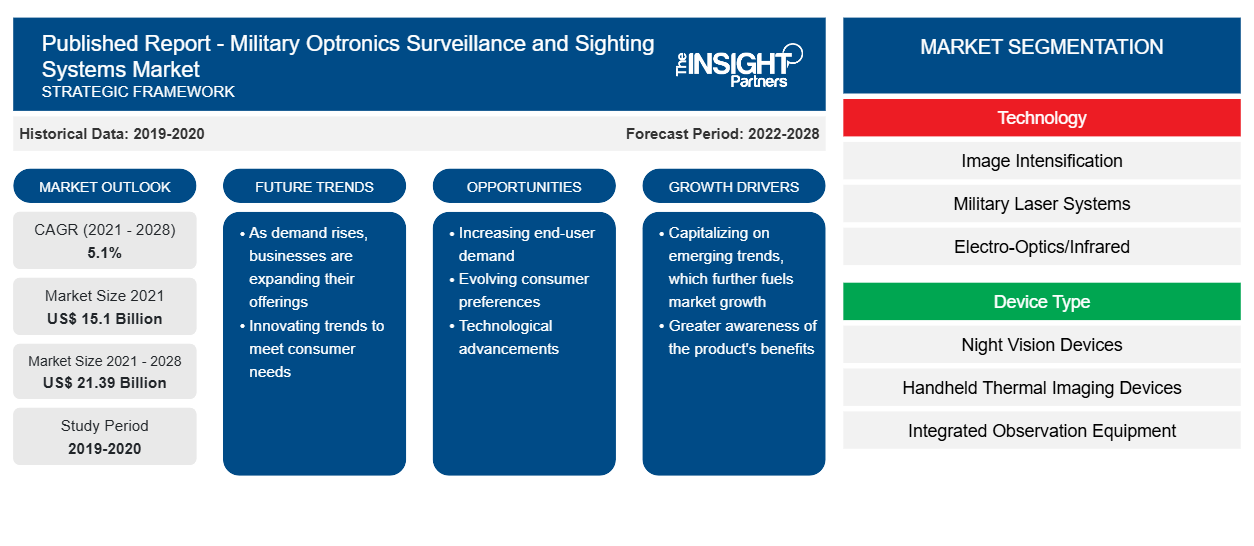

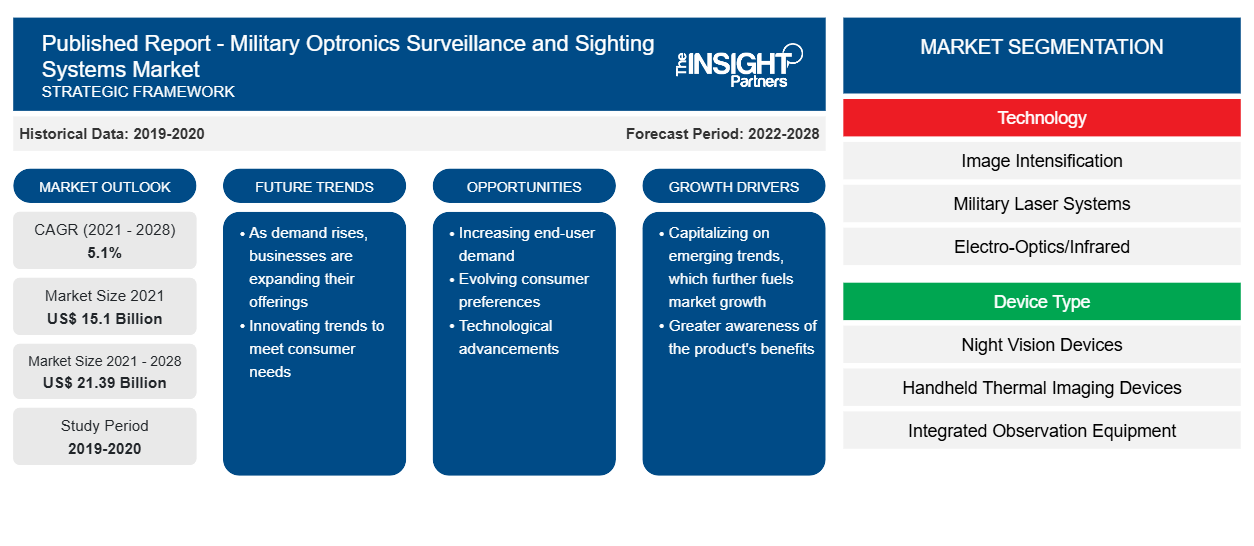

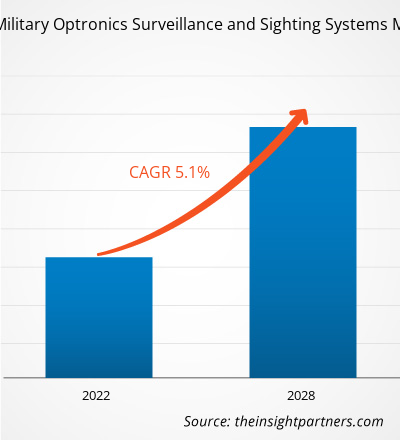

The military optronics surveillance and sighting systems market is expected to grow from US$ 15,099.84 million in 2021 to US$ 21,394.01 million by 2028. It is estimated to grow at a CAGR of 5.1% during the period of 2021–2028.

A night vision device provides soldiers with greater situational awareness by illuminating the surroundings during their night-time operations, while thermal imaging help soldiers locate a target in poor visibility conditions. Earlier, night vision devices used relatively heavier components, adding weight to soldiers. However, various market players are focusing on innovation to produce lightweight products keeping their comfort in mind. For example, ACTinBlack has developed a lightweight binocular night vision device with high optical performance and an ergonomic design. Due to the increasing innovation and the rising threat of terrorist attacks at night, the uptake of night vision devices with thermal imaging is also increasing. The demand for highly advanced individual warfighter systems is gaining momentum in various regions. It is more in demand in Europe and North America, where land forces are looking forward to equipping soldiers with optical devices, personnel protective equipment, and intelligence capabilities, enabling them to perform with utmost competence on the modern battlefield. Moreover, high budget allocation for advanced military systems and equipment procurement, territorial disputes among the countries, and increasing attacks at the boarders make imagery a crucial aspect in decision-making processes. This factor is expected to raise the adoption of night vision optoelectronic devices in the military and defense sector over the next few years.

Impact of COVID-19 Pandemic on Military Optronics Surveillance and Sighting Systems Market

The US is the largest spending country in military technologies across the world, making North America the leading market for military technologies. Despite the COVID-19 pandemic, the worldwide military expenditure has witnessed a growth of nearly 4% wherein majority of countries, worldwide, have increased their military budget. According to the study, the US accounted for around 29% of the total military optronics surveillance and sighting systems market in 2020 and witnessed a decline of 3.4%, owing to the pandemic challenges that vendors faced. Other countries in this region also faced the demand & supply gap across their respective military technologies markets.

Military technology manufacturers observed drop in deliveries for new defense technologies. Together with cancelation or rescheduling of military orders and delivery, labor shortage, and several other factors, this hampered their businesses and ability to deliver substantial volumes of new products to the customers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Published Report - Military Optronics Surveillance and Sighting Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Published Report - Military Optronics Surveillance and Sighting Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Military Optronics Surveillance and Sighting Systems Market Insights

Increasing Implementation of Next-Gen Technologies in Defense Systems Fuels Growth of Military Optronics Surveillance and Sighting Systems Market

The world is undergoing the ‘fourth industrial’ revolution, characterized by a rapid and converging advances in multiple next-generation technologies, including artificial intelligence (AI). AI is not just undergoing a renaissance in its technical development but is also starting to shape deterrence relations among nuclear-armed states. The potential of weaker nuclear-armed states can be increased with the integration of AI into their military platforms.

In January 2021, Lockheed Martin Corp announced three new next-generation infrared spacecraft to help detect enemy ballistic missile launches. In March 2021, Elbit Systems, an Israeli defense company, launched its next-generation advanced multi-sensor payload system (AMPS NG). Team Tempest—a UK technology and a defense partnership formed by BAE Systems, Leonardo, MBDA, Rolls-Royce, and the RAF—announced the development of a new radar technology by 2035 to deliver unparalleled data processing capability on the battlefield. Technological advancements in the military and defense system are driving the military optronics surveillance and sighting systems market substantially.

Device Type -Based Market Insights

Device Type -Based Market Insights

Based on the device type, the military optronics surveillance and sighting systems market is segmented into night vision devices, handheld thermal imaging devices, integrated observation equipment, standalone infrared, seismic and acoustic sensors, and others. In 2020, the seismic and acoustic sensors segment accounted for the largest market share.

Platform-Based Market Insights

Based on platform, the military optronics surveillance and sighting systems market is categorized into ground, airborne, and naval. In 2020, the ground segment accounted for the largest share in the market.

Leading players operating in the military optronics surveillance and sighting systems market adopt various strategies, such as technological innovations and mergers, acquisitions, and partnerships, to maintain their positions in the market. Some of the developments in this market are listed below:

- In July 2021, under its Night Vision Capability Programme, Organisation Conjointe de Cooperation en matière d’Armement (OCCAR) awarded the contract to a consortium of THEON SENSORS and HENSOLDT for the production and delivery of binocular night vision goggles (BNVG).

- In April 2018, Thales Group and MKU Limited signed two MoUs for strategic co-operation in the production of optronics devices. This strategic co-operation envisages manufacturing of night vision goggles, thermal infrared sensor engine, and hand-held thermal imagers for Indian Army.

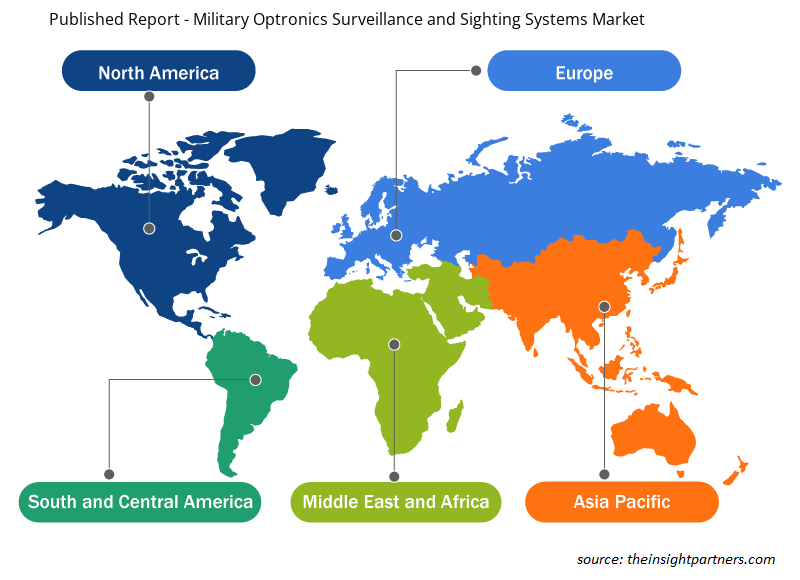

Military Optronics Surveillance & Sighting Systems Published Report - Military Optronics Surveillance and Sighting Systems Market Regional Insights

The regional trends and factors influencing the Published Report - Military Optronics Surveillance and Sighting Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Published Report - Military Optronics Surveillance and Sighting Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Published Report - Military Optronics Surveillance and Sighting Systems Market

Published Report - Military Optronics Surveillance and Sighting Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 15.1 Billion |

| Market Size by 2028 | US$ 21.39 Billion |

| Global CAGR (2021 - 2028) | 5.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

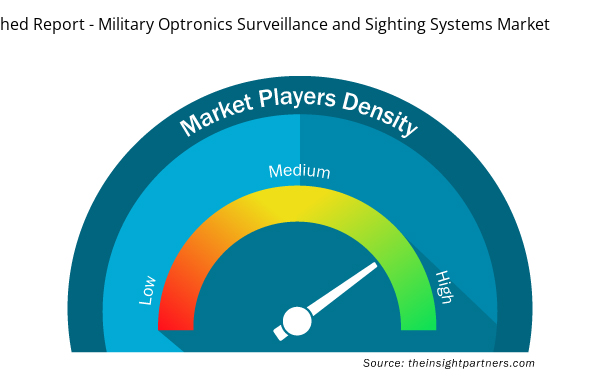

Published Report - Military Optronics Surveillance and Sighting Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Published Report - Military Optronics Surveillance and Sighting Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Published Report - Military Optronics Surveillance and Sighting Systems Market are:

- Airbus

- Lockheed Martin Corporation

- Thales Group

- General Dynamics Corporation

- L3Harris Technologies Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Published Report - Military Optronics Surveillance and Sighting Systems Market top key players overview

The global military optronics surveillance and sighting systems market has been segmented as mentioned below:

By Technology

- Image Intensification

- Military Laser Systems

- Electro-Optics/Infrared

By Device Type

- Night Vision Devices

- Handheld Thermal Imaging Devices

- Integrated Observation Equipment

- Standalone Infrared

- Seismic and Acoustic Sensors

- Others

By Platform

- Ground

- Airborne

- Naval

By Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

- Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

- South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Company Profiles

- HENSOLDT

- Lockheed Martin Corporation

- Thales Group

- L3Harris Technologies, Inc.

- Israel Aerospace Industries Ltd.

- Raytheon Technologies Corporation

- Safran

- Ultra

- Teledyne FLIR LLC

- Rafael Advanced Defense Systems Ltd.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, Device Type, and Platform

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

US led the military optronics surveillance & sighting systems market globally with a market share of 72% in the year 2020 followed by Canada and Mexico. Considering growing threat of terrorist activities, demand for military optronics surveillance and sighting systems is anticipated to growing considerably in the North America region in coming years

The major companies in military optronics surveillance & sighting systems includes Lockheed Martin Corporation, L3Harris Technologies, Inc., Elbit Systems Ltd., Thales Group, and Safran S.A. The ranking has been derived analysing multiple parameters such as annual revenue earned from military optronics surveillance & sighting systems portfolio, client base, geographic locations, R&D expenditure, brand image, and number of employees, among others. These companies are actively participating in developing military optronics surveillance & sighting systems for various applications.

In 2020, North America led the market with a substantial revenue share, followed by APAC and Europe. Asia Pacific is a prospective market for military optronics surveillance & sighting systems market players.

The global military optronics surveillance & sighting systems market was dominated by the electro-optics/infrared segment with market share of 45.7% in 2020. The increasing awareness among the market players about the advantages of the electro-optics/infrared is projected to increase investments in the segment, which lead to an increased production and sales, thereby boosting the segment growth.

The increasing deployment of UAVs for airborne and naval surveillance and mapping missions is resulting in a growing need for optronics surveillance and sighting system that can be effectively integrated within the UAV platform and will provide growth opportunities to the market players during the forecast period.

The military optronics surveillance & sighting systems have been in use for several years worldwide, however, the technology has been experiencing immense demand in recent years. The noteworthy increasing adoption of light-weight night vision devices is supporting the growth of military optronics surveillance & sighting systems market. Moreover, the increasing implementation of next-gen technologies in defense systems is also the crucial growth parameters for the military optronics surveillance & sighting systems market.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Military Optronics Surveillance & Sighting System Market

- Airbus

- Lockheed Martin Corporation

- Thales Group

- General Dynamics Corporation

- L3Harris Technologies Inc

- Israel Aerospace Industries

- Leidos inc

- Rafael Advanced Defense Systems Ltd

- Raytheon Company

- Safran S.A.

Get Free Sample For

Get Free Sample For