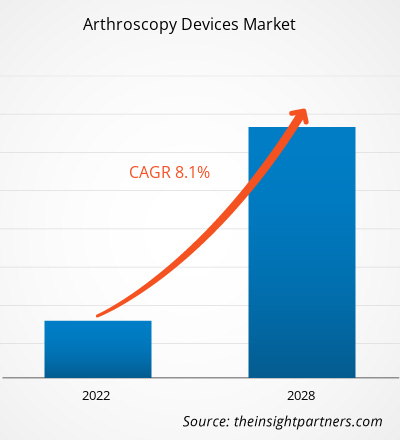

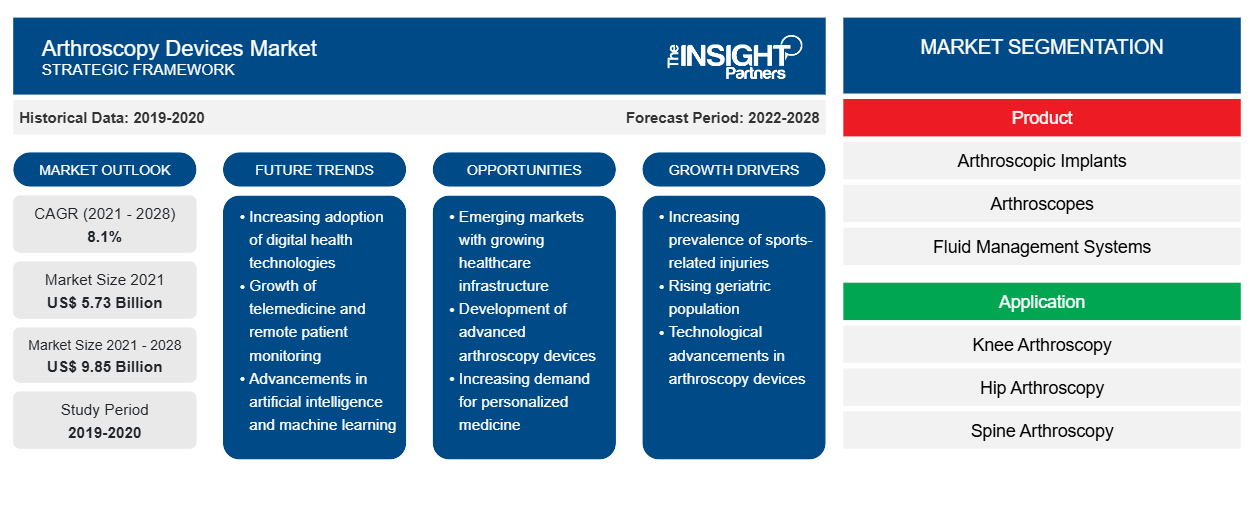

Se proyecta que el mercado de dispositivos de artroscopia alcance los US$ 9.853,88 millones para 2028 desde los US$ 5.725,24 millones en 2021; se espera que registre una CAGR del 8,1% entre 2021 y 2028.

La artroscopia es un procedimiento para diagnosticar y tratar problemas articulares. Un cirujano inserta un tubo estrecho conectado a una cámara de video de fibra óptica llamada artroscopio a través de una pequeña incisión del tamaño de un ojal. Un artroscopio es un dispositivo médico que permite a los médicos ver dentro de las articulaciones del cuerpo, como la rodilla, la cadera, la columna vertebral, el hombro y el codo, para inspeccionar, diagnosticar y realizar procedimientos terapéuticos. Los dispositivos de artroscopia pueden examinar enfermedades como la osteoartritis, la artritis reumatoide, la tendinitis y los tumores óseos en las articulaciones.

El informe ofrece información y un análisis profundo del mercado de dispositivos de artroscopia, haciendo hincapié en varios parámetros como las tendencias del mercado, los avances tecnológicos y la dinámica del mercado. También proporciona el análisis del panorama competitivo de los principales actores del mercado en todo el mundo. Además, incluye el impacto de la pandemia de COVID-19 en el mercado en todas las regiones. La pandemia de COVID-19 creó una crisis de salud pública y una crisis económica en todo el mundo. Antes de la pandemia, el mercado mundial de dispositivos de artroscopia crecía constantemente a medida que se realizaban exámenes de detección, consuelos y tratamientos regulares. La primera ola de COVID-19 interrumpió las consultas, los seguimientos y las evaluaciones de los casos oncológicos. La situación descontrolada que se creó en la industria de la salud en todo el mundo provocó la reducción del número de consultas y un menor número de casos de osteoartritis y artritis reumatoide diagnosticados. Varias empresas han experimentado graves pérdidas en el último trimestre de 2019; la pandemia también influyó negativamente en el primer y segundo trimestre de 2020. Por lo tanto, el impacto de la pandemia de COVID-19 en el mercado global fue inmediato y drástico. Las empresas de todo el mundo se vieron obstaculizadas debido a la interrupción de la cadena de suministro y al aumento de la demanda de productos y servicios sanitarios. Para reducir la infección por COVID-19 en hospitales y clínicas, los profesionales sanitarios y los pacientes adoptaron y prefirieron el tratamiento remoto de los pacientes. En estas circunstancias imprevisibles, la práctica ortopédica no podía permanecer inafectada. Se cancelaron o pospusieron muchos tratamientos quirúrgicos y consultas no urgentes. Se suspendieron las cirugías electivas en muchas instituciones y el volumen general de casos ortopédicos se redujo drásticamente para limitar la propagación del virus y reservar y reasignar recursos en personal sanitario (enfermeras, anestesiólogos), equipo médico (equipo de protección personal, respiradores) y camas. La estrategia de "quedarse en casa" en el mundo resultó en una reducción significativa de las cirugías de artroplastia y artroscopia, así como en una disminución de la incidencia de casos de osteoartritis durante el período de COVID-19.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Como la infraestructura sanitaria se vio afectada debido al brote de COVID-19 y la atención se centró en el tratamiento de la COVID-19, se descuidó el diagnóstico de diversas enfermedades. Además, la detección y el tratamiento de enfermedades musculoesqueléticas también se vieron obstaculizados por la pandemia de COVID-19. Esto limitó en gran medida el crecimiento del mercado de dispositivos de artroscopia en todo el mundo.

Perspectivas del mercado

La creciente prevalencia de trastornos musculoesqueléticos impulsará el mercado

Los trastornos musculoesqueléticos (TME) son las afecciones de salud más comunes en todo el mundo. Según los datos publicados por la Organización Mundial de la Salud (OMS), en febrero de 2021, aproximadamente 1.710 millones de personas en todo el mundo padecían problemas musculoesqueléticos. El dolor lumbar es una afección musculoesquelética muy extendida que afecta a 568 millones de personas en todo el mundo. El dolor lumbar es la principal causa de discapacidad en 160 países. Los trastornos musculoesqueléticos perjudican gravemente la movilidad y la destreza, lo que da lugar a una jubilación anticipada del trabajo, una disminución del bienestar y una disminución de la capacidad para socializar. El número de personas discapacitadas por afecciones musculoesqueléticas ha ido aumentando y se espera que esta tendencia continúe en las próximas décadas.MSDs) are the most common health conditions worldwide. According to the data published by the World Health Organization (WHO), in February 2021, approximately 1.71 billion individuals worldwide suffered from musculoskeletal problems. Lower back pain is a widespread musculoskeletal condition, affecting 568 million people worldwide. Lower back pain is the major cause of impairment in 160 countries. Musculoskeletal disorders severely impair mobility and dexterity, resulting in early retirement from work, decreased well-being, and diminished ability to socialize. The number of people disabled by musculoskeletal conditions has been growing, and this trend is expected to continue in the next decades.

Además, según la OMS, los países de altos ingresos son los más afectados en términos de población (441 millones), seguidos de los países de la Región del Pacífico Occidental de la OMS con 427 millones, mientras que el Sudeste Asiático tiene 369 millones. Las enfermedades musculoesqueléticas también son la principal causa de años vividos con discapacidad (AVD) en todo el mundo, representando aproximadamente 149 millones de AVD, o el 17% de todos los AVD. Las fracturas, que afectan a 436 millones de personas en todo el mundo, la osteoartritis (343 millones), otras lesiones (305 millones), los dolores de cuello (222 millones), las amputaciones (175 millones) y la artritis reumatoide (14 millones) contribuyen a la carga general de enfermedades musculoesqueléticas.YLDs) worldwide, accounting for roughly 149 million YLDs, or 17% of all YLDs. Fractures, which affect 436 million people worldwide, osteoarthritis (343 million), other injuries (305 million), neck pains (222 million), amputations (175 million), and rheumatoid arthritis (14 million) all contribute to the overall burden of musculoskeletal diseases.

La artroscopia quirúrgica es una opción terapéutica bien establecida para personas con dolor y disfunción articular crónicos. En comparación con los procedimientos articulares abiertos, la artroscopia es menos invasiva y produce mejores resultados generales para el paciente en cuanto al tratamiento de los síntomas, la estancia hospitalaria, la recuperación estructural y los resultados a largo plazo. Por lo tanto, se espera que la creciente prevalencia de trastornos musculoesqueléticos, osteoartritis y artritis reumatoide impulse el mercado durante el período de pronóstico.

Perspectivas basadas en productos

Según el producto, el mercado de dispositivos de artroscopia se segmenta en artroscopios, implantes artroscópicos, sistemas de gestión de fluidos , sistemas de radiofrecuencia, sistemas de visualización, sistemas de afeitado eléctrico y otros equipos artroscópicos. En 2021, el segmento de artroscopios tuvo la mayor participación del mercado y se espera que registre la CAGR más rápida del 9,1 % durante el período de pronóstico. radiofrequency systems, visualization systems, powered shaver systems, and other arthroscopic equipment. In 2021, the arthroscopes segment held the largest share of the market and is expected to register the fastest CAGR of 9.1% during the forecast period.

Perspectivas basadas en aplicaciones

Según la aplicación, el mercado de dispositivos de artroscopia se segmenta en artroscopia de rodilla, artroscopia de cadera, artroscopia de columna, artroscopia de pie y tobillo, artroscopia de hombro y codo, entre otros. En 2021, el segmento de artroscopia de cadera tuvo la mayor participación del mercado y se espera que registre la CAGR más alta del 8,9 % durante 2021-2028.CAGR of 8.9% during 2021–2028.

Los actores del mercado de dispositivos de artroscopia adoptan estrategias orgánicas como el lanzamiento y la expansión de productos para expandir su presencia y cartera de productos en todo el mundo y satisfacer las crecientes demandas.

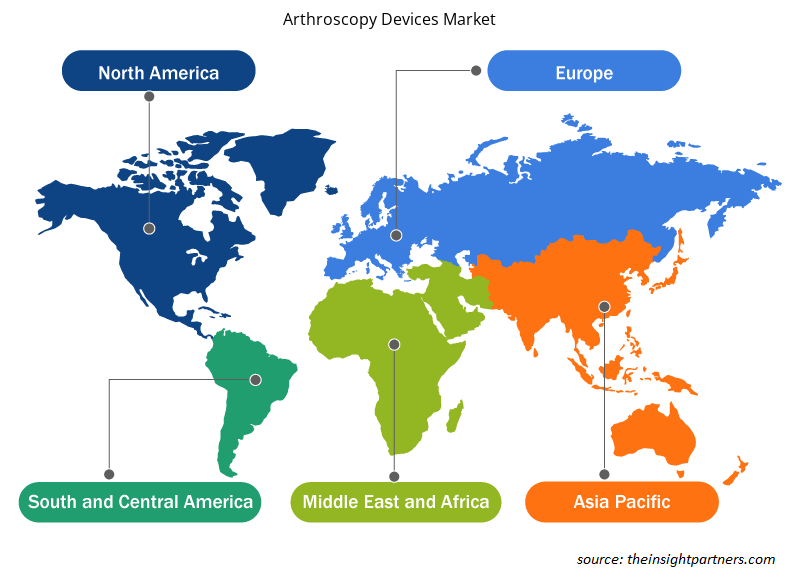

Por geografía

Según la geografía, el mercado de dispositivos de artroscopia está segmentado en América del Norte (EE. UU., Canadá y México), Europa (Reino Unido, Alemania, Francia, Italia, España y el resto de Europa), Asia Pacífico (China, Japón, India, Australia, Corea del Sur y el resto de Asia Pacífico), Medio Oriente y África (EAU, Arabia Saudita, Sudáfrica y el resto de Medio Oriente y África) y América del Sur y Central (Brasil, Argentina y el resto de América del Sur y Central).UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Perspectivas regionales del mercado de dispositivos de artroscopia

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de dispositivos de artroscopia durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de dispositivos de artroscopia en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de dispositivos de artroscopia

Alcance del informe de mercado de dispositivos de artroscopia

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | 5.730 millones de dólares estadounidenses |

| Tamaño del mercado en 2028 | US$ 9.85 mil millones |

| CAGR global (2021-2028) | 8,1% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos |

Por producto

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de dispositivos de artroscopia: comprensión de su impacto en la dinámica empresarial

El mercado de dispositivos para artroscopia está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de dispositivos de artroscopia son:

- Arthrex, Inc.

- Corporación CONMED

- Servicios Johnson y Johnson, Inc.

- KARL STORZ SE & Co. KG

- Medtronic

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de dispositivos de artroscopia

Perfiles de empresas

- Arthrex, Inc.

- Corporación CONMED

- Servicios Johnson y Johnson, Inc.

- KARL STORZ SE & Co. KG

- Medtronic

- Empresa de fabricación de equipos de impresión 3D.

- Smith y sobrino

- Corporación Stryker

- Biomet de Zimmer

- NuVasive, Inc.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de dispositivos de artroscopia

Obtenga una muestra gratuita para - Mercado de dispositivos de artroscopia