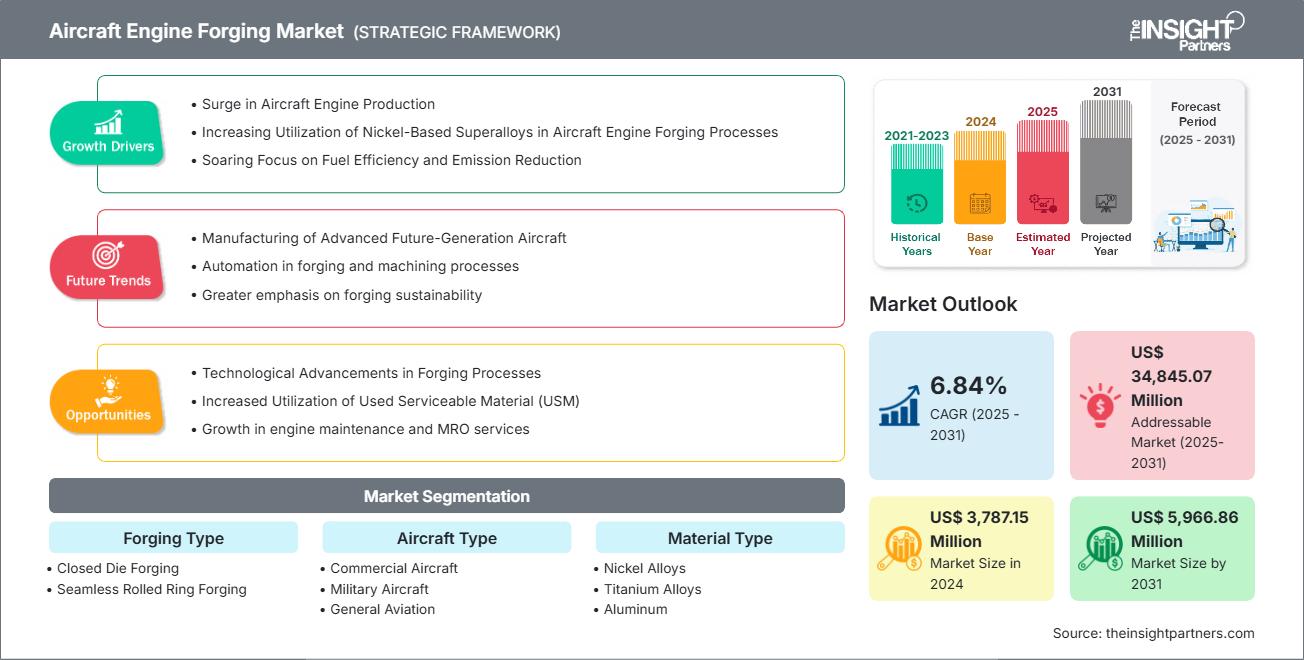

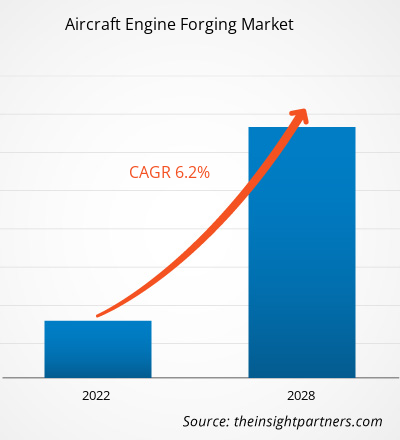

Se proyecta que el tamaño del mercado de forjado de motores de aeronaves alcance los 5.966,86 millones de dólares estadounidenses en 2031, frente a los 3.787,15 millones de dólares estadounidenses en 2024. Se espera que el mercado registre una tasa de crecimiento anual compuesta (TCAC) del 6,84 % durante el período 2025-2031.

Análisis del mercado de forjado de motores de aeronaves

El auge de la producción de motores de aviación, el creciente uso de superaleaciones a base de níquel en los procesos de forjado de motores de aviación y la creciente atención a la eficiencia del combustible y la reducción de emisiones son factores clave que impulsan el crecimiento del mercado de forjado de motores de aviación. Se prevé que los avances tecnológicos en los procesos de forjado y el uso de material utilizable (USM) generen oportunidades para el mercado en el futuro. Es probable que la fabricación de aeronaves avanzadas de próxima generación se convierta en una tendencia clave para el mercado en los próximos años.

Descripción general del mercado de forjado de motores de aeronaves

La forja de motores de aviación es un proceso de fabricación utilizado para producir componentes de alta resistencia y alto rendimiento para motores de aeronaves. Consiste en moldear metal (normalmente titanio, aleaciones de níquel o acero inoxidable) bajo presión extrema mediante martillos, prensas o matrices. Este proceso alinea la estructura del grano del metal con la forma de la pieza, mejorando así propiedades mecánicas como la resistencia, la resistencia a la fatiga y la durabilidad, fundamentales en las duras condiciones de funcionamiento de los motores a reacción.

La forja crea piezas de motor como discos de turbina, álabes de compresor, ejes y carcasas. Estos componentes deben soportar temperaturas extremas, altas velocidades de rotación y enormes tensiones. En comparación con la fundición o el mecanizado, la forja ofrece una integridad estructural superior y menos defectos internos, lo que la hace ideal para aplicaciones aeroespaciales donde la seguridad y el rendimiento son primordiales. Las técnicas avanzadas de forja, como la forja isotérmica y la forja de precisión, permiten tolerancias ajustadas y geometrías complejas, minimizando la necesidad de mecanizado adicional. Con la creciente demanda de eficiencia de combustible y motores ligeros, las piezas forjadas son esenciales en los diseños de motores modernos, incluidos los utilizados en aviones comerciales y militares. En general, la forja es vital en la industria aeroespacial, ya que garantiza la fiabilidad y la seguridad en entornos de motores exigentes.

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de forja de motores de aeronaves: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de forja de motores de aeronaves

Factores impulsores del mercado

- El aumento del tráfico aéreo y la expansión de la flota El aumento del tráfico aéreo mundial de pasajeros y carga está impulsando la demanda de nuevos aviones, lo que aumenta la necesidad de componentes de motor forjados que ofrezcan resistencia y durabilidad.

- Demanda de motores de bajo consumo de combustible Las aerolíneas priorizan la eficiencia del combustible para reducir los costos operativos y las emisiones, lo que lleva a una mayor adopción de piezas forjadas que respaldan diseños de motores livianos y de alto rendimiento.

- Estándares rigurosos de seguridad y rendimiento. Las regulaciones de aviación exigen componentes de alta fiabilidad. El forjado garantiza la integridad estructural y la resistencia a la fatiga, lo que lo hace esencial para las piezas críticas del motor.

- Crecimiento en la aviación de defensa Los programas de aeronaves militares se están expandiendo globalmente, lo que requiere componentes de motor robustos para soportar condiciones extremas, lo que impulsa aún más la expansión del mercado.

- Avances tecnológicos en materiales y procesos Las innovaciones en aleaciones a base de titanio y níquel y técnicas de forjado de precisión mejoran el rendimiento y el ciclo de vida del motor.

Oportunidades de mercado

- Programas de aeronaves de próxima generación Las próximas plataformas de aeronaves comerciales y de defensa presentan oportunidades para que los proveedores de forja integren materiales y diseños avanzados.

- Iniciativas de aviación sostenible El impulso hacia combustibles de aviación sostenibles y sistemas de propulsión híbridos-eléctricos requerirá nuevos componentes forjados optimizados para nuevas arquitecturas de motores.

- Servicios de posventa y MRO A medida que las flotas globales envejecen, aumenta la demanda de mantenimiento, reparación y revisión (MRO) de componentes del motor, lo que crea una oportunidad constante en el mercado de posventa.

- Expansión a los mercados emergentes El rápido crecimiento de la aviación en Asia Pacífico, Medio Oriente y África impulsa las capacidades regionales de fabricación y forja.

- Fabricación digital y automatización La adopción de tecnologías de la Industria 4.0 en los procesos de forja puede mejorar la eficiencia, reducir el desperdicio y permitir el control de calidad en tiempo real.

Análisis de segmentación del informe de mercado de forja de motores de aeronaves

El mercado de forja de motores de aviación se divide en diferentes segmentos para ofrecer una visión más clara de su funcionamiento, su potencial de crecimiento y las últimas tendencias. A continuación, se presenta el enfoque de segmentación estándar utilizado en la mayoría de los informes del sector.

Por tipo de forja

- Forja en matriz cerrada. Se utiliza para producir componentes complejos de alta resistencia con dimensiones precisas. Ideal para álabes de turbinas, discos y ejes de motores de aviación. Ofrece excelentes propiedades mecánicas y un excelente aprovechamiento del material.

- Forjado de anillos laminados sin costura. Ideal para componentes circulares grandes, como anillos de motor y pistas de rodamientos. Ofrece una integridad estructural superior y resistencia a la fatiga y al estrés térmico, esencial para motores a reacción de alto rendimiento.

Por tipo de material

- La aleación de níquel domina el mercado gracias a su resistencia a altas temperaturas, resistencia a la corrosión y durabilidad. Es crucial para las secciones de turbinas expuestas a calor y presión extremos.

- Aleación de titanio, valorada por su ligereza y alta relación resistencia-peso. Ampliamente utilizada en álabes de ventiladores y secciones de compresores para mejorar la eficiencia del combustible y reducir el peso del motor.

- Aluminio. Se utiliza en componentes de motores de baja tensión. Ofrece rentabilidad y facilidad de mecanizado, pero su rendimiento es limitado en aplicaciones de alta temperatura.

- Otros (p. ej., acero, aleaciones de cobalto). Los materiales especiales utilizados en aplicaciones específicas requieren propiedades mecánicas o térmicas únicas. Se encuentran a menudo en motores militares o experimentales.

Por tipo de aeronave

- Aviones comerciales. El segmento más grande está impulsado por la demanda global de viajes aéreos. Requiere componentes forjados con precisión en grandes cantidades para motores confiables y de bajo consumo de combustible.

- Aviones Militares: Se centra en el rendimiento en condiciones extremas. Utiliza aleaciones avanzadas y técnicas de forjado para lograr durabilidad, sigilo y alta velocidad.

- La aviación general incluye jets privados y aeronaves pequeñas. La demanda de componentes forjados ligeros y rentables que equilibren rendimiento y asequibilidad está en aumento.

Por aplicación

- Estuche para ventilador

- Carcasa exterior de la cámara de combustión

- Disco de turbina

- Rotores

- Otros

Por geografía

- América del norte

- Europa

- Asia Pacífico

- América Latina

- Oriente Medio y África

El mercado de forjado de motores de aeronaves en Asia Pacífico está experimentando un crecimiento significativo.

Perspectivas regionales del mercado de forja de motores de aeronaves

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de forja de motores de aeronaves durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de forja de motores de aeronaves en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de forja de motores de aeronaves

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2024 | US$ 3.787,15 millones |

| Tamaño del mercado en 2031 | US$ 5.966,86 millones |

| CAGR global (2025-2031) | 6,84% |

| Datos históricos | 2021-2023 |

| Período de pronóstico | 2025-2031 |

| Segmentos cubiertos |

Por tipo de forja

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de forja de motores de aeronaves: comprensión de su impacto en la dinámica empresarial

El mercado de forjado de motores de aviación está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias del consumidor, los avances tecnológicos y un mayor conocimiento de las ventajas del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades del consumidor y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de forja de motores de aeronaves

Análisis de la cuota de mercado de la forja de motores de aeronaves por geografía

El mercado de forjado de motores de aviación se segmenta en cinco regiones principales: América del Norte, Europa, Asia Pacífico (APAC), Oriente Medio y África (MEA) y América del Sur. América del Norte dominó el mercado en 2024, seguida de Europa y Asia Pacífico.

Norteamérica, en particular Estados Unidos, domina el mercado de forjado de motores de aviación. La región alberga a algunos de los mayores fabricantes aeroespaciales y contratistas de defensa del mundo, como General Electric Aviation y Pratt & Whitney. Gracias a los estrictos estándares de seguridad y rendimiento de la aviación comercial y militar, estas empresas impulsan la demanda de componentes forjados de alto rendimiento, como discos de turbinas y álabes de compresores. Una base industrial consolidada, el acceso a tecnologías avanzadas de forjado y la inversión en I+D aeroespacial contribuyen al liderazgo de Norteamérica. Canadá desempeña un papel de apoyo, con empresas especializadas en la fabricación de componentes aeroespaciales y la ingeniería de precisión.

A continuación se muestra un resumen de la participación de mercado y las tendencias por región.

1. América del Norte

- Cuota de mercado dominante debido a la fabricación aeroespacial avanzada y al gasto en defensa.

-

Factores clave

- Fuerte presencia de fabricantes de equipos originales (OEM) de aeronaves y proveedores de forja.

- Alta demanda de aviones comerciales y militares.

- Liderazgo tecnológico en procesos y materiales de forja.

- Tendencias Crecimiento en la forja de aleaciones de titanio y níquel; mayor inversión en tecnologías de aviación sostenible.

2. Europa

- Cuota de mercado significativa, respaldada por Airbus y los programas de defensa.

-

Factores clave

- Centrarse en motores ligeros y de bajo consumo de combustible.

- Fuerte impulso regulatorio para la aviación de bajas emisiones.

- I+D colaborativa entre los países de la UE.

- Tendencias Ampliación de la capacidad de forja para motores de próxima generación; énfasis en la economía circular y el reciclaje de materiales.

3. Asia Pacífico

- Cuota de mercado Región de más rápido crecimiento debido al aumento del tráfico aéreo y la expansión de la flota.

-

Factores clave

- Crecimiento rápido en los mercados de aviación nacional (China e India).

- Aumentar las capacidades locales de fabricación y MRO.

- Apoyo gubernamental al desarrollo del sector aeroespacial.

- Tendencias Creciente demanda de piezas forjadas de aluminio y titanio; surgimiento de centros regionales de forja.

4. Oriente Medio y África

- Cuota de mercado Mercado emergente con inversiones estratégicas en aviación.

-

Factores clave

- Ampliación de las aerolíneas nacionales y de la infraestructura aeroportuaria.

- Creciente interés en la aviación de defensa.

- Asociaciones con empresas aeroespaciales globales.

- Tendencias Inversión en instalaciones de forja; enfoque en materiales de alto rendimiento para entornos hostiles.

5. América del Sur

- Cuota de mercado Modesta pero creciente, liderada por la industria aeroespacial de Brasil.

-

Factores clave

- Demanda de aviones regionales y de aviación general.

- Desarrollo de cadenas de suministro aeroespaciales locales.

- La recuperación económica está impulsando la modernización de la flota.

- Tendencias Crecimiento en la forja de aluminio; mayor participación en programas aeroespaciales globales.

Densidad de actores del mercado de forja de motores de aeronaves: comprensión de su impacto en la dinámica empresarial

Densidad media del mercado y competencia

La competencia es media debido a la presencia de actores establecidos como All Metals & Forge Group, OTTO FUCHS KG, Pacific Forge Incorporated, Precision Castparts Corp., Safran SA, VSMPO-AVISMA Corp, Farinia Group, Doncasters Group, LISI GROUP y Allegheny Technologies Inc.

Este nivel medio de competencia impulsa a las empresas a destacar ofreciendo

- Diversos tipos de productos y materiales satisfacen las variadas necesidades de los consumidores, lo que aumenta la rivalidad.

- Las bajas barreras de entrada permiten que muchos actores pequeños y regionales ingresen al mercado.

- La demanda de personalización empuja a las marcas a innovar y diferenciarse constantemente.

- La fuerte presencia de fabricantes globales y locales intensifica la competencia en precios y características.

- El crecimiento del comercio electrónico permite las ventas directas al consumidor, aumentando la saturación del mercado.

- Los avances tecnológicos como los cobertizos inteligentes y los diseños modulares aumentan la apuesta por la innovación.

- Los consumidores sensibles al precio impulsan estrategias de precios y promociones agresivas.

Oportunidades y movimientos estratégicos

- Desarrollo de aleaciones avanzadas Invierta en materiales de alto rendimiento como aluminuros de titanio y superaleaciones a base de níquel para satisfacer las demandas de los motores de aeronaves de próxima generación.

- Soporte para componentes de Sustainable Aviation Forge optimizados para motores que funcionan con combustibles de aviación sostenible (SAF) y sistemas de propulsión híbridos-eléctricos.

- Tecnologías de forja digital Integre IA, IoT y gemelos digitales para monitoreo en tiempo real, mantenimiento predictivo y optimización de procesos en operaciones de forja.

- Diseño de componentes de motor modulares Desarrollamos piezas forjadas modulares que simplifiquen el mantenimiento y las actualizaciones, especialmente para aeronaves de aviación regional y general.

- Expansión a mercados emergentes Establecer instalaciones de forja en Asia Pacífico, Medio Oriente y Sudamérica para satisfacer la creciente demanda regional y reducir los riesgos de la cadena de suministro.

- Innovación en componentes ligeros Nos centramos en forjar componentes ligeros para mejorar la eficiencia del combustible y reducir las emisiones de los aviones comerciales y militares.

- Crecimiento del mercado de accesorios y MRO Aproveche la creciente demanda de servicios de mantenimiento, reparación y revisión (MRO) suministrando piezas de repuesto forjadas.

- Iniciativas colaborativas de I+D Asociarse con fabricantes de equipos originales, instituciones de investigación y organismos gubernamentales para desarrollar conjuntamente tecnologías de forjado para futuros sistemas de propulsión.

- Automatización y fabricación inteligente Adopte la robótica y las líneas de forja automatizadas para mejorar la productividad, la consistencia y la escalabilidad.

- Cumplimiento de estándares globales Alinear los procesos de forjado con los estándares internacionales de seguridad aérea y medio ambiente para garantizar el acceso al mercado global.

Las principales empresas que operan en el mercado de forjado de motores de aeronaves son

- Grupo All Metals & Forge

- OTTO FUCHS KG

- Pacific Forge Incorporated

- Precision Castparts Corp.

- Safran SA

- Corporación VSMPO-AVISMA

- Grupo Farinia

- Grupo Doncasters

- GRUPO LISI

- Allegheny Technologies Inc

Descargo de responsabilidad Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

Otras empresas analizadas durante el curso de la investigación

- Mettis Aerospace Limitada.

- FRISA

- ELLWOOD Texas Forge Houston

- Wuxi Paike Tecnología de nuevos materiales Co., Ltd.

- Forja SIFCO

- SQuAD Forjando la India

- Forja de Cantón

- Forja Carlton

- Empresa de forja especializada Weldaloy

- MATTCO FORGE INC.

- Corporación Arconic

- Industrias Consolidadas, Inc.

- Grupo Forgital

- Forja Bharat

- Voestalpine Bohler Aerospace GmbH & Co KG

- Howmet Aerospace

Noticias y desarrollos recientes del mercado de forja de motores de aeronaves

Safran Aircraft Engine firmó un acuerdo con HAL

Safran Aircraft Engines firmó un acuerdo con Hindustan Aeronautics Limited (HAL), empresa líder en el sector aeroespacial y de defensa de la India, para la industrialización y producción de piezas rotativas para motores LEAP. Este acuerdo respalda la política gubernamental "Make in India". Es consecuencia del memorando de entendimiento firmado por Safran Aircraft Engines y HAL en octubre de 2023 para desarrollar la cooperación industrial en la fabricación de piezas para motores LEAP, así como del contrato firmado el pasado febrero por ambos socios para la producción de piezas forjadas. Safran Aircraft Engines continúa expandiendo su presencia en la India y amplía el alcance de su cooperación con HAL mediante la producción de piezas de Inconel.

ATI Inc. firmó un acuerdo con Airbus

En mayo de 2025, ATI Inc. anunció la firma de un acuerdo plurianual con Airbus, que garantiza el suministro de placas, láminas y tochos de titanio a la empresa fabricante de fuselajes, a medida que continúa incrementando la producción de aeronaves de fuselaje estrecho y ancho. Esto posiciona a ATI como uno de los principales proveedores de productos laminados planos y largos de titanio para Airbus.

Informe de mercado sobre forja de motores de aeronaves: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de forja de motores de aeronaves (2021-2031)" proporciona un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado de forja de motores de aeronaves y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de forja de motores de aeronaves, así como dinámicas del mercado como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallado

- Análisis del mercado de forjado de motores de aeronaves que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama industrial y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes para el mercado de forjado de motores de aeronaves.

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de forja de motores de aeronaves

Obtenga una muestra gratuita para - Mercado de forja de motores de aeronaves