All Blogs

ACV Benefits: Why This Humble Vinegar Now Runs the Show

For decades, apple cider vinegar (ACV) lived a quiet life. It resided mostly in kitchen pantries. Its primary role was dressing salads. Sometimes, it helped pickle vegetables. It was a culinary workhorse, dependable but unsung. However, this pantry staple is now having a serious moment. Today, ACV is a wellness superstar. It is a beauty industry darling. Furthermore, it is a formidable market play [...]

Unlocking the Power of Cryotherapy: Embrace the Science of Cold Healing

Cryotherapy has evolved from a specialized recovery technique to a widely recognized wellness therapy. It intentionally exposes the body to extremely cold temperatures for a short duration to trigger powerful healing responses. Although stepping into a freezing chamber might sound uncomfortable, the benefits make it an increasingly attractive option for athletes, fitness enthusiasts, and health-co [...]

Transforming Emergency Care with EMS Computer Software: A Game-Changer

Technology increasingly shapes outcomes in emergency medical services, and investing in robust software is more critical than ever. Modern EMS operations rely on specialized computer systems designed for emergency care providers. These digital tools allow dispatchers, paramedics, and administrators to collaborate efficiently and respond rapidly. From managing patient records to optimizing ambulanc [...]

Home Automation: Secure or Exposed? The New TEC Rules

Imagine a house that thinks for itself. It manages its own energy use. It keeps your family completely secure. This vision is the promise of home automation. In 2025, that promise is rapidly turning into reality. The global market is undergoing a major transformation. This change is driven by AI, sustainability, and new government rules. We will dive into the top global developments. We will also [...]

Portable Bluetooth Speakers and the Pulse of Modern Culture

There was a time when sharing music meant passing around wired headphones or turning up a bulky stereo. Now, the same social ritual fits in the palm of your hand. From picnics to pool parties, Portable Bluetooth Speakers have transformed how we experience and share sound. They are not just gadgets; they are cultural symbols of connection, spontaneity, and a lifestyle that moves with rhythm. The Ri [...]

Are FCC's New Rules Changing the Future of Wireless Intercoms?

The world of live events moves fast. From a large broadcast studio to a bustling concert stage, clear communication is everything. That’s why wireless intercoms are so important. They are the invisible link that makes complex productions run smoothly. But guess what? The rules for using this technology are changing. The FCC, the U.S. regulatory body, just updated its playbook. If you use, se [...]

Can Economic Shifts Explain the Crude Oil Price Today?

The crude oil price today is more than just a number; it reflects the pulse of the global economy. With growing uncertainty in major markets, every change in oil prices affects everything from financial markets to the price you pay at the pump. What's driving these fluctuations? Are concerns about a slowing economy, shifts in supply, or hopeful signs from trade talks? If you want to understand ho [...]

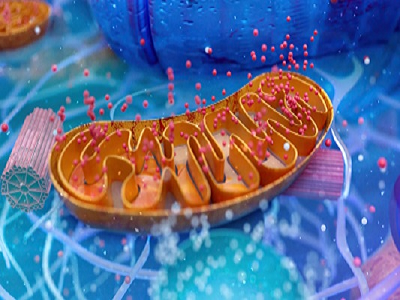

Bilirubin Nanotherapeutics for Targeting ROS-Driven Pathologies

Reactive oxygen species (ROS) are chemically reactive molecules formed during aerobic metabolism. These ROS include superoxide anion, hydrogen peroxide, hydroxyl radicals, singlet oxygen, ozone, and nitric oxide. The physiological roles of ROS are unknown, although they can become pathologically elevated and are of great significance in diseases due to the shock of the innate immune response. B [...]

Arteriotomy Closure Devices Transforming Vascular Access Care

All types of diagnostic and therapeutic interventions require arterial access. Manual compression has been the traditional way to achieve hemostasis after catheter-based procedures, yet this method has limitations. For instance, it often requires extended bed rest, causes patient discomfort, and can lead to bleeding complications like hematoma and pseudoaneurysm. However, this changed with the [...]

From Crisis to Control: How ART Revolutionized HIV Treatment

Human Immunodeficiency Virus (HIV) remains one of the world's most challenging public health issues, affecting over 38 million people globally. While no cure exists yet, the development and widespread use of anti-retroviral drugs (ARVs) have transformed HIV from a fatal diagnosis into a manageable chronic condition for millions. Therefore, in this blog, we will delve into what anti-retroviral drug [...]