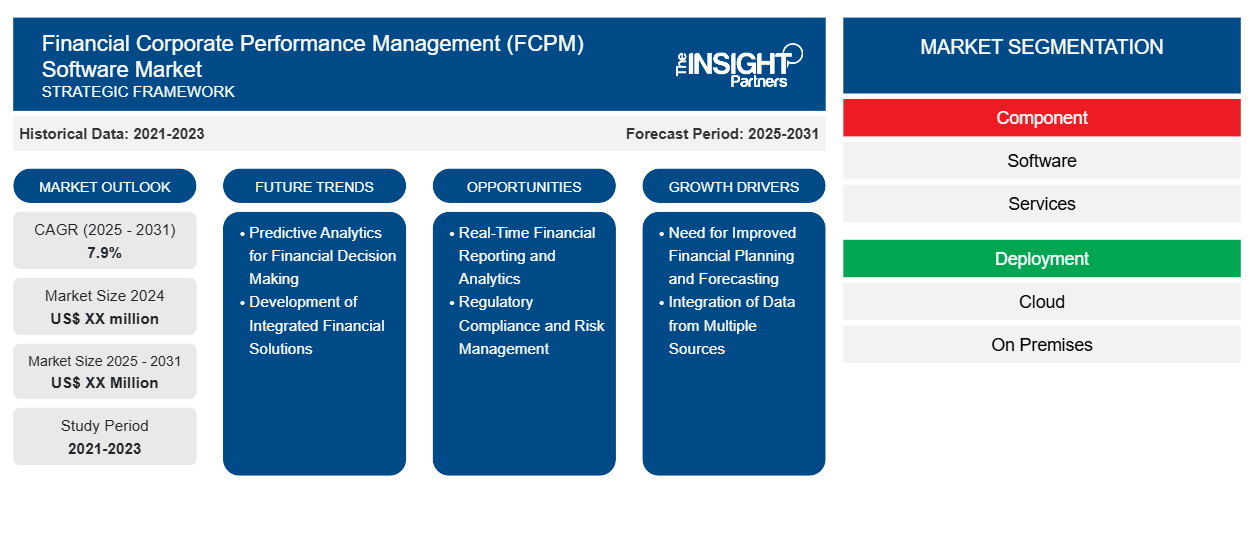

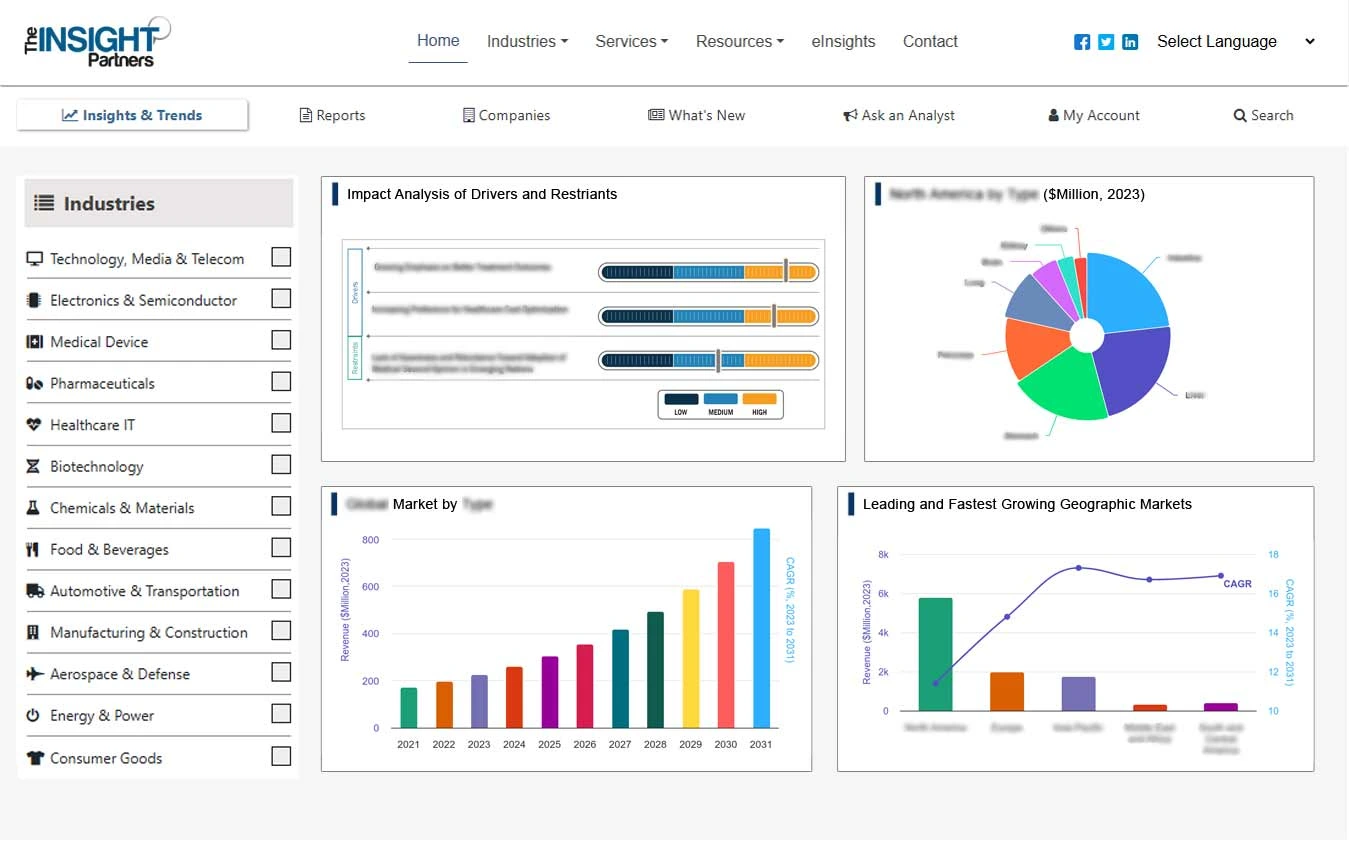

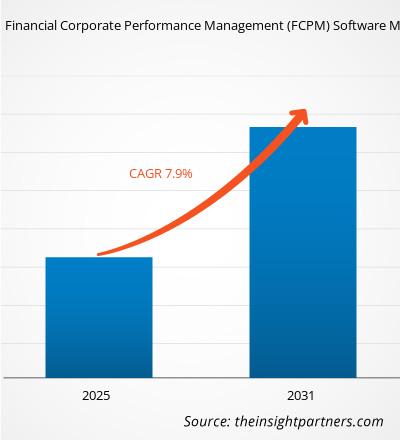

Se espera que el mercado de software de gestión del rendimiento corporativo financiero (FCPM) registre una CAGR del 7,9 % entre 2024 y 2031, con un tamaño de mercado que se expandirá de US$ XX millones en 2024 a US$ XX millones en 2031.

El informe está segmentado por componente (software, servicios), implementación (nube, instalaciones locales) y tamaño de la empresa (grandes empresas, pymes). El análisis global se desglosa a nivel regional y por países principales. El informe ofrece el valor en USD para el análisis y los segmentos anteriores.

Propósito del Informe

El informe Financial Corporate Performance Management (FCPM) Software Market de The Insight Partners tiene como objetivo describir el panorama actual y el crecimiento futuro, los principales factores impulsores, los desafíos y las oportunidades. Esto proporcionará información a diversas partes interesadas del negocio, como:

- Proveedores/fabricantes de tecnología: Para comprender la dinámica cambiante del mercado y conocer las oportunidades potenciales de crecimiento, lo que les permitirá tomar decisiones estratégicas informadas.

- Inversionistas: Realizar un análisis exhaustivo de tendencias sobre la tasa de crecimiento del mercado, las proyecciones financieras del mercado y las oportunidades que existen en toda la cadena de valor.

- Órganos reguladores: Regular las políticas y vigilar las actividades del mercado con el objetivo de minimizar los abusos, preservar la confianza de los inversores y defender la integridad y la estabilidad del mercado.

Segmentación del mercado de software de gestión del rendimiento financiero corporativo (FCPM)

Componente

- Software

- Servicios

Despliegue

- Nube

- En las instalaciones

Tamaño de la empresa

- Grandes empresas

- PYMES

Geografía

- América del norte

- Europa

- Asia-Pacífico

- América del Sur y Central

- Oriente Medio y África

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de software de gestión del rendimiento financiero corporativo (FCPM): perspectivas estratégicas

- Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores del crecimiento del mercado del software de gestión del rendimiento financiero corporativo (FCPM)

- Necesidad de una mejor planificación y previsión financiera: las organizaciones necesitan una planificación y previsión financiera precisa para mantenerse al día con el rápido ritmo del entorno empresarial. El software FCPM permite a los equipos financieros crear modelos financieros más precisos, predecir flujos de efectivo y gestionar mejor sus presupuestos. Las funciones de análisis de escenarios, entrada de datos históricos y ajustes en vivo en las previsiones brindan a las empresas una ventaja estratégica. La creciente incertidumbre económica y el entorno de mercado en rápida evolución han creado una necesidad urgente de una previsión y planificación financiera más sofisticada, y se ha convertido en una de las principales razones para adoptar el software FCPM.

- Integración de datos de múltiples fuentes: el mundo financiero moderno es muy complejo y las empresas trabajan con muchas fuentes de datos, incluidos sistemas financieros internos, bases de datos de clientes, sistemas ERP (planificación de recursos empresariales) y datos de mercado externos. El software FCPM está diseñado para integrar y consolidar los datos que provienen de fuentes tan variadas en una única plataforma unificada. Agiliza la generación de informes, elimina los silos de información y ayuda a las organizaciones en la toma de decisiones. La demanda de integración de datos multifuncionales para obtener información financiera integral está aumentando e impulsa la necesidad de soluciones FCPM.

Tendencias futuras del mercado de software de gestión del rendimiento financiero corporativo (FCPM)

- Análisis predictivo para la toma de decisiones financieras: para poder prever lo que puede deparar el futuro en cuanto a tendencias y resultados financieros, el análisis predictivo se considerará una característica clave del software FCPM. El uso de modelos predictivos ayudará a pronosticar el crecimiento de los ingresos, gestionar los riesgos financieros y la asignación adecuada de recursos por parte de las empresas. Este análisis predictivo permitirá a las empresas tomar las decisiones más informadas al tiempo que desarrollan estrategias basadas en datos. Con la mejora continua de sus capacidades predictivas, las soluciones FCPM también mejorarán para ayudar a las organizaciones a hacer frente a condiciones económicas inciertas.

- Desarrollo de soluciones financieras integradas: las empresas tienen la oportunidad de desarrollar soluciones financieras integradas de gestión del rendimiento financiero que combinen funciones de análisis, presupuestos, previsiones y generación de informes. Estas soluciones integrales pueden satisfacer las diversas necesidades de las organizaciones y ofrecer una solución integral para la gestión del rendimiento financiero.

Oportunidades de mercado del software de gestión del rendimiento financiero corporativo (FCPM)

- Informes y análisis financieros en tiempo real: las empresas necesitan información financiera procesable en tiempo real para tomar decisiones rápidas. El software FCPM es capaz de generar informes en tiempo real y análisis avanzados, lo que puede ayudar a los gerentes financieros y ejecutivos a monitorear el desempeño en relación con los KPI (indicadores clave de desempeño) y saber dónde se requiere atención. Con la creciente demanda de toma de decisiones en tiempo real, las organizaciones están recurriendo a soluciones FCPM que pueden proporcionar métricas financieras precisas a pedido, lo que las ayuda a responder a los cambios del mercado y optimizar el desempeño comercial.

- Cumplimiento normativo y gestión de riesgos: con la creciente complejidad de las regulaciones financieras en todo el mundo, las empresas necesitan garantizar el cumplimiento de diversas reglas y estándares, incluidas las NIIF (Normas Internacionales de Información Financiera), SOX (Ley Sarbanes-Oxley) y las regulaciones fiscales locales. El software FCPM ayuda a las organizaciones a automatizar los procesos de cumplimiento y gestionar los informes regulatorios de manera más eficiente. Además, facilita la gestión de riesgos al identificar los riesgos financieros potenciales y realizar un seguimiento del desempeño en relación con el umbral de esos riesgos; la información obtenida proporcionará los mejores conocimientos para reducirlos. Esta necesidad de una gestión de riesgos y un cumplimiento normativo adecuados impulsa significativamente el crecimiento del mercado de software FCPM.

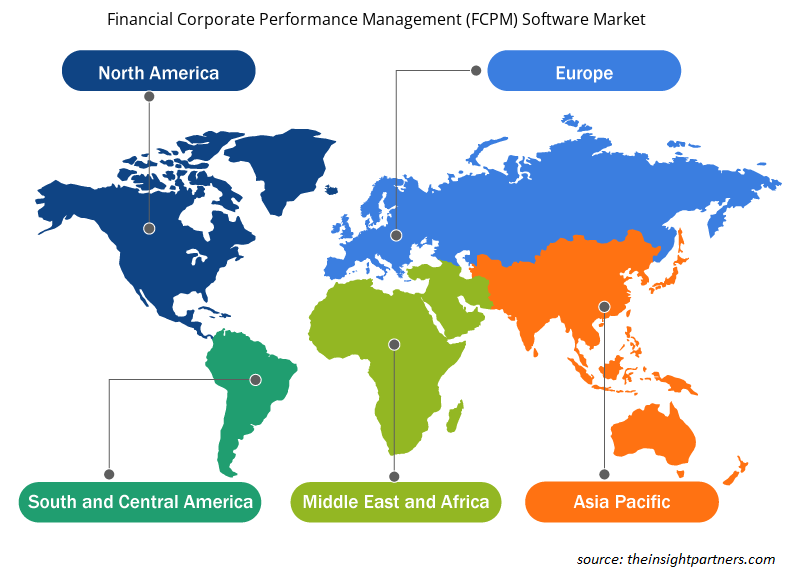

Perspectivas regionales del mercado de software de gestión del rendimiento financiero corporativo (FCPM)

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de software de gestión del rendimiento financiero corporativo (FCPM) durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de software de gestión del rendimiento financiero corporativo (FCPM) en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de software de gestión del rendimiento financiero corporativo (FCPM)

Alcance del informe sobre el mercado de software de gestión del rendimiento financiero corporativo (FCPM)

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2024 | XX millones de dólares estadounidenses |

| Tamaño del mercado en 2031 | US$ XX millones |

| Tasa de crecimiento anual compuesta (CAGR) global (2025-2031) | 7,9% |

| Datos históricos | 2021-2023 |

| Período de pronóstico | 2025-2031 |

| Segmentos cubiertos | Por componente

|

| Regiones y países cubiertos | América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

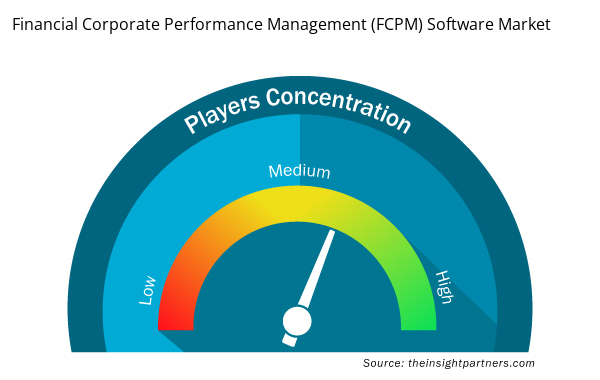

Densidad de actores del mercado de software de gestión del rendimiento financiero corporativo (FCPM): comprensión de su impacto en la dinámica empresarial

El mercado de software de gestión del rendimiento financiero corporativo (FCPM) está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de software de gestión del rendimiento financiero corporativo (FCPM) son:

- Oráculo

- SAP SE

- Servicios web de Amazon (AWS) Inc.

- Google LLC

- Microsoft

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de software de gestión del rendimiento financiero corporativo (FCPM)

Puntos de venta clave

- Cobertura integral: el informe cubre de manera integral el análisis de productos, servicios, tipos y usuarios finales del mercado de software de gestión del desempeño corporativo financiero (FCPM), proporcionando un panorama holístico.

- Análisis de expertos: el informe se compila sobre la base de un profundo conocimiento de expertos y analistas de la industria.

- Información actualizada: El informe asegura relevancia comercial debido a su cobertura de información reciente y tendencias de datos.

- Opciones de personalización: este informe se puede personalizar para satisfacer los requisitos específicos del cliente y adaptarse adecuadamente a las estrategias comerciales.

Por lo tanto, el informe de investigación sobre el mercado de software de gestión del rendimiento financiero corporativo (FCPM) puede ayudar a abrir el camino para descifrar y comprender el escenario de la industria y las perspectivas de crecimiento. Si bien puede haber algunas preocupaciones válidas, los beneficios generales de este informe tienden a superar las desventajas.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado Valor/volumen: global, regional, nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Preguntas frecuentes

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation as our team would review the same and check the feasibility

The major factors driving the financial corporate performance management (FCPM) software market are:

1. Need for Improved Financial Planning and Forecasting

2. Integration of Data from Multiple Sources

Predictive Analytics for Financial Decision Making is anticipated to play a significant role in the global financial corporate performance management (FCPM) software market in the coming years

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request

The Financial Corporate Performance Management (FCPM) Software Market is estimated to witness a CAGR of 7.9% from 2023 to 2031

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

1.Oracle

2.SAP SE

3.Amazon Web Services (AWS) Inc.

4.Google LLC

5.Microsoft

6.IBM Corp.

7.MuleSoft, LLC

8.Axiom

9.Visyond Ventures,

10.Cubus AG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenga una muestra gratuita de este informe

Obtenga una muestra gratuita de este informe