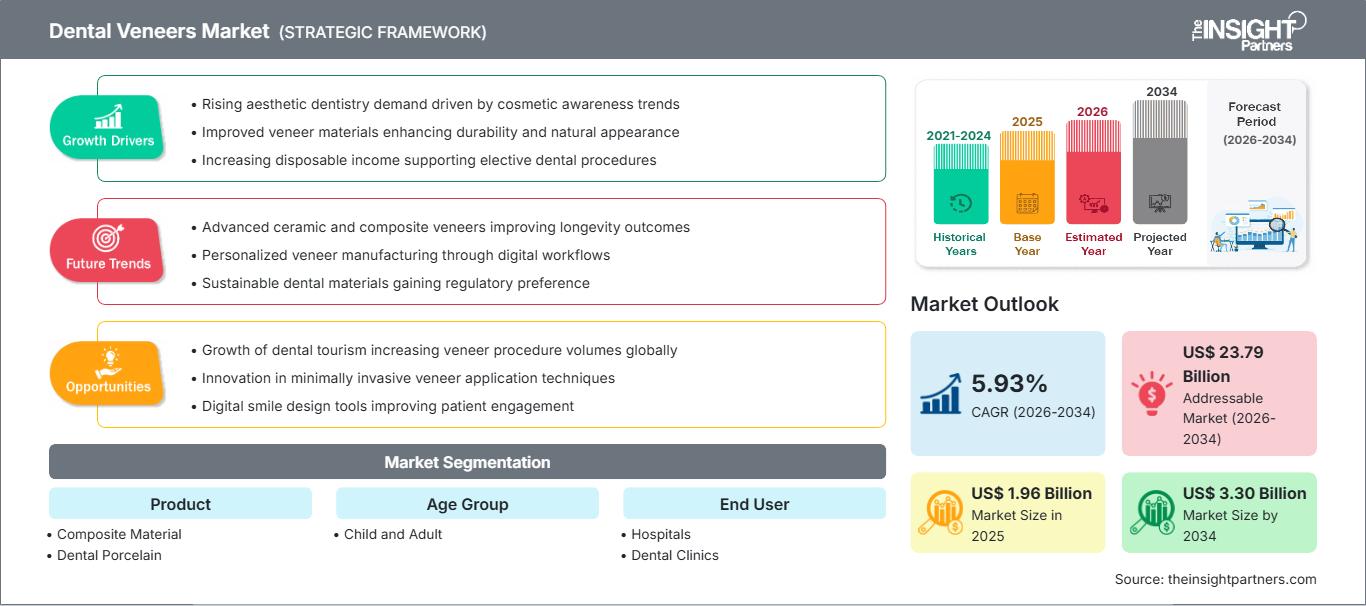

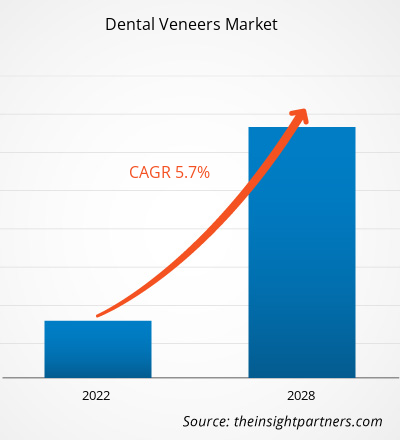

Se espera que el tamaño del mercado de carillas dentales alcance los US$ 3.300 millones en 2034, desde los US$ 1.960 millones en 2025. Se anticipa que el mercado registre una CAGR del 5,93 % durante el período 2026-2034.

Análisis del mercado de carillas dentales

El pronóstico para el mercado de carillas dentales indica crecimiento, debido a un número creciente de trastornos dentales, una creciente conciencia de los consumidores sobre el cuidado dental y un enfoque cada vez mayor en la odontología estética.

Otros factores que apoyan la expansión del mercado incluyen:

- Mayor demanda de procedimientos dentales cosméticos a medida que las personas priorizan cada vez más la estética de la sonrisa y la apariencia bucal.

- Expansión de las clínicas dentales a nivel mundial, haciendo que los servicios de odontología cosmética, incluidas las carillas, sean más accesibles.

- Innovaciones en materiales para carillas dentales (composite, porcelana, etc.) y técnicas de tratamiento que mejoran los resultados y atraen a una base de pacientes más amplia.

Sin embargo, una limitación notable es el costo a menudo elevado de los procedimientos dentales cosméticos, que puede limitar su adopción en ciertos mercados o entre pacientes sensibles a los costos.

Descripción general del mercado de carillas dentales

Las carillas dentales, también conocidas como carillas de porcelana o laminados de porcelana dental, son láminas ultrafinas hechas a medida, hechas de materiales del color del diente, diseñadas para cubrir la superficie frontal de los dientes y mejorar su apariencia. Estas carillas se adhieren con cemento de resina. El tratamiento se personaliza para cada paciente y permite cambiar el color, la forma, el tamaño o la longitud de los dientes, principalmente con fines estéticos.

Las carillas dentales representan un segmento clave de la odontología estética, ofreciendo a los pacientes una forma de mejorar su sonrisa sin necesidad de procedimientos reconstructivos más invasivos. A medida que aumentan las preocupaciones estéticas y la concienciación sobre el cuidado bucal a nivel mundial, las carillas dentales desempeñan un papel importante en las clínicas dentales modernas.

Personalice este informe según sus necesidades

Obtenga PERSONALIZACIÓN GRATUITAMercado de carillas dentales: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de carillas dentales

Factores impulsores del mercado:

- Aumento de la incidencia de trastornos dentales y necesidades cosméticas: un número cada vez mayor de personas experimentan problemas dentales (decoloración, daños, desalineación), lo que impulsa la demanda de soluciones correctivas y cosméticas como las carillas.

- Creciente conciencia del consumidor y demanda de estética: hoy en día, más personas son conscientes de la apariencia dental y la estética de la sonrisa, lo que impulsa la demanda de carillas como procedimiento dental cosmético.

- Expansión de las clínicas dentales y accesibilidad de los servicios: con más clínicas dentales a nivel mundial, incluso en los mercados emergentes, las carillas se vuelven accesibles para una población más amplia, lo que aumenta el alcance potencial del mercado.

Oportunidades de mercado:

- Innovación de materiales (carillas de composite y porcelana): la disponibilidad y adopción de diferentes materiales de carillas, como el composite y la porcelana, ofrecen opciones para pacientes con distintas necesidades y presupuestos.

- Crecimiento de la odontología cosmética en mercados emergentes: A medida que aumentan los ingresos disponibles y se extiende la conciencia estética en las economías emergentes, es probable que aumente la demanda de procedimientos dentales cosméticos, incluidas las carillas, lo que ofrece oportunidades de crecimiento. (Si bien no se desglosa geográficamente, la escala global del mercado sugiere oportunidades fuera de los mercados tradicionales).

- Aumento de la infraestructura de las clínicas dentales y de los servicios cosméticos: a medida que las clínicas dentales proliferan en todo el mundo y amplían sus servicios de odontología cosmética, las carillas pueden convertirse en una opción de tratamiento más común y ampliamente aceptada.

Análisis de segmentación del informe de mercado de carillas dentales

Por producto:

- Material compuesto

- Carillas dentales de porcelana

Por grupo de edad:

- Niño

- Adulto

Por usuario final:

- Hospitales

- Clínicas dentales

Por geografía:

- América del norte

- Europa

- Asia-Pacífico

- América del Sur y Central

- Oriente Medio y África

Perspectivas regionales del mercado de carillas dentales

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de carillas dentales durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de carillas dentales en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de carillas dentales

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2025 | 1.960 millones de dólares estadounidenses |

| Tamaño del mercado en 2034 | US$ 3.30 mil millones |

| CAGR global (2026-2034) | 5,93% |

| Datos históricos | 2021-2024 |

| Período de pronóstico | 2026-2034 |

| Segmentos cubiertos |

Por producto

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de carillas dentales: comprensión de su impacto en la dinámica empresarial

El mercado de carillas dentales está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias del consumidor, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades del consumidor y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de carillas dentales

Análisis de la cuota de mercado de las carillas dentales por geografía

Según el informe de The Insight Partners, se analizan las tendencias regionales y los factores que influyen en el mercado de carillas dentales en las principales regiones mundiales (América del Norte, Europa, Asia Pacífico, América del Sur y Central, Medio Oriente y África).

- Norteamérica y Europa: Históricamente, estas regiones han experimentado una adopción significativa de la odontología cosmética y los procedimientos de estética dental gracias a su mayor conocimiento y mejor acceso a las clínicas dentales. Esto indica que siguen manteniendo una cuota sustancial del mercado de carillas.

- Asia-Pacífico: Dado el crecimiento de la población, el aumento del ingreso disponible, la creciente urbanización y la expansión de los sectores dentales privados, Asia-Pacífico representa una región prometedora para el crecimiento en el mercado de carillas, especialmente a medida que aumenta la conciencia sobre la odontología cosmética.

- América Latina, Medio Oriente y África: Estas regiones representan mercados emergentes donde la adopción puede aumentar gradualmente, especialmente con una mejor infraestructura dental, una mayor conciencia de la estética dental y una expansión de los servicios dentales.

Densidad de actores del mercado de carillas: comprensión de su impacto en la dinámica empresarial

Este entorno competitivo impulsa a los jugadores a diferenciarse a través de:

- Ofrecemos carillas de porcelana o composite de alta calidad que equilibran costo, durabilidad y estética.

- Ampliación de la distribución a través de clínicas dentales y proveedores de odontología cosmética a nivel mundial.

- Invertir en innovación de materiales y técnicas de tratamiento para atraer a los pacientes que buscan mejores resultados estéticos.

- Campañas de marketing y concientización del consumidor para resaltar los beneficios de las carillas frente a las alternativas cosméticas o restaurativas dentales tradicionales.

Oportunidades y movimientos estratégicos

- Enfoque en mercados emergentes y Asia-Pacífico: los actores del mercado pueden expandir su presencia en regiones de alto potencial (Asia-Pacífico, América Latina, MEA) estableciendo asociaciones con clínicas dentales locales o lanzando opciones de carillas de menor costo.

- Innovación de materiales: invertir en materiales y ofrecer carillas de porcelana o composite duraderas y rentables para satisfacer distintas sensibilidades y preferencias de precios.

- Expansión y accesibilidad de la red de clínicas: colaboraciones con clínicas dentales y cadenas de odontología cosmética para ofrecer carillas como parte de paquetes más amplios de cambio de imagen de la sonrisa.

- Campañas de marketing y concientización: aumentar la conciencia de los consumidores sobre los procedimientos dentales cosméticos y la estética dental para aprovechar la creciente demanda de carillas entre los adultos.

Los principales actores clave del mercado son:

- Glidewell

- Amann Girrbach AG

- 3M

- VladMiVa

- Cerámica de circón

- DEN‑MAT Holdings, LLC

- PRODUCTOS ULTRADENT Inc.

- PLANMECA OY

- Centro Dental Lion

Otros actores analizados durante el curso de la investigación:

- Ivoclar Vivadent AG

- Dentsply Sirona Inc.

- Fábrica de dientes VITA

- Tecnología Align, Inc.

- Smile Brands Inc.

- Grupo Coltene

- Kulzer GmbH

- Estudios dentales DaVinci

- Carillas MAC (Laboratorios MicroDental)

Mercado de carillas dentales: desarrollos y tendencias recientes

- El segmento de materiales compuestos tuvo la mayor participación (≈ 47,6%) del mercado.

- El segmento de usuarios finales de clínicas dentales tuvo la mayor participación en 2025, debido al creciente número de clínicas dentales en todo el mundo que ofrecen servicios de odontología cosmética.

- Se prevé que el segmento de carillas de porcelana registre la CAGR más alta durante el período de pronóstico (2021-2034), lo que indica una preferencia creciente por las carillas a base de porcelana a pesar del mayor costo, probablemente debido a su durabilidad y ventaja estética.

- Las empresas del mercado de carillas se están centrando en el lanzamiento de productos, la expansión de la cartera y las estrategias de asociación para fortalecer su presencia global.

Cobertura del informe y entregables

El informe "Pronóstico del mercado de carillas dentales hasta 2034 - Análisis global" de The Insight Partners ofrece un análisis detallado que abarca:

- Tamaño del mercado y pronóstico a nivel global y regional para todos los segmentos clave del mercado.

- Dinámica del mercado: tendencias, impulsores, restricciones y oportunidades clave.

- Análisis de segmentación por producto, grupo de edad, usuario final y geografía.

- Panorama competitivo y perfiles de empresas de los principales actores de la industria.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de carillas dentales

Obtenga una muestra gratuita para - Mercado de carillas dentales