La seguridad de los pagos es un marco que ayuda a proteger los sistemas de pago y reducir el fraude. La creciente popularidad de los pagos en línea y la creciente penetración de Internet son los factores que están impulsando el crecimiento del mercado de seguridad de pagos. El creciente número de aplicaciones de pago y la creciente industria del comercio electrónico están creando oportunidades para que las empresas que operan en el mercado obtengan una base de clientes más amplia y generen más ingresos. Los proveedores de seguridad de pagos se están centrando en ofrecer una solución más avanzada para ganar una posición sólida en el mercado de seguridad de pagos.

DINÁMICA DEL MERCADO

La creciente adopción de modos de pagos digitales, el aumento de una serie de actividades fraudulentas y las crecientes preocupaciones de seguridad entre los usuarios son los principales factores que se esperan. para impulsar el crecimiento del mercado de pagos digitales. Sin embargo, la falta de confianza en las transacciones en línea es el principal factor restrictivo. El mercado de seguridad de pagos está muy fragmentado con la presencia de varios grandes actores, así como empresas de nivel 2.

ALCANCE DEL MERCADO

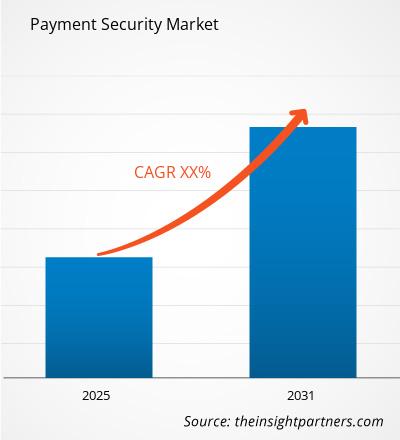

El "Análisis del mercado global de seguridad de pagos hasta 2031" es un estudio especializado y en profundidad de la industria de la seguridad de pagos con un enfoque especial en la Análisis de tendencias del mercado global. El informe tiene como objetivo proporcionar una descripción general del mercado de seguridad de pagos con una segmentación detallada del mercado por componente, tamaño de la empresa, industria vertical y geografía. Se espera que el mercado mundial de seguridad de pagos sea testigo de un alto crecimiento durante el período de pronóstico. El informe proporciona estadísticas clave sobre el estado del mercado de los principales actores del mercado de seguridad de pagos y ofrece tendencias y oportunidades clave en el mercado de seguridad de pagos.

SEGMENTACIÓN DEL MERCADO

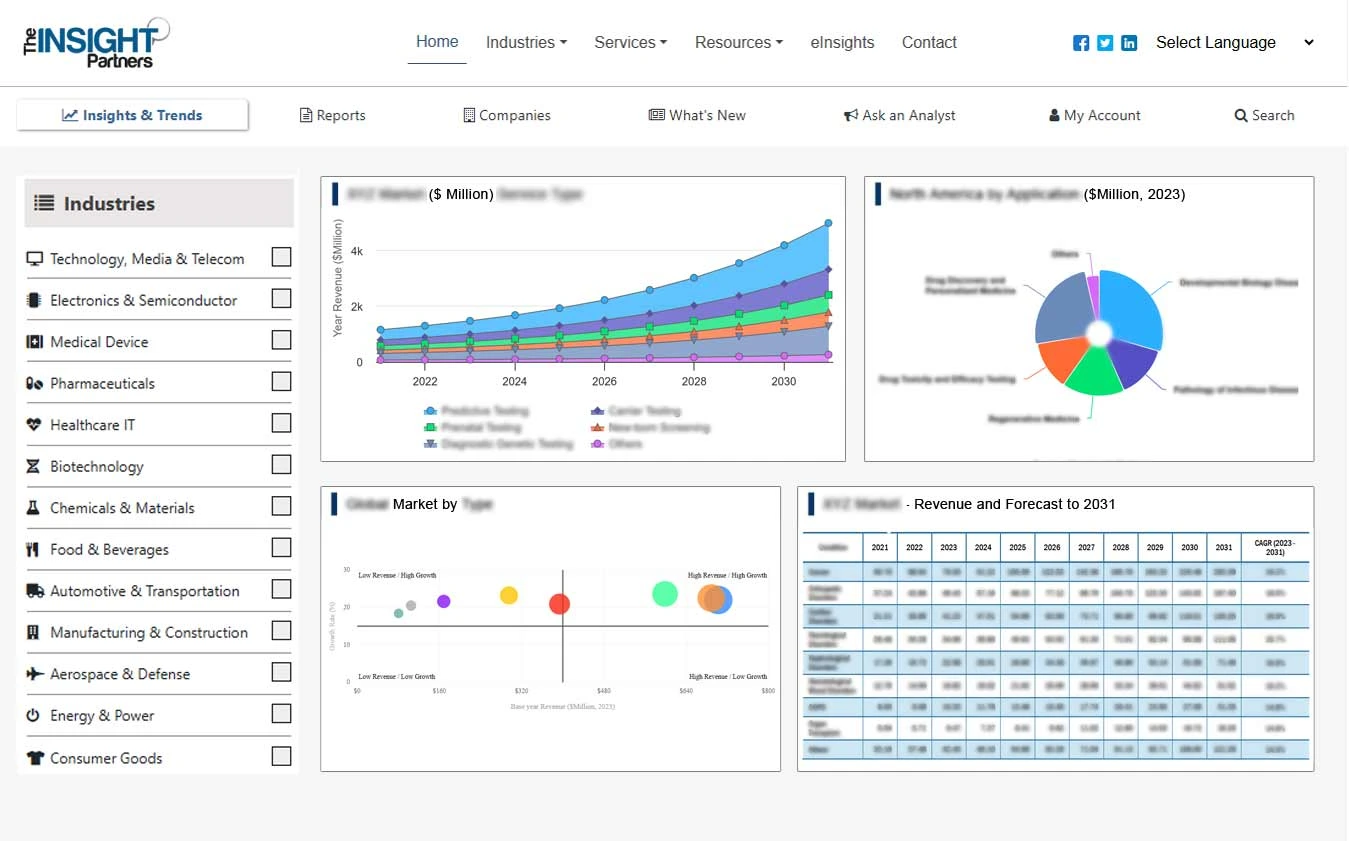

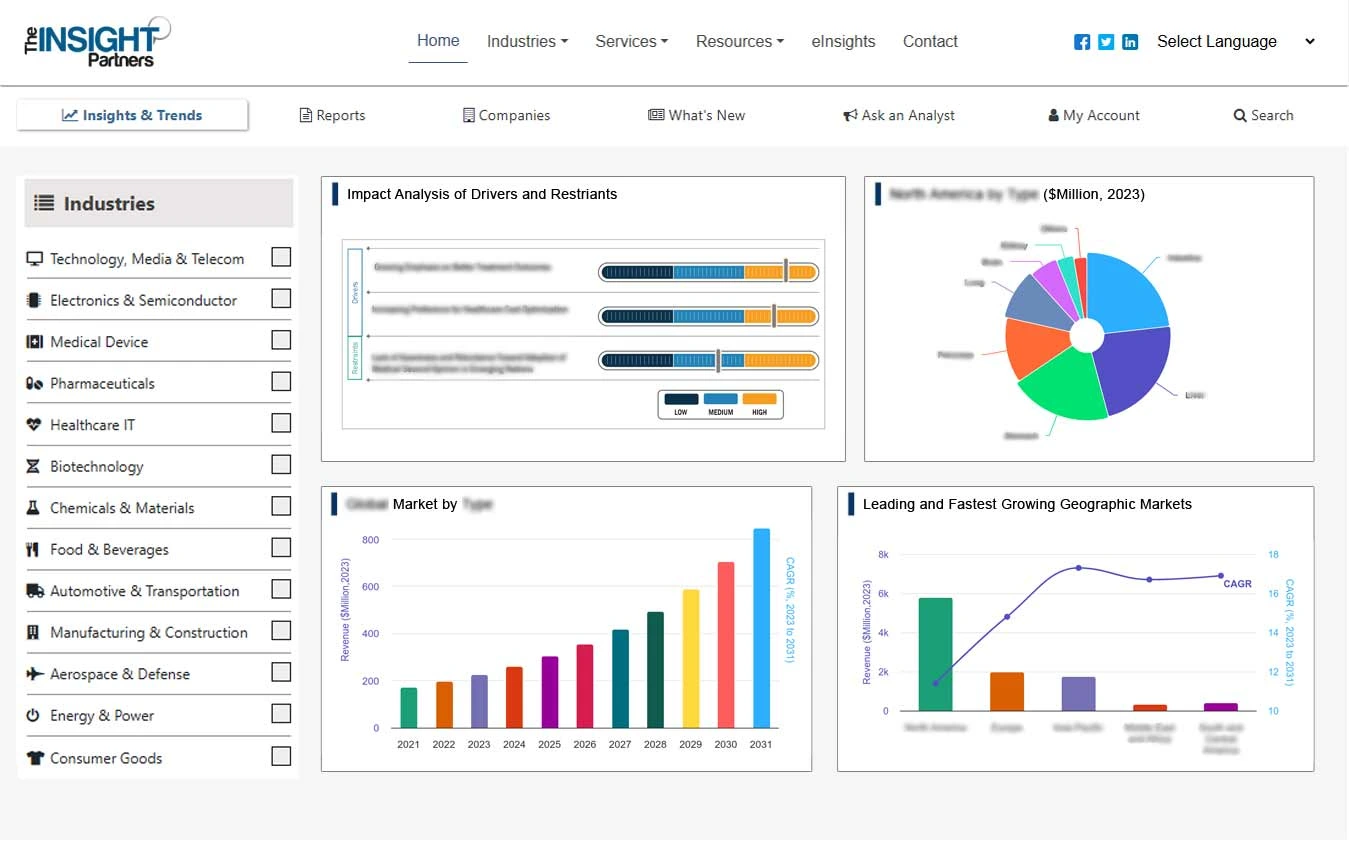

El El mercado global de seguridad de pagos está segmentado según el componente, el tamaño de la empresa y la industria vertical. Según el componente, el mercado se segmenta en solución y servicio. Según el tamaño de las empresas, el mercado se divide en PYME y grandes empresas. Sobre la base de la industria vertical, el mercado se segmenta en venta minorista y comercio electrónico, viajes y hotelería, atención médica, educación, medios y entretenimiento, y otros.

El informe proporciona una descripción detallada de la industria que incluye información tanto cualitativa como cuantitativa. Proporciona una descripción general y una previsión del mercado global de seguridad de pagos en función de varios segmentos. También proporciona el tamaño del mercado y estimaciones de pronóstico del año 2021 al 2031 con respecto a cinco regiones principales, a saber; América del Norte, Europa, Asia-Pacífico (APAC), Medio Oriente y África (MEA) y Sur y África. Centroamérica. El mercado de seguridad de pagos de cada región se subsegmenta posteriormente en los respectivos países y segmentos. El informe cubre el análisis y el pronóstico de 18 países a nivel mundial junto con las tendencias actuales y las oportunidades que prevalecen en la región.

El informe analiza los factores que afectan el mercado de seguridad de pagos tanto desde el lado de la demanda como de la oferta y evalúa en mayor profundidad la dinámica del mercado que afecta el mercado durante el período de pronóstico, es decir, impulsores, restricciones, oportunidades y tendencias futuras. El informe también proporciona un análisis PEST exhaustivo para las cinco regiones, a saber; América del Norte, Europa, APAC, MEA y Sur y Sur. Centroamérica después de evaluar los factores políticos, económicos, sociales y tecnológicos que afectan el mercado de seguridad de pagos en estas regiones.

El informe también incluye los perfiles de empresas clave de seguridad de pagos junto con su análisis FODA y estrategias de mercado. Además, el informe se centra en los principales actores de la industria con información como perfiles de empresas, componentes y servicios ofrecidos, información financiera de los últimos 3 años y desarrollo clave en los últimos cinco años.

- Sistemas de pago Bluefin< /li>

- Cybersource

- Elavon

- Índice

- Pagos inteligentes

- SecurionPay

- Pagos Shift4, LLC

- Sisa Information Security

- TNS Inc.

- TokenEx

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado Valor/volumen: global, regional, nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Preguntas frecuentes

The global payment security market is expected to grow at a CAGR of 14.1% during 2023 - 2031.

The surge in cyberattacks, stringent government regulations such as GDPR and PCI DSS, and the shift towards online and mobile payments are the major factors that propel the global payment security market.

The expansion of contactless and biometric payments and cloud-based payment security solutions are anticipated to play a significant role in the global payment security market in the coming years.

The key players holding majority shares in the global payment security market are Shift4 Payment Inc.; TokenEx, LLC; Paypal Holdings, Inc.; Bluefin Payment Systems; Visa Inc.; and Broadcom.

North America is anticipated to grow with a high growth rate during the forecast period.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenga una muestra gratuita de este informe

Obtenga una muestra gratuita de este informe