EV charging infrastructure market space has noticed rapid growth, leaving experts ecstatic with certain numbers. Electric vehicle market has seen a 62% increase in 2021. In response to growing popularity, key manufacturers have started to retool their production lines to aim at a larger EV future.

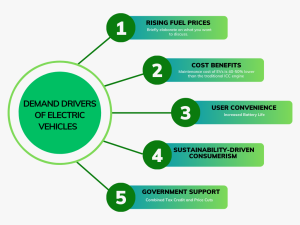

What Drives the Adoption of EVs?

- Hikes in fuel Prices- The rising prices of fuel and decreased prices of batteries are encouraging people to shift to electric vehicles. Moreover, the maintenance cost of EVs is 40-50% lower than the traditional ICC engine vehicles. Combined tax credits and price cuts have fostered purchases.

- User Convenience- EVs need infrequent maintenance than ICC engines. Furthermore, technical advancements in the charging facilities and improved driving ranges are key drivers of attracting consumers to buy EVs. Increased battery life is addressing consumers’ range anxiety leading to faster adoption.

- Sustainability-driven consumerism- New generation drivers are more conscious about the environment and climate change. They are likely to opt for greener options in mobility. The increasing consumer awareness and willingness to pay premiums for EVs have led to a rise EV charging infrastructure market.

Significance of EV Charging Infrastructure Market

Mounting electric vehicles’ usage stimulated the need for robust charging facilities. As a result, demand for charging infrastructure is anticipated to rise in the future. Consumers opting for all-electric vehicles, or plug-in hybrid EVs call for electric vehicle charging infrastructure, charging stations at public places and workstations expected to bring an uptake in the adoption of electric vehicles. As per a survey, there is a rise in public and private charging stations in the US.

EV Charging Design Terminologies

EV charging industry players need to abide by the Open charge point interface protocol. Connection between e-mobility service providers and EV charging infrastructure market drivers. It is anticipated to enhance single communication where all EV charging infrastructure market players are connected for improved continuity of supply.

EV charging cables are anticipated to gain traction of growth in the coming years. The mobility services are expected to improve in terms of optimal user experience. Alternative fueling station locator technology helps drivers find their nearest public and private EV charging points.

Key Principles to Consider While Planning EV Charging Stations

- Prioritizing Equity in Public EV Stations

The charging infrastructure should equally cater to the needs of diverse vehicles. In rural regions, the lack of charging infrastructure is a concern faced by EV drivers. Currently, EV charging companies only target commercial regions where EV concentration is considerably high. Players need to plan expansion to all regions improving accessibility of the EV charging infrastructure market.

- Building Public EV chargers

Even though most charging demands are met by home chargers, public charging stations are increasingly needed to refuel EVs. To analyze the locations companies can track vehicle parking behavior and driving in detail to capture local needs. In the US it is expected that by 2030, more people will prefer charging their vehicles at public places or in fleet depots.

EV drivers who can’t recharge at home will drive demand for charging stations wherever they need them on the way. This is expected to bring traction of growth in EV charging infrastructure market in coming years. In denser urban areas the home charging access is limited. Publicly accessible chargers would be key enablers of EV adoption.

- Understanding the Needs of Consumers and Expectations

Consumers’ expectations from charging infrastructure may vary for the type of charging. For home or office charging consumers expect affordable hardware and facilities like measurement of power consumed. While for destination charging stations, consumers expect ease in accessibility and availability at nearby locations.

Minimal charging tariffs are likely to attract more EV owners to charging points. On-the-go charging solutions should ensure quick billing and offer loyalty points. Companies can enhance user experience by providing ancillary services such as fast food, and café while waiting. Fleet charging options should be convenient and provide sufficient charging speed.

Trends in EV Charging Infrastructure Market to Address Range Anxiety

- Slow Chargers

Slow chargers operate between 2.3kW to 2.5kW, and they use alternating current. China has a major EV charging infrastructure market share in slow chargers was estimated about 1 million in 2022. Europe had 460000 slow charges in 2022, this is after a 50% increase from the previous year. Companies investing in slow charging stations could generate decent revenue in regions such as the US, Europe, and China.

- Fast Chargers

Public fast chargers enhance the rate of EV adoption among people who do not have private charging setups. The majority of fast chargers belong to China. In Europe, fast charging stations are centered in France, Germany, and Norway. Under Alternative Fuel Infrastructure regulation (AFIR), Europe is anticipated to invest EUR1.5 billion in EV charging stations by the end of 2023. This is likely to bring more investment and funding to players operating in the EV charging infrastructure market.

The United States also had about 28000 fast chargers in 2022. The National Electric Vehicle Infrastructure Formula Program (NEVI) is expected to accelerate investment in EV charging infrastructure in the coming years.

- Electric Light Duty Vehicles to Public Chargers Ratio

The share of battery EVs has increased while the charging points per battery EV have decreased. The demand for EVs will only increase with more battery EV charging stations being created and public charging stations being improved.

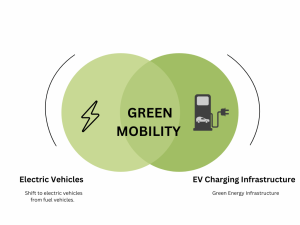

- Sustainable EV Charging Infrastructure Market

The transformation began by shifting to electric vehicles from fuel vehicles and needs sustainable infrastructure to continue. Integrated renewable energy generation is required to ensure green infrastructure. Growing demand for charging stations is adding responsibility to companies in the creation of a greener transportation ecosystem. As a result, solutions integrating renewable options and smart grids are anticipated to promote sustainability.

EV Charging Infrastructure Market Companies to Tackle the Challenge of Micromobility

The major challenge in planning micromobility is the lack of interoperable types of equipment for charging. Universal standards are required to improve connectivity. USB-C technology is suggested by some experts to tackle the challenge of interoperability ahead of EV charging infrastructure market players.

Removable batteries are serviced at indoor stations such as lockers. However, In the UK proprietary charging cables are provided where e-bikes can be charged. Manufacturers need to work on making outdoor charging infrastructure integrated. Brands need to offer alternatives for outdoor charging facilities. State and local governments have a role in partnering mobility drive with charging infrastructure companies to create robust charging facilities in public places.

Setting up an EV charging station requires huge costs depending on the type of infrastructure and its capacity. Lack of standardization can lead to issues in compatibility, and it can hamper the adoption of EVs. These charging infrastructures need a certain amount of electricity to run operations. Grid infrastructure may not be efficient enough to handle large-scale EV station requirements.

EV charging infrastructure market participants need to tackle the challenge of lack of awareness about EVs. If people are aware of electric vehicles and their benefits they still might need guidance on finding the nearest EV station. The lack of reliable charging points may demotivate people from buying EVs and this will directly affect the penetration of charging infrastructure.

Opportunities for EV Charging Infrastructure Market Companies

Fast Charging solutions for heavy transit

The ultra-fast charging is required for heavy-duty fleet trucks. In 2022, Triton, and Volvo have come together in a joint partnership for the development of ultra-fast charging stations. Companies need to plan charging stations near highways. They should follow the right sizing and grid upgrades. Electric trucks and electric buses will rely on off-shift charging stations for their energy and operations.

Tesla owns about 61% of fast DC public chargers in the U.S. The company is also offering CCS adapters to accommodate non-thesis owners. The company has expanded charging stations to drivers of EVs in California and Buffalo.

- Battery Swapping for Cost Advantage

As suggested by ICCT analysis, battery swapping of EVs offers a cost advantage. Provided the right policies and incentives battery swapping could be the next idea to scale. China is the leading country in the battery-swapping trend. This concept is already gaining traction in Asian countries such as India and Thailand.

- Planning Partnerships

Statewide and international partners are playing a crucial role in building EV corridors. Local and regional partners are identifying and providing technical expertise needed for companies. These agencies can assist companies in contributing to the Clean City Coalition.

Top automotive players such as Hyundai, Audi, Ford, and Volkswagen are making EVs that use combined charging systems (CCS) for EVs. They enable compatible cars capable of charging from both DC and AC allowing single plugs to support all-electric vehicles. These types of charging facilities are anticipated to increase in the future.

- Capitalize on Commercial Capacity

Electric vehicles have become a hot spot in the global automotive arcade. About 67% more electric cars were purchased by drivers in the US in 2022 than in 2021. The behavior patterns of these drivers have a stake in the creation of business opportunities in the EV market. The biggest pain point of EV owners is charging anxiety. The fear of running out of charging on extended trips. Insufficient public charging points are reasonably associated with this fear. Manufacturers have an opportunity to capitalize on their capacity in commercial charging stations.

High-tech EV chargers seem a promising business model for the future. They are highly capital-intensive. Moreover, enterprises can take these EV chargers on lease and get profit from the charging-as-a-service model. Asset leasing could be the enabler of rapid EV infrastructure.

- AI and ML innovation

Artificial Intelligence and Machine learning used in charging stations can lead to greener and smarter charging facilities. These technologies optimize the use of energy, manage charging patterns, and offer grid integration. AI-driven charging stations can predict the patterns and help in managing flow at EV charging points. The data-driven insights are expected to empower EV vehicles as well as companies.

- Value-added Services and Customization

Electric vehicle charger manufacturers have to offer the quality of service at a competitive cost. This is crucial for survival in a market where consumers are cost-conscious. Original Equipment manufacturers (OEMs) need to provide customized options. Integrated software for monitoring can broaden the services they offer.

Government Support in EV Charging Infrastructure Market to Attract Investors

Globally, sustainability has gained traction of attention. Countries are moving to green transport. Governments have encouraged consumers to buy electric vehicles. Companies are getting grants and subsidies for the production of electric vehicles. These active steps by the government have propelled the need for charging infrastructure. Government steps such as tax breaks to companies offering and operating EV charging points in public places. Standardization policies are expected to improve interoperability. These efforts are likely to reshape electrified sustainable transportation in the future.

European governments have been at the forefront of pushing the growth of EV charging infrastructure market. EU countries have started renovating residential buildings in alignment with charging point facilities. EU countries are aiming to create 1 out of 20 parking spaces for malls and offices to have EV charging facilities.

Germany has invested USD 6.1 billion in electric vehicle charging installation. UK is also promoting EV ownership and the installation of charging stations by landlords. Norway provides 100% subsidies for public charging infrastructure. Currently, Norway comprises a total of 8% of EU public charging points even though it makes up only 1% of the EU’s populace. Government support has played a crucial role in the deeper penetration of public EV stations in Norway.

The United States passed the Bipartisan Infrastructure Law in 2021. This law is meant to develop national public charging systems. The U.S. government has tried to address the interoperability challenge with a law authorizing the generation of a joint Office of Energy and Transportation. The office will follow the responsibility of connecting and maintaining a network of about 500000 public EV charging stations. This legislation further extends support of USD 2.5 billion to communities for innovations in charging facilities. These steps are encouraging new projects and investment in this industry. Rising EV charging infrastructure market sales in the US are partially due to new tax credits.

Apart from Europe and the U.S., China is an undisputed leader in the Electric vehicle industry. The Chinese government plays an integral role in the growth of EV facilities in public places. With the commitment to accelerate EV infrastructure, it has accepted measures to encourage investors. The country has the goal to facilitate charging infrastructure for 20 million vehicles by 2025. It also aimed to reduce the cost of public charging. Pro-innovatory stand of China is seen as motivating the world to sustainable infrastructure for electric vehicles.

Future Outlook for EV Charging Manufacturers

Charging manufacturers are capturing high opportunities in the market. The market is anticipated to increase demand from residential as well as commercial segments. Ensuring the quality of products and services is likely to bring a competitive advantage for players. Players need to explore specialized or customized offerings to retain an edge over others. The right selection of location and value-added services is likely to create EV charging infrastructure market differentiation. Interoperability for different EVs will ensure safety paramount.

Companies need to predict EV charging behaviors to increase the utilization of their charging points. Strategic alliances and partnerships are expected from leading players to fulfill their business goals. Automotive dealers, retailers, and corporate housing societies will have a key stake in the market. EV Charging Infrastructure Market is emerging as the next big business opportunity where investment and innovation are keys to business success.

References:

EVRoaming Foundation- Open charge points interface protocol

Diversity and Inclusion- Diversity and Inclusion

International Energy Agency- Trends in charging infrastructure

International Council on Clean Transportation- Alternative Fuel Infrastructure Regulation

U.S Joint Office of Energy and Transport- National Electric Vehicle Infrastructure Formula Program