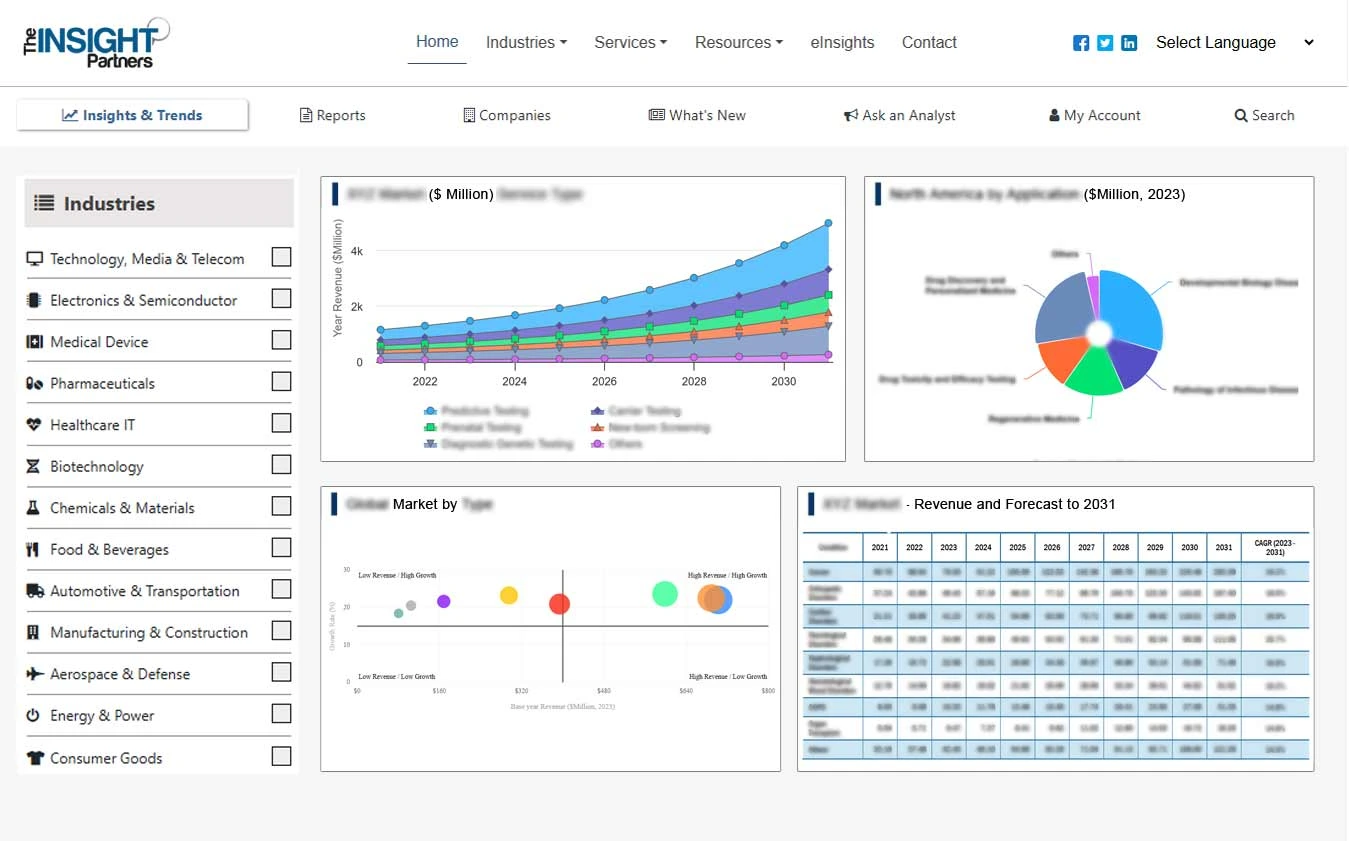

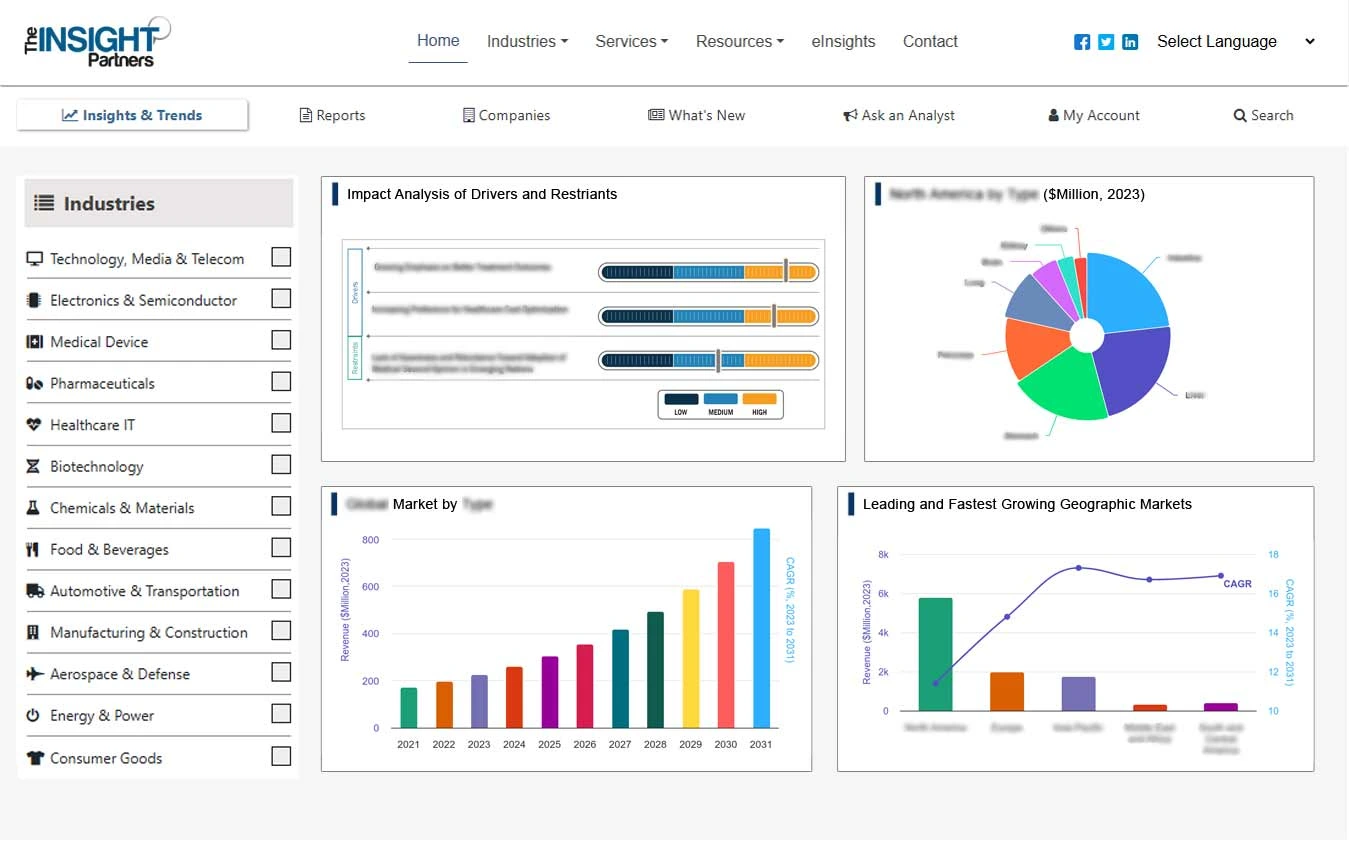

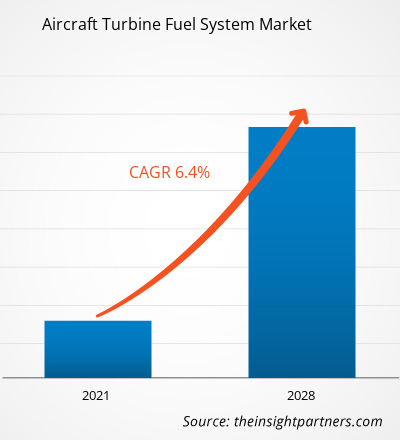

[Informe de investigación] El mercado de sistemas de combustible para turbinas de aviones se valoró en 2.087,63 millones de dólares en 2020 y se prevé que alcance los 3.303,73 millones de dólares en 2028; Se espera que crezca a una tasa compuesta anual del 6,4% de 2021 a 2028.

El sistema de combustible de turbina de avión es uno de los sistemas cruciales de los aviones. El sistema de combustible de turbina de la aeronave gestiona el flujo de combustible para un rendimiento óptimo de la aeronave durante diversas etapas del vuelo, como maniobras rápidas, cambios de altitud y aceleraciones o desaceleraciones repentinas. Inicialmente, los operadores de vuelo operaban manualmente el sistema de combustible de la turbina del avión; sin embargo, con el avance de la tecnología, se introdujeron en el mercado sistemas de combustible de turbinas de aviones autocalibrados, como el control digital de motor con autoridad total (FADEC). El mercado de sistemas de combustible para turbinas de aviones está experimentando un crecimiento significativo debido al aumento año tras año de los presupuestos gubernamentales para la seguridad nacional. Los gobiernos de todo el mundo están invirtiendo significativamente en la adquisición de flotas de aviones comerciales y militares de última generación. Además, la creciente industria de la aviación comercial debido al aumento de los ingresos disponibles entre la población de clase media, junto con la creciente operación de MRO en todo el mundo, está impulsando la tasa de producción de aviones, lo que está impulsando la demanda del mercado de sistemas de combustible para turbinas de aviones a nivel mundial.

Personalice la investigación para adaptarla a sus necesidades

Podemos optimizar y adaptar el análisis y el alcance que no se cumplen a través de nuestras ofertas estándar. Esta flexibilidad le ayudará a obtener la información exacta que necesita para la planificación y la toma de decisiones de su negocio.

Mercado de sistemas de combustible de turbinas de aviones: ideas estratégicas

CAGR (2020 - 2028)6,4%- Tamaño del mercado 2020

US$ 2,09 mil millones - Tamaño del mercado 2028

US$ 3,3 mil millones

Dinámica del mercado

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

Jugadores claves . Jugadores principales

- Eaton

- Honeywell Internacional Inc.

- Jihostroj

- Equipo mascota Co.

- Parker Hannifin Corp.

- Safran

- Grupo Triunfo, Inc.

- Sistemas de combustible de turbina Inc.

- Woodward Inc.

Panorama regional

- América del norte

- Europa

- Asia-Pacífico

- América del Sur y Central

- Medio Oriente y África

Segmentación de mercado

Tipo

Tipo- hidromecánico

- Control digital del motor con autoridad total

Solicitud

Solicitud- Avión comercial

- Aeronave militar

- Aviones de aviación general

- El PDF de muestra muestra la estructura del contenido y la naturaleza de la información con análisis cualitativo y cuantitativo.

Impacto de la pandemia de COVID-19 en el mercado de sistemas de combustible de turbinas de aviones

En medio de la pandemia del brote de COVID-19, toda la industria de la aviación comercial se detuvo con recursos mínimos para prever el futuro. Varias unidades de producción en EE. UU., Francia, Rusia y China fueron suspendidas temporalmente para cumplir con las normas gubernamentales relativas al cierre y al distanciamiento físico. Los fabricantes de aviones presenciaron una reducción del 30% al 50% en la demanda de la mayoría de los modelos de aviones, especialmente los modelos de aviones comerciales. La menor producción y ensamblaje de aviones disminuyó la demanda de sistemas de combustible para turbinas de avión, lo que resultó en una menor generación de ingresos. Este factor frenó el crecimiento del mercado de sistemas de combustible para turbinas de aviones.

Perspectivas del mercado del sistema de combustible de turbinas de aviones

Aumento de la fabricación de aviones

Debido a la producción sustancial de flotas de aviones militares y comerciales, la industria de la aviación mundial está creciendo a un ritmo constante. Durante la última década, la industria de la aviación comercial ha sido testigo de un enorme crecimiento debido al aumento de los ingresos disponibles entre las masas, junto con el surgimiento de aerolíneas de bajo costo (LCC) y diversas iniciativas de expansión de flota emprendidas por las compañías de servicio completo (FSC). Se prevé que la industria de la aviación comercial aumentará en un futuro próximo debido al creciente número de pasajeros de viajes aéreos y la adquisición de aviones. Por lo tanto, se prevé que la creciente adquisición de aviones en todo el mundo impulse el mercado de sistemas de combustible para turbinas de aviones durante el período de pronóstico.

Perspectivas del mercado basadas en tipos

Según el tipo, el mercado de sistemas de combustible para turbinas de aviones se segmenta en hidromecánico, control digital del motor con autoridad total (FADEC) e hidromecánico/electrónico. El control digital del motor con autoridad total (FADEC) utiliza una computadora digital, conocida como EEC (control electrónico del motor) o ECU (unidad de control del motor), y accesorios relacionados para controlar los parámetros de rendimiento del motor de la aeronave. El FADEC funciona recibiendo múltiples variables de entrada, como temperaturas del motor, presiones del motor, posición de la palanca del acelerador y densidad del aire de las condiciones de vuelo en tiempo real. La entrada es recopilada por ECU o EEC y se procesa hasta 70 veces por segundo. Una mejor eficiencia del combustible, un funcionamiento eficiente del motor, la protección automática del motor con respecto a operaciones fuera de tolerancia, una mejor integración del sistema con el motor y los sistemas de la aeronave, y el monitoreo y diagnóstico del motor son los principales factores que impulsan el crecimiento del mercado de sistemas de combustible para turbinas de aeronaves.

Los actores que operan en el mercado de sistemas de combustible para turbinas de aviones se centran en estrategias como fusiones, adquisiciones e iniciativas de mercado para mantener sus posiciones en el mercado. A continuación se enumeran algunos avances de los actores clave:

- En 2021, Honeywell International Inc. anunció el desarrollo de un turbogenerador para aviones híbridos-eléctricos. El nuevo turbogenerador funcionará con combustible para aviones, diésel y combustibles alternativos sostenibles.

- En 2021, Triumph Group, Inc. anunció que había conseguido múltiples extensiones de contrato con Boeing Commercial Airplanes, lo que ampliaría su colaboración en componentes críticos del sistema. Los contratos destacan el enfoque estratégico de Triumph en ofertas de sistemas de alto valor que incluyen sistemas de accionamiento, hidráulicos y de combustible, soluciones de engranajes, así como ofertas de mantenimiento, reparación y revisión.

Alcance del informe de mercado de Sistema de combustible de turbina de avión

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2020 | 2.090 millones de dólares |

| Tamaño del mercado para 2028 | 3.300 millones de dólares |

| CAGR global (2020 - 2028) | 6,4% |

| Información histórica | 2018-2019 |

| Período de pronóstico | 2021-2028 |

| Segmentos cubiertos | Por tipo

|

| Regiones y países cubiertos | América del norte

|

| Líderes del mercado y perfiles clave de empresas |

|

- El PDF de muestra muestra la estructura del contenido y la naturaleza de la información con análisis cualitativo y cuantitativo.

El informe segmenta el mercado mundial de sistemas de combustible para turbinas de aviones de la siguiente manera:

Por tipo

- hidromecánico

- Control digital del motor con autoridad total (FADEC)

- Hidromecánica/Electrónica

Por aplicación

- Avión comercial

- Aeronave militar

- Aviones de aviación general

Por geografía

- América del norte

- A NOSOTROS

- Canadá

- México

- Europa

- Francia

- Alemania

- Italia

- Reino Unido

- Rusia

- El resto de Europa

- Asia Pacífico (APAC)

- Porcelana

- India

- Corea del Sur

- Japón

- Australia

- Resto de Asia Pacífico

- Medio Oriente y África (MEA)

- Sudáfrica

- Arabia Saudita

- Emiratos Árabes Unidos

- Resto de MEA

- América del Sur (SAM)

- Brasil

- Resto de SAM

Perfiles de empresa

- Aeroespacial Collins

- Eaton Corporation plc

- Honeywell Internacional Inc.

- Jihostroj como

- Equipo mascota Co.

- Corporación Parker-Hannifin

- Safran

- Plata Atena GmbH

- Grupo Triunfo, Inc.

- Woodward, Inc.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado Valor/volumen: global, regional, nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Preguntas frecuentes

The aircraft turbine fuel system market is led by full authority digital engine control (FADEC) segment with highest share and is expected to dominate in the forecast period. The Full Authority Digital Engine Control (FADEC) uses a digital computer, known as an EEC (Electronic Engine Control) or ECU (engine control unit), and related accessories to control the parameters of aircraft engine performance. The FADEC functions by receiving multiple input variables, such as engine temperatures, engine pressures, throttle lever position, and air density of real-time flight conditions. The input is gathered by ECU or EEC and is processed up to 70 times per second. Better fuel efficiency, efficient engine operation, automatic engine protection with regards to out-of-tolerance operations, better system integration with engine and aircraft systems, and engine monitoring and diagnostics are the major factors driving the growth of aircraft turbine fuel system market.

Governments across the world are significantly investing on procurement of advanced state-of-the-art commercial as well as military aircraft fleet. Additionally, growing commercial aviation industry owing to rise in disposable income among middle class population coupled with the growing MRO operation across the world is bolstering the growth of the aircraft production rate. This is reflecting rise in demand for aircraft turbine fuel system market

Since the beginning of the 21st century, the aviation industry has flourished in China. At present, China holds the second-largest aviation market after the US. Boeing, American aircraft giant, in November 2020 announced that Chinese carriers are projected to acquire 8,600 new airplanes over the next 20 years. Also, the country’s commercial jet fleet has expanded sevenfold since 2000, which is ~25% of all aviation growth worldwide over the past decade. According to Carnoc, about 25% of the global single-aisle aircraft were procured by Chinese carriers. The incremental growth of the aviation industry in China is attributed to rapid growth in middle-class consumers coupled with robust economic growth and growing urbanization. Further, the Aircraft giants such as Boeing and Airbus have manufacturing assemblies in China, which complements the growth of the aircraft turbine fuel system market. Also, in setback of Boeing 737, two consecutive crash and the announcement of discontinuation of Airbus A320 is projected to complement the adoption of COMAC C919 and C929 aircraft as these are considered the immediate substitute to Boeing 737 and Airbus A320. Meanwhile, the country has the second-largest defense budget across the world after the US, and a significant portion of the defense is allotted to the procurement of advanced military aircraft and upgradation & MRO operations. Thus, all these are bolstering the aviation industry in China, which is projected to create ample growth opportunities for aircraft turbine fuel system market players.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Aircraft Turbine Fuel System Market

- Eaton

- Honeywell International Inc.

- Jihostroj

- Mascott Equipment Co.

- Parker Hannifin Corp.

- Safran

- Triumph Group, Inc.

- Turbine Fuel Systems Inc.

- Woodward Inc.

- Collins Aerospace

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

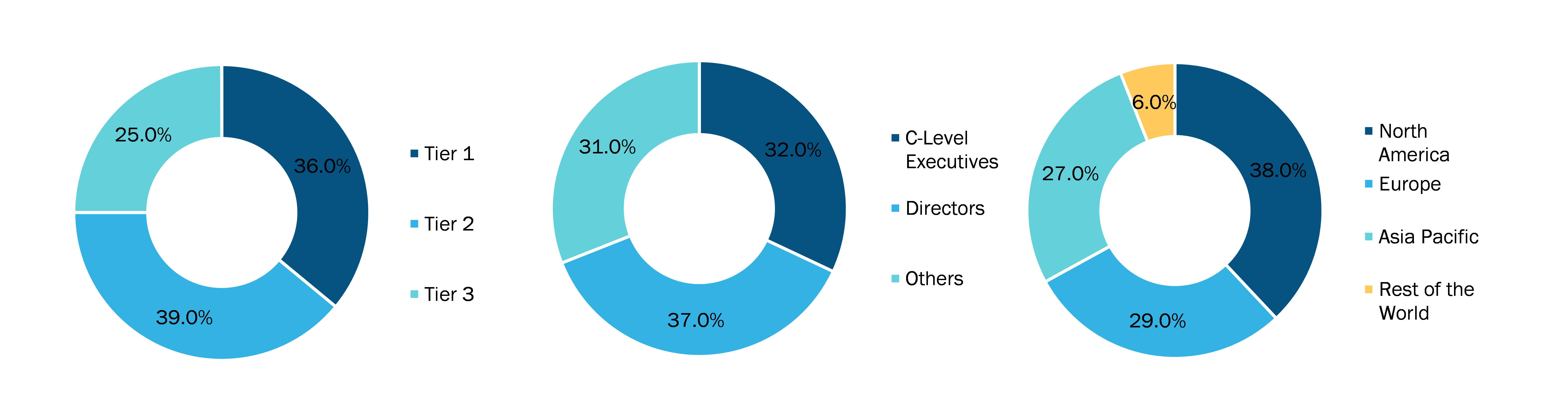

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenga una muestra gratuita de este informe

Obtenga una muestra gratuita de este informe