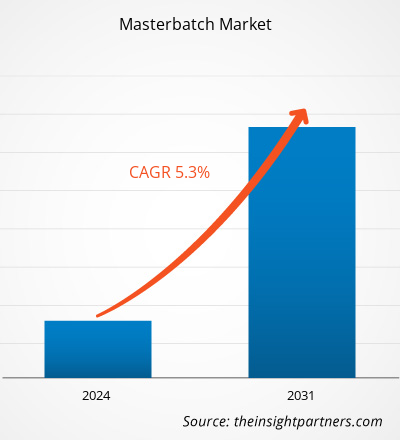

Der Masterbatch-Markt wurde im Jahr 2023 auf 12,32 Milliarden US-Dollar geschätzt und soll bis 2031 18,56 Milliarden US-Dollar erreichen; von 2023 bis 2031 wird eine durchschnittliche jährliche Wachstumsrate (CAGR) von 5,3 % erwartet.

Markteinblicke und Analystenansichten:

Masterbatches können Pigmente, Additive oder Füllstoffe enthalten, die während eines Wärmeprozesses in ein Trägerharz eingekapselt werden, das dann abgekühlt und in eine körnige Form geschnitten wird. Die Nachfrage nach Masterbatches wird durch die wachsende Kunststoffindustrie und andere Branchen wie Verpackung, Automobil, Bauwesen und Konsumgüter getrieben. Masterbatches werden im Allgemeinen bei der Herstellung von Platten, Fasern, Folien, Spritzgussteilen und extrudierten Profilen verwendet. Wichtige Marktteilnehmer bieten eine breite Produktpalette wie Additiv-Masterbatches, Weiß-Masterbatches, Farb-Masterbatches, Spezialeffekte und Füllstoff-Masterbatches an. Darüber hinaus beeinflussen Umweltbedenken und Vorschriften zur Kunststoffabfallbewirtschaftung die Nachfrage nach kompostierbaren oder biologisch abbaubaren Masterbatches und unterstützen das Wachstum des Masterbatch-Marktes .

Wachstumstreiber und Herausforderungen:

Die steigende Nachfrage nach Kunststoffverpackungen in Schwellenländern und die steigende Nachfrage nach schwarzen Masterbatches aus Endverbrauchsindustrien tragen zum wachsenden Masterbatch-Markt bei. Die Präsenz etablierter Branchen, darunter Lebensmittel und Getränke sowie Konsumgüter, in Ländern wie China, Indien, Japan und Südkorea treibt die Nachfrage nach Verpackungslösungen im asiatisch-pazifischen Raum an. Der Markt für Kunststoffverpackungen im asiatisch-pazifischen Raum hat aufgrund der schnell wachsenden Verpackungsindustrie, des wachsenden Lebensmitteleinzelhandels und des steigenden Verbraucherbewusstseins für nachhaltige Kunststoffverpackungen ein bemerkenswertes Wachstum erlebt. Schwarzes Masterbatch ist eine kostengünstige und weithin bevorzugte Option auf dem Masterbatch-Markt. Es wird hauptsächlich in Verpackungsanwendungen für Produkte wie Folien, Beutel, Flaschen und Behälter verwendet. Es bietet Opazität, UV-Schutz und ästhetische Attraktivität. Schwarzes Masterbatch eignet sich aufgrund seiner Eigenschaften wie UV- und Wärmeschutz auch für die Herstellung von Schläuchen und Geomembranen. Das Wachstum in den Bereichen Unterhaltungselektronik, Verpackung, Automobil, Bauwesen und anderen Endverbrauchsindustrien stärkt die Nachfrage nach schwarzen Masterbatches. Der wachsende Bedarf an Kunststoffverpackungen in Schwellenländern und die steigende Nachfrage nach schwarzen Masterbatches aus den Endverbrauchsindustrien treiben den Masterbatch-Markt an.

Die Schwankungen der Rohstoffpreise können den Masterbatch-Markt bremsen. Rohstoffe, die bei der Masterbatch-Herstellung verwendet werden, werden auf den globalen Märkten als Handelswaren gehandelt und unterliegen damit der Dynamik der Rohstoffmärkte. Polymere auf Rohölbasis unterliegen aufgrund verschiedener Faktoren, darunter Störungen in der Lieferkette und Nachfrageschwankungen, Preisschwankungen. Die steigenden Rohölpreise aufgrund schwankender globaler Wirtschaftsbedingungen treiben die Harzpreise in die Höhe. Die Beziehung zwischen Rohölpreisen und Polymerkosten kann anhand mehrerer Faktoren bestimmt werden, wie Produktionskosten, Marktvolatilität, Auswirkungen auf die Lieferkette und Marktwettbewerb. Preiserhöhungen bei Erdölprodukten und anderen Rohstoffen können die Gewinnmargen der Produkte einschränken und eine Herausforderung für den Masterbatch-Markt darstellen.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlose Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

- Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst eine Datenanalyse von Markttrends bis hin zu Schätzungen und Prognosen.

Berichtssegmentierung und -umfang:

Die „Globale Masterbatch-Marktanalyse und -prognose bis 2031“ ist eine spezialisierte und eingehende Studie mit einem starken Fokus auf globale Markttrends und Wachstumschancen. Der Bericht soll einen Überblick über den Markt mit detaillierter Marktsegmentierung nach Typ, Polymer und Endverbrauchsbranche geben. Der Markt hat in der jüngsten Vergangenheit ein hohes Wachstum erlebt und wird diesen Trend voraussichtlich im Prognosezeitraum fortsetzen. Der Bericht liefert wichtige Statistiken zur weltweiten Verwendung von Masterbatch. Darüber hinaus bietet der globale Masterbatch-Marktbericht eine qualitative Bewertung verschiedener Faktoren, die die Marktleistung weltweit beeinflussen. Der Bericht enthält auch eine umfassende Analyse der führenden Akteure auf dem Markt und ihrer wichtigsten strategischen Entwicklungen. Es wurden mehrere Analysen durchgeführt, um die wichtigsten Antriebsfaktoren, Masterbatch-Markttrends und lukrativen Möglichkeiten zu ermitteln, die wiederum dazu beitragen würden, die wichtigsten Einnahmequellen zu identifizieren.

Die Masterbatch-Marktprognose wird auf der Grundlage verschiedener sekundärer und primärer Forschungsergebnisse geschätzt, wie z. B. wichtiger Unternehmensveröffentlichungen, Verbandsdaten und Datenbanken. Darüber hinaus bieten die Ökosystemanalyse und Porters Fünf-Kräfte-Analyse eine 360-Grad-Ansicht des Marktes, die hilft, die gesamte Lieferkette und verschiedene Faktoren zu verstehen, die die Marktleistung beeinflussen.

Segmentanalyse:

Der globale Masterbatch-Markt ist nach Typ, Polymer und Endverbrauchsbranche segmentiert. Basierend auf dem Typ ist der Markt in Weiß, Schwarz, Additiv, Farbe, Füllstoff und andere segmentiert. Das weiße Segment hatte 2023 einen erheblichen Anteil am Masterbatch-Markt. Weißes Masterbatch ist eine Art Additiv, das als Farbstoff bei der Polymerherstellung verwendet wird. Es verleiht den Farbstoffen weiße Töne . Weißes Masterbatch enthält hochwertige Titandioxidsorten, die Licht streuen können. In der Kunststoffindustrie wird weißes Masterbatch bei Laminierungen, Beschichtungen, Schutzfolien, Formgebung usw. verwendet.

Basierend auf Polymeren ist der Markt in Polyethylen, Polypropylen, Polyethylenterephthalat, Polystyrol und andere segmentiert. Das Polyethylensegment hielt 2023 einen beträchtlichen Marktanteil bei Masterbatches. Masterbatches auf Polyethylenbasis sind eine konzentrierte Mischung aus Additiven und einem Basispolymer, Polyethylen, die die Eigenschaften von Kunststoffen und anderen Materialien verbessern soll. Mit Masterbatches hergestellte Polyethylenprodukte werden in den Bereichen Verpackung, Automobil, Baumaterialien, Konsumgüter, Landwirtschaft, Textilien und Schuhe verwendet.

Basierend auf der Endverbrauchsbranche ist der Masterbatch-Markt in Bauwesen, Automobil, Verpackung, Landwirtschaft, Elektrik und Elektronik und andere unterteilt. Das Verpackungssegment hatte im Jahr 2023 einen erheblichen Marktanteil. Masterbatch wird in der Baubranche stark genutzt, da es verschiedene Vorteile und Funktionen für eine Vielzahl von Baumaterialien bietet. Der im Bauwesen verwendete Kunststoff erfordert spezielle Zusatzstoffe, um die Leistung, Zugfestigkeit und Ästhetik von Kunststoffen zu verbessern. Die Industrie verwendet Masterbatch für Farbe und Ästhetik, UV-Beständigkeit, Flammschutz, Energieeffizienz sowie antistatische und leitfähige Eigenschaften.

Regionale Analyse:

Der Bericht bietet einen detaillierten Überblick über den Markt in Bezug auf fünf große Regionen – Nordamerika, Europa, Asien-Pazifik (APAC), Naher Osten und Afrika (MEA) sowie Süd- und Mittelamerika. In Bezug auf den Umsatz dominierte der asiatisch-pazifische Raum den Masterbatch-Markt. Der Markt in der Region wurde im Jahr 2023 auf mehr als 6 Milliarden US-Dollar geschätzt. Der asiatisch-pazifische Markt ist nach Ländern in Australien, China, Indien, Japan, Südkorea und den Rest des asiatisch-pazifischen Raums unterteilt. Masterbatches werden bei der Herstellung von Innen- und Außenteilen für Autos verwendet und bieten verschiedene Eigenschaften wie Flammschutz, Farbdispersion und UV-Stabilität. Laut dem Bericht der Internationalen Organisation der Kraftfahrzeughersteller wurde die Kraftfahrzeugproduktion im asiatisch-pazifischen Raum im Jahr 2022 auf 48,96 Millionen Einheiten geschätzt. Diese Faktoren fördern das Wachstum des Masterbatch-Marktes im asiatisch-pazifischen Raum.

Der europäische Masterbatch-Markt wird voraussichtlich bis 2031 mehr als 2 Milliarden US-Dollar erreichen. In Europa sind mehrere große Verpackungsunternehmen vertreten, darunter Tetra Laval International SA, Amcor plc, Berry Global Group Inc, Smurfit Kappa Group plc, DS Smith plc, Ardagh Group SA und UPM-Kymmene Corp. Anti-Rutsch-Additiv-Masterbatch wird in Folienverpackungen verwendet, um den Reibungskoeffizienten zwischen Folien oder Polyethylenplatten zu erhöhen. Nachhaltigkeitsinitiativen und Vorschriften zur Kreislaufwirtschaft haben die Hersteller jedoch zusätzlich dazu veranlasst, kompostierbares oder recyceltes Masterbatch zu entwickeln. Daher treiben Entwicklungen in der Verpackungsindustrie in Europa die Nachfrage nach Masterbatches an.

Der Masterbatch-Markt in Nordamerika wird voraussichtlich im Zeitraum 2023–2031 eine durchschnittliche jährliche Wachstumsrate von ca. 5 % verzeichnen. Laut der American Coatings Association sind Bautenanstriche in den USA der größte Sektor und das größte Segment der Farbenindustrie und machen mehr als 50 % des Gesamtvolumens der jährlich produzierten Anstriche aus. Laut der Federal Highway Administration des US-Verkehrsministeriums hat die US-Regierung 2021 den Infrastructure Investment and Jobs Act unterzeichnet, der langfristige Infrastrukturinvestitionen umfasst und in den Geschäftsjahren 2022–2026 550 Milliarden US-Dollar für den Bau von Straßen, Brücken sowie öffentlichen Verkehrsmitteln und Wasserinfrastruktur bereitstellt. Somit treibt die Entwicklung der Bauindustrie in Nordamerika den Masterbatch-Markt in der Region an.

Regionale Einblicke in den Masterbatch-Markt

Die regionalen Trends und Faktoren, die den Masterbatch-Markt im Prognosezeitraum beeinflussen, wurden von den Analysten von Insight Partners ausführlich erläutert. In diesem Abschnitt werden auch die Marktsegmente und die Geografie des Masterbatch-Marktes in Nordamerika, Europa, im asiatisch-pazifischen Raum, im Nahen Osten und Afrika sowie in Süd- und Mittelamerika erörtert.

- Holen Sie sich die regionalspezifischen Daten für den Masterbatch-Markt

Umfang des Masterbatch-Marktberichts

| Berichtsattribut | Details |

|---|---|

| Marktgröße im Jahr 2023 | 12,32 Milliarden US-Dollar |

| Marktgröße bis 2031 | 18,56 Milliarden US-Dollar |

| Globale CAGR (2023 - 2031) | 5,3 % |

| Historische Daten | 2020-2022 |

| Prognosezeitraum | 2024–2031 |

| Abgedeckte Segmente | Nach Typ

|

| Abgedeckte Regionen und Länder | Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Dichte der Marktteilnehmer für Masterbatches: Auswirkungen auf die Geschäftsdynamik verstehen

Der Masterbatch-Markt wächst rasant, angetrieben durch die steigende Nachfrage der Endverbraucher aufgrund von Faktoren wie sich entwickelnden Verbraucherpräferenzen, technologischen Fortschritten und einem größeren Bewusstsein für die Vorteile des Produkts. Mit steigender Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um die Bedürfnisse der Verbraucher zu erfüllen, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

Die Marktteilnehmerdichte bezieht sich auf die Verteilung von Firmen oder Unternehmen, die in einem bestimmten Markt oder einer bestimmten Branche tätig sind. Sie gibt an, wie viele Wettbewerber (Marktteilnehmer) in einem bestimmten Marktraum im Verhältnis zu seiner Größe oder seinem gesamten Marktwert präsent sind.

Die wichtigsten auf dem Masterbatch-Markt tätigen Unternehmen sind:

- „Avient Corp.

- Ampacet-Unternehmen

- Cabot Corp

- LyondellBasell Industries NV

- Plastika Kritis SA

- Penn Color Inc

Haftungsausschluss : Die oben aufgeführten Unternehmen sind nicht in einer bestimmten Reihenfolge aufgeführt.

- Überblick über die wichtigsten Akteure auf dem Masterbatch-Markt

Branchenentwicklungen und zukünftige Chancen:

Nachfolgend sind einige Initiativen großer Unternehmen auf dem Masterbatch-Markt aufgeführt (laut Pressemitteilungen der Unternehmen):

- Im Jahr 2023 führte Ampacet Corporation ColorMark ein, eine Masterbatch-Additivtechnologie. Das entwickelte Produkt ist mit Polypropylen, Polystyrol, Polycarbonat und Polyamid kompatibel. Das Masterbatch erzeugt dauerhafte und wetterbeständige Farben, die in sechs beliebten Farben erhältlich sind – Rot, Orange, Gelb, Grün, Blau und Lila.

- Im Jahr 2023 eröffnete Penn Color Inc. seine erste Produktionsanlage in Thailand. Ziel des Unternehmens ist es, Märkte im gesamten asiatisch-pazifischen Raum mit hochwertigen Farb- und Additiv-Masterbatches zu versorgen.

- Im Jahr 2023 brachte Cabot Corporation REPLASBLAK auf den Markt, ein kreisförmiges schwarzes Masterbatch aus nachhaltigem Material. Das Unternehmen brachte drei schwarze Masterbatch-Produkte auf den Markt – REPLASBLAK rePE5475 100 % kreisförmiges schwarzes Masterbatch, REPLASBLAK rePE5265 70 % kreisförmiges schwarzes Masterbatch und REPLASBLAK rePE5250 60 % kreisförmiges schwarzes Masterbatch.

Wettbewerbslandschaft und Schlüsselunternehmen:

Avient Corp, Ampacet Corporation, Cabot Corp, LyondellBasell Industries NV, Plastika Kritis SA, Penn Color Inc, Americhem, FRILVAM SPA, Polyvel Inc und Vanetti Spa gehören zu den wichtigsten Akteuren, die im Masterbatch-Marktbericht vorgestellt werden. Die globalen Marktteilnehmer konzentrieren sich darauf, qualitativ hochwertige Produkte anzubieten, um die Kundennachfrage zu erfüllen.

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branche und Wettbewerbsumfeld

- Excel-Datensatz

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Häufig gestellte Fragen

Asia Pacific accounted for the largest share in the global masterbatch market in 2023. As per the International Trade Administration, total investments in China's infrastructure during the 14th Five-Year Plan period (2021–2025) are estimated to reach ~US$ 4 trillion. According to the National Investment Promotion & Facilitation Agency, India allocated an investment budget of US$ 1.4 trillion in infrastructure under the National Infrastructure Pipeline by 2025, of which 18% accounted for roads and highways, 17% accounted for urban infrastructure, and 12% for railways.

Masterbatch manufacturers implement various strategic initiatives to maintain competitiveness, meet evolving customer demands, and capitalize on market opportunities. Masterbatch producers invest in research and development to innovate and introduce new products with enhanced properties, functionalities, and sustainable features.

The major players operating in the global masterbatch market are Avient Corp, Ampacet Corporation, Cabot Corp, LyondellBasell Industries NV, Plastika Kritis SA, Penn Color Inc, Americhem, FRILVAM SPA, Polyvel Inc, and Vanetti Spa.

Based on type, the market is segmented into white, black, additives, color, filler, and others. In 2023, the white segment held the largest masterbatch market share. The color segment is expected to register the highest CAGR from 2023 to 2031. White masterbatch is a type of additive used as a colorant in polymer manufacturing.

Masterbatch is widely used for coloring, UV stabilization, anti-block properties, and flame retardancy in plastic packaging solutions such as films, bottles, containers, sheets, and wraps. It offers several advantages such as precise color control, cost-effectiveness, ease of handling, and customization, making it a preferred choice for achieving desired properties in the packaging products.

Based on polymer, the market is segmented into polyethylene, polypropylene, polyethylene terephthalate, polystyrene, and others. The polyethylene segment held the largest masterbatch market share in 2023, and the polypropylene segment is expected to register a significant CAGR from 2023 to 2031. Polyethylene-based masterbatch is a concentrated blend of additives and a base polymer, polyethylene, which is designed to improve the properties of plastics and other materials.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Masterbatch Market

- Avient Corp

- Ampacet Corporation

- Cabot Corp

- LyondellBasell Industries NV

- Plastika Kritis SA

- Penn Color Inc

- Americhem

- FRILVAM SPA

- Polyvel Inc

- Vanetti Spa

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Holen Sie sich ein kostenloses Muster für diesen Bericht

Holen Sie sich ein kostenloses Muster für diesen Bericht