In recent years, a dynamic shift has been observed from inpatient to outpatient care that has changed the face of healthcare. Outpatient care is anticipated to achieve a noteworthy revenue of USD 1.37tn in 2024. This sector is estimated to display steady annual growth while leading to a substantial ambulatory surgical center market share. The United States are leading market in the expansion of outpatient care services with its advanced healthcare infrastructure and accessible medical services.

The number of U.S. ambulatory healthcare establishments has risen from 546 thousand in 2007 to 643 thousand in 2020. Emergence of outpatient care models transforming operations, business models, capital, and staffing. Ambulatory surgical centers (ASC) have become increasingly important as they carry out an increasing number of medical procedures following advancements in healthcare technologies. The rise in the use of non-conventional sites for healthcare facilities such as Telehealth, Primary Care Clinics, Community Health Centers, and Ambulatory Surgery Centers are striking trends in the outpatient healthcare industry.

Due to advancements in technologies and backed by a desire to optimize healthcare costs, ambulatory care centers are expected to attract investors, healthcare organizations, community health centers, and healthcare policymakers. At present ambulatory care centers are capable of handling minor surgeries and some of these are also handling complex surgeries. The expansion of ambulatory surgical centers to complex surgical processes will unlock new growth horizons in outpatient healthcare in the coming decade. This article will brief on the state of the ambulatory surgical center market by gauging market drivers, growth dynamics, recent trends, and developments.

Ambulatory Surgical Center Market Drivers, Opportunities, and Growth Discussion

Mounting Ophthalmic Surgeries and Evolution of Office-Based Surgery Suits

As recorded by the American Academy of Ophthalmology (AAO), about 45 million Americans wear contact lenses and approximately 800,000 ophthalmic surgeries are performed every year in the United States. Ambulatory care centers are occupied with the latest equipment and facilities assisting in serving patients who can be treated with one-day procedures and discharges within a few hours after surgeries. With prior procedure schedules, ASCs prevent commotion and provide a clean environment that ensures healthcare hygiene. Increased ophthalmic surgeries are anticipated to bring upward traction in ambulatory surgical center market.

As ASCs have become an integral part of ophthalmic surgeries, the discussion has moved further to integrate office-based surgery (OBS). More ophthalmologists are estimated to invest in office-based suits. In 2019 there were 100 office-based surgery suits in the United States. Doctors who experience practice growth, and are in transition mode can find investing in office-based surgery a viable investment move in the ambulatory care centers market in the coming decade.

Multispecialty ASCs Vs Single Specialty ASCs which is a more Investible Opportunity?

Outpatient surgery centers are expected to ramp up in terms of popularity as a less expensive and faster option. Finding out which one is investible between multispecialty ASCs and Single ASCs is an immediate business concern.

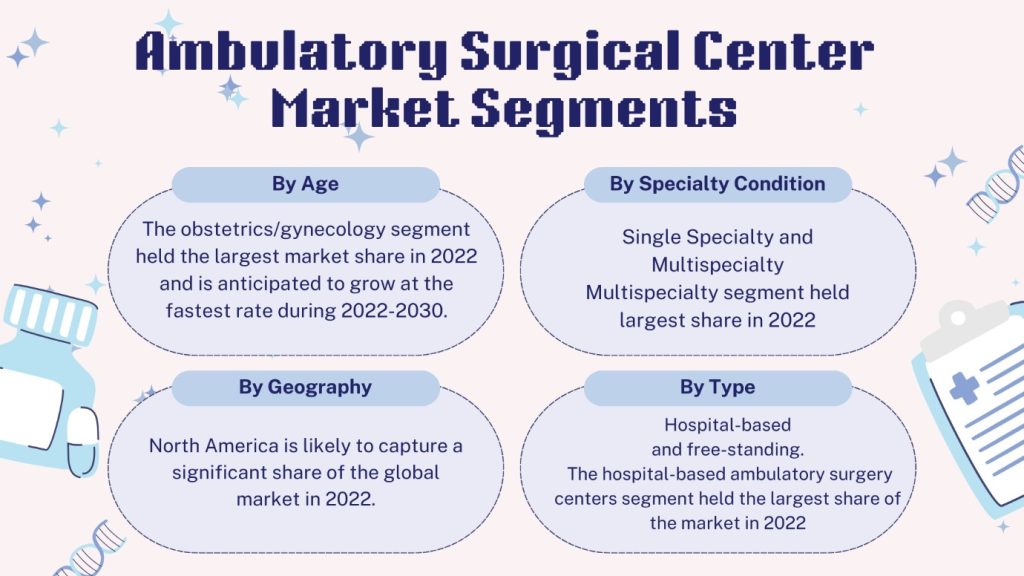

Increased preference by healthcare organizations for expanding outpatient facilities has favored the expansion of ambulatory surgical center market share in recent years. Employment in ambulatory healthcare services has seen a considerable rise in recent years. Employment in US multispecialty ambulatory health care services was around 4.3 million in 1999 which has crossed 7.8 million in 2021. The multispecialty centers segment held the largest ambulatory surgical center market share in 2022.

As multispecialty ASCs allow diversification, it seems a more investible option. With multispecialty ambulatory care centers even if one specialty service takes a hit from reimbursements the new non-surgical treatment can remain afloat with the other specialty strength. However single specialty model won’t be completely outweighed in the coming years as these players can focus on specific services and need to invest in only specific equipment rather than spreading themselves too thin.

Increasing Chronic Diseases Augment Demand for Surgeries

As per the US Census Bureau, the geriatric population crossed 55.8 million in 2020, which was 16.8% of the national populace. Aged grown-ups are likely to contribute more to the demand for hospitalization than grown-ups and middle-aged people. Nearly 17% of Americans over age 65 rehabilitate at least formerly by that time. The growing geriatric population is anticipated to bring a notable surge in conditions like bone disorders, muscular pain, and infections. Growing demand for chronic disease management is anticipated to favor ambulatory surgical center market growth.

National Institute of Health cited in 2018, that chronic diseases are responsible for seven out of 10 deaths in the U.S. As chronic diseases are long-lasting, they require consistent patient-centric care. Ambulatory care settings can play a crucial role in the management of chronic diseases by providing outpatient services and supporting self-management among patients. Evidence collected from patients experiencing chronic health conditions indicates that timely and effective primary health care has a vital role in enhancing health outcomes for persons with chronic diseases, by addressing expensive hospitalizations and emergency department visits.

Investible Specialty ASC – Insights on Patient Volume and Reimbursements

Gastroenterology and endoscopy are likely to remain popular in ambulatory surgical centers due to Medicare paying for 40% of GI procedures and reimbursement of screening colonoscopies. Colon cancer cases have become increasingly common. Gastroenterologists introduce many procedures in ASCs. GI procedures are anticipated to remain low to medium reimbursement and high-volume surgeries in ASCs.

Pain management has taken time to make it to ASCs as payers are strict about the procedure counts while healthcare companies are strict about the use of services. With more physicians moving procedures out of ASCs due to involved reimbursement. However, complex procedures are estimated to stay as part of ASC services, the specialty is high volume with a lower rate of reimbursement.

Orthopedics is distinct from than other 3 ASC specialties in terms of greater impact of commercial reimbursement. Hospitals actively seek orthopedic physicians and many have already opted to remain independent as ASCs. Orthopedic ASCs anticipated to have a sizable volume with the highest average reimbursements.

Thinking of Expanding into the Ambulatory Surgical Center Market? here is a Future Outlook!

No doubt ambulatory surgery center space has grown exponentially with significant patient volume and the number of procedures that are possible in ASCs over traditional hospital setups. The growing preference by patients towards smaller outpatient care facilities like ASCs is driven by lower costs, flexibility of schedules, and customized care. Business expansion into ASCs seems promising potential as between 2014 to 2020, a total increase of 11% was observed in Medicare-certified ASCs and the volume of Medicare payments for ASC procedures increased by 29%. Over the next 4 years, Medicare Certified ASCs anticipated to grow by 25%.

With more than 93% of ASCs having physicians as owners, there is a rising preference for ASCs by medical professionals. This physician ownership model seems to have high earning potential. Private healthcare players are enacting policies to drive operations to ASCs, anticipated to fuel the ambulatory surgical center market size in coming years.

“The ambulatory surgical center market size is expected to cross USD 60.30 billion by 2030, from USD 36.99 billion in 2022. It is estimated to record a CAGR of 6.5% during 2022–2030”

Hospital-based ASCs held a major share in 2022, these are typically located within hospitals and allow a wide range of operations as they comply with regulations for both ambulatory care centers and hospitals.

North America is expected to capture the largest ambulatory surgical center market share in the coming decade due to the elevated rate of chronic conditions and spurring funding by government and private equity investors. Major medical centers and research institutes present in North America are driving innovation in minimally invasive procedures. The use of robotics and high-definition imaging is anticipated to remain key technologies in the ambulatory surgical center market.

Recent Developments in the Ambulatory Surgical Center Market

- March 2024: McLaren Greater Lansing, part of statewide McLaren Health Care, has announced its plans to expand further into the community, enhancing patients’ access to health care services. USD 40 million investment will be made in building freestanding ambulatory care centers or emergency departments intended to increase access to commonly used in-demand health services.

- July 2023: Adventist HealthCare (AHC) opened its new state-of-the-art Ambulatory Surgery Center located at National Harbor. The Ambulatory Surgery Center will serve as a link between nearby Adventist HealthCare Fort Washington Medical Center and its new primary care facility, located just minutes from each other. Together, each operation will supply the critical services that are essential to meeting the healthcare needs of the community.

References –

Healio.com – Office-based surgery, ASCs have an evolving role in ophthalmology

BeckersASC.com – ASC single specialty vs. multispecialty — Which is best?

Forbes – How Capitalism Is Driving the Ambulatory Surgery Center Industry