A lot of excitement has been witnessed among plant based meat products marketplayers in offering meat alternatives in recent years.Stemming meat-like taste from plants is not a new method, but technology has increased their appeal and taste to a great extent.

Plant based meat is preferred for the sensory experience it offers. Plant-based meat has emerged as a beatific option to indulge occasionally. As a result, global plant-based meat substitutes are shaping dietary changes driven by a variety of social, environmental, and cultural factors. Plant based delicacies such as ‘Impossible Burger’ and ‘Beyond Burger’ are spotted in abundance in food outlets, grocery stores, and restaurants.

The quest for nutritional and eco-friendly food resources as part of food habits is driving the global community to plant-based analogs. The rising demand for plant based meat products market analogs (PBMA) is attributed to an increasing inclination towards animal welfare, mushrooming veganism, and the negative impact of meat on the environment and humans that raised the demand for alternatives in recent years. Furthermore, animal agriculture is fueling climate crisis and deforestation which is a significant issue.

Plant based meat products markets have opened an option for both producers and consumers to support the food industry. Cereals, Veggies, and Algae are explored as protein-rich bioresources that mimic animal meat in terms of texture, taste, and aromatic sense. This article aims to offer a comparative interpretation of meat alternatives available in commercial and conventional markets.

Consumers Seeking the Science Behind Plant Based Meat

The sole concept of vegan meat is based on the mimic of animal products not only in terms of taste but also in terms of nutrition profile. These products are rich in fat, water, vitamins, minerals, and proteins. Setain and Tofu conventionally did a great job in the replacement of meat products. Today brand’s hunt for advanced alternatives continues in the direction of taste, texture, and appearance.

Most recently, soy protein isolates, concentrates, and textured soy protein have resulted in growth in the soy protein ingredients market. The plant based meat products market is expected to surpass the valuation of USD 14,527.55 million by the end of 2028. The market was valued at USD 5,354.72 million in 2021. Most successful plant based meat products market brands try to mimic the taste and texture of meat-based delicacies.

Finding a precise blend of plant-based ingredients is the first important stage in the production of plant-based meats such as fish, eggs, and milk analog. These ingredients could be isolated ingredients such as vitamins, minerals, rice, wheat, beans, peas, and mushrooms. These ingredients differ from animal products in terms of composition, physiochemical, and other properties. One of the major challenges ahead of plant based meat products market companies is to assemble these into animal products analog.

Physiochemical approaches are based on controlling molecular interactions of plant-derived biopolymers to mimic meat. A mixture of polysaccharides is used in this process. The challenge of matching nutritional profile plant based food undergoes encapsulation techniques that enhance micronutrient content in food such as zinc, vitamin B, and Iron.

Plant proteins can form gel, thicken paste, and emulsify foams. These are rich sources of amino acids that can be derived from mung beans, lentils, and peas. Plant based lipids and carbs are extracted to further mimic the taste of animal analogs. Exposed to precise temperature solid plant fat content can mimic animal fats.

Plant based meat products market players have been demonstrating tremendous capacities in enhancing food texture, taste, and color. For instance, Beyond Meat uses beet juice to recreate the desired color of meat. Betalain in beet undergoes a chemical transformation after heating. A range of scientific and technological approaches are used by brands to create structures from plant-derived ingredients.

Plant Based Meat Products Market Overview

Consumers inclination toward healthy eating is a key motivator for their purchase of plant-based alternatives. A new wave of plant based products made with whole ingredients is attributed to mushrooming nutritional awareness and environmental urges. Recent concerns about the environment and animal health have had a positive impact on the plant based meat products market.

The sense of urgency that has developed around substitutions of meat products in the last decade is driven by the consumer segment- flexitarians. Flexitarians are not willing to compromise on their sensory experience while choosing meatless s meat. Consumers deliberately reduce their meat consumption while they may not completely give up on meat. These consumers anticipated considerable plant based meat products market development in plant-based alternatives in the coming years.

During COVID-19, sales of fake plant-based meat products grew by 200% in retail stores owing to the hype of healthy alternatives for meat. This has favored companies with great funds about USD 2 billion. As per the Plant-based Foods Association in the US about 79 million U.S. households are using meatless meat products.

Pea proteins are dominantly used to make plant-based meat products. There was a slight increase in the prices of pea proteins during the pandemic due to supply chain disruptions. World Health Organization (WHO) published a guide for people regarding consumption of food during a pandemic. Nutritional advice by WHO during the pandemic further recommended curbing the consumption of red meat due to the high percentage of saturated fat. These guidelines gave a stage to plant-derived meat to improve immunity.

Process and Opportunities for Plant Based Meat Products Market Companies

- Source Plant Protein – Only 12 commercially available plant-based proteins provide 3/4th of world plant-based food. Plant based meat products market brands have a huge opportunity to research and discover new protein sources that potentially boost the texture and taste of products.

- Optimize Protein– Sources plant-based protein goes through protein purification to form a protein concentrate. This biological breakdown has benefits such as making proteins more soluble Gelation aids in giving plant-based meat its desirable texture. The addition of specific nutrients is done to improve texture.

- Resembling of Meat Alternatives– Informing consumers about how plant-based meats resemble conservative options could be a big draw for brands willing to attract repeat purchases. Even though protein content dominates in plant-based meat addition of fat, water, and carbs can have a significant role in taste appeal.

- Processing-Food is processed in desirable shapes appropriately by kneading, stretching, and pressing. Streamlined manufacturing systems are needed to evaluate production. Furthermore, real-time monitoring and diagnosis can ensure consistency and taste throughout the production.

- Distribution– Plant-based meat is seen to have the capacity to meet market gaps and address reactive agile demands of the emerging plant based meat products market. Especially in COVID-19 supply chain disruptions in conventional animal-based food have led to spurred demand for plant based meat products market.

Nutritional Gains and Downsize of Plant Based Meat Products-

Plant-based products are healthy sources of antioxidants, vitamins, and minerals. Plant food produces lower greenhouse gases that are known to have less environmental impact. Unprocessed red meat is consistently associated with disease risks whereas shifting to plant-based meats can aid in preventing biodiversity loss. The shifting dietary patterns have duel benefits for humans and the planet.

Plant-based diets have saved billions of euros in European health care costs. Excessive meat consumption placed an additional burden on European healthcare systems. In 2020, there were about 2.4 million deaths globally, and 240 million Euros were healthcare costs attributed to processed meat consumption.

For people who do not prefer animal food, switching to plant-based alternatives can be plenty helpful. These are further great for people who follow the moderate approach in diets and are ready for plant-based substitution. Overall plant based food is seen to eliminate the need for animal products and realize a ‘one health’ impact on individuals, and the planet.

While choosing plant based meat consumers should avoid artificial ingredients such as fillers, and additives and some experts suggest that these ingredients could be harmful to health. People also may avoid intake of added sugar, be it fructose or maltose. High-calorie products hinder weight management. Additionally, if someone has celiac disease then plant-based meat should be skipped from diets, as plant based meat contains seitan and vital wheat gluten.

Moreover, plant-based meat may not match the exact protein profile with animal sources protein. It can also be lower in B12, Zinc, and vitamins than regular meat products. So supplementing vitamin B12, and variation of whole foods could help people to address these deficiencies while choosing plant-based products. Looking for product packaging consumers tend to get information on nutrient content in plant-based food. Plant based meat products market players have to be transparent about their product profiles. Even though tofu is a great inexpensive plant-based meat alternative other than plant-based meat alternatives can be more expensive.

Challenges ahead of plant-based meat product market players

Brands Unable to Attract Repeat purchases

Attracting consumers to try plant-based meat is achievable with strategic marketing efforts. Retaining customers’ interest in repeat buying is a challenge ahead of manufacturers. Mainstream accessibility of plant-based products also invites the need for consistent demonstration of the benefits of meatless meat.

Operational Burns daunting growth of plant based meat product market players

Companies opting for high-tech operations cutting their workforce cost. While it’s anticipated that these brands are likely to enter into the cost-cutting period in this decade. Stringent zero-based budgeting is desired to protect companies’ margins and profits. This means companies are not in a position to completely innovate their products and likely to slack back. However, if there are only a few products produced by brands, there needs dedicated marketing to ensure expected returns on plant based meat products market investment. Strong marketing could ignite consumers’ interest in plant-based alternatives.

Low-Margin for Retailers

There are zero economic incentives for supermarkets, grocery shops, and retailers to dedicate their shelves to plant-based products. As their store owners aim to sell anything and everything they don’t want to displace animal based products from their shelves. – The margin food sector makes it more competitive for plant-based meat product market companies to acquire space on shelves. Meat products are seen to attract consumers as well as gatekeepers between consumers and companies with their winning marketing strategies.

Fair labeling

Informative packaging plays a crucial role in the penetration of plant-based products to wider consumers. In many regions, there are no separate regulations that govern plant-based meat products. Labeling should be clear about conveying that products are meatless. Pictorial representation could bring more clarity here. Several studies confirm products labeled as “clean” attract more sales from consumers willing to pay extra for sustainable alternatives.

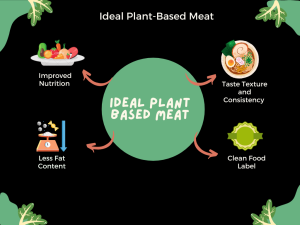

Characteristics of Ideal Plant Based Meat – A Guide for Plant Based Meat Products Market Participants

Strategic Takeaways from Leading Plant based Meat Products Market Players

- The success of leading brands is attributed to their focus on nutritional profiles. Nutrition that adds taste to products of brands such as Impossible Foods and Beyond Meat, gives them an edge over brands in competition such as Boca and Gardein.

- Actual Veggies has launched a non-GMO vegan burger recently focused on single veggies and they eliminate the use of oils and are low in salts. The unique spice blend of this brand has added great texture to their burgers and taste too.

- Leading companies in this industry are driven by a desire to offer climate-friendly foods and reduce unhealthy meat consumption. Beyond Meat in 2021, relaunched chicken line products. Eat JUST have produced plant-based egg which is an extremely versatile product by the company.

- Tofurky has been in the plant based meat products market since 1980, the brand has grown from phase of startup to a well-established brand in 2022. The brand is popular for plant-based deli slices, ham roasts, burgers, and more.

Future Outlook

As many plant based alternatives are now available many of them are capable of addressing both nutritional and taste expectations. These brands doing great in attracting consumers towards plant-sourced meat. However, companies need to increase nutritional standpoints to attract repeat sales of products. Consumers expect changes when manufacturers promise continuous innovations for better products.

The next-generation plant-based meats won’t thrive only on environmental or health impacts. Companies need to improve products in terms of the prime value of products to become an alternative to traditional options of meat. The plant based meat market is anticipated to go beyond just a fad once brands can source more natural protein options and generate core value for many while sustainability is another advantage adding strength to plant-based deals.

References:

World Health Organisation (WHO)- Plant-based diets and their impact on health, sustainability and the environment

National Library of Medicine- Comprehensive Review on the Role of Plant Protein as a Possible Meat Analogue: Framing the Future of Meat

World Health Organisation (WHO)- Nutrition advice for adults during the COVID-19 outbreak