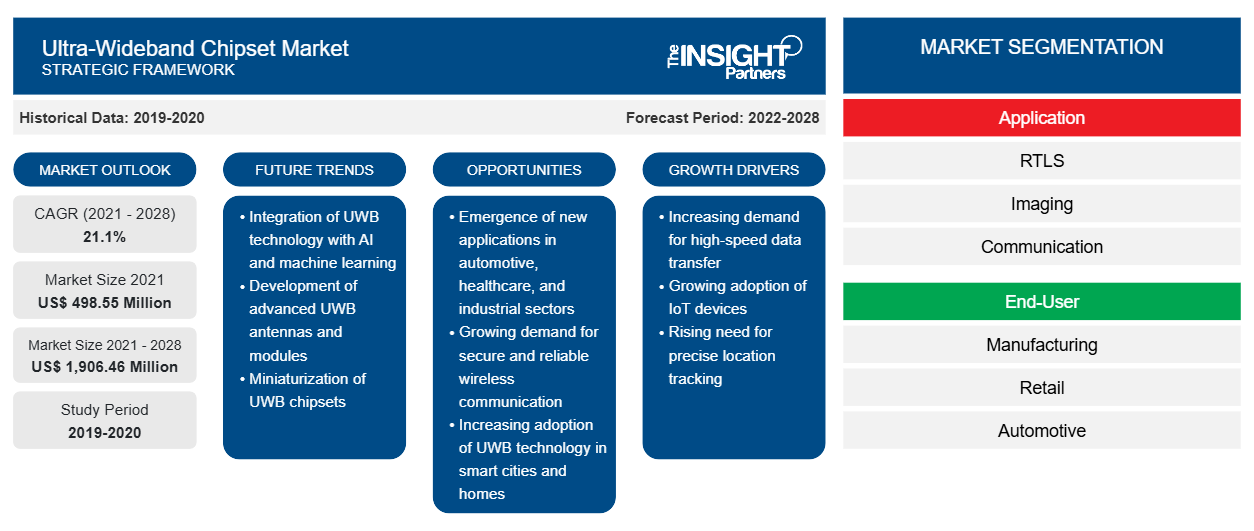

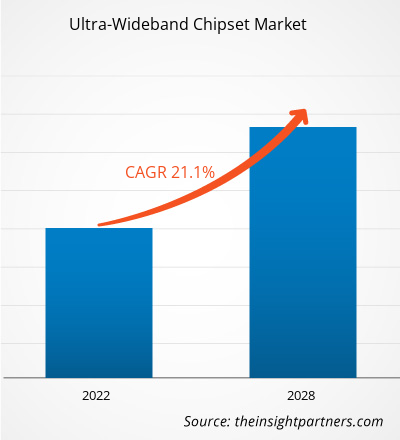

Der Markt für Ultrabreitband-Chipsätze wurde im Jahr 2021 auf 498,55 Millionen US-Dollar geschätzt und soll bis 2028 1.906,46 Millionen US-Dollar erreichen; von 2021 bis 2028 wird mit einer durchschnittlichen jährlichen Wachstumsrate von 21,1 % gerechnet.

Ultrabreitband ist eine der wachsenden Technologien, die in Echtzeit-Ortungssystemen (RTLS) eingesetzt werden und aufgrund ihrer höheren Genauigkeit bei der Objektverfolgung ein erhebliches Wachstumspotenzial aufweisen. Die UWB-Technologie bietet eine hohe Genauigkeit und große Reichweite sowie einen geringeren Stromverbrauch als andere RTLS-Technologien wie RFID. Dies hat zu einer zunehmenden Verbreitung der UWB-Technologie in Anwendungen geführt, die eine hohe Genauigkeit erfordern. Aufgrund dieser höheren Genauigkeit der UWB-Technologie sind mehrere Endbenutzer von RTLS von RFID und Wi-Fi auf die UWB-Technologie umgestiegen, um die Effizienz des Produkts zu verbessern. Darüber hinaus bieten die UWB-integrierten RTLS-Lösungen verschiedene Vorteile für RTLS-Anwendungen und treiben so den Markt für Ultrabreitband-Chipsätze voran.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlos individuelle Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

- Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst eine Datenanalyse von Markttrends bis hin zu Schätzungen und Prognosen.

Auswirkungen der COVID-19-Pandemie auf die Marktgröße für Ultrabreitband-Chipsätze im asiatisch-pazifischen Raum

Aufgrund der COVID-19-Pandemie haben mehrere Regionen stark gelitten, insbesondere der asiatisch-pazifische Raum. Die Fertigungssektoren auf der ganzen Welt leiden unter geringer Produktion und einer schwächeren Lieferkette. Darüber hinaus hat der Arbeitskräftemangel auch die Fertigungsindustrie beeinträchtigt. Auch die Produktionsanlagen für UWB-basierte Systeme wurden entweder geschlossen oder konnten nicht die volle Kapazität produzieren, was sich von 2020 bis Mitte 2021 negativ auf die Umsätze der Unternehmen ausgewirkt und kurzfristig zu einem langsameren Wachstum geführt hat. Mit der zunehmenden Nutzung von Fernüberwachungstechnologie könnten Softwareverwaltungstools jedoch in der Zeit nach COVID zu einer höheren Akzeptanz führen. Die Gesamtauswirkungen von COVID-19 auf den Markt für Ultrabreitband-Chipsätze weltweit sind also gering bis mäßig.

Markteinblicke – Ultrabreitband-Chipsatzmarkt

Zunehmende Nutzung der UWB-Technologie bei der Ortung persönlicher und privater Geräte treibt Wachstum auf dem Markt für Ultrabreitband-Chipsätze voran

UWB verbessert das Verbrauchererlebnis von Home-Entertainment-Produkten wie Laptops, Fernsehern und Audiogeräten erheblich. Dies hat zu einer zunehmenden Verbreitung der UWB-Technologie geführt und letztendlich das Wachstum des Marktes für Ultrabreitband-Chipsätze angekurbelt. Es wird auch verwendet, um persönliche Gegenstände zu verfolgen. Beispielsweise ist der Apple U1-Chip für räumliches Bewusstsein in iPhones 11, 12 und 13 integriert. Darüber hinaus haben nach Apple verschiedene Smartphone-Hersteller die UWB-Technologie in ihre Produkte integriert und so zum Wachstum des Marktes für Ultrabreitband-Chipsätze beigetragen. Darüber hinaus hat Apple im April 2021 AirTag mit UWB-Technologie herausgebracht, woraufhin Samsung offiziell seinen Galaxy SmartTag+-Tracker mit UWB auf den Markt brachte. Somit trägt der Anstieg der Verbreitung zum Wachstum des Marktes für Ultrabreitband-Chipsätze bei. significantly enhances the consumer experience of home entertainment products such as laptops, TV, and audio. This has led to increasing UWB technology adoption and eventually boosts the ultra-wideband chipset market growth. It is also being used to track the personal item. For example, the Apple U1 chip for spatial awareness is integrated into iPhones 11, 12, and 13. In addition, after Apple, various smartphone manufacturers have integrated UWB technology in their products, contributing to the growth of the ultra-wideband chipset market. Moreover, in April 2021, Apple released AirTag with UWB technology, post which Samsung officially launched its Galaxy SmartTag+ tracker comprising UWB. Thus, the surge in adoption rate contributes to the growth of the ultra-wideband chipset market.

Anwendungsbasierte Erkenntnisse

Basierend auf dem Angebot ist der Markt für Ultrabreitband-Chipsätze in RTLS, Bildgebung und Kommunikation unterteilt. Das Kommunikationssegment war 2021 Marktführer. Die drahtlose UWB-Kommunikation überträgt beträchtliche Datenmengen über ein breites Frequenzspektrum von 3,1 bis 10,6 GHz. Sie umfasst Anwendungen für Entfernungsmessung, Authentifizierung, drahtloses USB und Datenübertragung. Darüber hinaus ist die Nachfrage nach drahtlosen Breitband-Kommunikationssystemen aufgrund neuer Anwendungen wie mobiler Ad-hoc-Netzwerke und Datenerfassung über ein drahtloses Sensornetzwerk deutlich gestiegen , was die Nachfrage nach Ultrabreitband-Chipsätzen ankurbelt.ultra-wideband chipset market is segmented into RTLS, imaging, and communication. The communication segment led the market in 2021. UWB wireless communication transmits considerable data over a broad frequency spectrum ranging from 3.1 to 10.6 GHz. It includes ranging, authentication, wireless USB, and data transfer applications. Furthermore, the demand for wireless wideband communications systems has increased significantly, owing to emerging applications such as mobile ad-hoc networking and data collection through a ultra-wideband chipset market size.

Der Markt für Ultrabreitband-Chipsätze ist nach Anwendung, Endbenutzer und Geografie segmentiert. Nach Typ wird der Markt für Ultrabreitband-Chipsätze in bildgebende Messsysteme und nicht bildgebende Messsysteme unterteilt. Nach Endbenutzer wird der Markt für Ultrabreitband-Chipsätze in Fertigung, Einzelhandel, Automobil, Gesundheitswesen und Unterhaltungselektronik segmentiert. Geografisch ist der Markt für Ultrabreitband-Chipsätze in Nordamerika, Europa, Asien-Pazifik (APAC) und den Rest der Welt segmentiert. ALEREON, INC.; Apple Inc.; Bespoon SAS; Decawave Limited; TAIYO YUDEN CO., LTD.; Taoglas; Johanson Technology, Inc.; NOVELDA; NXP Semiconductors NV; und Pulse-Link, inc. gehören zu den Hauptakteuren, die im Rahmen der Studie zum Markt für Ultrabreitband-Chipsätze profiliert wurden.ultra-wideband chipset market is segmented based on application, end user, and geography. Based on type, the ultra-wideband chipset market is categorized into imaging measurement systems and non-imaging measuring systems. Based on end user, the ultra-wideband chipset market is segmented into manufacturing, retail, automotive, healthcare, and consumer electronics. Geographically, the ultra-wideband chipset market is segmented into North America, Europe, Asia Pacific (APAC), and the Rest of World. ALEREON, INC.; Apple Inc.; Bespoon SAS; Decawave Limited; TAIYO YUDEN CO., LTD.; Taoglas; Johanson Technology, Inc.; NOVELDA; NXP Semiconductors N.V.; and Pulse-Link, inc. are among the key players profiled during the ultra-wideband chipset market study.

Regionale Einblicke in den Ultrabreitband-Chipsatzmarkt Chipset Market Regional Insights

Die regionalen Trends und Faktoren, die den Markt für Ultrabreitband-Chipsätze im Prognosezeitraum beeinflussen, wurden von den Analysten von Insight Partners ausführlich erläutert. In diesem Abschnitt werden auch die Marktsegmente und die Geografie für Ultrabreitband-Chipsätze in Nordamerika, Europa, im asiatisch-pazifischen Raum, im Nahen Osten und Afrika sowie in Süd- und Mittelamerika erörtert.Ultra-Wideband Chipset Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Ultra-Wideband Chipset Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Holen Sie sich die regionalspezifischen Daten für den Ultrabreitband-ChipsatzmarktUltra-Wideband Chipset Market

Umfang des Marktberichts für Ultrabreitband-Chipsätze

| Berichtsattribut | Details |

|---|---|

| Marktgröße im Jahr 2021 | 498,55 Millionen US-Dollar |

| Marktgröße bis 2028 | 1.906,46 Millionen US-Dollar |

| Globale CAGR (2021 - 2028) | 21,1 % |

| Historische Daten | 2019-2020 |

| Prognosezeitraum | 2022–2028 |

| Abgedeckte Segmente | Nach Anwendung

|

| Abgedeckte Regionen und Länder | Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Dichte der Marktteilnehmer für Ultrabreitband-Chipsätze: Auswirkungen auf die Geschäftsdynamik verstehen

Der Markt für Ultrabreitband-Chipsätze wächst rasant. Die Nachfrage der Endnutzer steigt aufgrund von Faktoren wie sich entwickelnden Verbraucherpräferenzen, technologischen Fortschritten und einem größeren Bewusstsein für die Vorteile des Produkts. Mit der steigenden Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um die Bedürfnisse der Verbraucher zu erfüllen, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

Die Marktteilnehmerdichte bezieht sich auf die Verteilung der Firmen oder Unternehmen, die in einem bestimmten Markt oder einer bestimmten Branche tätig sind. Sie gibt an, wie viele Wettbewerber (Marktteilnehmer) in einem bestimmten Marktraum im Verhältnis zu seiner Größe oder seinem gesamten Marktwert präsent sind.

Die wichtigsten auf dem Markt für Ultrabreitband-Chipsätze tätigen Unternehmen sind:

- Gesellschaften, beginnend mit ALERE

- Apple Inc.

- Bespoon SAS

- Decawave Limited

- TAIYO YUDEN CO., LTD.

Haftungsausschluss : Die oben aufgeführten Unternehmen sind nicht in einer bestimmten Reihenfolge aufgeführt.

- Überblick über die wichtigsten Akteure auf dem Markt für Ultrabreitband-Chipsätze

Die Akteure auf dem Markt für Ultrabreitband-Chipsätze konzentrieren sich hauptsächlich auf die Entwicklung fortschrittlicher und effizienter Produkte.

- Im Jahr 2021 hat Apple Inc. den AirTag mit U1-UWB-Chipsatz auf den Markt gebracht, der für die Objektverfolgung mit dem iPhone entwickelt wurde.

- Im Jahr 2020 brachte Samsung sein neues Smartphone mit dem Namen Samsung Galaxy Note20 Ultra auf den Markt, das mit dem Ultrabreitband-Chipsatz von NXP Semiconductors ausgestattet ist.

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branche und Wettbewerbsumfeld

- Excel-Datensatz

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Häufig gestellte Fragen

The automotive and transportation industry has witnessed a series of new and emerging UWB technology applications for the past few years and wireless technology is majorly used in automobiles for radio reception and navigation purposes. Additionally, the introduction of advanced features in cars such as keyless entry and tire pressure monitoring has also led to the higher adoption of wireless data transmission techniques which will create growth opportunities of the market during the forecast period.

Ongoing advancements in new application areas of UWB technology in the wireless sensor network and growing deployment of the technology in mobile devices have increased the scope of UWB technology. Furthermore, UWB is one of the fastest-growing technologies adopted in RTLS systems, with a considerable growth potential due to its accuracy in tracking assets. UWB technology and the next-generation BLE beacon technology are likely to be in demand by the providers of RTLS solutions and asset tracking systems during the forecast period. Thus, the adoption of RTLS (real-time location system) of ultra-wideband chipsets to track or locate people or objects within confined areas such as shopping malls, hospitals, and airports is expected to boost the global ultra-wideband (UWB) chipset market during the forecast period.

The communication segment is expected to dominate the market during the forecast period. UWB communication utilizes wide bandwidth and supports high data rates. UWB wireless communication transmits a huge amount of data over a wide frequency spectrum between 3.1 to 10.6GHz. It includes applications such as ranging, authentication, wireless USB, data transfer. USB UWB communication mainly uses low-powered radio signals of short pulses for the transmission and reception of data. Recently, ultra-wideband antenna applications have grown to include a wide range of computing devices and Internet of Things (IoT) peripherals. Most of these wireless communication systems employ a UWB antenna for data transmission, reception, positioning, location identification, sensing, and tracking. Depending on the radiation characteristics of the communication system, UWB antenna design varies, and each application requires customized UWB antennas. Thus, the above factor will lead market players to invest more on development of the products.

Ultra-wideband technology is considered to be the fastest-growing technology, which is predicted to notably enhance the consumers experience related to smartphones, TVs, home entertainment products, audio equipment, and laptops. UWB is known for offering wireless connections at speeds of around 110 Mbit/sec and higher, thus making it suitable for connecting televisions to recorders and DVD players, home audio equipment, and personal video recorders (PVRs). UWB is able to meet the low power requirements of handheld electronics and offers a low-cost solution that is relevant for wide consumer adoption. The major use of UWB chipsets is expected to be across smartphones, wearable, Ipad, homepod, and mini watches. The devices that are equipped with the Apple-designed U1 chip feature ultra-Wideband technology for spatial awareness. UWB is available for iPhone 11, iPhone 12, and iPhone 13 variants. UWB is not available in all the countries of the world and is subject to international regulatory requirements. In the consumer electronics sector, the use of UWB technology is anticipated to be the most for smartphones.

In 2020, Asia Pacific holds the largest share of the global ultra-wideband chipset market owing to the integration of UWB technology in consumer electronic devices for RTLS, imaging, and communication. China leads the region due to the heavy investments in research and development of UWB technology. Moreover, the increasing healthcare industry in the region and the need for highly accurate imaging and detection systems are among the factors driving the market growth.

NXP Semiconductors, Qorvo, Decaware, Alereon and Apple are the five key market players operating in the Global Ultra-Wideband Chipset Market. listing of Key Five Players in the Global Ultra-Wideband Chipset Market by giving weightage to following key parameters: overall revenue, segmental revenue, brand image & industry experience, current automatic tolling system portfolio, innovative and advanced technology integration/material enhancements, customer base, geographical reach, new product launches, partnerships, mergers & acquisitions, and other market related activities.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Ultra Wideband Chipset Market

- ALEREON, INC.

- Apple Inc.

- Bespoon SAS

- Decawave Limited

- TAIYO YUDEN CO., LTD.

- Johanson Technology, Inc.

- NOVELDA AS

- NXP Semiconductors N.V.

- Pulse-Link, inc.

- Taoglas

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Holen Sie sich ein kostenloses Muster für diesen Bericht

Holen Sie sich ein kostenloses Muster für diesen Bericht