The global automotive wiring harness market accounted to US$ 47.08 Bn in 2018 and is expected to grow at a CAGR of 4.27% during the forecast period 2019 – 2027

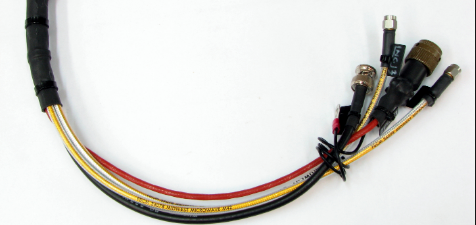

Automobiles today have thousands or more connection points for circuits and wires. The major challenge of wiring harness technology lies in its design to recuperate cost-effective techniques accurately and rapidly assembling these connections. A wiring harness is an organized set of terminals, wires, and connectors that plays throughout the vehicle’s body and supply electric power and information, thus playing a critical role in the connection of a variety of components. As vehicles continue to provide advanced functions, their component parts increasingly require electronics to save space and meet other requirements. The multifarious macroeconomic risks, especially the impending Brexit as well as the possible weakening in the Chinese economy, are also weighing on the automotive industry. In addition, there are sector-specific factors like the diesel crisis, driving restrictions, and the threat of import duties.

The Automotive Wiring Harness Market globally is segmented on the basis of vehicle type into passenger cars, light commercial vehicles and medium & heavy commercial vehicles. The automotive wiring harness market is further segmented by type into main harness, cockpit harness, auxiliary harness, ICE harness, e-motor harness; and others. The other end-use segments involved in global automotive wiring harness market include banking, retail, and GIS mapping among others.

The top five companies in the automotive wiring harness market include Lear Corporation, LEONI AG, Aptiv, Sumitomo Electric Co. Ltd., and Furukawa Electric Co. The above listing is based on multiple factors including automotive wiring harness segment revenue, product portfolio, upcoming products, investment in R&D, mergers and acquisitions activities, and future plans. Companies have taken several market initiatives in order to expand their footprint across the world and to fulfill the growing demand of the Automotive Wiring Harness Market. In 2019, Lear Corporation announced the completion of acquisition of Seattle-based Xevo Inc., a leading automotive software supplier that develops solutions for cloud, car, and mobile devices. The acquisition of Xevo enhances Lear’s capabilities in software, services, and data analytics and strengthen its market position in connectivity.

The players present in automotive wiring harness market mainly concentrate towards the partnership, collaborations, agreements and other activities for the deployment of new technological solutions across the world permit the company maintain its brand name globally. Most of the market initiative were observed in APAC region, which have high potential of automotive wiring harness market related services. Few on the important market initiatives and acquisitions from the industry are mentioned below:

| Year | News | Country |

| 2019 | Lear Corporation announced the completion of acquisition of Seattle-based Xevo Inc., a leading automotive software supplier that develops solutions for cloud, car, and mobile devices. The acquisition of Xevo enhances Lear’s capabilities in software, services, and data analytics and strengthen its market position in connectivity | North America |

| 2018 | Aptiv announced the acquisition of Winchester Interconnect, a leading provider of advanced interconnect solutions for harsh environment applications, from an affiliate of Snow Phipps Group. Winchester will operate as an independent business unit within Aptiv’s Signal & Power Solutions segment, and will continue to go to market under its current brand names. | APAC |

| 2018 | Aptiv completed its acquisition of KUM, a leading provider of highly engineered connectors and cable management solutions for a range of harsh-environment automotive applications. | APAC |