Manufacturers in the US and Europe vitrectomy devices market are adopting developmental strategies such as product launch and mergers & acquisitions to sustain the competitive environment in the market. For instance, in July 2021, Topcon Corporation acquired VISIA Imaging S.r.l, an ophthalmic device manufacturer headquartered in suburban Florence, Italy. Similarly, In July 2020, Bausch + Lomb introduced the new PINNACLE 360 25-gauge Scleral Fixation Forceps. The 25-gauge Scleral Fixation Forceps feature ergonomic 360-degree actuation and glare-free tips that undergo a patented fine-wire process to create micro-serrated edges that promote traction.

Danaher (Leica) and Bausch + Lomb– are Notable Market Players in US and Europe Vitrectomy Devices Market

The US and Europe vitrectomy devices manufacturers are focused on the production of vitrectomy devices for treatment of retinal diseases. Their involvement in product development and innovations helps ensure the cost-effective, efficient, and improved stability of the devices in the regional and global markets. Moreover, the governments are providing the required support through appropriate amount of funds allocation to the healthcare sector.

The US and Europe vitrectomy devices market majorly consists of the players such as D.O.R.C Dutch Opthalmic Research Center (International) B.V, HOYA Corporation, NIDEK CO., LTD, Danaher, Carl Zeiss Meditec, Alcon Inc., Iridex Corporation, Bausch Health Companies Inc., GEUDER AG, Topcon Corporation, Optos amongst others. The companies have been implementing various strategies that have helped the growth of the company and in turn have brought about various changes in the market. The companies have utilized organic strategies such as launches and product approvals. Whereas, the inorganic strategies such as mergers & acquisitions and collaborations, were widely seen in the market.

Several organic approaches, such as product launches, and expansion in the US and Europe vitrectomy devices market, have resulted in the positive growth of the market. Likewise, inorganic strategies such as mergers & acquisitions, and collaboration have help the company to strengthen its revenue, which allows the company to hold a strong position in the market.

Below is the list of the growth strategies adopted by the players operating in the US and Europe vitrectomy devices market:

| YEAR | NEWS |

| Jul-2021 | Topcon Corporation acquired VISIA Imaging S.r.l, an ophthalmic device manufacturer headquartered in suburban Florence, Italy. The acquisition enhanced Topcon’s development and manufacturing capabilities of anterior segment devices and software that complements the company’s strong portfolio of fundus imaging devices, including fundus cameras and optical coherence tomography (OCT). |

| Jul-2020 | Bausch + Lomb introduced the new PINNACLE 360 25-gauge Scleral Fixation Forceps. The 25-gauge Scleral Fixation Forceps feature ergonomic 360-degree actuation and glare-free tips that undergo a patented fine-wire process to create micro-serrated edges that promote traction. |

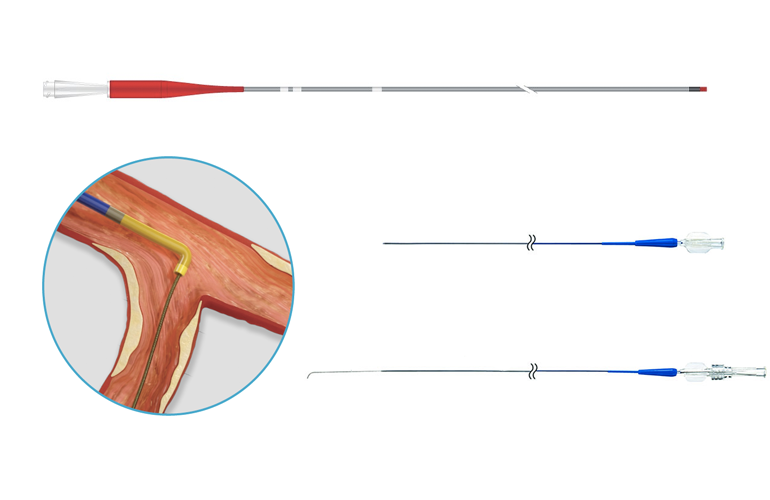

| Jun-2020 | DORC launched a new range of EVA EquiPhaco needles and sleeves. The previous EVA EquiPhaco range delivered superior performance and ease of use across a wide range of reusable and single-use designs. The new range of needles and sleeves delivered superior ultrasound efficiency, improved anterior chamber stability, and easier sleeve positioning. |