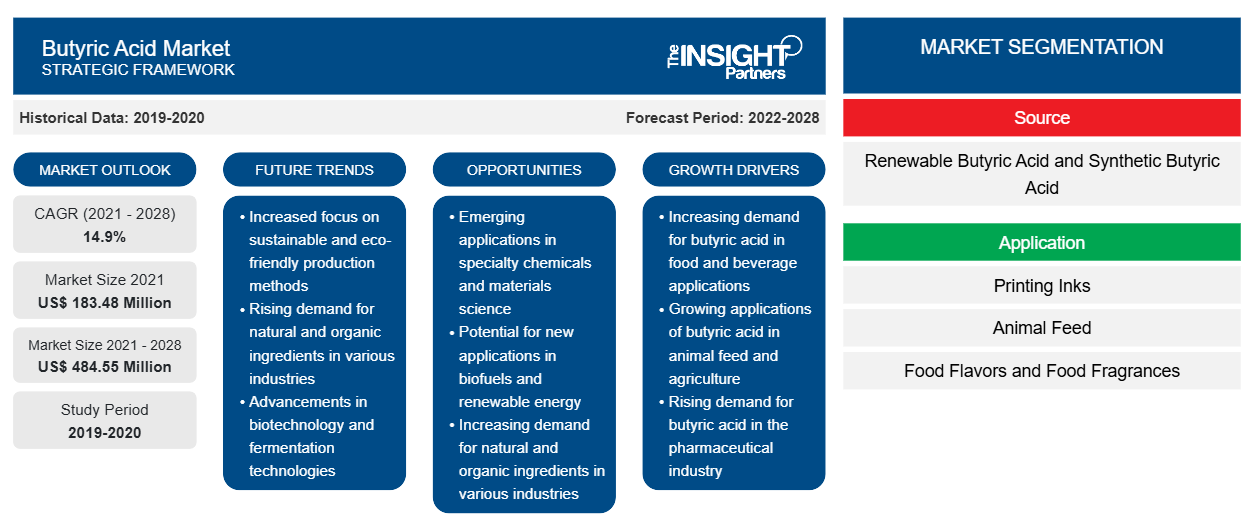

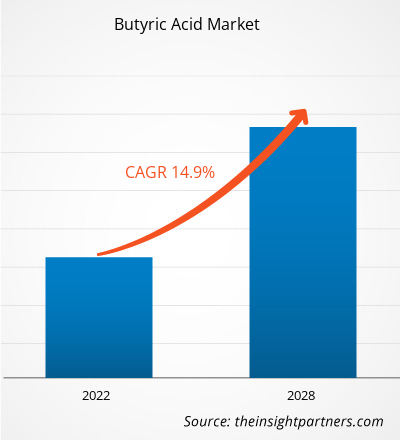

El mercado del ácido butírico se valoró en US$ 183,48 millones en 2021 y se proyecta que alcance los US$ 484,55 millones en 2028; se espera que crezca a una CAGR del 14,9% entre 2021 y 2028.

El ácido butírico es un líquido incoloro con un olor penetrante y desagradable. El ácido tiene varias aplicaciones importantes en las industrias química, alimentaria y farmacéutica. El ácido butírico tiene muchas aplicaciones en la industria farmacéutica.

En 2020, Asia Pacífico tuvo la mayor participación en los ingresos del mercado mundial. El creciente número de granjas ganaderas en Asia Pacífico está aumentando el consumo de alimento para animales y, en consecuencia, proliferando el mercado del ácido butírico . El crecimiento de las granjas ganaderas en la región de Asia Pacífico se puede atribuir a la mayor demanda de productos cárnicos de calidad debido a la mejora del ingreso per cápita y la creciente conciencia de la salud entre los consumidores de la región de Asia Pacífico.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

- Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impacto de la pandemia de COVID-19 en el mercado del ácido butírico

La pandemia de COVID-19 ha afectado negativamente a las economías e industrias en varios países debido a los confinamientos, las prohibiciones de viaje y los cierres de empresas. En 2020, varias industrias tuvieron que ralentizar sus operaciones debido a las interrupciones en las cadenas de valor provocadas por el cierre de las fronteras nacionales e internacionales, lo que restringió la demanda de ácido butírico. La pandemia de COVID-19 provocó volatilidad en los precios de la materia prima necesaria para producir ácido butírico. El consumo mundial de ácido butírico disminuyó debido a la baja demanda de varios sectores posteriores, como los sabores alimentarios, las fragancias alimentarias y los intermedios químicos. La disponibilidad limitada de las materias primas y la reducción de la demanda de los sectores posteriores debido a la pandemia de COVID-19 han afectado negativamente al crecimiento del mercado del ácido butírico.

Perspectivas del mercado

Demanda creciente del sector de alimentos para animales

El ácido butírico es conocido por sus efectos beneficiosos sobre la salud y el desarrollo intestinal. Durante décadas, se ha utilizado en la industria de la alimentación animal para garantizar una mejor salud intestinal y el rendimiento animal. Además, el ácido butírico se ha convertido en una alternativa antibiótica de primera elección para los productores de pollos de engorde, ponedoras, pavos y cerdos con el cambio de la industria de la alimentación animal para reducir el uso de antibióticos.

En los últimos años, la industria ganadera en varios países se ha expandido rápidamente con el cambio en las preferencias dietéticas entre los consumidores hacia las proteínas animales. El crecimiento de la población, el aumento de los ingresos, la elevación del nivel de vida y la urbanización han sido los factores clave que impulsan la demanda de carne en todo el mundo. La creciente demanda de productos cárnicos resalta la necesidad de alimentos y aditivos para piensos. La creciente demanda de productos de alimentación animal en diferentes regiones impulsa la demanda de ácido butírico, impulsando así el crecimiento del mercado del ácido butírico.

El ácido butírico es uno de los ácidos grasos de cadena corta más beneficiosos que desempeña un papel clave en la mejora de la salud digestiva, el control del peso y la prevención del cáncer. El fuerte crecimiento de la industria farmacéutica en diferentes países del mundo está dando lugar a un uso cada vez mayor del ácido butírico para diversas aplicaciones. Además, existe un creciente interés en el uso del ácido butírico como precursor para la producción de biocombustibles. Se espera que esto ofrezca oportunidades lucrativas para el crecimiento del mercado del ácido butírico durante el período de pronóstico.

Información de origen

Según las fuentes, el mercado mundial de ácido butírico se ha segmentado en ácido butírico renovable y ácido butírico sintético. El segmento de ácido butírico sintético tuvo una mayor participación en el mercado mundial en 2020. El segmento de ácido butírico sintético representa una participación importante debido a su amplia aplicación para producir tintas de impresión, desinfectantes, sabores, medicamentos, perfumes, esencias y aditivos alimentarios, entre otros.

Algunos de los actores que operan en el mercado global del ácido butírico incluyen Eastman Chemical Company; OQ Chemicals GmbH; Tokyo Chemical Industry Co., Ltd.; Perstorp Holding AB; Alfa Aesar; MERCK KGaA; Vigon International, LLC.; Hefei TNJ Chemical Industry Co., Ltd.; KUNSHAN ODOWELL CO., LTD; y Yufeng International Co., Ltd. Los actores que operan en el mercado del ácido butírico se centran en proporcionar productos de alta calidad para satisfacer la demanda de los clientes. Estos actores del mercado están altamente enfocados en el desarrollo de ofertas de servicios innovadores y de alta calidad para satisfacer los requisitos de los clientes.

Perspectivas regionales del mercado del ácido butírico

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado del ácido butírico durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado del ácido butírico en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de ácido butírico

Alcance del informe de mercado de ácido butírico

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 183,48 millones |

| Tamaño del mercado en 2028 | US$ 484,55 millones |

| CAGR global (2021-2028) | 14,9% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos | Por fuente

|

| Regiones y países cubiertos | América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

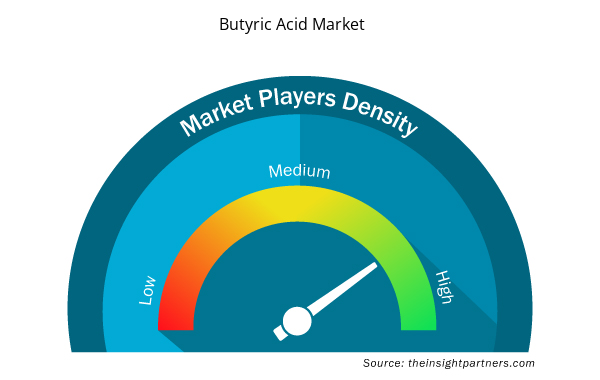

Densidad de actores del mercado de ácido butírico: comprensión de su impacto en la dinámica empresarial

El mercado del ácido butírico está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado del ácido butírico son:

- Compañía química Eastman

- OQ Productos químicos GmbH

- Industria química de Tokio Co., Ltd.

- Perstorp Holding AB

- Alfa Aesar

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de ácido butírico

Informe Destacado

- Tendencias progresivas de la industria en el mercado del ácido butírico para ayudar a los actores a desarrollar estrategias efectivas a largo plazo

- Estrategias de crecimiento empresarial adoptadas por los mercados desarrollados y en desarrollo

- Análisis cuantitativo del mercado del ácido butírico de 2019 a 2028

- Estimación de la demanda mundial de HR-PIB

- Análisis de las cinco fuerzas de Porter para ilustrar la eficacia de los compradores y proveedores que operan en la industria

- Avances recientes para comprender el escenario competitivo del mercado

- Tendencias y perspectivas del mercado, así como factores que impulsan y restringen el crecimiento del mercado del ácido butírico

- Asistencia en el proceso de toma de decisiones destacando las estrategias de mercado que sustentan el interés comercial y conducen al crecimiento del mercado.

- El tamaño del mercado del ácido butírico en varios nodos

- Descripción detallada y segmentación del mercado, así como la dinámica de la industria HR-PIB

- Tamaño del mercado del ácido butírico en diversas regiones con prometedoras oportunidades de crecimiento

Mercado mundial del ácido butírico

Fuente

- Ácido butírico renovable

- Ácido butírico sintético

Solicitud

- Tintas de impresión

- Alimento para animales

- Sabores y fragancias de los alimentos

- Intermedios químicos

- Farmacéutico

- Otros

Perfiles de empresas

- Compañía química Eastman

- OQ Productos químicos GmbH

- Industria química de Tokio Co., Ltd.

- Perstorp Holding AB

- Alfa Aesar

- Compañía Merck KGaA

- Vigon Internacional, LLC.

- Industria química Hefei TNJ Co., Ltd.

- Compañía Kunshan Odowell, Ltd.

- Compañía Internacional Yufeng, Ltd.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado Valor/volumen: global, regional, nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

- Europe Surety Market

- Health Economics and Outcome Research (HEOR) Services Market

- Data Annotation Tools Market

- Thermal Energy Storage Market

- Hydrocephalus Shunts Market

- Carbon Fiber Market

- Saudi Arabia Drywall Panels Market

- Extracellular Matrix Market

- Compounding Pharmacies Market

- Dairy Flavors Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Preguntas frecuentes

Growing demand for butyric acid from animal feed sector is one of the major driving factors for the market. Butyric acid is known for its beneficial effects on gut health and development. For decades, it has been in use in the animal feed industry for ensuring improved gut health and animal performance. The use of butyric acid in animal nutrition also helps in improving nutrient absorption.

Asia Pacific (APAC) is anticipated to grow with the fastest CAGR at rate of 15.3% from 2021 to 2028. The growing number of livestock farms in APAC is propelling animal feed consumption levels, subsequently leading to the proliferation of the butyric acid market.

Due to the COVID-19 pandemic, butyric acid manufacturers witnessed a slight disruption in the supply chain of butyric acid during the first two quarters of 2020. However, the supply chain of butyric acid materials has been restored, and production activities have regained normalcy in late 2020. Later, the market was not significantly negatively impacted by the pandemic. Further, with the growing COVID-19 vaccinations and eased in lockdown restrictions, the global economy is resuming, and subsequently, the butyric acid market is regaining its growth.

Based on application, the animal feed segment accounted the largest share of the global butyric acid market. Butyric acid and fatty acids are extensively used in production of poultry and swine feed due to its beneficial properties such as improving digestibility, better colonisation resistance, and improved growth performance among young livestock.

The major players operating in the global butyric acid market are Eastman Chemical Company; OQ Chemicals GmbH; Tokyo Chemical Industry Co., Ltd.; Perstorp Holding AB; Alfa Aesar; MERCK KGaA; Vigon International, LLC.; Hefei TNJ Chemical Industry Co.,Ltd.; KUNSHAN ODOWELL CO.,LTD; and Yufeng International Co.,Ltd.

During the forecast period, Asia Pacific is anticipated to account for the largest share in the global butyric acid market. The region houses few of the fastest developing economies of the world such as China and India and that are the major consumer of the butyric acid. Moreover, in the Asia Pacific region, there is a growing number of livestock farms which is increasing the consumption of animal feed and subsequently proliferating the butyric acid market.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies_ Butyric Acid Market

- Eastman Chemical Company

- OQ Chemicals GmbH

- Tokyo Chemical Industry Co., Ltd.

- Perstorp Holding AB

- Alfa Aesar

- MERCK KGaA

- Vigon International, LLC.

- Hefei TNJ Chemical Industry Co.,Ltd.

- KUNSHAN ODOWELL CO.,LTD

- Yufeng International Co.,Ltd

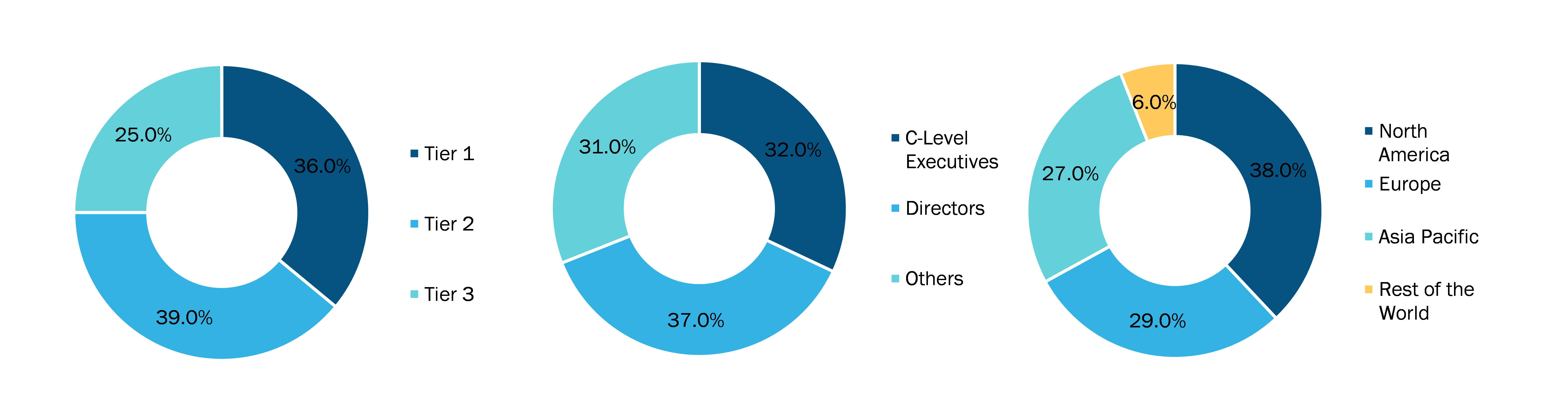

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenga una muestra gratuita de este informe

Obtenga una muestra gratuita de este informe