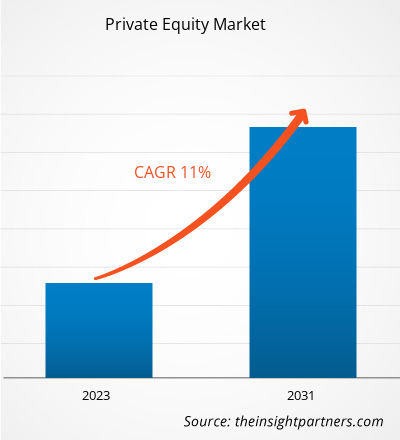

The private equity market size is expected to grow from US$ 460.0 billion in 2023 to US$ 1060.0 billion by 2031; it is anticipated to expand at a CAGR of 11% from 2023 to 2031. The availability of a massive volume of capital in the market influences the private equity market. Private equity firms raise capital from investors and use it to make investments.

Private Equity

Market Analysis

The increasing need for diversification of capital is another factor driving the private equity market. Investors seek to diversify their investment portfolios to mitigate risk and maximize returns. Private equity investments offer an opportunity for investors to diversify their capital allocation by investing in different asset classes, industries, and geographies. The emerging trend of start-up culture has also played a role in driving the private equity market. Start-ups often require significant capital to fund their growth and expansion plans. Private equity firms provide funding to start-ups in exchange for equity ownership, allowing them to participate in the potential upside of these high-growth companies.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Private Equity Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Private Equity Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Private Equity

Industry Overview

- Private equity refers to a form of financing in which investment funds are raised from firms or accredited investors to make direct investments in private companies. Unlike publicly traded companies, these private companies are not listed on a public stock exchange.

- Private equity firms invest in a wide range of companies, including start-ups, struggling companies, and mature businesses, with the goal of realizing appreciation in the value of the acquired assets over a specific time frame, typically 10-12 years.

- Private equity investments offer the potential for higher returns compared to public markets and can provide diversification opportunities for investors. However, it is important to note that private equity investments are typically illiquid and involve a longer-term investment horizon compared to public equity investments.

Private Equity

Market Drivers and Opportunities

Larger Growth Investments to Drive the Private Equity

Market Growth

- In 2021, growth investments reached a total of US$ 19.6 billion, experiencing a decrease of approximately 14% compared to the previous year. However, it is important to note that the growth investments in 2020 were artificially inflated by mega investments worth US$ 15.1 billion in companies of the RIL group. When we adjust for these exceptional deals, the growth investments in 2021 are nearly 2.5 times the value recorded in 2020 (USD 7.8 billion, adjusted value), and more than double the value seen in any of the previous years.

- This significant growth in 2021 can be attributed not only to a higher number of deals but also to an increase in the average deal size. There were 187 deals recorded in 2021, which is 61% higher compared to the previous year's 116 deals. Additionally, the average deal size in 2021 was US$ 105 million, almost 50% higher than in preceding years, except for 2020, which had a higher average deal size due to the mega deals in RIL group companies.

- The growth investments in 2021 were notably strong across several sectors. Eight sectors, including e-commerce, media and entertainment, real estate, and financial services, recorded over US$ 1 billion in growth investments. Thus, all the aforementioned factors are anticipated to drive the private equity market growth.

Private Equity

Market Report Segmentation Analysis

- Based on fund type, the private equity market forecast is segmented into buyouts, venture capital (VCs), real estate, infrastructure, and others.

- The venture capital segment is expected to hold a substantial private equity market share in 2023. Venture capital focuses on providing funding to startups and young businesses that show potential for long-term growth. These companies are often in their early stages and require substantial funds to fuel their growth and development. Venture capitalists are attracted to the potential for above-average returns despite the inherent risks involved.

- Venture capital plays a crucial role in providing funding to companies that may lack access to traditional capital markets, bank loans, or other debt instruments. This is particularly important for new companies or ventures with limited operating history, as venture capital becomes a popular and essential source of raising money.

- Venture capital investments offer the potential for significant returns. While the risk is higher compared to other forms of investments, successful investments in high-growth startups can yield substantial profits, which is anticipated to bring new private equity market trends.

Private Equity

Market Share Analysis By Geography

The scope of the private equity market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant private equity market share. The persistently low-interest rates on traditional fixed-income investments have made them less attractive to investors. As a result, investors are seeking higher returns elsewhere, and private equity offers the potential for higher yields. This has led to increased interest and investment in the private equity market in North America.

Private Equity

Private Equity Market Regional Insights

The regional trends and factors influencing the Private Equity Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Private Equity Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Private Equity Market

Private Equity Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 460.0 Billion |

| Market Size by 2031 | US$ 1060.0 Billion |

| Global CAGR (2023 - 2031) | 11% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Investments

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

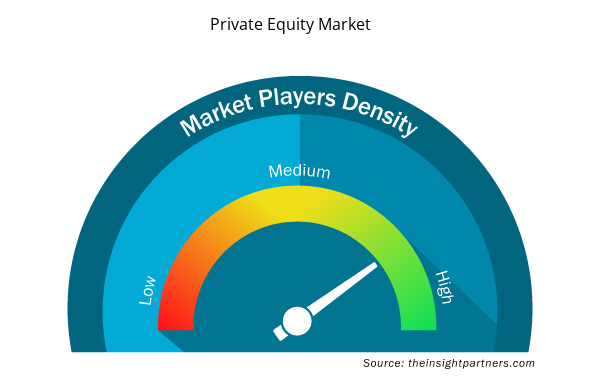

Private Equity Market Players Density: Understanding Its Impact on Business Dynamics

The Private Equity Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Private Equity Market are:

- AHAM Asset Management Berhad

- Allens

- Apollo Global Management, Inc.

- Bank of America Corp.

- BDO Australia

- Blackstone Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Private Equity Market top key players overview

The "Private Equity Market Analysis" was carried out based on fund type, investment, and geography. Based on fund type, the private equity market is segmented into buyouts, venture capital (VCs), real estate, infrastructure, and others. Based on Investments, the market is segmented into large cap, upper middle, lower middle, and real estate. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Private Equity

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the private equity market. A few recent key market developments are listed below:

- In September 2022, Nonantum Capital Partners, a middle-market private equity firm, completed the acquisition of LJP Waste Solutions from Aperion Management. LJP Waste Solutions is a leading regional provider of non-hazardous solid waste and recycling services, specializing in zero landfill and waste-to-energy solutions. The company, founded in 1993, offers innovative and sustainable disposal solutions by working directly with customers to evaluate waste and identify recyclable materials or waste streams that can be converted into fuel using waste-to-energy methods.

[Source: Nonantum Capital Partners, Company Website]

- In August 2022, Trilegal, a leading law firm in India, acted as the sole advisor to Prosus Ventures and PayU India in their acquisition of IndiaIdeas.com Limited (BillDesk). This acquisition marks the largest-ever deal in the digital payments space in India, with a value of US$ 4.7 billion. Trilegal played a crucial role in securing unconditional approval from the Competition Commission of India (CCI) for the transaction successfully navigating the regulatory process.

[Source: Trilegal, Company Website]

Private Equity

Market Report Coverage & Deliverables

The market report on “Private Equity Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Non-Emergency Medical Transportation Market

- Environmental Consulting Service Market

- Europe Tortilla Market

- Small Internal Combustion Engine Market

- Fishing Equipment Market

- Electronic Shelf Label Market

- Legal Case Management Software Market

- Dairy Flavors Market

- Unit Heater Market

- Pipe Relining Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Fund Type, Investments, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global private equity market are Blackstone Inc, HSBC Holdings Plc, Morgan Stanley, CVC Capital Partners, and The Carlyle Group.

The increasing need for diversification of capital. Investors seeking to diversify their investment portfolios to mitigate risk and maximize returns are the major factors that propel the global private equity market.

The global private equity market is expected to reach US$ 1060.0 billion by 2031.

Crowdfunding and new investment platforms are impacting private equity, which is anticipated to play a significant role in the global private equity market in the coming years.

The private equity market size is expected to grow from US$ 460.0 billion in 2023 to US$ 1060.0 billion by 2031; it is anticipated to expand at a CAGR of 11% from 2023 to 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- AHAM Asset Management Berhad

- Allens

- Apollo Global Management, Inc.

- Bank of America Corp.

- BDO Australia

- Blackstone Inc.

- CVC Capital Partners

- HSBC Holdings Plc

- Morgan Stanley

- The Carlyle Group

- Warburg Pincus LLC

Get Free Sample For

Get Free Sample For