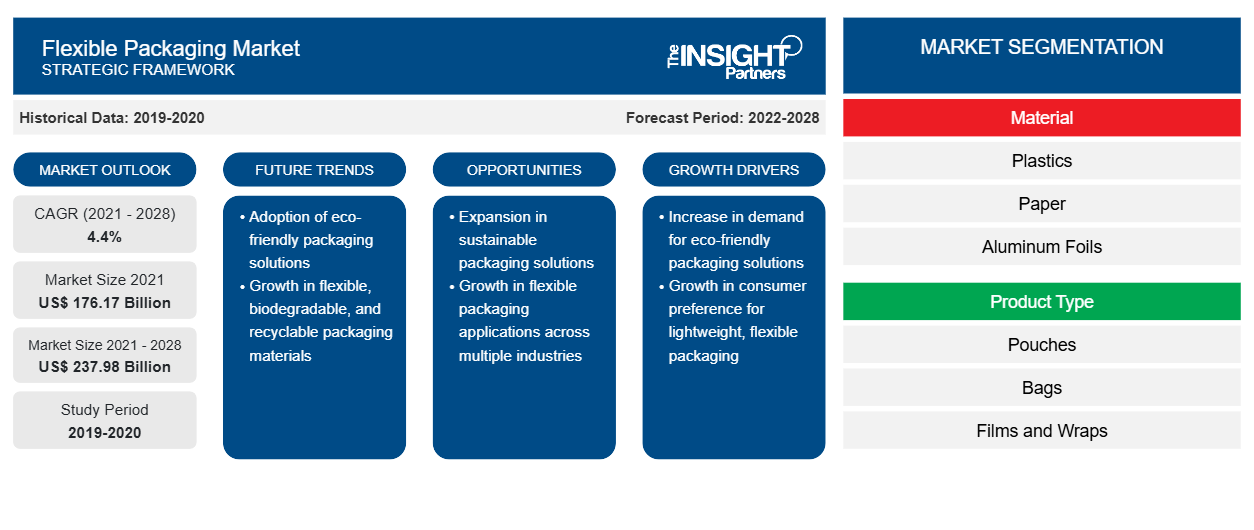

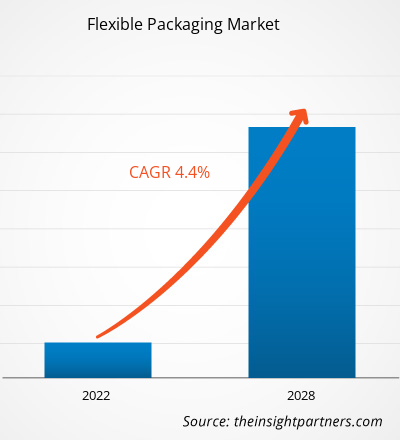

Se proyecta que el mercado de envases flexibles alcance los 237.975,67 millones de dólares en 2028, frente a los 176.173,61 millones de dólares en 2021; se espera que crezca a una CAGR del 4,4% entre 2021 y 2028.

Los envases flexibles incluyen revestimientos, bolsas, sellos, paquetes de muestra y bolsas. Pueden estar compuestos de película, plástico, papel, papel de aluminio, etc. Se utilizan para diversos alimentos y bebidas, productos de consumo, CD de música, productos farmacéuticos, paquetes de software informático y nutracéuticos. La durabilidad que ofrecen los envases flexibles permite a los fabricantes imprimir diseños personalizados llamativos y de alta calidad, que aumentan la visibilidad del producto en un entorno minorista.

En 2020, Asia Pacífico tuvo la mayor participación en los ingresos del mercado mundial de envases flexibles . Según la Cooperación Económica Asia-Pacífico, Australia es uno de los países desarrollados de APAC. El sector de alimentos y bebidas es la industria manufacturera más grande de Australia, y representa el 32% de la facturación total de fabricación del país. Según el Informe sobre el estado de la industria de 2019 del Consejo Australiano de Alimentos y Comestibles, el sector de alimentos y bebidas, comestibles y productos frescos tiene un valor de USD 85,32 mil millones. La industria está compuesta por 15.000 empresas de todos los tamaños que emplean a más de 273.000 personas. La creciente industria de alimentos y bebidas impulsa el mercado de envases flexibles.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

- Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impacto de la pandemia de COVID-19 en el mercado de envases flexibles

El cierre de las unidades de fabricación, la dificultad en la adquisición de materias primas y las restricciones en la logística han tenido un impacto negativo en el mercado de los envases flexibles. Sin embargo, la COVID-19 ha provocado un aumento masivo de la entrega de comestibles en línea. Además, las industrias de alimentos y bebidas envasados están siendo testigos de un aumento en la demanda de alimentos y bebidas estables en almacenamiento, incluidos los productos lácteos, a medida que los consumidores se apresuran a abastecer las despensas. Millones de hogares comenzaron a comprar comestibles en línea para recogerlos o entregarlos a domicilio, y muchos seguirán utilizando opciones de comercio electrónico después de que pase la crisis. Además, la creciente demanda de productos alimenticios procesados, como los alimentos orientados a la conveniencia que generalmente utilizan materiales de envasado premium de alta barrera para una mayor vida útil, está preparada para alentar la necesidad de envases flexibles.

Perspectivas del mercado

Aumento del consumo de alimentos y bebidas procesados

Según el informe de Anu Food Brazil, los ingresos totales del sector minorista de alimentos brasileño fueron de US$ 96 mil millones en 2019. La industria de alimentos y bebidas en Brasil logró un crecimiento del 6,7% en 2019 y del 12,8% en 2020. El mercado de alimentos congelados está prosperando en Brasil. El mercado de alimentos congelados está prosperando en Brasil debido a la expansión de la clase media, el aumento del poder adquisitivo y un aumento en el número de personas que trabajan a tiempo completo. Por lo tanto, la creciente preferencia de los consumidores por los alimentos de conveniencia impulsa el mercado de envases flexibles.

Perspectivas de la industria de los materiales

Según el material, el mercado mundial de envases flexibles se segmenta en plásticos, papel, láminas de aluminio y otros. El segmento de plásticos tuvo la mayor participación del mercado mundial de envases flexibles en 2020. Los envases de plástico flexibles implican varios tipos de material plástico que se utilizan para el envasado de diferentes productos. El tipo de material utilizado en el embalaje depende de la aplicación y el tipo de producto que se va a envasar. Generalmente, se utilizan materiales plásticos, como polietileno, polipropileno, poliestireno y cloruro de polivinilo, en los envases de plástico flexibles. Los envases flexibles se consideran la forma más conveniente y económica de conservar, distribuir y envasar alimentos, bebidas, productos farmacéuticos y varios consumibles.

Algunos de los actores clave que operan en el mercado global de envases flexibles incluyen Amcor plc, Huhtamaki, Mondi, Berry Global Inc., Sealed Air, Sonoco Products Company, Coveris, Constantia Flexibles, Flexpak Services y Transcontinental Inc. Los actores que operan en el mercado están altamente enfocados en el desarrollo de ofertas de productos innovadores y de alta calidad para satisfacer los requisitos de los clientes.

Perspectivas regionales del mercado de envases flexibles

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de envases flexibles durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de envases flexibles en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de envases flexibles

Alcance del informe de mercado de envases flexibles

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 176,17 mil millones |

| Tamaño del mercado en 2028 | US$ 237,98 mil millones |

| CAGR global (2021-2028) | 4,4% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos | Por material

|

| Regiones y países cubiertos | América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

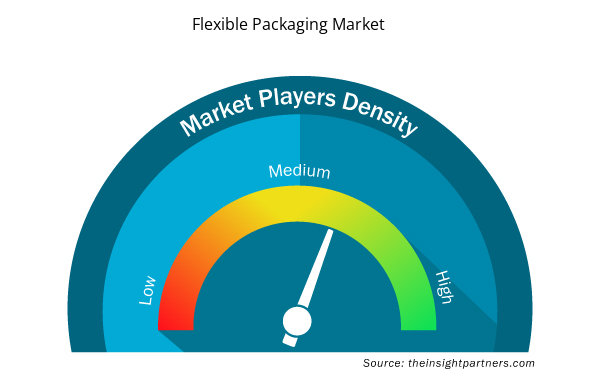

Densidad de actores del mercado de envases flexibles: comprensión de su impacto en la dinámica empresarial

El mercado de envases flexibles está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de envases flexibles son:

- Amcor plc

- Huhtamaki

- Mundo

- Compañía global de bayas Inc.

- Aire sellado

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de envases flexibles

Informe Destacado

- Tendencias progresivas en la industria de envases flexibles para ayudar a los actores a desarrollar estrategias efectivas a largo plazo

- Estrategias de crecimiento empresarial adoptadas por los actores del mercado en países desarrollados y en desarrollo

- Análisis cuantitativo del mercado de envases flexibles de 2019 a 2028

- Estimación de la demanda mundial de envases flexibles

- Análisis de las cinco fuerzas de Porter para ilustrar la eficacia de los compradores y proveedores que operan en la industria

- Avances recientes para comprender el escenario competitivo del mercado

- Tendencias y perspectivas del mercado, así como factores que impulsan y restringen el crecimiento del mercado de envases flexibles

- Asistencia en el proceso de toma de decisiones destacando las estrategias de mercado que sustentan el interés comercial, lo que conduce al crecimiento del mercado.

- El tamaño del mercado de envases flexibles en varios nodos

- Descripción detallada y segmentación del mercado, así como de la dinámica de la industria.

- Tamaño del mercado de envases flexibles en diversas regiones con prometedoras oportunidades de crecimiento

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado Valor/volumen: global, regional, nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Preguntas frecuentes

The major players operating in the global flexible packaging market are Amcor plc; Huhtamaki; Mondi; Berry Global Inc.; Sealed Air; Sonoco Products Company; Coveris; Constantia Flexibles; Flexpak services; Transcontinental Inc.

In 2020, Asia-Pacific accounted for the largest share of the global flexible packaging market. The market for flexible packaging across Asia-Pacific has witnessed notable growth owing to the rapidly expanding packaging industry, growth of the food retail sector, and rising consumer awareness about sustainable packaging solutions across the region. The foodservice sector in Asia-Pacific is rapidly expanding owing to rapid economic growth, growth of the tourism sector, improving lifestyles of consumers, and rising disposable income levels. The region's food & beverage market is witnessing significant growth due to ample availability of various varieties of functional food and drinks and their growing demand among the millennial population. According to The Annual Report on Catering Industry Development of China 2019 (ARCIDC), China is the second-largest food and beverage economy across the world. The food and beverage revenue in China was over US$ 620 billion in 2018. The report further states that the online sales of food and beverages increased by US$ 44 billion from 2011 to 2017. Hence the growing demand for food & beverage in the region drives the flexible packaging market.

In 2020, the plastics segment accounted for the largest market share. Flexible plastic packaging delivers a wide range of protective properties while ensuring a minimum amount of material being used. It is made from high-grade polymers such as PVC, polyamide, polypropylene, and polyethylene. These polymers are FDA-approved and are contaminant-free. They can take on extreme temperatures and pressures. Furthermore, they also act as a protective layer for the food and beverage by protecting it from micro-organisms, UV rays, moisture, and dust.

The bags segment held the largest share of the market in 2020. These are commonly made of metal foil, plastic, and occasionally, paper. These bags are used in various packaging applications including food products, confectionery products, biscuits, coffee, powdered milk, snacks, etc. Also, these bags are easy for transport, material savings, and repeated use.

In 2020, Asia-Pacific is the fastest-growing region in the global flexible packaging market. According to Asia-Pacific Economic Cooperation, Australia is one of the developed countries in APAC. The food & beverage sector is Australia’s largest manufacturing industry, accounting for 32% of the country’s total manufacturing turnover. According to the Australian Food and Grocery Council’s 2019 State of the Industry Report, the food & beverage, grocery, and fresh produce sector is worth $122 billion. The industry is made up of 15,000 businesses of all sizes that employ over 273,000 people. The growing food & beverage industry drives the flexible packaging market.

The food and beverages segment held the largest share of the market in 2020. Flexible packaging is widely used for packaging food products such as eggs, fresh fruits and vegetables, and salad, among others. Flexible packaging protects products from moisture, UV rays, mold, dust, and other environmental contaminants that can negatively affect the product, thereby maintaining its quality and extending its shelf life. Also, with the growth of online food delivery channels the demand for flexible, affordable, and recyclable packaging is also on a rise.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Flexible Packaging Market

- Amcor plc

- Huhtamaki

- Mondi

- Berry Global Inc.

- Sealed Air

- Sonoco Products Company

- Coveris

- Constantia Flexibles

- Flexpak services

- Transcontinental Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenga una muestra gratuita de este informe

Obtenga una muestra gratuita de este informe