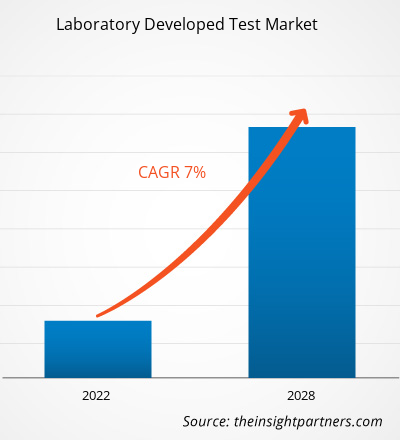

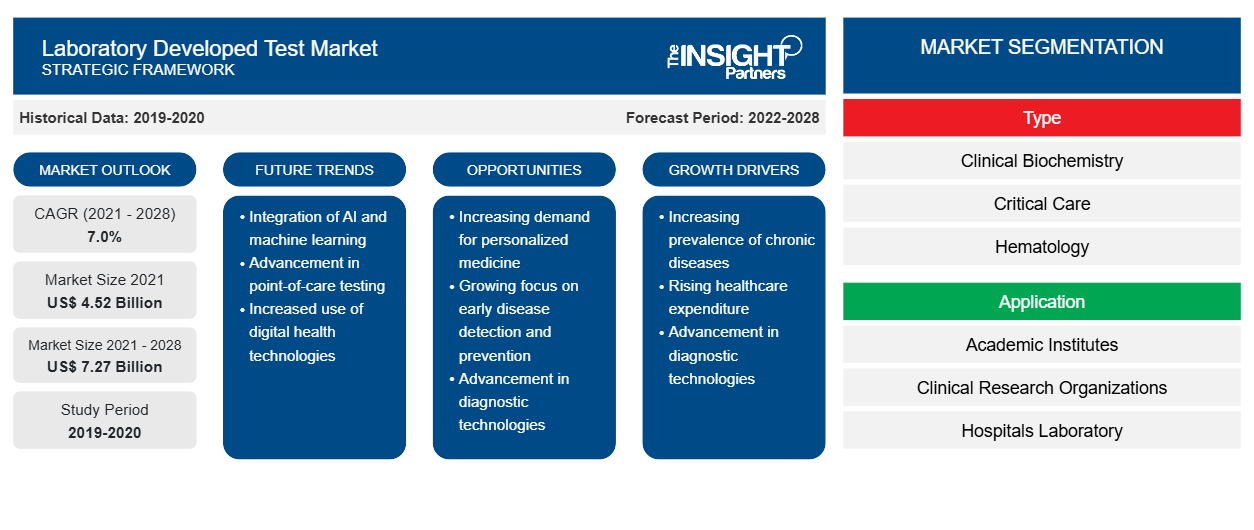

Se espera que el mercado de pruebas desarrollado en laboratorio alcance los US$ 7.269,3 millones para 2028 desde los US$ 4.524,75 millones en 2021; se espera que crezca a una CAGR del 7,0% durante 2021-2028.

Una prueba desarrollada en laboratorio (LDT, por sus siglas en inglés) es un tipo de prueba de diagnóstico in vitro diseñada y utilizada en un solo laboratorio. Estas pruebas se pueden utilizar para estimar o distinguir analitos como proteínas, biomoléculas/compuestos (glucosa, colesterol, etc.) y ADN extraído de muestras recolectadas de sujetos humanos. La expansión de los métodos automatizados de diagnóstico in vitro (IVD, por sus siglas en inglés) para que los laboratorios y dispensarios brinden análisis precisos y sin errores está impulsando el crecimiento del mercado de pruebas desarrolladas en laboratorio.

El crecimiento del mercado de pruebas desarrolladas en laboratorio se atribuye principalmente a factores como el aumento de la incidencia de cáncer y trastornos genéticos y la gran cantidad de lanzamientos de productos. Sin embargo, el cambiante panorama regulatorio está obstaculizando el crecimiento del mercado. Por ejemplo, en Europa, el cumplimiento del Reglamento sobre dispositivos in vitro (IVDR) será obligatorio para todas las pruebas de diagnóstico in vitro a partir de mayo de 2022; el reglamento tiene como objetivo garantizar la eficacia clínica y la seguridad de las pruebas médicas, transformando así la industria del diagnóstico, lo que es una gran preocupación para los actores del mercado.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Perspectivas del mercado

La investigación continua sobre medicamentos personalizados ofrece oportunidades de crecimiento a los actores del mercado de pruebas desarrolladas en laboratorio

Las LDT desempeñan un papel vital en el desarrollo de medicamentos personalizados que probablemente resulten ser medios prometedores para abordar enfermedades a través de tratamientos o curas eficaces que hasta ahora se habían eludido. Según la Personalized Medicine Coalition, los medicamentos personalizados representaban solo el 5% de las nuevas entidades moleculares aprobadas por la FDA en 2005; sin embargo, en 2016, este número aumentó a más del 25%. Además, el 42% de todos los compuestos y el 73% de los compuestos oncológicos en desarrollo tienen el potencial de servir como medicamentos personalizados. Las empresas biofarmacéuticas casi han duplicado sus inversiones en I+D en medicamentos personalizados en los últimos cinco años, y se espera que aumenten aún más sus inversiones en un 33% en los próximos cinco años. Los investigadores biofarmacéuticos también predicen un aumento del 69% en el desarrollo de medicamentos personalizados en los próximos cinco años. Las pruebas de laboratorio se utilizan para diagnosticar enfermedades y predecir y monitorear la respuesta a los medicamentos, así como para obtener datos informáticos necesarios para algoritmos predictivos complejos. play a vital role in the development of personalized medicines that are likely to prove as promising means of tackling diseases through far eluded effective treatments or cures. As per the Personalized Medicine Coalition, personalized medicines accounted for only 5% of the new FDA-approved molecular entities in 2005; however, in 2016, this number rose to more than 25%. Additionally, 42% of all compounds and 73% of oncology compounds in the pipeline have the potential to serve as personalized medicines. Biopharmaceutical companies have nearly doubled their R&D investments in personalized drugs in the last five years, and they are further expected to increase their investments by 33% in the next five years. Biopharmaceutical researchers also predict a 69% increase in the development of personalized medicines in the next five years. Laboratory tests are used to diagnose illness and predict and monitor drug response as well as to obtain informatics data needed for complex predictive algorithms.

Los medicamentos personalizados se están convirtiendo en la marca registrada del tratamiento del cáncer; se trata de un enfoque en constante evolución que se basa en la personalización de los tratamientos según la composición genética individual. En 2019, la FDA aprobó 12 medicamentos personalizados para investigar y abordar las causas fundamentales de la enfermedad, combinando así la medicina de precisión con la atención clínica. La creciente demanda de medicamentos personalizados ofrece importantes oportunidades de crecimiento para los actores que operan en el mercado de pruebas desarrolladas en laboratorio.

Perspectivas basadas en tipos

El mercado de pruebas desarrolladas en laboratorio, por tipo, está segmentado en bioquímica clínica, cuidados intensivos, hematología, microbiología, diagnóstico molecular, inmunología y otros. Se espera que el segmento de diagnóstico molecular tenga la mayor participación del mercado en 2021. Sin embargo, se anticipa que el segmento de hematología registre la CAGR más alta del mercado durante el período de pronóstico.CAGR in the market during the forecast period.

Perspectivas basadas en aplicaciones

Por aplicación, el laboratorio desarrolló una aplicación de mercado de prueba en institutos académicos, organizaciones de investigación clínica, laboratorios de hospitales, centros de diagnóstico especializados y otros. Se estima que el segmento de laboratorios de hospitales representará la mayor participación de mercado en 2021. Sin embargo, se anticipa que el segmento de centros de diagnóstico especializados registrará la CAGR más alta del mercado durante el período de pronóstico.CAGR in the market during the forecast period.

Los lanzamientos y aprobaciones de productos son estrategias que las empresas suelen adoptar para ampliar su presencia global y sus carteras de productos. Además, los actores del mercado de pruebas desarrollado en laboratorio se centran en la estrategia de asociación para ampliar su clientela, lo que, a su vez, les permite mantener su marca a nivel mundial.

El informe segmenta el mercado de pruebas desarrollado en laboratorio de la siguiente manera

Según el tipo, el mercado de pruebas desarrolladas en laboratorio se segmenta en bioquímica clínica, cuidados intensivos, hematología, microbiología, diagnóstico molecular, inmunología y otros. Según la aplicación, el mercado de pruebas desarrolladas en laboratorio se segmenta en institutos académicos, organizaciones de investigación clínica, laboratorios de hospitales, centros de diagnóstico especializados y otros. Sobre la base de la geografía, el mercado de pruebas desarrolladas en laboratorio se segmenta en América del Norte (EE. UU., Canadá y México), Europa (Reino Unido, Alemania, Francia, Italia, España y el resto de Europa), Asia Pacífico (China, Japón, India, Australia, Corea del Sur y el resto de Asia Pacífico), Oriente Medio y África (EAU, Arabia Saudita, Sudáfrica y el resto de Oriente Medio y África) y América del Sur y Central (Brasil, Argentina y el resto de América del Sur y Central).

Perspectivas regionales del mercado de pruebas desarrollado en laboratorio

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de pruebas desarrolladas en laboratorio durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de pruebas desarrolladas en laboratorio en América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur y Central.

- Obtenga los datos regionales específicos para el mercado de pruebas desarrollado en laboratorio

Alcance del informe de mercado de pruebas desarrolladas en laboratorio

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 4,52 mil millones |

| Tamaño del mercado en 2028 | 7.270 millones de dólares estadounidenses |

| CAGR global (2021-2028) | 7.0% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de pruebas desarrolladas en laboratorio: comprensión de su impacto en la dinámica empresarial

El mercado de pruebas desarrolladas en laboratorio está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de pruebas desarrolladas en laboratorio son:

- Quest Diagnostics Incorporated

- F. HOFFMANN-LA ROCHE LTD.,

- QIAGEN

- Illumina, Inc.,

- Eurofins Científico

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de pruebas desarrolladas en laboratorio

Perfiles de empresas

- Quest Diagnostics Incorporated

- F. HOFFMANN-LA ROCHE LTD.,

- QIAGEN

- Illumina, Inc.,

- Eurofins Científico

- Biodesix

- Biotecnologías adaptativas

- Bioteranósticos

- Rosetta Genomics Ltd.,

- Salud Guardián

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de pruebas desarrollado en laboratorio

Obtenga una muestra gratuita para - Mercado de pruebas desarrollado en laboratorio