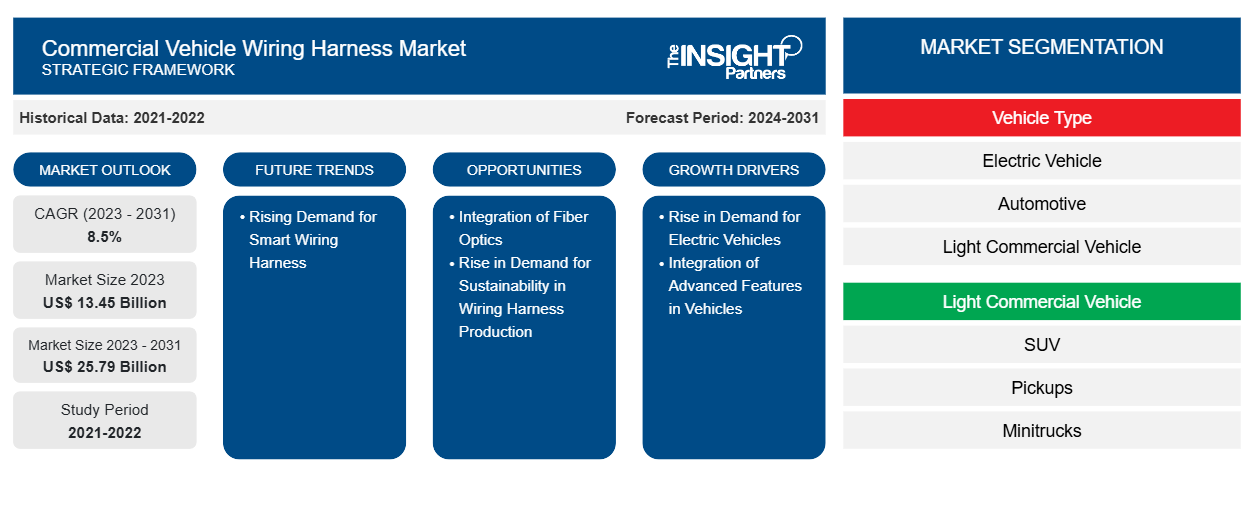

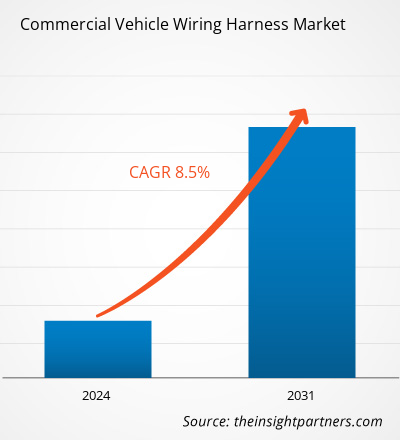

Das Marktvolumen für Kabelbäume für Nutzfahrzeuge dürfte von 13,45 Milliarden US-Dollar im Jahr 2023 auf 25,79 Milliarden US-Dollar im Jahr 2031 anwachsen. Von 2023 bis 2031 wird für den Markt eine durchschnittliche jährliche Wachstumsrate (CAGR) von 8,5 % erwartet. Das Aufkommen intelligenter Kabelbäume dürfte neue Trends auf dem Markt mit sich bringen.

Marktanalyse für Kabelbäume für Nutzfahrzeuge

Die Nachfrage nach Elektrofahrzeugen ( EVs ) steigt weltweit, insbesondere aufgrund der starken staatlichen Politik, die ihre Einführung unterstützen, und der wachsenden Umweltbedenken. Diese steigende Nachfrage nach EVs treibt das Wachstum des Marktes für Kabelbäume für Nutzfahrzeuge an , da Kabelbäume eine entscheidende Rolle bei der Handhabung des Energie- und Informationsflusses in Fahrzeugen spielen. Darüber hinaus treibt die zunehmende Integration von fortschrittlichen Funktionen wie selbstfahrenden Autos und fortschrittlichen Fahrerassistenzsystemen (ADAS) das Wachstum des Marktes an. Außerdem wird erwartet, dass die zunehmende Integration von Glasfaser für hohe Konnektivität und die steigende Nachfrage nach Nachhaltigkeit bei der Kabelbaumproduktion Chancen für das Wachstum des Marktes für Kabelbäume für Nutzfahrzeuge schaffen. Zudem wird erwartet, dass die steigende Nachfrage nach intelligenten Kabelbäumen, die mit jedem Fahrzeug kompatibel sind, das Wachstum des Marktes im Prognosezeitraum weiter vorantreiben wird.

Marktübersicht für Kabelbäume für Nutzfahrzeuge

Der Kabelbaum ist eine Sammlung von elektrischen Kabeln oder Kabelsätzen, die alle elektrischen und elektronischen Komponenten in einem Auto verbinden , wie Sensoren, elektronische Steuereinheiten, Batterien und Aktuatoren. Der Kabelbaum steuert den Energie- und Informationsfluss innerhalb des elektrischen Systems, um Hauptfunktionen des Autos wie Lenken und Bremsen sowie Nebenfunktionen wie Belüftung und Infotainment zu ermöglichen. Kabelbäume verbinden mehrere Drähte zu nicht flexiblen Bündeln, was sie sicherer macht als lose Drähte und die Gefahr von Kurzschlüssen in Stromkreisen verringert. Darüber hinaus bestehen Kabelbäume aus langlebigen Materialien. Sie sind so gebaut, dass diese Bündel auch unter rauen Bedingungen und bei der Übertragung enormer Stromlasten gut funktionieren. Darüber hinaus tragen Kabelbäume dazu bei, die Kraftstoffeffizienz jedes Autos zu verbessern, was die Nachfrage nach ihnen in der Automobilindustrie weiter steigert.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlos individuelle Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

- Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst eine Datenanalyse von Markttrends bis hin zu Schätzungen und Prognosen.

Treiber und Chancen auf dem Markt für Kabelbäume für Nutzfahrzeuge

Steigende Nachfrage nach Elektrofahrzeugen

Die Verkaufszahlen von Elektrofahrzeugen ( EV ) steigen aufgrund von Umweltschutzbedenken und Regierungspolitiken, die die Einführung von Fahrzeugen mit niedrigen oder keinen Emissionen fördern. Darüber hinaus bieten Regierungen verschiedener Länder ihren Bürgern Subventionen und Steuererleichterungen an, um die Einführung von Elektrofahrzeugen zu fördern . Die Regierungsbehörden ergreifen verschiedene Initiativen, um Elektrofahrzeuge weltweit zu fördern. Mehrere US-Bundesstaaten ergreifen Initiativen, indem sie finanzielle Anreize wie Rabatte, Steuergutschriften und Ermäßigungen bei der Zulassungsgebühr bieten und so die Einführung von Elektrofahrzeugen im Land fördern. Im Jahr 2021 beispielsweise bot die Regierung von Colorado eine Steuergutschrift von 4.000 US-Dollar beim Kauf eines leichten Elektrofahrzeugs an . Ebenso gewährt die Regierung von Connecticut eine ermäßigte zweijährliche Zulassungsgebühr von 38 US-Dollar für Elektrofahrzeuge . Solche Regierungsinitiativen führen zu steigenden Elektrofahrzeugverkäufen weltweit. Laut dem jährlichen Global EV Outlook 2024 der IEA wurden im Jahr 2023 weltweit etwa 14 Millionen neue Elektroautos zugelassen.

Im Jahr 2023 wurden 3,5 Millionen Elektroautos mehr verkauft als im Jahr 2022, was einer Steigerung von 35 % gegenüber dem Vorjahr entspricht. Der gleichen Quelle zufolge machten Elektroautos 2023 etwa 18 % aller verkauften Autos aus, was einer Steigerung gegenüber 14 % im Jahr 2022 entspricht. Von der Gesamtzahl der weltweit im Jahr 2023 neu zugelassenen Elektroautos entfielen etwa 60 % auf China, 25 % auf Europa und 10 % auf die USA. Die Zahl der Neuzulassungen von Elektroautos erreichte in China im Jahr 2023 8,1 Millionen, was einer Steigerung von 35 % gegenüber 2022 entspricht. China ist der weltweit größte Produzent von Elektrofahrzeugen und produziert 64 % des weltweiten Elektrofahrzeugvolumens . Daher steigert der Anstieg der Elektrofahrzeugverkäufe die Nachfrage nach Kabelbäumen, da diese eine entscheidende Rolle bei der Steuerung des Energie- und Informationsflusses innerhalb von Elektrofahrzeugen spielen .

Integration von Glasfaser

Die zunehmende Abhängigkeit von Glasfaserkabeln wird zu einem Eckpfeiler von Innovation und Effizienz in der sich rasch wandelnden Automobilindustrie. Da Autos immer stärker mit neuer Technologie vernetzt werden, wird der Einsatz von Glasfaserkabeln in Autos entscheidend, um dem gestiegenen Bedarf an schnellerer Datenübertragung und besserer Leistung gerecht zu werden. Glasfaserkabel verbessern die Unterhaltungs- und Informationssysteme im Auto und bieten Passagieren und Fahrern ein unvergleichliches audiovisuelles Erlebnis, das die Benutzerzufriedenheit und das Gesamtfahrerlebnis drastisch steigert. Darüber hinaus können Glasfaserkabel Echtzeit-Fahrzeugdiagnosen, verbesserte Fahrerassistenzsysteme und autonome Fahrfunktionen bieten, indem sie eine schnelle Datenübertragung ermöglichen, die für sekundenschnelle Entscheidungen entscheidend ist. Ihre Anwendung im Automobildesign reduziert das Fahrzeuggewicht, was zu kraftstoffeffizienteren und umweltfreundlicheren Fahrzeugen führt.

Glasfasern sind in Systemen wie adaptiver Geschwindigkeitsregelung, Kollisionsvermeidung und Spurverlassenswarnungen, die eine schnelle Datenübertragung erfordern, von entscheidender Bedeutung. Ihre Anwendung stellt sicher, dass Sicherheitsmaßnahmen nicht nur effektiver, sondern auch zuverlässiger sind, was den Fahrern ein größeres Gefühl der Sicherheit vermittelt. Darüber hinaus ermöglicht die Verwendung von Glasfaserkabeln in Fahrzeugkommunikationssystemen einen nahtloseren und effizienteren Informationsfluss, der für das ordnungsgemäße Funktionieren moderner Sicherheitsmaßnahmen von entscheidender Bedeutung ist. Diese Echtzeitkommunikation verbessert die Fahrzeugleistung und stellt einen bedeutenden Schritt in der Innovation der Fahrzeugsicherheit dar, der den Weg für zukünftige Fortschritte in der Fahrzeugtechnologie ebnet und die Branche zu einem höheren Niveau des Insassenschutzes führt. Daher wird erwartet, dass die zunehmende Integration von Glasfasern in Fahrzeuge die Nachfrage nach Kabelbäumen im Prognosezeitraum steigern wird.

Marktbericht über Kabelbäume für Nutzfahrzeuge – Segmentierungsanalyse

Wichtige Segmente, die zur Ableitung der Marktanalyse für Kabelbäume für Nutzfahrzeuge beigetragen haben, sind Fahrzeugtyp, leichtes Nutzfahrzeug sowie mittleres und schweres Nutzfahrzeug.

- Nach Fahrzeugtyp ist der Markt für Kabelbäume für Nutzfahrzeuge in Elektrofahrzeuge, Automobile, leichte Nutzfahrzeuge (LCV) sowie mittlere und schwere Nutzfahrzeuge (MHCVs) unterteilt. Das Automobilsegment hielt im Jahr 2023 den größten Anteil am Markt für Kabelbäume für Nutzfahrzeuge.

- Der Markt für Kabelbäume für Nutzfahrzeuge (LCVs) ist in SUVs, Pickups, Mini-Trucks und Minivans unterteilt. Das SUV-Segment hatte im Jahr 2023 den größten Anteil am Markt für Kabelbäume für Nutzfahrzeuge.

- Der Markt für Kabelbäume für Nutzfahrzeuge für mittlere und schwere Nutzfahrzeuge (MHCV) ist unterteilt in mittlere und schwere Lkw, schwere Bergbaufahrzeuge, schwere Baufahrzeuge, schwere Landwirtschaftsfahrzeuge und mittlere Landwirtschaftsfahrzeuge/Traktoren. Das Segment der mittleren und schweren Lkw dominierte den Markt für Kabelbäume für Nutzfahrzeuge im Jahr 2023.

Marktanteilsanalyse für Kabelbäume für Nutzfahrzeuge nach Geografie

- Der Markt für Kabelbäume für Nutzfahrzeuge ist in fünf große Regionen unterteilt: Nordamerika, Europa, Asien-Pazifik (APAC), Naher Osten und Afrika (MEA) sowie Süd- und Mittelamerika. Der asiatisch-pazifische Raum dominierte den Markt im Jahr 2023, gefolgt von Nordamerika und Europa.

- Nordamerika verzeichnete 2023 ein enormes Wachstum bei den Elektrofahrzeugverkäufen. Laut dem jährlichen Global EV Outlook 2024 der Internationalen Energieagentur (IEA) erreichten die Neuzulassungen von Elektroautos in den USA im Jahr 2023 1,4 Millionen, was einem Anstieg von mehr als 40 % gegenüber 2022 entspricht. Verschiedene Akteure auf dem Markt für Kabelbäume für Nutzfahrzeuge in der Region ergreifen verschiedene Initiativen, um das Bewusstsein für die Vorteile dieser Komponenten zu schärfen. Nach dem Erfolg der in den Jahren 2022 und 2023 veranstalteten Konferenzen plant die Süddeutscher Verlag Events GmbH beispielsweise, am 28. und 29. Oktober 2024 ihre dritte US Automotive Wire Harness & EDS Conference in Dearborn, Michigan, auszurichten. Diese Veranstaltungen sollen OEMs, Kabelbaumentwickler, Tier1- und Tier2-Zulieferer, Hochspannungsspezialisten und andere innovative Zulieferer über die Herstellung und das Design von Kabelbäumen für Nutzfahrzeuge sowie deren Vorteile unter rauen Bedingungen informieren und ihnen Wissen vermitteln.

Regionale Einblicke in den Markt für Kabelbäume für Nutzfahrzeuge

Die regionalen Trends und Faktoren, die den Markt für Kabelbäume für Nutzfahrzeuge im Prognosezeitraum beeinflussen, wurden von den Analysten von Insight Partners ausführlich erläutert. In diesem Abschnitt werden auch die Marktsegmente und die Geografie für Kabelbäume für Nutzfahrzeuge in Nordamerika, Europa, im asiatisch-pazifischen Raum, im Nahen Osten und Afrika sowie in Süd- und Mittelamerika erörtert.

- Erhalten Sie regionale Daten zum Markt für Kabelbäume für Nutzfahrzeuge

Umfang des Marktberichts zum Kabelbaum für Nutzfahrzeuge

| Berichtsattribut | Details |

|---|---|

| Marktgröße im Jahr 2023 | 13,45 Milliarden US-Dollar |

| Marktgröße bis 2031 | 25,79 Milliarden US-Dollar |

| Globale CAGR (2023 - 2031) | 8,5 % |

| Historische Daten | 2021-2022 |

| Prognosezeitraum | 2024–2031 |

| Abgedeckte Segmente | Nach Fahrzeugtyp

|

| Abgedeckte Regionen und Länder | Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

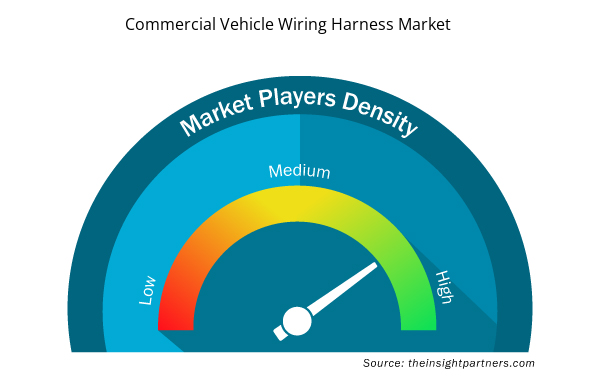

Marktteilnehmerdichte: Der Einfluss auf die Geschäftsdynamik

Der Markt für Kabelbäume für Nutzfahrzeuge wächst rasant. Dies wird durch die steigende Nachfrage der Endnutzer aufgrund von Faktoren wie sich entwickelnden Verbraucherpräferenzen, technologischen Fortschritten und einem größeren Bewusstsein für die Vorteile des Produkts vorangetrieben. Mit der steigenden Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um die Bedürfnisse der Verbraucher zu erfüllen, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

Die Marktteilnehmerdichte bezieht sich auf die Verteilung von Firmen oder Unternehmen, die in einem bestimmten Markt oder einer bestimmten Branche tätig sind. Sie gibt an, wie viele Wettbewerber (Marktteilnehmer) in einem bestimmten Marktraum im Verhältnis zu seiner Größe oder seinem gesamten Marktwert präsent sind.

Die wichtigsten auf dem Markt für Kabelbäume für Nutzfahrzeuge tätigen Unternehmen sind:

- Motherson Sumi Systems Ltd.

- AME Systems (VIC) Pty Ltd.

- Funken-Minda

- Yazaki Corp

- Sumitomo Electric Industries Ltd

- Nexans SA

Haftungsausschluss : Die oben aufgeführten Unternehmen sind nicht in einer bestimmten Reihenfolge aufgeführt.

- Überblick über die wichtigsten Akteure auf dem Markt für Kabelbäume für Nutzfahrzeuge

Neuigkeiten und aktuelle Entwicklungen zum Markt für Kabelbäume für Nutzfahrzeuge

Der Markt für Kabelbäume für Nutzfahrzeuge wird durch die Erhebung qualitativer und quantitativer Daten nach Primär- und Sekundärforschung bewertet, die wichtige Unternehmensveröffentlichungen, Verbandsdaten und Datenbanken umfasst. Nachfolgend sind einige der Entwicklungen auf dem Markt für Kabelbäume für Nutzfahrzeuge aufgeführt:

- Lear Corporation, einer der weltweit führenden Technologieanbieter für die Automobilindustrie in den Bereichen Sitze und elektronische Systeme, gab die Übernahme von M&N Plastics bekannt, einem in Privatbesitz befindlichen, in Michigan ansässigen Spezialisten für Spritzguss und Hersteller technischer Kunststoffkomponenten für die elektrische Verteilung in Kraftfahrzeugen.

(Quelle: Lear Corporation, Pressemitteilung, März 2024)

- Das japanische Unternehmen Sumitomo Electric Wiring Systems Inc. hat eine vorläufige Vereinbarung mit der ägyptischen General Authority for Investment and Free Zones unterzeichnet, um in Ägypten die weltweit größte Fabrik für Kabelbäume für Elektrofahrzeuge zu errichten. Die Fabrik wird in einer Freihandelszone in der Stadt des 10. Ramadan auf einer Fläche von 150.000 Quadratmetern errichtet. Das Projekt umfasst Investitionen von rund 100 Millionen US-Dollar für den Export der Produkte an globale Autohersteller in Europa und dem Nahen Osten.

(Quelle: Sumitomo Electric Wiring Systems Inc., Pressemitteilung, April 2023)

Marktbericht zum Kabelbaum für Nutzfahrzeuge – Umfang und Ergebnisse

Die „Marktgröße und Prognose für Kabelbäume für Nutzfahrzeuge (2021–2031)“ bietet eine detaillierte Analyse des Marktes, die die unten genannten Bereiche abdeckt:

- Marktgröße und Prognose für Kabelbäume für Nutzfahrzeuge auf globaler, regionaler und Länderebene für alle wichtigen Marktsegmente, die im Rahmen des Berichts abgedeckt sind

- Markttrends für Kabelbäume für Nutzfahrzeuge sowie Marktdynamik wie Treiber, Einschränkungen und wichtige Chancen

- Detaillierte PEST- und SWOT-Analyse

- Marktanalyse für Kabelbäume für Nutzfahrzeuge, die wichtige Markttrends, globale und regionale Rahmenbedingungen, wichtige Akteure, Vorschriften und aktuelle Marktentwicklungen umfasst

- Branchenlandschaft und Wettbewerbsanalyse, die die Marktkonzentration, Heatmap-Analyse, prominente Akteure und aktuelle Entwicklungen für den Markt für Nutzfahrzeug-Kabelbäume umfasst

- Detaillierte Firmenprofile

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branche und Wettbewerbsumfeld

- Excel-Datensatz

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Häufig gestellte Fragen

Rising demand for smart wiring harness are expected to drive the growth of the commercial vehicle wiring harness market in the coming years.

The key players holding majority shares in the commercial vehicle wiring harness market include Motherson Sumi Systems Ltd., AME Systems (VIC) Pty Ltd., Spark Minda, Yazaki Corp, Sumitomo Electric Industries Ltd, Nexans SA, Furukawa Electric Co Ltd, Lear Corp, DRÄXLMAIER Group, and ECOCABLES.

Rise in demand for electric vehicles and integration of advanced features in vehicles are driving factors in the commercial vehicle wiring harness market.

The commercial vehicle wiring harness market was estimated to be valued at US$ 13.45 billion in 2023 and is anticipated to grow at a CAGR of 8.5% over the forecast period.

The automotive segment led the commercial vehicle wiring harness market with a significant share in 2023.

The commercial vehicle wiring harness market is expected to reach US$ 25.79 Billion by 2031.

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Commercial Vehicle Wiring Harness Market

- Motherson Sumi Systems Ltd.

- AME Systems (VIC) Pty Ltd.

- Spark Minda

- Yazaki Corp

- Sumitomo Electric Industries Ltd

- Nexans SA

- Furukawa Electric Co Ltd

- Lear Corp

- DRÄXLMAIER Group

- ECOCABLES

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Holen Sie sich ein kostenloses Muster für diesen Bericht

Holen Sie sich ein kostenloses Muster für diesen Bericht