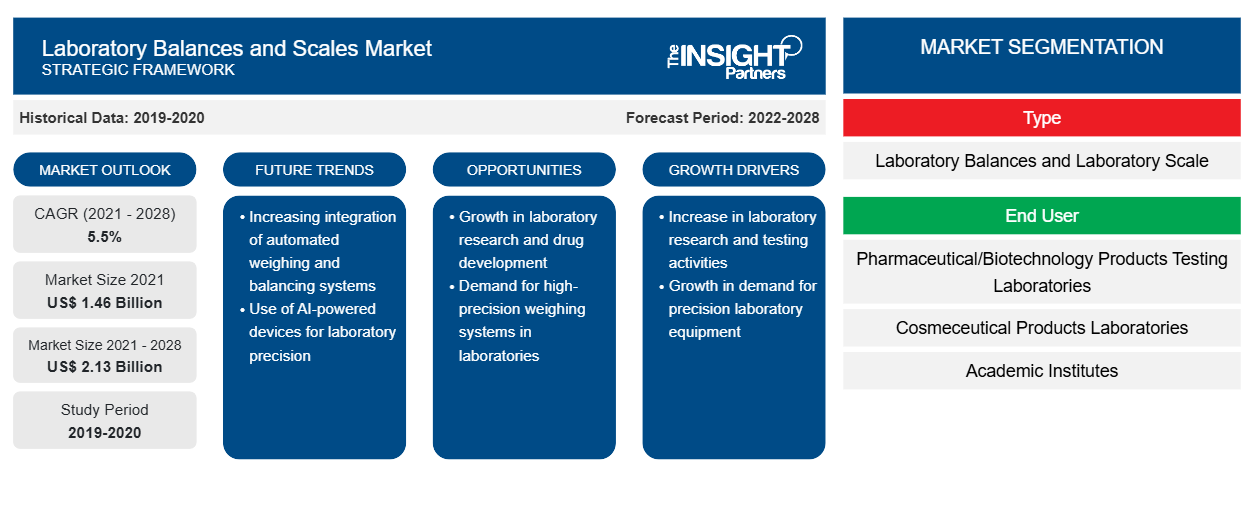

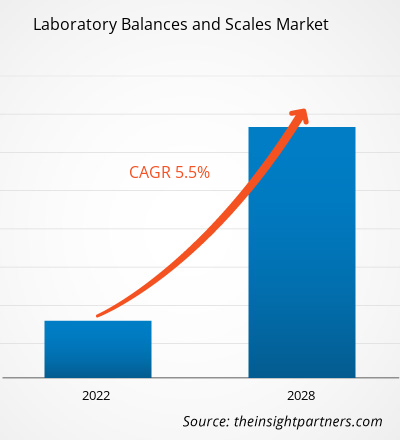

Se espera que el mercado de balanzas y básculas de laboratorio alcance los 2.131,14 millones de dólares en 2028, frente a los 1.463,53 millones de dólares en 2021. Se estima que el mercado crecerá a una CAGR del 5,5 % entre 2021 y 2028.

El alcance del mercado de balanzas y básculas de laboratorio incluye el tipo, el usuario final y la región. El mercado de balanzas y básculas de laboratorio, según la región, está segmentado en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central. El informe ofrece información y un análisis en profundidad del mercado de balanzas y básculas de laboratorio haciendo hincapié en varios parámetros, como las tendencias del mercado, los avances tecnológicos, la dinámica del mercado y el análisis del panorama competitivo de los principales actores del mercado en todo el mundo. También incluye un análisis del impacto de COVID-19 en todas las regiones.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

- Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Perspectivas del mercado

Aumento del número de líneas de investigación de empresas farmacéuticas y biotecnológicas y organizaciones de investigación por contrato

La infraestructura sanitaria está experimentando un gran crecimiento en la cantidad de ensayos clínicos y de investigaciones en curso en todo el mundo. Los ensayos clínicos son un paso crucial y significativo para evaluar la seguridad y la eficacia de una estrategia, un tratamiento o un dispositivo médico para su uso comercial. Estos estudios también ayudan a comprender y determinar los mejores enfoques médicos para un área terapéutica en particular. Los ensayos clínicos se llevan a cabo principalmente para recopilar datos sobre la seguridad y la eficacia de un nuevo fármaco y el desarrollo de un dispositivo. Antes de que las autoridades reguladoras aprueben las moléculas de los fármacos o los dispositivos médicos, se llevan a cabo una serie de estudios clínicos.

Número de estudios registrados para ensayos clínicos

Año de primera publicación | Estudios al inicio del año | Estudios durante el año | Estudios de fin de año |

2015 | 181.304 | 24.130 | 205.434 |

2016 | 205.434 | 27.809 | 233.243 |

2017 | 233.243 | 29,198 | 262.441 |

2018 | 262.441 | 17.836 | 280.277 |

2019 | 293.275 | 32,519 | 325.794 |

2020 | 325.794 | 36.740 | 362.534 |

Fuente: Clinical Trials.gov y análisis de The Insight Partners

Por lo tanto, el creciente número de ensayos clínicos acelera la demanda de instrumentos y equipos de laboratorio, lo que en última instancia impulsará el mercado de básculas y balanzas de laboratorio durante el período de pronóstico.

Perspectivas basadas en tipos

El mercado de balanzas y básculas de laboratorio , por tipo, se segmenta en balanzas de laboratorio y básculas de laboratorio. El segmento de balanzas de laboratorio se subdivide a su vez en balanzas analíticas, balanzas de carga superior/precisión, balanzas micro y ultramicro, balanzas de humedad, balanzas portátiles y otras balanzas. El segmento de básculas de laboratorio también se subdivide a su vez en básculas de sobremesa, básculas contadoras, básculas compactas y otras básculas. El segmento de balanzas de laboratorio tuvo la mayor participación del mercado en 2021, mientras que se prevé que el mismo segmento registre la CAGR más alta del 5,8% en el mercado durante el período de pronóstico.

Perspectivas regionales del mercado de balanzas y básculas de laboratorio

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de balanzas y básculas de laboratorio durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de balanzas y básculas de laboratorio en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de balanzas y básculas de laboratorio

Alcance del informe de mercado de balanzas y básculas de laboratorio

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | 1.460 millones de dólares estadounidenses |

| Tamaño del mercado en 2028 | US$ 2,13 mil millones |

| CAGR global (2021-2028) | 5,5% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos | Por tipo

|

| Regiones y países cubiertos | América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

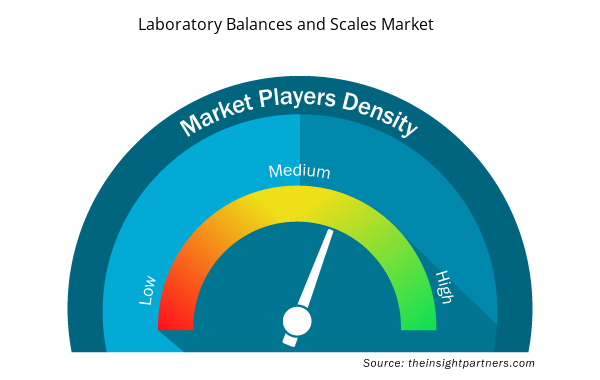

Densidad de los actores del mercado de balanzas y básculas de laboratorio: comprensión de su impacto en la dinámica empresarial

El mercado de balanzas y básculas de laboratorio está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de balanzas y básculas de laboratorio son:

- METTLER TOLEDO

- Sartorius AG

- Instrumentos PCE

- OHAUS

- Equipo Adam Ltd.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de balanzas y básculas de laboratorio

Información basada en el usuario final

Según las indicaciones, el mercado de balanzas y básculas de laboratorio abarca laboratorios de prueba de productos farmacéuticos y biotecnológicos, laboratorios de productos cosmecéuticos, institutos académicos y laboratorios de investigación. Los laboratorios de prueba de productos farmacéuticos y biotecnológicos tuvieron la mayor participación del mercado en 2020, y se estima que el mismo segmento registrará la CAGR más alta del mercado del 6,7% durante el período de pronóstico.

Las estrategias inorgánicas, como las asociaciones y las fusiones y adquisiciones, son comúnmente adoptadas por las empresas para satisfacer la cambiante demanda de los clientes y mantener su marca en todo el mundo. Los actores del mercado que operan en el mercado de balanzas y básculas de laboratorio también adoptan estrategias orgánicas, como el lanzamiento y la expansión de productos, para ampliar su presencia y su cartera de productos en todo el mundo, así como para satisfacer la creciente demanda.

Por tipo

- Balanzas de laboratorio

- Balanzas Analíticas

- Balanzas de carga superior/de precisión

- Balanzas micro y ultramicro

- Balances de humedad

- Balanzas portátiles

- Otros saldos

- Básculas de laboratorio

- Básculas de banco

- Básculas de conteo

- Básculas compactas

- Otras escalas

Por el usuario final

- Laboratorios de análisis de productos farmacéuticos y biotecnológicos

- Laboratorios de productos cosmecéuticos

- Institutos académicos

- Laboratorios de investigación

Por geografía

- América del norte

- A NOSOTROS

- Canadá

- México

- Europa

- Francia

- Alemania

- Italia

- Reino Unido

- España

- Resto de Europa

- Asia Pacífico (APAC)

- Porcelana

- India

- Corea del Sur

- Japón

- Australia

- Resto de APAC

- Oriente Medio y África (MEA)

- Sudáfrica

- Arabia Saudita

- Emiratos Árabes Unidos

- Resto de MEA

- América del Sur y Central (SCAM)

- Brasil

- Argentina

- Resto de estafa

Perfiles de empresas

- METTLER TOLEDO

- Sartorius AG

- Instrumentos PCE

- OHAUS

- Equipo Adam Ltd.

- PRECISIÓN EN GRAMOS

- Balanzas y básculas RADWAG

- Empresa Scientech Inc.

- BONSO Electrónica Internacional Inc.

- Compañía A&D, Limitada

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado Valor/volumen: global, regional, nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

- Asset Integrity Management Market

- Batter and Breader Premixes Market

- Health Economics and Outcome Research (HEOR) Services Market

- HVAC Sensors Market

- Fishing Equipment Market

- Smart Water Metering Market

- Non-Emergency Medical Transportation Market

- Nitrogenous Fertilizer Market

- Micro-Surgical Robot Market

- Malaria Treatment Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Preguntas frecuentes

The costs of the Laboratory Balances and Scales are much higher, and they may cost US$ 300–1500, or more, per type. The cost may also differ from product to product types.

Driving factors include rapid growth of pharmaceutical and biotechnology industry and increasing number of research pipeline of pharma-biotech companies and contract research organizations. However, the limited replacement rate among end users is likely to hamper the growth of the market to a certain extent.

Micro catheter is small-diameter catheter, preferably used during minimally invasive surgeries. . Laboratory balances are specifically used to measure mass of the substance, while laboratory scales are utilized to measure weight of the substances. These scales and balances are classified on the basis of weighing capacity. Weighing of materials play a vital role in research and development as well as production monitoring and quality control.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Laboratory Balances and Scales Market

- METTLER TOLEDO

- Sartorius AG

- PCE Instruments

- OHAUS

- Adam Equipment Ltd

- GRAM PRECISION

- RADWAG Balances and Scales

- Scientech Inc.

- BONSO Electronics International Inc.

- A&D Company, Limited

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenga una muestra gratuita de este informe

Obtenga una muestra gratuita de este informe