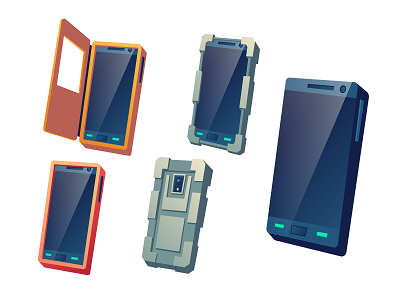

The enhanced safety features and robust design of rugged smartphones as well as feature phones that are designed specifically for task workforce that is engaged in challenging work environments, is driving their adoption over simple consumer grade mobile phones. Equipping task/field workers with smart and advanced rugged phones allows efficient communication between employees and enhances the productivity of overall operations in a range of challenging environments. The demand for rugged mobile phones for mission critical and non-critical communication in industries such as transport & logistics, manufacturing & construction, and retail & warehousing among many others is increasing at an impressive pace. Moreover, the increasing trend of digitalization across industries and advancements in communication technologies like 5G are expected to fuel the growth of rugged phones globally over the forecast period of 2023 to 2028. Integration of advanced capabilities such as thermal imaging and scanning coupled with continuously increasing processor power, high memory, and large screens of smartphones is another factor that is anticipated to boost the demand of these phones across industrial, commercial, and public safety applications among others. However, the COVID-19 outbreak has impacted the yearly growth rate of rugged phones market in the year 2020, owing to supply chain disruptions and limited/reduced manufacturing levels in countries such as China. Despite some slowdown in 2020, the market demand is anticipated to grow at a positive rate in the forecast period of 2023-2028. Caterpillar, Sonim Technologies Inc., Blackview, Kyocera, And Doogee Are Among The Key Market Players Operating In The Rugged Phones Market. The market for rugged phones is segmented into type, screen size, end user, and geography. Based on type, the rugged phones market is divided into smartphone and featured phones. The featured phones segment contributed the largest revenue share in 2022. Based on screen size, the market is divided into below 5-inch, 5 inch to 6 inch, and above 6 inch. The 5 inch to 6 inch segment contributed the largest revenue share in 2022 and it is also projected to be the fastest growing sector in terms of growth rate. On basis of end-use, the market is segmented into industrial, government, commercial, military & defense, and consumer. In 2022, industrial segment led the rugged phones market globally. Geographically, the market is segmented into five key regions, namely North America, Europe, Asia Pacific, Middle East & Africa and South America. North American region held the largest revenue share in 2022 followed by Europe and Asia Pacific. Asia Pacific is projected to be the fastest growing region with a CAGR of 8.9% from 2023 to 2028. The top ten companies in the market include Blackview, Caterpillar, Kyocera, OUKITEL, Samsung Electronics Co Ltd, AGM Mobile, Sonim Technologies Inc., Ulefone Mobile, Unitech Electronics Co., LTD., and Zebra Technologies Corp. The above listing of key players is derived by considering multiple factors such as overall revenue, new product launches, market initiatives, investment in technology up-gradation, mergers & acquisitions, and other joint activities. A few of the important market initiatives and product developments from the industry are mentioned below. Few of the important market initiatives and product developments from the industry are mentioned below:

| Year | News |

| 2022 | AGM Mobile's H5 smartphone was billed for release in April 2022 and was touted as the world's first Android 12 rugged smartphone. It also has the loudest phone speaker on the market, with a monstrous 109 dB capacity |

| 2022 | Outkitel?has announced the launch of the WP19 rugged phone, with the world's largest battery in a rugged smartphone. The flagship phone will be released at the end of June 2022, with various upgrades and exciting features compared to its predecessors. |

| 2022 | UleFone released another rugged model that's more powerful, the Power Armor 18T. It comes with a more powerful chipset, a brand-new microscope camera, a thermal sensor, and so on. |

| 2022 | Sonim Technologies Inc. announced that the global unlocked version of the ultra-rugged XP10 5G smartphone would be available in early 2023. The XP10, which has recently launched with multiple carriers in North America, is the latest addition to Sonim's ultra-rugged product line, building on the solid foundation of its predecessor, the XP8. |

| 2020 | Sonim Technologies and Crossover Distribution partnered together to expand Crossover Distribution solution offerings from the core network to endpoint user devices, offering channel partners an even more expansive product portfolio. |