The gas engine manufacturing industry is continuously evolving with innovations in natural gas engines offerings to support emission targets. Rising demand for low-emission, fuel-efficient engines to reduce air pollution, and the advent of special gas engines in the manufacturing, utilities, and remote generation application sectors are the key factors propelling the gas engine market growth. Also, biogas-powered engines with improved electric efficiency and low emissions are creating substantial growth opportunities for the market players. The gas engine manufacturers are focusing offering advanced products to address the rising demand for high power outputs, meeting diesel engine standards. Major heavy industries, remote power plants, and manufacturing companies are selecting high-power gas engines due to enhanced electric efficiency and reduced fuel costs. The use of natural gas in gas engines combustion technology can resolve the emission problems, along with assisting customers in meeting new regulatory norms. There is an increase in the adoption of gas engines in South America, Africa, and Asia, while North America and Europe are focusing on adopting solar and wind energy during the forecast period.

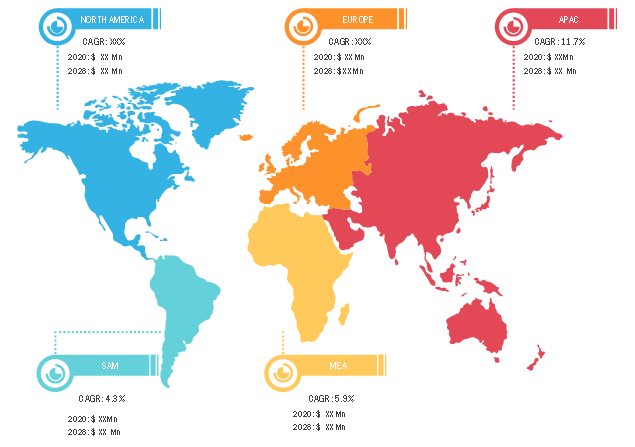

The global gas engine market has been segmented into five major regions: North America, Europe, APAC, MEA, and SAM. APAC holds the dominant share in the gas engine market, whereas North America is expected to be the fastest-growing region in the global market. Governments of various countries are imposing certain regulations to control the emissions of diesel and petrol engines, thus compelling engine manufacturers to opt for alternative fuel solutions such as natural gases. Gas engines release less emissions to generate a sufficient amount of with power high efficiency. The emission monitoring and regulatory bodies from various countries are imposing stringent regulations on the use of diesel engines and generators. To meet these regulatory standards, various industries are deploying gas engine and generators for power generation. Governments of various countries are imposing certain regulations to control the emissions of diesel and petrol engines, thus compelling engine manufacturers to opt for alternative fuel solutions such as natural gases. Gas engines release less emissions to generate a sufficient amount of with power high efficiency. The emission monitoring and regulatory bodies from various countries are imposing stringent regulations on the use of diesel engines and generators. To meet these regulatory standards, various industries are deploying gas engine and generators for power generation.

INNIO JENBACHER GMBH & CO OG, CUMMINS INC, FAIRBANKS MORSE, LLC, WÄRTSILÄ CORPORATION, R SCHMITT ENERTEC GMBH – PROMINENT MARKET PARTICIPANTS IN GAS ENGINE MARKET

The top five companies in the gas engine market include Innio Jenbacher Gmbh & Co Og, Cummins Inc, Fairbanks Morse, Llc, Wärtsilä Corporation, R Schmitt Enertec Gmbh. The above listing of key players is derived by considering multiple factors such as overall revenue, current gas engine portfolio, new product launches, market initiatives, investment in technology up-gradation, mergers & acquisitions, and other joint activities. There are various other notable players in the global gas engine market ecosystem such as Caterpillar Inc., Kawasaki Heavy Industries, Ltd., Liebherr, MAN SE, and Mitsubishi Heavy Industries, Ltd., amongst others.

The electric power, automotive, manufacturing, and transportation industries, among others, in developing countries such as India, China, and Brazil are highly dependent on fossil fuels. Rise in population and the lack of supporting infrastructure for electric technologies are the major factors supporting the gas engine market. Electric motors, electric devices, solar plants, and wind projects are more expensive than gas engines, which is driving the preference of various countries toward gas engines as an environment-friendly solution. Further, improvements in the emission norms for diesel engines for which various industries are shifting on gas engines for low emissions. According to The World Bank Group data for access to electricity, only ~91.6% of the population has access to electricity in South Asia, while others are still lack access to electricity. Hence, south Asian countries are strongly adopting natural gas for power generation application. Further, electricity consumption for basic applications in countries such as China and India is increasing with the surge in population, owing to which they are opting for gas engines for electricity generation.