[Research Report] The remote sensing services market was valued at US$ 13,025.5 million in 2019 and is projected to reach US$ 37,650.7 million by 2027; it is expected to grow at a CAGR of 14.8% from 2020 to 2027.

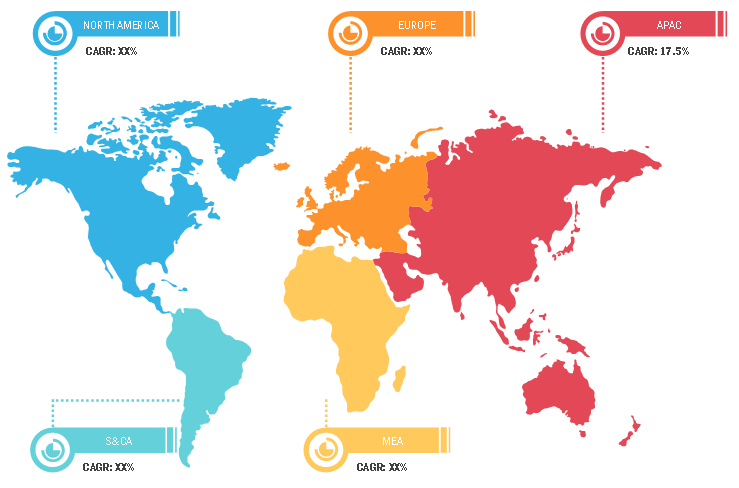

The remote sensing services market is broadly segmented into five major regions—North America, Europe, APAC, MEA, and SAM. North America held the largest share of the market in 2019. Increasing demand for remote sensing services in various sectors, such as oil & gas, mineral exploration, agriculture, energy & power, earth observation, search and rescue, weather forecasting, scientific research, forest industry, and oceanography propels the growth of the remote sensing services market in this region. The US government offers satellite, UAV, manned aircraft, ground, and spatial services to obtain important information for mineral exploration, mapping, resource management, and land-use planning applications. The growing investments in various military and commercial satellites programs are likely to boost the remote sensing services market in North America during the forecast period.

Impact of COVID-19 Pandemic on Remote Sensing Services Market

The COVID-19 pandemic has led to a temporary halt in agricultural activities, urban planning, forestry activities, and so on, since the beginning of 2020. With the imposition of lockdown across various countries in the world, the industries of respective applications have been witnessing declining . Due to low growth in the first quarter of 2020, the remote sensing services market has witnessed slight decline; however, with the resuming businesses in several countries from second and third quarters, the market has been gradually growing.

Due to lower technological developments, the remote sensing service providers have witnessed slow demand from end users such as agriculture, weather, and forest as well as from military forces. This has had a negative impact on the remote sensing services market.

Lucrative Regions in Remote Sensing Services Market

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Market Insights–Remote Sensing Services Market

Diverse Application Areas for Remote Sensing

The remote sensing techniques are being deployed in applications ranging from monitoring urban dynamics—such as urban sprawl, traffic patterns, and land usage changes—to providing assistance for the planning of humanitarian crisis and emergency response. The military forces, agriculture departments, forest departments, and weather forecasting departments are among the chief adopters of remote sensing services. The military forces use satellite images and remote sensing in a broad array of applications, including intelligence, cartography, terrain analysis, battlefield management, military installation management, and terrorist activity monitoring. The broad array of remote sensing applications is accelerating the growth of the service providers.

Resolution Segment Insights

Based on resolution, the spatial segment dominated the remote sensing services market in 2019. Spatial resolution in remote sensing depicts how much detail in the photographic images is visible to the normal human eye. The higher the spatial resolution, greater the details exhibited by the image.

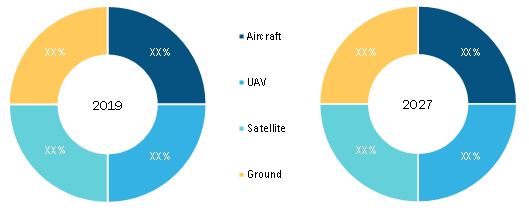

Platform Type Segment Insights

Based on platform type, the satellite segment dominated the remote sensing services market in 2019. Satellite imagery is used for agricultural monitoring around the globe, providing longest operational applications for the Landsat program.

Remote Sensing Services Market, by Platform Type (% share)

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

End User Segment Insights

Based on end user, the commercial satellite segment dominated the remote sensing services market in 2019.. Remote sensing has its application in broad areas, including weather, vegetation, forestry, pollution, land use, or erosion. Demand to integrate remote sensing for monitoring and mapping vegetation conditions throughout a range of scales is growing with increasing vegetation.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Published Report - Remote Sensing Services Market: Strategic Insights

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Published Report - Remote Sensing Services Market: Strategic Insights

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

The players operating in the remote sensing services market focus on new product innovations and developments by integrating advanced technologies and features in their products, which offers them a competitive edge.

- In March 2020, Mallon Technology won the Best Service Category award of GO Awards Northern Ireland 2020. The award is recognized for the excellent customer service provided by the company.

- In January 2019, NorthStar Earth & Space Inc. announced a strategic partnership with SpecTIR Hyperspectral & Remote Sensing Solutions of Reno, Nevada, to deliver complete hyperspectral imaging services. SpecTIR's airborne hyperspectral image services will complement space-based hyperspectral image services delivered by NorthStar, the world's first global information platform to monitor Earth.

- In December 2019, Mallon Technology won the Runners Up award in DM Awards 2019. The award recognized for the Document Capture services.

The global remote sensing services market has been segmented as follows:

Remote Sensing Services Market – by Resolution

- Spectral

- Spatial

- Radiometric

- Temporal

Remote Sensing Services Market– by Platform Type

- Aircraft

- UAV

- Satellite

- Ground

Remote Sensing Services Market – by Platform Type

- Commercial

- Defense

Remote Sensing Services Market- by Region

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

MEA

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

SAM

- Brazil

- Argentina

- Rest of SAM

Remote Sensing Services Market – Companies Profiles

- Antrix Corporation Limited

- CyberSWIFT Infotech Pvt. Ltd.

- Geo Sense Sdn. Bhd.

- Mallon Technology

- EKOFASTBA S.L.

- Satellite Imaging Corporation

- Terra Remote Sensing Inc.

- The Airborne Sensing Corporation

- Sanborn Map Company

- SpecTIR

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The use of remote sensing across the globe is expanding. Ranging from monitoring urban dynamics, such as urban sprawl, traffic patterns, and changes in land use, to providing assistance for the planning of humanitarian crisis & emergency respond—the application areas of remote sensing are widening. For more than 40 years, the Landsat satellites are acquiring images of Earth’s surface. This has turned into the world’s longest constantly-acquired collection of space-based moderate-resolution land remote sensing data. In addition, the National Satellite Land Remote Sensing Data Archive keeps a record of millions of Landsat images about changes in urban land areas across the world. The military forces, agriculture department, forest, and weather forecasting department are among users of remote sensing services. In military, the forces use satellite images and remote sensing in a broad array of applications, including intelligence, cartography, terrain analysis, battlefield management, military installation management, and monitoring of terrorist activity. The use of remote sensing is expected to expand in order to ensure proper functioning of the mentioned applications in the military. Also, with the procurement of unmanned aerial vehicles over manned aerial vehicles, the use of remote sensing would increase as unmanned aerial vehicles can easily reach difficult terrains, where defense forces may not reach. Therefore, military and defense are more inclined toward using unmanned aerial vehicles. In addition, remote sensing also helps aerospace to get plethora of information about missing aircrafts. Numerous satellites orbit the Earth on a regular bases to collect data which can be useful for finding crashed or lost aircraft.

The commercial segment led the market in 2019 with highest share and is expected to continue its dominance during the forecast period. Remote sensing has its application in broad areas, including weather, vegetation, forestry, pollution, land use, or erosion. Companies such as AABSyS provide remote sensing services by generating data to analyze and compare data of the above-mentioned applications. It also offers remote sensing services that are effective for military observation, city planning, archaeological investigations, and more. With constant technological developments, remote sensing is also getting deployed for monitoring an array of remotely detectable properties of vegetation.

In the era of technological advancements, an enormous amount of data gets generated. Big data has various unique characteristics, such as multi-source, high-dimensional, multi-scale, and dynamic-state. Enormous data generated through the atmosphere, agriculture, carbon cycle, environment, Earth surface processes, forest, hydrology, land cover, and ocean need appropriate remote sensing techniques to get real-time imagery accurately. Big data's end user must consider concrete and specific characteristics of remote sensing to extract valuable information and understand the geo-processes. As remote sensing is considered a trusted and important source of information for mapping and monitoring human-made areas and natural land, remote sensing penetration is growing exponentially. In addition to growth of big data and increase in data sensing, urban planning is also among the applications of remote sensing. Spatial data gathered through satellite remote sensing and airborne sensors makes vital contributions toward the massive pool of big data sources, which is used as a backbone for urban-related study. Increasing inclination toward big data would help in extracting information for urban planning and mapping.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Remote Sensing Services Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. Remote Sensing Services Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Government Regulations in Developed Countries

5.1.2 Diverse Application Areas of Remote Sensing

5.2 Market Restraints

5.2.1 Lack of IoT Infrastructure in Underdeveloped Countries

5.3 Market Opportunity

5.3.1 Increasing Scope of Big Data

5.4 Future Trend

5.4.1 Integration of Emerging and Sophisticated Technologies

5.5 Impact Analysis of Drivers and Restraints

6. Remote Sensing Services Market – Global Market Analysis

6.1 Remote Sensing Services Market Global Overview

6.2 Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

6.3 Market Positioning – Global Market Players Ranking

7. Remote Sensing Services Market Analysis – By Resolution

7.1 Overview

7.2 Remote Sensing Services Market, By Resolution (2019 and 2027)

7.3 Spectral

7.3.1 Overview

7.3.2 Spectral: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

7.4 Spatial

7.4.1 Overview

7.4.2 Spatial: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

7.5 Radiometric

7.5.1 Overview

7.5.2 Radiometric: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

7.6 Temporal

7.6.1 Overview

7.6.2 Temporal: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

8. Remote Sensing Services Market – By Platform Type

8.1 Overview

8.2 Remote Sensing Services Market, by Platform Type (2019 and 2027)

8.3 Aircraft

8.3.1 Overview

8.3.2 Aircraft: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

8.4 UAV

8.4.1 Overview

8.4.2 UAV: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

8.5 Satellite

8.5.1 Overview

8.5.2 Satellite: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

8.6 Ground

8.6.1 Overview

8.6.2 Ground: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

9. Remote Sensing Services Market Analysis – By End User

9.1 Overview

9.2 Remote Sensing Services Market, By End User (2019 and 2027)

9.3 Commercial

9.3.1 Overview

9.3.2 Commercial: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

9.4 Defense

9.4.1 Overview

9.4.2 Defense: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10. Remote Sensing Services Market – Geographic Analysis

10.1 Overview

10.2 North America: Remote Sensing Services Market

10.2.1 North America: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.2.2 North America: Remote Sensing Services Market, by Resolution

10.2.3 North America: Remote Sensing Services Market, by Platform Type

10.2.4 North America: Remote Sensing Services Market, by End User

10.2.5 North America: Remote Sensing Services Market, by Key Country

10.2.5.1 US: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.2.5.1.1 US: Remote Sensing Services Market, by Resolution

10.2.5.1.2 US: Remote Sensing Services Market, by Platform Type

10.2.5.1.3 US: Remote Sensing Services Market, by End User

10.2.5.2 Canada: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.2.5.2.1 Canada: Remote Sensing Services Market, by Resolution

10.2.5.2.2 Canada: Remote Sensing Services Market, by Platform Type

10.2.5.2.3 Canada: Remote Sensing Services Market, by End User

10.2.5.3 Mexico: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.2.5.3.1 Mexico: Remote Sensing Services Market, by Resolution

10.2.5.3.1.1 Mexico: Remote Sensing Services Market, By Platform Type

10.2.5.3.2 Mexico: Remote Sensing Services Market, by Platform Type

10.2.5.3.3 Mexico: Remote Sensing Services Market, by End User

10.3 Europe: Remote Sensing Services Market

10.3.1 Europe: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.3.2 Europe: Remote Sensing Services Market, by Resolution

10.3.3 Europe: Remote Sensing Services Market, by Platform Type

10.3.4 Europe: Remote Sensing Services Market, by End User

10.3.5 Europe: Remote Sensing Services Market, by Key Country

10.3.5.1 Germany: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.3.5.1.1 Germany: Remote Sensing Services Market, by Resolution

10.3.5.1.2 Germany: Remote Sensing Services Market, by Platform Type

10.3.5.1.3 Germany: Remote Sensing Services Market, by End User

10.3.5.2 France: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.3.5.2.1 France: Remote Sensing Services Market, by Resolution

10.3.5.2.2 France: Remote Sensing Services Market, by Platform Type

10.3.5.2.3 France: Remote Sensing Services Market, by End User

10.3.5.3 Italy: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.3.5.3.1 Italy: Remote Sensing Services Market, by Resolution

10.3.5.3.2 Italy: Remote Sensing Services Market, by Platform Type

10.3.5.3.3 Italy: Remote Sensing Services Market, by End User

10.3.5.4 UK: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.3.5.4.1 UK: Remote Sensing Services Market, by Resolution

10.3.5.4.2 UK: Remote Sensing Services Market, by Platform Type

10.3.5.4.3 UK: Remote Sensing Services Market, by End User

10.3.5.5 Russia: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.3.5.5.1 Russia: Remote Sensing Services Market, by Resolution

10.3.5.5.2 Russia: Remote Sensing Services Market, by Platform Type

10.3.5.5.3 Russia: Remote Sensing Services Market, by End User

10.3.5.6 Rest of Europe: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.3.5.6.1 Rest of Europe: Remote Sensing Services Market, by Resolution

10.3.5.6.2 Rest of Europe: Remote Sensing Services Market, by Platform Type

10.3.5.6.3 Rest of Europe: Remote Sensing Services Market, by End User

10.4 APAC: Remote Sensing Services Market

10.4.1 APAC: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.4.2 APAC: Remote Sensing Services Market, by Resolution

10.4.3 APAC: Remote Sensing Services Market, by Platform Type

10.4.4 APAC: Remote Sensing Services Market, by End User

10.4.5 APAC: Remote Sensing Services Market, by Key Country

10.4.5.1 China: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.4.5.1.1 China: Remote Sensing Services Market, by Resolution

10.4.5.1.2 China: Remote Sensing Services Market, by Platform Type

10.4.5.1.3 China: Remote Sensing Services Market, by End User

10.4.5.2 India: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.4.5.2.1 India: Remote Sensing Services Market, by Resolution

10.4.5.2.2 India: Remote Sensing Services Market, by Platform Type

10.4.5.2.3 India: Remote Sensing Services Market, by End User

10.4.5.3 Japan: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.4.5.3.1 Japan: Remote Sensing Services Market, by Resolution

10.4.5.3.2 Japan: Remote Sensing Services Market, by Platform Type

10.4.5.3.3 Japan: Remote Sensing Services Market, by End User

10.4.5.4 South Korea: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.4.5.4.1 South Korea: Remote Sensing Services Market, by Resolution

10.4.5.4.2 South Korea: Remote Sensing Services Market, by Platform Type

10.4.5.4.3 South Korea: Remote Sensing Services Market, by End User

10.4.5.5 Australia: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.4.5.5.1 Australia: Remote Sensing Services Market, by Resolution

10.4.5.5.2 Australia: Remote Sensing Services Market, by Platform Type

10.4.5.5.3 Australia: Remote Sensing Services Market, by End User

10.4.5.6 Rest of APAC: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.4.5.6.1 Rest of APAC: Remote Sensing Services Market, by Resolution

10.4.5.6.2 Rest of APAC: Remote Sensing Services Market, by Platform Type

10.4.5.6.3 Rest of APAC: Remote Sensing Services Market, by End User

10.5 MEA: Remote Sensing Services Market

10.5.1 MEA: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.5.2 MEA: Remote Sensing Services Market, by Resolution

10.5.3 MEA: Remote Sensing Services Market, by Platform Type

10.5.4 MEA: Remote Sensing Services Market, by End User

10.5.5 MEA: Remote Sensing Services Market, by Key Country

10.5.5.1 Saudi Arabia: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.5.5.1.1 Saudi Arabia: Remote Sensing Services Market, by Resolution

10.5.5.1.2 Saudi Arabia: Remote Sensing Services Market, by Platform Type

10.5.5.1.3 Saudi Arabia: Remote Sensing Services Market, by End User

10.5.5.2 UAE: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.5.5.2.1 UAE: Remote Sensing Services Market, by Resolution

10.5.5.2.2 UAE: Remote Sensing Services Market, by Platform Type

10.5.5.2.3 UAE: Remote Sensing Services Market, by End User

10.5.5.3 South Africa: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.5.5.3.1 South Africa: Remote Sensing Services Market, by Resolution

10.5.5.3.2 South Africa: Remote Sensing Services Market, by Platform Type

10.5.5.3.3 South Africa: Remote Sensing Services Market, by End User

10.5.5.4 Rest of MEA: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.5.5.4.1 Rest of MEA: Remote Sensing Services Market, by Resolution

10.5.5.4.2 Rest of MEA: Remote Sensing Services Market, by Platform Type

10.5.5.4.3 Rest of MEA: Remote Sensing Services Market, by End User

10.6 SAM: Remote Sensing Services Market

10.6.1 SAM: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.6.2 SAM: Remote Sensing Services Market, by Resolution

10.6.3 SAM: Remote Sensing Services Market, by Platform Type

10.6.4 SAM: Remote Sensing Services Market, by End User

10.6.5 SAM: Remote Sensing Services Market, by Key Country

10.6.5.1 Brazil: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.6.5.1.1 Brazil: Remote Sensing Services Market, by Resolution

10.6.5.1.2 Brazil: Remote Sensing Services Market, by Platform Type

10.6.5.1.3 Brazil: Remote Sensing Services Market, by End User

10.6.5.2 Argentina: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.6.5.2.1 Argentina: Remote Sensing Services Market, by Resolution

10.6.5.2.2 Argentina: Remote Sensing Services Market, by Platform Type

10.6.5.2.3 Argentina: Remote Sensing Services Market, by End User

10.6.5.3 Rest of SAM: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

10.6.5.3.1 Rest of SAM: Remote Sensing Services Market, by Resolution

10.6.5.3.2 Rest of SAM: Remote Sensing Services Market, by Platform Type

10.6.5.3.3 Rest of SAM: Remote Sensing Services Market, by End User

11. Impact of COVID-19 Outbreak

11.1 Impact of COVID-19 Pandemic on Global Remote Sensing Services Market

11.1.1 North America: Impact Assessment of COVID-19 Pandemic

11.1.2 Europe: Impact Assessment of COVID-19 Pandemic

11.1.3 Asia-Pacific: Impact Assessment of COVID-19 Pandemic

11.1.4 Middle East and Africa: Impact Assessment of COVID-19 Pandemic

11.1.5 South America: Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

13. Company Profiles

13.1 Antrix Corporation Limited

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 CyberSWIFT Infotech Pvt. Ltd.

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Geo Sense Sdn. Bhd.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Mallon Technology

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 EKOFASTBA S.L.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Satellite Imaging Corporation

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Terra Remote Sensing Inc.

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 The Airborne Sensing Corporation

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 The Sanborn Map Company, Inc.

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 SpecTIR

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Table 2. North America: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 3. North America: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 4. North America: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 5. US: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 6. US: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 7. US: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 8. Canada: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 9. Canada: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 10. Canada: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 11. Mexico: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 12. Mexico: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 13. Mexico: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 14. Europe: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 15. Europe: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 16. Europe: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 17. Germany: Remote Sensing Services Market, by Resolution –Revenue and Forecast to 2027 (US$ Million)

Table 18. Germany: Remote Sensing Services Market, by Platform Type –Revenue and Forecast to 2027 (US$ Million)

Table 19. Germany: Remote Sensing Services Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 20. France: Remote Sensing Services Market, by Resolution –Revenue and Forecast to 2027 (US$ Million)

Table 21. France: Remote Sensing Services Market, by Platform Type –Revenue and Forecast to 2027 (US$ Million)

Table 22. France: Remote Sensing Services Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 23. Italy: Remote Sensing Services Market, by Resolution –Revenue and Forecast to 2027 (US$ Million)

Table 24. Italy: Remote Sensing Services Market, by Platform Type –Revenue and Forecast to 2027 (US$ Million)

Table 25. Italy: Remote Sensing Services Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 26. UK: Remote Sensing Services Market, by Resolution –Revenue and Forecast to 2027 (US$ Million)

Table 27. UK: Remote Sensing Services Market, by Platform Type –Revenue and Forecast to 2027 (US$ Million)

Table 28. UK: Remote Sensing Services Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 29. Russia: Remote Sensing Services Market, by Resolution –Revenue and Forecast to 2027 (US$ Million)

Table 30. Russia: Remote Sensing Services Market, by Platform Type –Revenue and Forecast to 2027 (US$ Million)

Table 31. Russia: Remote Sensing Services Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 32. Rest of Europe: Remote Sensing Services Market, by Resolution –Revenue and Forecast to 2027 (US$ Million)

Table 33. Rest of Europe: Remote Sensing Services Market, by Platform Type –Revenue and Forecast to 2027 (US$ Million)

Table 34. Rest of Europe: Remote Sensing Services Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 35. APAC: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 36. APAC: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 37. APAC: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 38. China: Remote Sensing Services Market, by Resolution –Revenue and Forecast to 2027 (US$ Million)

Table 39. China: Remote Sensing Services Market, by Platform Type –Revenue and Forecast to 2027 (US$ Million)

Table 40. China: Remote Sensing Services Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 41. India: Remote Sensing Services Market, by Resolution –Revenue and Forecast to 2027 (US$ Million)

Table 42. India: Remote Sensing Services Market, by Platform Type –Revenue and Forecast to 2027 (US$ Million)

Table 43. India: Remote Sensing Services Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 44. Japan: Remote Sensing Services Market, by Resolution –Revenue and Forecast to 2027 (US$ Million)

Table 45. Japan: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 46. Japan: Remote Sensing Services Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 47. South Korea: Remote Sensing Services Market, by Resolution –Revenue and Forecast to 2027 (US$ Million)

Table 48. South Korea: Remote Sensing Services Market, by Platform Type –Revenue and Forecast to 2027 (US$ Million)

Table 49. South Korea: Remote Sensing Services Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 50. Australia: Remote Sensing Services Market, by Resolution –Revenue and Forecast to 2027 (US$ Million)

Table 51. Australia: Remote Sensing Services Market, by Platform Type –Revenue and Forecast to 2027 (US$ Million)

Table 52. Australia: Remote Sensing Services Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 53. Rest of APAC: Remote Sensing Services Market, by Resolution –Revenue and Forecast to 2027 (US$ Million)

Table 54. Rest of APAC: Remote Sensing Services Market, by Platform Type –Revenue and Forecast to 2027 (US$ Million)

Table 55. Rest of APAC: Remote Sensing Services Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 56. MEA: Remote Sensing Services Market, by Resolution– Revenue and Forecast to 2027 (US$ Million)

Table 57. MEA: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 58. MEA: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 59. South Africa: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 60. South Africa: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 61. South Africa: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 62. UAE: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 63. UAE: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 64. UAE: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 65. South Africa: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 66. South Africa: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 67. South Africa: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 68. Rest of MEA: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 69. Rest of MEA: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 70. Rest of MEA: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 71. SAM: Remote Sensing Services Market, by Resolution– Revenue and Forecast to 2027 (US$ Million)

Table 72. SAM: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 73. SAM: Remote Sensing Services Market, by End User– Revenue and Forecast to 2027 (US$ Million)

Table 74. Brazil: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 75. Brazil: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 76. Brazil: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 77. Argentina: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 78. Argentina: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 79. Argentina: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 80. Rest of SAM: Remote Sensing Services Market, by Resolution – Revenue and Forecast to 2027 (US$ Million)

Table 81. Rest of SAM: Remote Sensing Services Market, by Platform Type – Revenue and Forecast to 2027 (US$ Million)

Table 82. Rest of SAM: Remote Sensing Services Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 83. List of Abbreviation

LIST OF FIGURES

Figure 1. Remote Sensing Services Market Segmentation

Figure 2. Remote Sensing Services Market Segmentation – By Geography

Figure 3. Global Remote Sensing Services Market Overview

Figure 4. Remote Sensing Services Market, by Geography

Figure 5. Remote Sensing Services Market, By Platform Type

Figure 6. Remote Sensing Services Market, By Resolution

Figure 7. Remote Sensing Services Market, By End User

Figure 8. Porter’s Five Forces Analysis

Figure 9. Ecosystem Analysis

Figure 10. Expert Opinion

Figure 11. Global Remote Sensing Services Market: Impact Analysis of Drivers and Restraints

Figure 12. Geographic Overview of Remote Sensing Services Market

Figure 13. Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 14. Remote Sensing Services Market Revenue Share, by Resolution (2019 and 2027)

Figure 15. Spectral: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 16. Spatial: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 17. Radiometric: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 18. Temporal: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 19. Remote Sensing Services Market Revenue Share, by Platform Type (2019 and 2027)

Figure 20. Aircraft: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 21. UAV: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 22. Satellite: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 23. Ground: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 24. Remote Sensing Services Market Revenue Share, by End User (2019 and 2027)

Figure 25. Commercial: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 26. Defense: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 27. Global Remote Sensing Services Market Revenue Share, by Region (2019 and 2027)

Figure 28. North America: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 29. North America: Remote Sensing Services Market Revenue Share, by Resolution (2019 and 2027)

Figure 30. North America: Remote Sensing Services Market Revenue Share, by Platform Type (2019 and 2027)

Figure 31. North America: Remote Sensing Services Market Revenue Share, by End User (2019 and 2027)

Figure 32. North America: Remote Sensing Services Market Revenue Share, by Key Country (2019 and 2027)

Figure 33. US: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 34. Canada: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 35. Mexico: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 36. Europe: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 37. Europe: Remote Sensing Services Market Revenue Share, by Resolution (2019 and 2027)

Figure 38. Europe: Remote Sensing Services Market Revenue Share, by Platform Type (2019 and 2027)

Figure 39. Europe: Remote Sensing Services Market Revenue Share, by End User (2019 and 2027)

Figure 40. Europe: Remote Sensing Services Market Revenue Share, by Key Country (2019 and 2027)

Figure 41. Germany: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 42. France: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 43. Italy: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 44. UK: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 45. Russia: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 46. Rest of Europe: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 47. APAC: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 48. APAC: Remote Sensing Services Market Revenue Share, by Resolution (2019 and 2027)

Figure 49. APAC: Remote Sensing Services Market Revenue Share, by Platform Type (2019 and 2027)

Figure 50. APAC: Remote Sensing Services Market Revenue Share, by End User (2019 and 2027)

Figure 51. APAC: Remote Sensing Services Market Revenue Share, by Key Country (2019 and 2027)

Figure 52. China: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 53. India: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 54. Japan: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 55. South Korea: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 56. Australia: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 57. Rest of APAC: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 58. MEA: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 59. MEA: Remote Sensing Services Market Revenue Share, by Resolution (2019 and 2027)

Figure 60. MEA: Remote Sensing Services Market Revenue Share, by Platform Type (2019 and 2027)

Figure 61. MEA: Remote Sensing Services Market Revenue Share, by End User (2018 and 2027)

Figure 62. MEA: Remote Sensing Services Market Revenue Share, by Key Country (2019 and 2027)

Figure 63. Saudi Arabia: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 64. UAE: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 65. South Africa: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 66. Rest of MEA: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 67. SAM: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 68. SAM: Remote Sensing Services Market Revenue Share, by Resolution (2019 and 2027)

Figure 69. SAM: Remote Sensing Services Market Revenue Share, by Platform Type (2019 and 2027)

Figure 70. SAM: Remote Sensing Services Market Revenue Share, by End User (2018 and 2027)

Figure 71. SAM: Remote Sensing Services Market Revenue Share, by Key Country (2019 and 2027)

Figure 72. Brazil: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 73. Argentina: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 74. Rest of SAM: Remote Sensing Services Market – Revenue and Forecast to 2027 (US$ Million)

Figure 75. Impact of COVID-19 Pandemic in North American Country Markets

Figure 76. Impact of COVID-19 Pandemic in Europe Country Markets

Figure 77. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

Figure 78. Impact of COVID-19 Pandemic in Middle East and Africa Country Markets

Figure 79. Impact of COVID-19 Pandemic in South America Country Markets

The List of Companies - Remote Sensing Services Market

- Antrix Corporation Limited

- CyberSWIFT Infotech Pvt. Ltd

- Geo Sense Sdn. Bhd

- Mallon Technology

- EKOFASTBA S.L

- Satellite Imaging Corporation

- Terra Remote Sensing Inc

- The Airborne Sensing Corporation

- The Sanborn Map Company, Inc

- SpecTIR

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Published Report - Remote Sensing Services Market

Nov 2020

Aerospace Stainless Steel And Superalloy Fasteners Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material Type [Stainless Steel, Superalloy (A286, Inconel 718, Waspaloy, and Others)], Application (Airframe, Engine, Interior, and Others), Aircraft Type (Fixed Wing and Rotary Wing), Product Type (Screws, Rivets, Nut/Bolts, and Others), and Geography

Nov 2020

Military Antenna Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Aperture Antennas, Dipole Antennas, Travelling Wave Antennas, Monopole Antennas, Loop Antennas, Array Antennas, Others); Frequency (High Frequency, Very High Frequency, Ultra-High Frequency); Platform (Marine, Ground, Airborne); Application (Communication, Telemetry, Electronic Warfare, Surveillance, Navigation); and Geography

Nov 2020

Helicopter MRO Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Airframe Maintenance, Engine Maintenance, Component Maintenance, Line Maintenance); Helicopter Type (Light Helicopter, Medium Helicopter, Heavy Helicopter); End User (Commercial, Military); and Geography

Nov 2020

Airport Infrastructure Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Airport Type (Commercial Airport, Military Airport, General Aviation Airport); Infrastructure Type (Terminal, Control Tower, Taxiway & Runway, Hangar, Others); and Geography

Nov 2020

Airport Fueling Equipment Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Tanker Capacity (Below 5000 litres, 5000-20000 litres, Above 20000 litres); Aircraft Type (Civil Aircraft, Military Aircraft); Power Source (Electric, Non-Electric); and Geography

Nov 2020

Nov 2020

Airborne Pods Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Aircraft Type (Combat Aircraft, Helicopters, UAVs and Others); Pod Type (ISR, Targeting, and Countermeasure); Sensor Technology (EO/IR, EW/EA, and IRCM); Range (Short, Long, and Intermediate); and Geography

Nov 2020

Air Defense Radar Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Range (Long Range, Medium Range, Short Range); Product Type (Synthetic Aperture and Moving Target Indicator Radar, Surveillance Radar, Airborne Early Warning Radar, Multi-functional Radar, Weather Radar, Others); System Type (Fixed, Portable); Platform (Ground-based, Aircraft-mounted, Naval-based); Application (Ballistic Missile Defense, Identification Friend or Foe, Weather Forecasting, Others); and Geography

Get Free Sample For

Get Free Sample For