The sleep tech devices market is focused on improving and enhancing various aspects of sleep, as well as monitoring and analyzing sleep patterns and quality. Sleep-based disorders are an increasing issue in most Western economies. In America, one out of three people doesn’t get sufficient sleep. Globally, this number is about 45% of the population. Sleep disorders, when combined with lack of sleep, have severe consequences on the general state of health of an individual. Sleep tech devices cater to different aspects of sleep regulation, analysis, and improvement. The aim is to address varying sleep-related issues and combat sleep loss.

The sleep tech devices market is divided into wearable and non-wearable products based on type. The wearable segment is likely to be dominant in the forecast period. In the past few years, the rise of smartwatches, fitness trackers, and other consumer wearables has made it possible to monitor sleep remotely at scale. According to Sleep Health, about 50-70 million Americans suffer from sleep problems, sitting at home all day with a lack of natural light, fresh air, social interaction, and exercise disrupted circadian rhythms. The wearable technology market is anticipated to be a US$ 170.91 billion industry by 2025-end.

From start-ups to big tech companies, the sleep tech devices market is attracting new entrants and the interest of several insurance companies, healthcare organizations, employers, and policymakers. This article will focus on emerging technological trends and why the sleep tech devices market could be the next hotspot for investors.

How is Technology Countering Sleep Disorders?

Sleep Monitors to Treat Sleep Apnea

With the increasing discipline of sleep medicine, the number of sleep experts and sleep physicians is increasing globally. A meta-analysis by Peppard et al. showed that 10% of men and 3% of women between the ages of 30 and 49 years and 17% of men and 9% of women between the ages of 50 and 70 years have obstructive sleep apnea. The sleep apnea devices market has witnessed significant growth as sleep apnea affects millions of people globally. AI-driven solutions for sleep monitoring and treating sleep apnea improve the treatment options.

Continuous improvements in technology and a varied range of sleep apnea devices available in the market lead to market growth. Inspire Medical Systems, Inc., has launched its Inspire sleep apnea device. To keep the patient’s airway open while they sleep, the innovative surgical implant uses gentle electrical pulses. The Inspire doesn’t require any large equipment or a mask, unlike traditional CPAP machines. It has a remote to turn it on and off. This device treats sleep apnea by offering an alternative to the unpleasant effects of using a CPAP mask.

Smart Sleep Mask to Alleviate Stress

The sleep mask market is experiencing higher growth owing to rising stress levels. According to the American Psychological Association, in 2022 nearly two out of five (37%) Americans rated their mental health as only fair or poor, up from 31% a year ago. 55% of Americans are stressed during the day. Sleep masks are designed to block out light and improve sleep health. It creates a dark environment conducive to rest to avoid pressure on the eyes.

Smart sleep masks with built-in Bluetooth headphones available in the market can help with faster and better sleep. Many market players such as LC-Dolida offer customizable features in these smart sleep masks. In the consumer electronics market, such innovative technologies are presenting opportunities for investors to tap into the growing demand for sleep tech accessories.

Mobile Sleep Apps, Online Platforms, and E-commerce Sites – Supply Demand Dynamics

The potential incorporation of technologies for more personalized and improved sleep quality is a key market selling point. The sleep tech devices market has been expanding beyond traditional retail settings. The emergence of e-commerce and online platforms offering a wide range of options contributes to growth.

The SleepTuner’s mobile device app offers businesses the chance to offer their employees sleep coaching, virtual consultation, and assistance. Their compact wearable sensor is considered the most precise sensor in the sleep tech devices market, and its overall approach to sleep habits is truly one-of-a-kind.

Room for Personalized Technology Devices – What’s in Sight for Investors?

Consumers prefer non-invasive procedures over medication or invasive procedures. Personalized technology devices offer solutions based on one’s sleep patterns and preferences. The market players have room to maneuver and develop relaxation devices for better sleep. Sleep tech devices market players are investing in integrating sleep tech devices with technology.

There is scope for continuous research and development in sleep technology. In the sleep sector, the competition is rising as many startups are emerging. The advancement of sensors, data analytics, and algorithms used in these devices is a key focus area. Since 2010, there has been a hike in interest from venture capitalists in the sleep tech devices market. By 2018, the amount of money invested in sleep tech devices surged significantly, the 2018 boom was driven by the number of startups funded, which doubled compared to 2017, and by the $20 million-plus funding rounds from sleep technology pioneers such as Dreem, Invicta Medical, and Whoop.

From specialized pillows to weighted blankets, market leaders should aim to create a more comfortable sleep environment. The pillow pad of the MOONA system is linked to a water-based heat pump that adjusts your pillow to your preferred temperatures, ranging from 64°F/18°C to 95°F/35°C. Zephyr’s MATRx Plus, an FDA-approved medical device operated via tablet, detects obstructive sleep apnea in individuals and assesses the suitability of oral appliances as a treatment option.

To observe users overnight, many companies are incorporating tiny sensors into wearable gadgets. Giants such as Google, Samsung, and Huawei being at the forefront of the consumer-electronics revolution offer sleep-related technology in their gadgets. Recognizing that sleep is the window to holistic health, Samsung partner 3Boon1 expanded its capabilities to provide smart mattresses equipped with sensors and an AI algorithm that sets the ideal temperature of the bed.

Redefining Rest: A Taxonomy of Sleep Tech Devices

Decades of research have been dedicated to building a solid base for sleep technology that counters sleep disorders. The most prevalent sleep disorders on the rise include insomnia, sleep apnea, and restless leg syndrome among other disorders. Sleep-related absence from work is thought to account for the loss of 10 million working hours a year in the United States. CPAP machines, oral appliances, and other medical devices are designed to manage sleep apnea. These devices maintain open airways during sleep. Sleep-tracking wearables generate vast amounts of data, including heart rate, movement, and brain activity.

Digital sleep tracking has become part of everyday life. Smartphones with built-in sensors, dedicated sleep tracker software, and a range of devices are inevitable. Smartphone companies offer approximately 50 applications. They use accelerometers built into smartphones to track all the movements at night. Advancements in sensor technologies by market operators offer more accurate sleep tracking.

A standout achievement in the realm of sleep technology comes from the Finnish firm, Oura. In 2022, they achieved sales exceeding 1 million units of their sleep tracking rings. A significant factor in the success of this startup from Finland is its timely expansion into the US market to seize the substantial business potential and engage with an initial community of biohackers.

Regional Highlights of the Sleep Tech Devices Market

North America’s Proactive Approach Towards Health Monitoring

North America is a significant contributor to the sleep tech devices market. In the United States, inadequate sleep costs businesses up to $433 billion. Lost sleep also takes a toll on productivity: an analysis using data from US companies puts the annual cost at $1,300 to $3,000 per employee. The region is marked by the presence of several well-established players innovating new products.

The interest from investors, established sleep infrastructure with over 2,500 sleep clinics, a user base open to leveraging technologies for enhancing overall well-being, and a tech-savvy community willing to invest more collectively make the United States an optimal market.

The region is a technological hub leading to the development of sophisticated wearable devices. The easy access to healthcare facilities drives the adoption of sleep tech devices. The rising healthcare expenditure by consumers in the region for diagnosis and treatment impacts sleep tech devices market growth.

Focus on Personal Health Improvement to Increase Pace in Asia-Pacific

The Asia-Pacific region is marked by an expanding middle-class population. This comes along with a higher disposal income and increased expenditure on healthcare. The region exhibits significant growth potential due to the rising entrance of market players. The tech-savvy people in the region led to an increased adoption of wearable sleep trackers.

The established brands in India like Sleepwell, Kurlon, Duroflex, and Restolex, and new brands like The Sleep Company are pioneering to significantly improve overall sleep quality and have the potential to become ten-billion-dollar companies.

Future Outlook for Investors

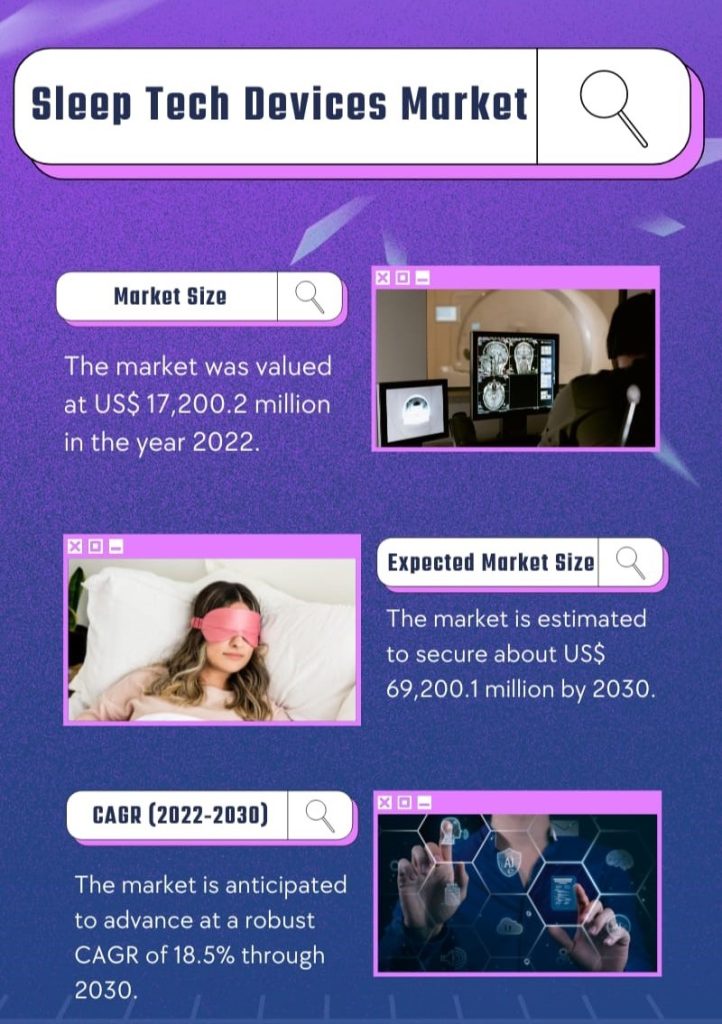

The sleep tech devices market is a booming sector with an estimated valuation of US$ 17,200.2 million in 2022. This value is expected to grow to US$ 69,200.1 million by 2030-end. The sleep tech devices market is expected to advance with a robust CAGR of 18.5% from 2022 to 2030. Investments in continuous improvement and innovation in sensor technology are futuristic.

Companies are working on data analytics and AI-driven insights to provide accurate and actionable sleep data. The focus is on designing devices that are comfortable, non-intrusive, and easy to use to ensure user satisfaction.

Brands are adopting strong marketing strategies. Brand recognition, and consumer education about the importance of sleep health play a significant role. Sleep tech devices market players are striving to differentiate themselves by gaining a competitive edge. Product offerings with unique features, and holistic solutions intensify competition.

References

NutriousLife: How Technology Could Help You Get to Sleep

GalenData: The Need for New Sleep Technologies

Forbes – Sleep Tech Innovations – Next Frontier in the mattress space?