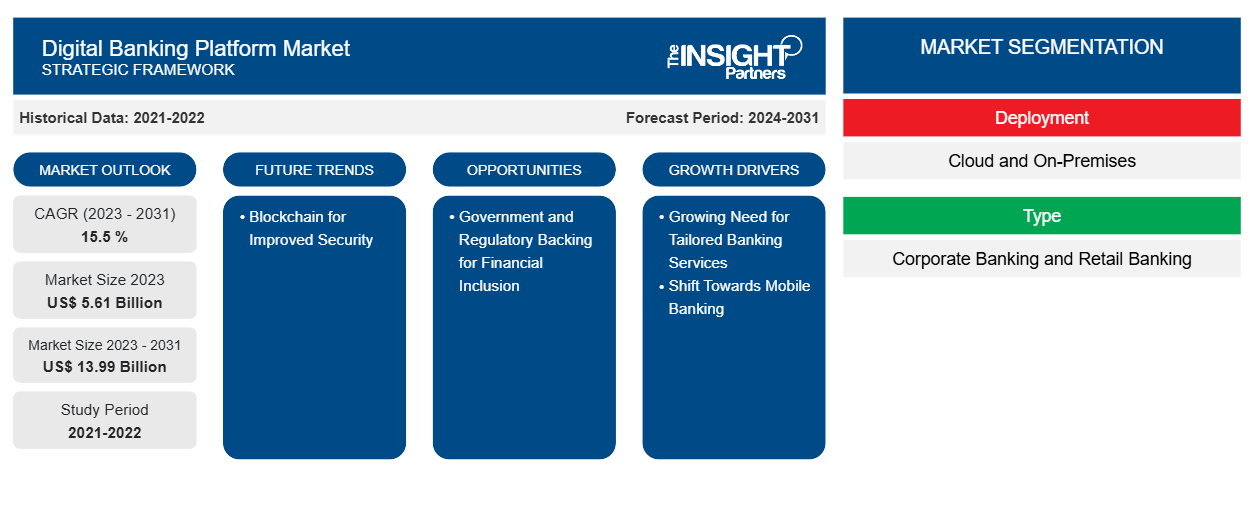

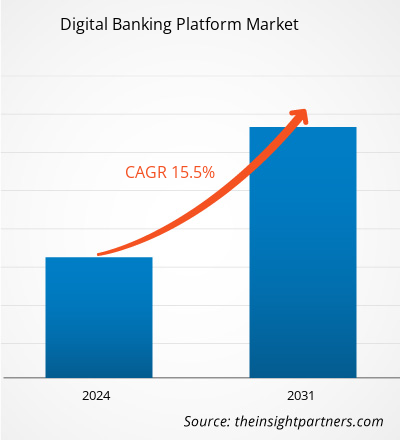

Se proyecta que el tamaño del mercado de plataformas de banca digital alcance los 13.990 millones de dólares en 2031, frente a los 5.610 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 15,5 % entre 2023 y 2031. Es probable que la creciente necesidad de servicios bancarios personalizados y respaldo regulatorio para la inclusión financiera siga siendo una tendencia clave en el mercado de plataformas de banca digital.

Análisis del mercado de plataformas de banca digital

A medida que aumenta el uso de teléfonos móviles, más personas optan por utilizar la banca móvil debido a su comodidad. Este cambio ha animado a los bancos a crear sistemas bancarios digitales que se puedan utilizar en dispositivos móviles, lo que permite a los usuarios realizar sus operaciones bancarias mientras están en movimiento. Además, estos sistemas ayudan a los bancos a hacer más eficientes sus operaciones, reducir gastos e integrar tecnologías modernas como la inteligencia artificial y el análisis de datos para personalizar los servicios y mejorar la toma de decisiones.

Descripción general del mercado de plataformas de banca digital

Una plataforma de banca digital es un sistema electrónico disponible a través de Internet o aplicaciones móviles, que permite a los consumidores realizar de forma remota diversas tareas bancarias y transacciones financieras. Estas tareas incluyen la gestión de cuentas, pagos, solicitudes de préstamos y acceso a una amplia gama de servicios bancarios. La plataforma también ofrece funciones como gestión de cuentas, depósitos móviles, billeteras digitales, herramientas de presupuesto y atención al cliente a través de chatbots o servicios de mensajería. Las principales ventajas de las plataformas de banca digital son la comodidad, la accesibilidad y la eficiencia tanto para los clientes como para los bancos. Los usuarios pueden realizar transacciones bancarias cómodamente sin visitar una sucursal física, lo que genera una mayor satisfacción y compromiso del cliente.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

- Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de plataformas de banca digital

Creciente necesidad de servicios bancarios personalizados para favorecer al mercado

Existe una tendencia creciente a que los clientes busquen servicios financieros personalizados, lo que lleva a los bancos a adoptar plataformas digitales para ofrecer experiencias personalizadas. A través de la banca digital, los bancos pueden ofrecer productos y servicios financieros especializados, mejorando la lealtad y la satisfacción del cliente. La creciente demanda de servicios bancarios personalizados refleja un cambio en las preferencias de los consumidores hacia soluciones financieras a medida. Los clientes ahora desean experiencias personalizadas que satisfagan sus necesidades específicas, lo que impulsa a los bancos a recurrir a plataformas digitales para una experiencia bancaria más individualizada.

Respaldo gubernamental y regulatorio para la inclusión financiera

El esfuerzo mundial por promover la banca digital está motivado por la comprensión de su potencial significativo para mejorar la inclusión financiera. Mediante el uso de plataformas digitales, las personas que históricamente han estado excluidas del sistema financiero formal, como las que no tienen servicios bancarios o los tienen sub-bancarizados, ahora pueden acceder a servicios financieros esenciales. Esta ampliación del acceso financiero no solo reduce la disparidad entre quienes tienen y no tienen servicios bancarios, sino que también impulsa el crecimiento económico al permitir que más personas participen en la economía formal. En consecuencia, el respaldo regulatorio a la banca digital no solo sirve como una forma de mejorar la inclusión financiera, sino también como una estrategia para fomentar el progreso económico general y minimizar las desigualdades sociales.unbanked or underbanked, can now access crucial financial services. This extension of financial access not only reduces the disparity between those with and without banking services but also boosts economic growth by enabling more people to engage in the formal economy. Consequently, regulatory backing for digital banking serves not only as a way to enhance financial inclusion but also as a strategy to foster overall economic progress and minimize societal inequalities.

Análisis de segmentación del informe de mercado de plataformas de banca digital

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de la plataforma de banca digital son la implementación y el tipo.

- Según la implementación, el mercado se divide en nube y local. El segmento local tuvo una participación de mercado significativa en 2023.

- Por tipo, el mercado está segmentado en banca corporativa y banca minorista. El segmento de banca corporativa tuvo una participación sustancial del mercado en 2023.

Análisis de la cuota de mercado de las plataformas de banca digital por geografía

El alcance geográfico del informe del mercado de la plataforma de banca digital se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur/América del Sur y Central.

América del Norte, especialmente Estados Unidos, cuenta con una de las tasas más altas de adopción de tecnología a nivel mundial. El uso generalizado de teléfonos inteligentes y la fuerte penetración de Internet crean un entorno ideal para el desarrollo y el predominio de los servicios bancarios digitales. La infraestructura financiera bien establecida de la región fomenta la innovación en la banca digital, respaldada por un sector bancario maduro, un entorno regulatorio favorable e inversiones sustanciales en empresas de tecnología financiera . Los consumidores de América del Norte muestran una marcada preferencia por los servicios digitales, incluida la banca, impulsada por el deseo de realizar transacciones bancarias en línea rápidas, fáciles y seguras. Esta demanda motiva a los bancos e instituciones financieras a mejorar continuamente sus plataformas digitales.

Perspectivas regionales del mercado de plataformas de banca digital

The regional trends and factors influencing the Digital Banking Platform Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Digital Banking Platform Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Digital Banking Platform Market

Digital Banking Platform Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.61 Billion |

| Market Size by 2031 | US$ 13.99 Billion |

| Global CAGR (2023 - 2031) | 15.5 % |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered | By Deployment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

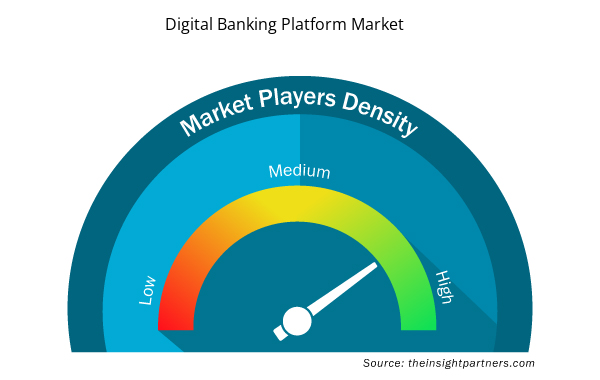

Market Players Density: Understanding Its Impact on Business Dynamics

The Digital Banking Platform Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Digital Banking Platform Market are:

- Appway AG

- CREALOGIX Holding AG

- EdgeVerve Systems Limited

- Fiserv, Inc.

- Oracle Corporation

- SAP SE

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Digital Banking Platform Market top key players overview

Digital Banking Platform Market News and Recent Developments

The digital banking platform market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- Apiture, un proveedor líder de soluciones de banca digital, anunció hoy que NWSB (The New Washington State Bank), una institución financiera comunitaria que brinda servicios a clientes en el sur de Indiana desde 1908, ha seleccionado la plataforma de banca digital de Apiture para impulsar sus soluciones de banca en línea y móvil. NWSB implementará las soluciones de banca para consumidores, banca comercial, apertura de cuentas e inteligencia de datos de Apiture para brindar una experiencia fluida e innovadora a sus clientes minoristas y comerciales.

(Fuente: Apiture, sitio web de la empresa, 2024)

- Alkami Technology, Inc. (Nasdaq: ALKT) (“Alkami”), un proveedor líder de soluciones de banca digital basadas en la nube para instituciones financieras en los EE. UU., anunció hoy que Elevations Credit Union (“Elevations”) lanzó la plataforma de banca minorista y comercial en línea de Alkami. Luego de un proceso de implementación sin inconvenientes, Elevations ahora está aprovechando la plataforma para hacer crecer su cartera comercial y minorista y ganar participación de mercado.

(Fuente: Alkami Technology, Inc., comunicado de prensa, 2024)

Informe sobre el mercado de plataformas de banca digital: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de plataformas de banca digital (2023-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado Valor/volumen: global, regional, nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Preguntas frecuentes

The market is expected to reach US$ 13.99 billion by 2031.

The key players holding majority shares in the market are Appway AG, CREALOGIX Holding AG, EdgeVerve Systems Limited, Fiserv, Inc., and Oracle Corporation.

Blockchain for improved security is anticipated to play a significant role in the digital banking platform market in the coming years.

The growing need for tailored banking services and the shift towards mobile banking are the major factors that propel the digital banking platform market.

The market was estimated to be US$ 5.61 billion in 2023 and is expected to grow at a CAGR of 12.1% during the forecast period 2023 - 2031.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenga una muestra gratuita de este informe

Obtenga una muestra gratuita de este informe