South America majorly consists of countries such as Brazil, Argentina, and the Rest of SAM. The majority of countries in this region are still in the developing stage, and their inclination toward advanced defense systems is increasing gradually. Colombia’s military expenditure in 2020 was US$ 9.21 billion, and Peru’s military spending in 2020 was US$ 2.63 billion. As per GlobalFirepower, Columbia has 483 armored vehicles. According to GlobalFirepower, Peru has 146 tanks and around 522 armored vehicles.

LS MTRON, Ocean Rubber Factory LLC, Soucy-Defense, GMT Rubber-Metal-Technic Ltd and Defence Service Tracks GmbH – Prominent Market Participants in Military Rubber Tracks Market

In 2019, Brazil underwent a military modernization program, which included revitalizing M60 combat vehicles, Leopard 1A1, and M113 armored vehicles. The procurement of armored vehicles is increasing in Brazil. As of 2020, the Brazilian Army was using legacy armored personnel carriers (APCs) and infantry fighting vehicles (IFVs) such as the M113, AMX-VCI, and VCTP. All these armored personnel carriers (APCs) and infantry fighting vehicles (IFVs) were on the verge of replacement as their maintenance became difficult and expensive.

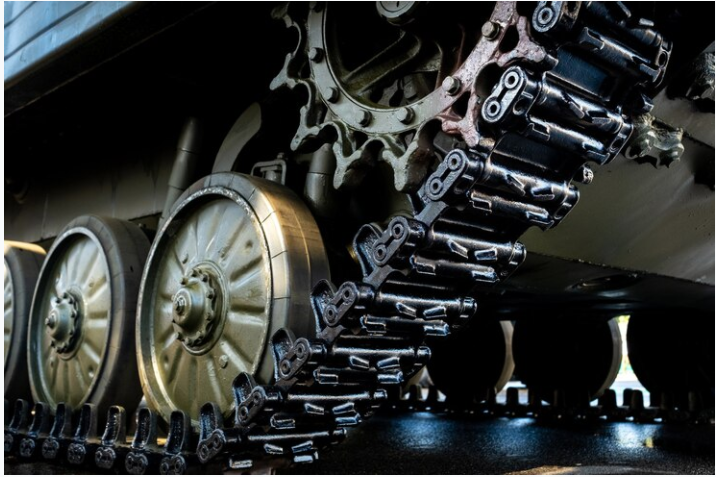

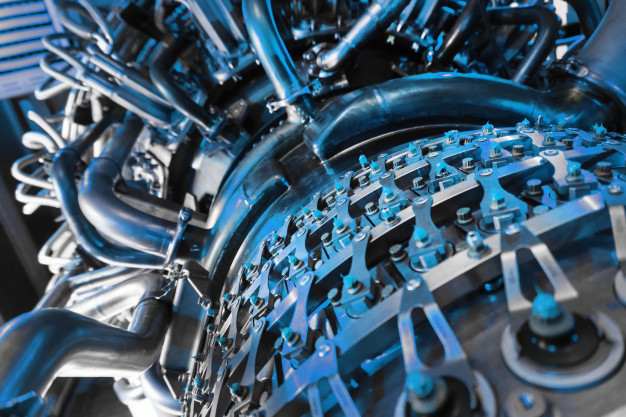

Owing to their properties such as affordability, ability to work in wet and muddy conditions, fewer vibrations, and higher speeds, the adoption of military rubber tracks is expected to rise in the South America region in the coming years. Moreover, military modernization programs, exclusive benefits of rubber tracks, and the increase in the need for the latest battle tanks and armored infantry fighting vehicles (AIFV) are expected to fuel the growth of the military rubber tracks market in the South America region in the near future.

The containment measures taken by several South American countries to combat the rapid spread of the virus affected all economic activities in the region in 2020. This adversely affected the overall GDP of the region. Lockdowns imposed in various countries, such as Brazil and Argentina, led to the decline in manufacturing capacities of military rubber tracks across the region. However, with the rise in investment across military vehicle manufacturers of the region, the demand for rubber tracks experienced a slight increase in 2020. For instance, Allison Transmission, a defense vehicle manufacturing company with a regional headquarter in Brazil, relaunched the production of X200-4A light tracked combat vehicles in July 2020. These factors positively impacted the growth of the market across the region.

LS MTRON, Ocean Rubber Factory LLC, Soucy-Defense, GMT Rubber-Metal-Technic Ltd and Defence Service Tracks GmbH – are among the well-known players operating in the global military rubber tracks market and are focused on product development and innovations.

Brazil’s military expenditure in 2019 was US$ 25.90 billion which reduced to US$ 19.73 billion in 2020. A notable decrease of 23.82% is considered to act as a key weakness with respect to the development of the military rubber tracks market in the country. As per the World Bank collection of development indicators, in 2020, military expenditure of Brazil was reported to be around 1.43 % of its GDP. As per GlobalFirepower, the country has 439 tanks and around 1,958 armored vehicles. Rubber tracks are more suitable on grass, dirt, or other soft surfaces. Rubber tracks offer more noise absorption as compared to any metal or steel track. Thus, the country has huge scope for modernization programs, where rubber tracks can be adopted for respective armored vehicles.

The top five companies in the market are LS MTRON, Ocean Rubber Factory LLC, Soucy-Defense, GMT Rubber-Metal-Technic Ltd and Defence Service Tracks GmbH. The above listing of key players is derived by considering multiple factors such as overall revenue, current military rubber tracks market portfolio, new product launches, market initiatives, investment in technology up-gradation, mergers & acquisitions, and other joint activities. A few of the important market initiatives and product developments from the industry are mentioned below:

| Year | News | Region |

| 2021 | William Cook Holdings Limited announced that it has signed contract with Rheinmetall for providing its tracks for LYNX IFVs on trial in Australia. | Europe |

| 2020 | Soucy and Supacat announced that they have collaborated for upgrading the new and legacy armoured fleets from Steel Track to Composite Rubber Tracks of the UK armed forces | Europe |

| 2018 | TGL announced it has developed new pads for IDF armored personal carriers which offers longer shelf life than the previous generation of pads | MEA |