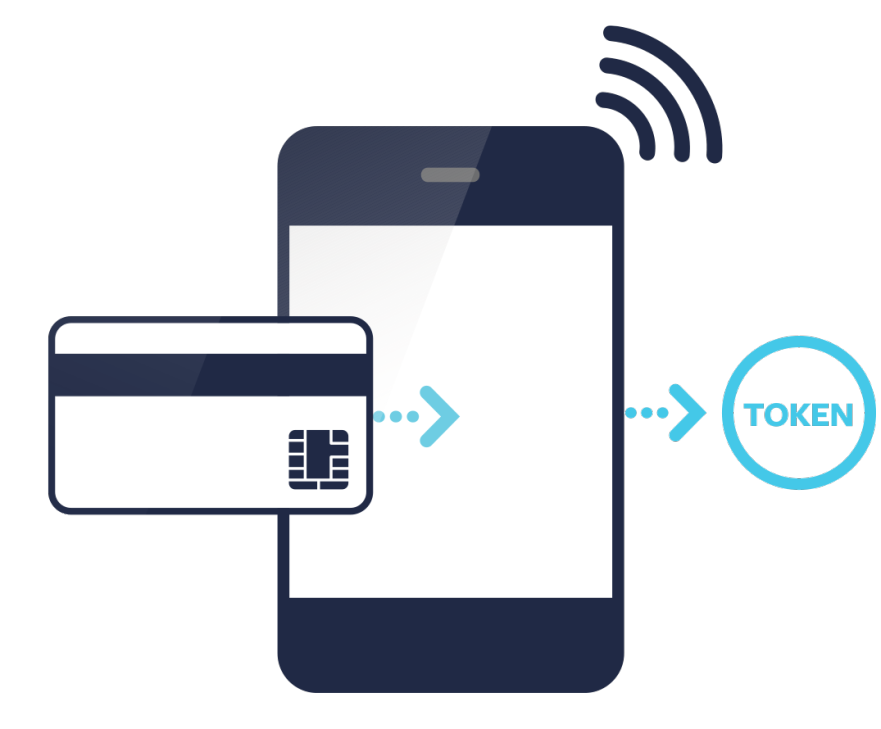

Tokenization solutions are often used for credit card processing. The payment card industry (PCI) council defines tokenization as a process wherein the primary account number (PAN) is replaced with an alternate/surrogate value known as a token. The key factor attributed to the growth of the global tokenization market is the growing data security concerns in all the data-sensitive organizations across the world. The tokenization market is anticipated to witness a noteworthy growth owing to a huge number of financial firms choosing for rising security in payment processing systems. Also, with rising incidences of credit card fraudulent activities, there is an increase in the demand for payment security.

Moreover, other factors propelling the tokenization market include a rise in the number of cyberattacks and data breaches. For instance, cyberattacks by the WannaCry ransomware impacted numerous financial institutions, banks, and hospitals in 2017. Over 200,000 computers worldwide were hacked. Several such cyberattacks have raised concerns regarding payment and data security. Furthermore, the demand for security solutions in SMEs has increased significantly. However, factors such as high implementation and cost of hardware upgrades are anticipated to hinder the growth of the tokenization market to a certain extent, particularly in the SME segment.

FISERV, INC., CIPHERCLOUD, MICRO FOCUS, THALES ESECURITY (THALES GROUP), and SEQUENT SOFTWARE– PROMINENT MARKET PARTICIPANTS IN TOKENIZATION MARKET

The tokenization market is segmented into component, enterprise size, deployment, and industry vertical. Based on component, the market is further segmented into solutions and services (managed/outsourced services, professional services). Tokenization solutions involve payment security, customer data management, omnichannel management, compliance & policy management, and encryption. Based on enterprise size, the tokenization market is further bifurcated into SMEs and large enterprises. Further, by industry vertical, the market is categorized into BFSI, retail, healthcare, government, IT & telecom, and others.

Geographically, North America is estimated to hold a major share of the global tokenization market. Robust adoption and penetration of tokenization solutions and services, along with a considerable application of tokenization in diverse industries across the region, is supporting the growth of the tokenization market in North America. Additionally, APAC is projected to observe a prosperous growth owing to growing adoption cloud-based solutions in emerging economies, as well as growth in the number of industries.

Broadcom Inc.; CipherCloud; Fiserv, Inc; First Data Corporation; TokenEx; Micro Focus International plc; OpenText Corporation; Visa Inc.; Sequent Software Inc.; and Thales Group are among the key players profiled in the tokenization market report.

Most of the market initiatives were observed in North America region, which have a high potential of tokenization providers. Few of the important market initiatives and product developments from the industry are mentioned below:

| Year | News | Region |

| 2020 | Fiserv, Inc. partnered with Protegrity in order to launch TransArmor Personal Data Protection to help companies protect customer data. It also helps to encrypt and tokenize personal information. | North America |

| 2020 | Visa Inc. announced the addition of 28 new partners in its Visa Token Service as credential-on-file token requestors. The addition of new partners will reinforce the company’s global digital payment security. New partners include acquirer gateway as well as technology partners. | North America |