The breast cancer screening market has garnered significant attention as breast cancer is the second leading cause of cancer deaths recorded among women. Most of the cases of breast cancer are observed among middle-aged and older women. In recent years breast cancer cases have increased by 0.6% per year. In 2022, there were about 2.3 million women diagnosed with breast cancer accounting for 670,000 deaths globally. However, breast cancer deaths have been decreasing since 1989. An overall decline of 42% in cancer deaths was noticed during 2021. A decrease in death rates is attributed to increased awareness, early-stage detection, and better screening technologies. At present 5–year survival rate is 90% which is substantially higher than 5–the five-year survival rate of 75% in 1975.

Early diagnosis of breast cancer plays a vital role in its treatment, as it may prevent the condition from becoming complex. Timely screening ensures stable and suitable care is offered to the patient acting as a timely intervention. Mammography, ultrasound, and magnetic resonance imaging (MRI) are some prominent methods used to screen breast cancer. The rising need for early detection has propelled breast cancer screening market growth in recent years.

The United States Preventive Services Task Force (USPSTF), recommended women between the age of 50 to 74 years should get a mammography regularly. Rising obesity, heightened consumption of alcohol, and increasing age are certain factors contributing to the rising breast cancer screening market share in the US. Family history also increases breast cancer risk. High penetrance of gene mutations greatly increases the risk of breast cancer among US women. Increasing emphasis on early screening has improved investment in the market. This article will delve into breast cancer screening market trends, forecasts, and technologies.

Why the USA is a Lucrative Breast Cancer Screening Market?

The average risk of women in the US developing breast cancer in their lifespan stands at 13%. According to the American Cancer Society’s estimates, in 2024, about 310,720 new cases of breast cancer will be diagnosed in women. The organization further projects 42,250 women will die from breast cancer. About 75.9% of women have had a mammogram since 2021. Mounting awareness of breast cancer within the region is anticipated to rise in the US breast cancer screening market share in the coming decade.

Mounting Obesity Cases – Rise in Breast Cancer Screening Tests

National Center for Health Statistics has shown that 42.4% of US adults were obese in 2018, among all obese populace 41.95 were women. The prevalence of high obesity among women in the US is a major factor in increasing the risk of breast cancer. Women with obesity may be reluctant to seek treatment or health intervention due to fear of stigmatization by society and healthcare professionals. Negative attitudes towards people with obesity further hinder the uptake of cancer screening. Although regular screening for breast cancer can’t prevent breast cancer, it can assist in early detection and improve breast cancer therapeutics.

Government’s Effort to Address Disparities – An Uptake in Breast Cancer Screening Market

Rising reimbursements and insurance coverage offered by companies are anticipated to drive the adoption of breast cancer screening tests. Governments globally have focused on addressing disparities in breast cancer screening. Through community-based programs, technological advancements, and policy changes, countries are determined to improve access to breast cancer screening services. Centers for Disease Control and Prevention (CDC) offers an early detection program that provides high-quality breast cancer screening services to women has played a crucial role in bringing an uptake in private players’ participation in the breast cancer screening market.

In May 2022, the U.S. Department of Health and Human Services (HHS) announced USD 5 million in funding for community health centers intended to increase life-saving cancer screening facilities. This funding called for action on cancer screening and early detection as part of the “Cancer Moonshot” initiative.

Many third-party payer benefit plans in the United States have focused on Medicare and Medicaid covering genetic testing costs. Most insurance plans cover Breast Cancer Type 1 (BRCA1) and Type 2 (BRCA2) for people having a breast cancer history in the family.

UK government is also upfront in offering £10 million for breast cancer diagnosis. Continuous investment in mobile breast screening units is the most suitable way to increase capacity. Government-encouraged screening initiatives save around 1300 women each year with 21,000 cancers detected every year.

Favorable government initiatives are anticipated to bring upward traction in the cancer screening market. Developing countries are increasingly focusing on screening for cancer in individuals above the age of 30 years. Screening of these cancers is an integral part of healthcare policies and agendas.

A Glance at Profitable Opportunities in the Breast Cancer Screening Market

Imaging Test Segment to Remain Highly Investible

Blood marker tests, imaging tests, genetic tests, and immunohistochemistry tests are some prominent product types. The imaging test segment held the largest share of the breast cancer screening market in 2019. It is anticipated to grow at the highest CAGR value in 2018–2017.

In terms of end users, the breast cancer screening market is segmented into diagnostic, cancer institutes, and hospitals. The hospitals segment held the largest share of the market in 2019. Alongside, diagnostic centers are expected to register the highest CAGR in coming years.

February 2023: Global Breast Cancer Initiative Framework

The global cancer initiative framework by the World Health Organization (WHO) is anticipated to drive a roadmap for fulfilling the goal of saving the lives of 2.5 million people from breast cancer by 2040. Such global initiatives are expected to expand market opportunities and product innovation in the breast cancer screening market.

Genetic tests have gained prominence due to an increasing understanding of genetic factors that increase the risk of breast cancer. Expanding the scope of screening approaches is anticipated to propel breast cancer screening market share in coming years.

Breast Cancer Screening Market – Technological Innovations

Breast Cancer Risk Assessment Tools – Scope in Patient-Centric Care

Breast cancer risk assessment tool helps healthcare companies to estimate women’s five or 10-year and lifetime risk of developing breast cancer. Cancer screening machine manufacturers are investing in advanced technologies such as 3D mammographs and tools that analyze cancer risk are anticipated to open new opportunities in the cancer screening market. Gail model is one of the commonly used assessment tools available for free and the test can be completed within five minutes. Gail’s model is fast and easy and also assists in accurate assessment. The National Cancer Institute (NCI) recommends detailed breast cancer risk assessment tools like the IBIS Breast Cancer Evaluation Tool which can be taken online.

Transforming Breast Cancer Screening Market – Advantages of 3D Mammography

In November 2023, Reedsburg Area Medical Center—a leading player in the breast cancer screening market— developed a 3D mammography machine. This technological breakthrough offers a new dimension for patient comfort and precision.

Notable advancements such as digital mammography and the use of X-rays for breast images have improved visualization through manipulation. Innovation of 3D mammography has reduced 40% call unnecessary call-backs. This technology eases the need for follow-up appointments and ensures prompt interventions when and where needed.

Factors That Might Act as Hindrance in Breast Cancer Screening Market Growth

False Positive Results Necessitating Extra Testing

There is scope for 3D mammographs generating false positive results necessitating more biopsies and tests that may deviate patients. Over diagnosis may become a cause of concern for patients, also the rising cost of health care expenses.

Even though the screening is crucial to identify the women who may benefit from intensive breast cancer surveillance. There is a lack of standardized approach in office-based screening for breast cancer in the United States. This may result in an assessment of women at high risk. Healthcare providers will need expertise in cancer genetics and counseling for breast cancer-related mutations. Investment in research and development in this domain is anticipated to favor breast cancer screening market growth.

High Cost of Diagnostic Likely to Hinder Adoption of Breast Cancer Screening

The high cost of breast cancer screening tests is anticipated to remain a key restraint ahead of market players. Advanced imaging methods such as molecular imaging and MRI are expensive for large patient crowd. Addressing screening costs should be targeted by healthcare providers. Private players, insurance companies, and hospitals have scope to manage screening innovation.

Breast Cancer Screening Market – Future Outlook

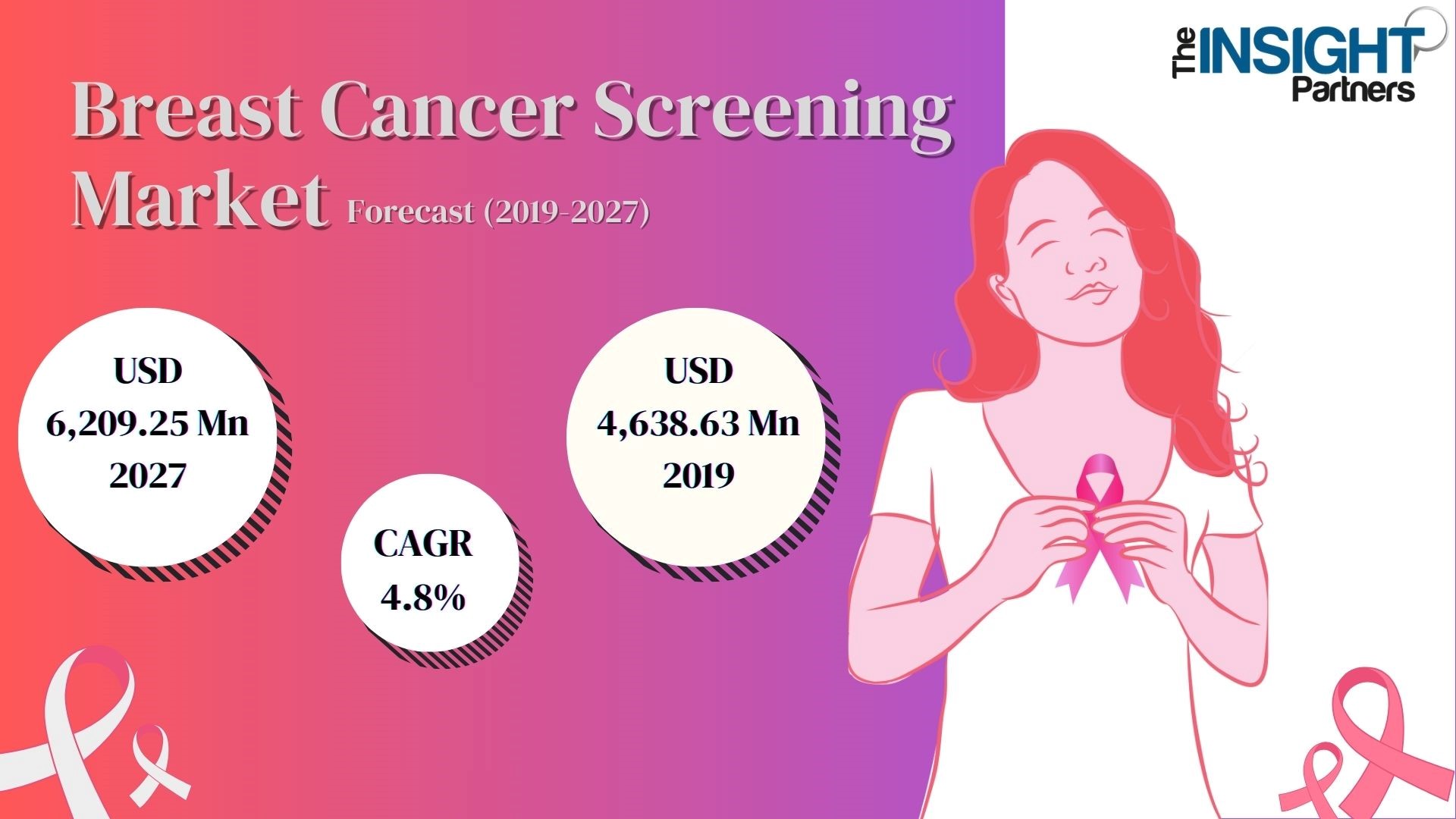

The breast cancer screening market is projected to cross USD 6,209.25 million by 2027 from USD 4,638.63 Mn in 2019; it is estimated to grow at a CAGR of 4.8% from 2020 to 2027. The foremost goal of screening is to detect disease at its earliest and most treatable stage. The screening procedures identify the early signs of cancer, even before the symptoms begin to show. Mounting prominence for early diagnosis of breast cancer and the need for successful treatment are anticipated to remain key drivers of breast cancer screening market size in coming years.

References

Ramchealth.com

The Guardian

World Health Organization (WHO) – Global Breast Cancer Initiative implementation framework