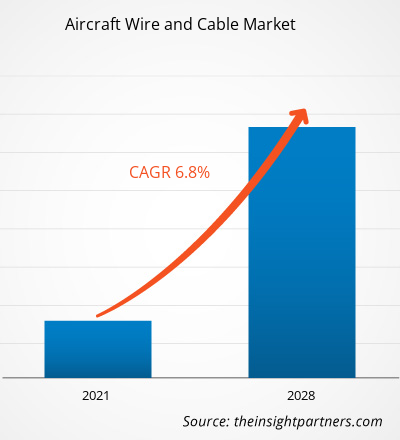

[Informe de investigación] El mercado global de cables y alambres para aeronaves se valoró en US$ 716,63 millones en 2020 y se proyecta que alcance los US$ 1.153,64 millones para 2028; se espera que crezca a una CAGR del 6,8% durante el período de pronóstico de 2021 a 2028.

El mercado de cables y alambres para aeronaves se segmenta en cinco regiones principales: Norteamérica, Europa, Asia-Pacífico, Oriente Medio y África (MEA) y Sudamérica. En términos de participación de mercado, Norteamérica dominó este mercado en 2020. Esta región cuenta con la presencia de empresas multinacionales dedicadas al suministro de cables y alambres para aeronaves, lo que la convierte en una región líder y dominante en dicho mercado en 2020. Factores como la disponibilidad de capacidades tecnológicas, el apoyo de infraestructura, la I+D y la profesionalidad técnica, entre otros, han contribuido a la significativa consolidación de la participación de mercado de cables y alambres para aeronaves en Norteamérica.

Impacto de la pandemia de COVID-19 en el mercado de cables y alambres para aeronaves

Según el último informe de situación de la Organización Mundial de la Salud (OMS), Estados Unidos, India, Brasil, Rusia, Reino Unido, Francia, España e Italia se encuentran entre los países más afectados por el brote de COVID-19. El brote comenzó en Wuhan (China) en diciembre de 2019 y, desde entonces, se ha propagado rápidamente por todo el mundo. La crisis de la COVID-19 afecta a industrias de todo el mundo, y la economía global se vio afectada negativamente en 2020 y probablemente en 2021. La pandemia ha afectado a las empresas y proveedores de cables y alambres para aeronaves en todo el mundo. Los actores del mercado experimentaron interrupciones en sus operaciones, y es probable que esto tenga consecuencias hasta mediados de 2021. Hasta el brote de la COVID-19, la industria aeroespacial experimentaba un crecimiento sustancial en términos de producción y servicios, a pesar de los enormes retrasos de los fabricantes de aeronaves; la industria de la aviación mundial fue testigo de un aumento significativo en el número de pasajeros, un incremento en la adquisición de aeronaves (tanto comerciales como militares), así como un mayor crecimiento en las actividades de MRO.

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de cables y alambres para aeronaves: Perspectivas estratégicas

- Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Perspectiva del mercado: Mercado de alambres y cables para aeronaves.

La rápida expansión del sector de la aviación a nivel mundial y la creciente adopción de tecnologías avanzadas para el buen funcionamiento de las aeronaves contribuyen significativamente al crecimiento del mercado. Además, la presencia de importantes fabricantes de aeronaves, como Boeing y Airbus, y el aumento de la renta disponible en los países en desarrollo son algunos de los factores que impulsan la demanda de estos cables y alambres para aeronaves.

Se prevé que el creciente gasto en defensa en importantes economías, como EE. UU., China, India, Rusia y Arabia Saudita, impulse el mercado de cables y alambres para aeronaves en los próximos años. Además, el creciente desarrollo tecnológico, las crecientes inversiones en investigación y desarrollo (I+D) por parte de los fabricantes de equipos originales (OEM) para aeronaves y la creciente demanda de transporte aéreo impulsan el crecimiento del sector aeroespacial y de defensa, lo que a su vez impulsa el crecimiento del mercado de cables y alambres para aeronaves.

Información sobre segmentos de tipo

En cuanto al tipo, el segmento de cables es el más exigente del mercado y se espera que domine la cuota de mercado. Sin embargo, con el aumento en la adopción de cables para diversas funciones, se prevé que sea el de mayor crecimiento en el mercado de cables para aeronaves.

Información sobre segmentos de tipos de aeronaves

Según el tipo de aeronave, el mercado global de cables y alambres para aeronaves se segmenta en comercial y militar. Debido al notable crecimiento en el número de entregas de aeronaves comerciales, se espera que este tipo de aeronave domine el mercado en términos de participación durante el período de pronóstico.

Información sobre segmentos de tipo de ajuste

Según el tipo de ajuste, el mercado global de cables y alambres para aeronaves está dominado por el segmento de ajuste de línea, que tuvo la mayor parte de la participación de mercado en el año 2020 y se anticipa que continuará su dominio durante el período de pronóstico en el mercado global de cables y alambres para aeronaves.

Información sobre segmentos de aplicaciones

Según la aplicación, el mercado de cables y alambres para aeronaves está dominado por el segmento de transferencia de energía, que tuvo la mayor participación de mercado en 2020 y se anticipa que continuará su dominio durante el período de pronóstico en el mercado global de cables y alambres para aeronaves.

Los actores del mercado se centran en innovaciones y desarrollos de nuevos productos integrando tecnologías y características avanzadas en sus productos para competir con la competencia.

- En 2020, Harbour Industries LLC declaró que era fabricante aprobado de varios cables coaxiales de baja pérdida y cables de datos de alta velocidad utilizados en los aviones de combate de quinta generación F-35 Lighting II de Lockheed Martin.

- En 2020, TE Connectivity (TE) presentó su nuevo sistema Ethernet de par único Mini-ETH para aviones comerciales.

- En 2019, Carlisle Companies Incorporated adquirió el 100% de las acciones de Draka Fileca SAS de Prysmian SpA

Alambres y cables para aeronaves

Perspectivas regionales del mercado de cables y alambres para aeronaves

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de cables y alambres para aeronaves durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de cables y alambres para aeronaves en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de cables y alambres para aeronaves

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2020 | US$ 716,63 millones |

| Tamaño del mercado en 2028 | US$ 1.153,64 millones |

| CAGR global (2020-2028) | 6,8% |

| Datos históricos | 2018-2019 |

| Período de pronóstico | 2021-2028 |

| Segmentos cubiertos | Por tipo

|

| Regiones y países cubiertos | América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de cables y alambres para aeronaves: comprensión de su impacto en la dinámica empresarial

El mercado de cables y alambres para aeronaves está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de cables y alambres para aeronaves

El mercado global de cables y alambres para aeronaves se ha segmentado de la siguiente manera:

Mercado de cables y alambres para aeronaves: por tipo

- Cable

- Cable

- Aprovechar

Mercado de cables y alambres para aeronaves: por tipo de aeronave

- Comercial

- Militar

Mercado de cables y alambres para aeronaves: por tipo de ajuste

- Ajuste de línea

- Modernización

Mercado de cables y alambres para aeronaves: por aplicación

- Transferencia de potencia

- Transferencia de datos

- Sistema de control de vuelo

- Aviónica

- Iluminación

Mercado de cables y alambres para aeronaves por región

- América del norte

- A NOSOTROS

- Canadá

- México

- Europa

- Francia

- Alemania

- Italia

- Reino Unido

- Rusia

- Resto de Europa

- Asia Pacífico (APAC)

- Porcelana

- India

- Corea del Sur

- Japón

- Australia

- Resto de APAC

- Oriente Medio y África (MEA)

- Sudáfrica

- Arabia Saudita

- Emiratos Árabes Unidos

- Resto de MEA

- América del Sur (SAM)

- Brasil

- Argentina

- Resto de SAM

Mercado de cables y alambres para aeronaves: perfiles de empresas

- Axon Enterprise, Inc.

- Industrias Harbour, LLC

- Draka

- Glenair, Inc.

- HUBER+SUHNER

- Compañía AE Petsche

- AMETEK Inc.

- Corporación Amphenol

- Carlisle Companies Incorporated

- Collins Aerospace, una empresa de Raytheon Technologies Corporation

- TE Connectivity Ltd.

- WL Gore y Asociados, Inc.

- Cables y alambres PIC

- Nexans

- Radial

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de cables y alambres para aeronaves

Obtenga una muestra gratuita para - Mercado de cables y alambres para aeronaves