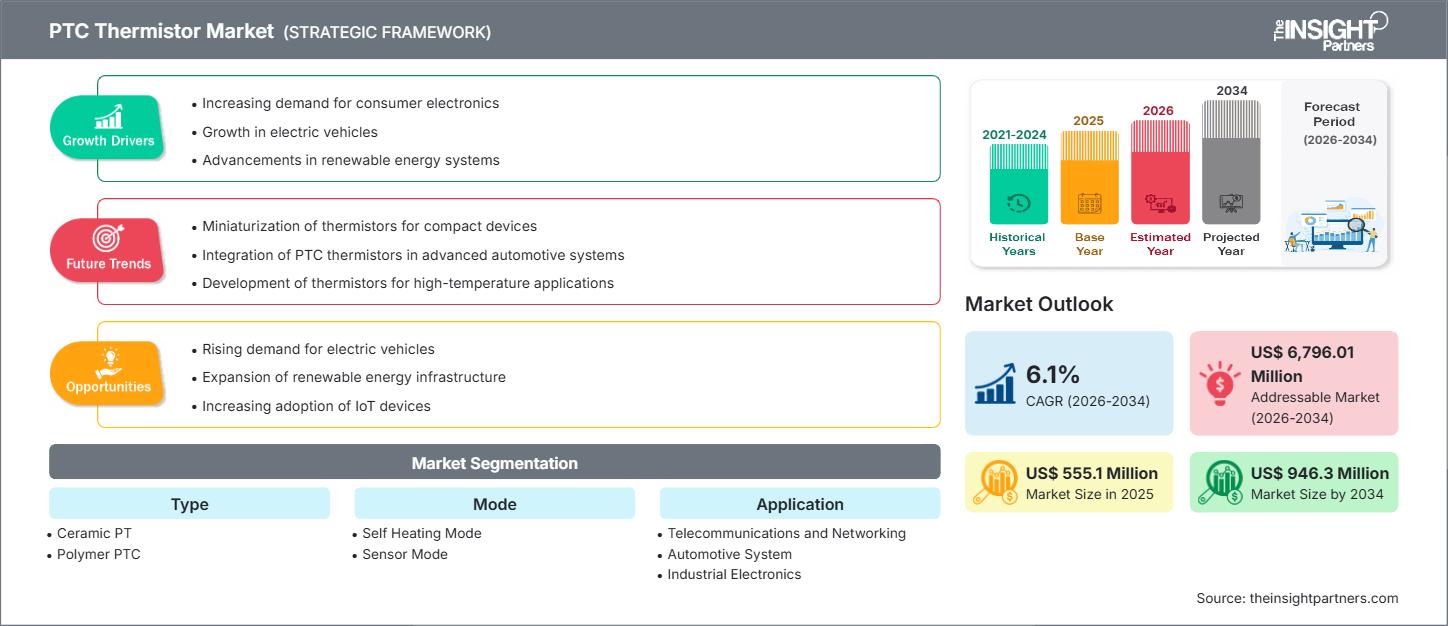

El mercado de termistores PTC (coeficiente de temperatura positivo) se valoró en 555,1 millones de dólares estadounidenses en 2025 y se proyecta que alcance los 946,3 millones de dólares estadounidenses en 2034. Se espera que el mercado crezca a una tasa de crecimiento anual compuesta (TCAC) del 6,1 % entre 2026 y 2034.

Análisis del mercado de termistores PTC

Se prevé un crecimiento constante del mercado de termistores PTC en los próximos años. Algunos factores que contribuirán a este crecimiento serán el mayor uso de termistores PTC en la electrónica de consumo, especialmente en dispositivos compactos como los smartphones, donde la protección contra sobrecorriente y la rápida respuesta térmica son cruciales.

Otros factores que contribuyen a la creciente demanda de termistores PTC son la creciente electrificación automotriz, especialmente en la automatización industrial, y la necesidad de elementos calefactores autorregulables. Su estabilidad, fiabilidad y capacidad de autorreinicio han hecho que los dispositivos PTC resulten muy atractivos en diversas aplicaciones de protección y detección.

Sin embargo, el crecimiento del mercado podría verse obstaculizado por los costos de los materiales, la competencia de tecnologías alternativas de protección térmica y las limitaciones de escala en algunas aplicaciones de alta precisión.

Descripción general del mercado de termistores PTC

Los termistores PTC son tipos de resistencias sensibles a la temperatura cuyas resistencias aumentan significativamente por encima de la temperatura umbral y encuentran aplicaciones en protección contra sobrecorriente, calentadores autorreguladores y detección térmica.

Las características del termistor PTC incluyen un aumento de la resistencia cuando la corriente en un circuito aumenta o la temperatura supera cierto punto, lo que limita la corriente para evitar daños. Sirven como elementos autorreguladores en aplicaciones de calefacción, ya que su resistencia cambia dinámicamente con las condiciones variables para proporcionar calor constante sin necesidad de controles externos.

En consecuencia, los termistores PTC encuentran aplicaciones en un amplio campo de la electrónica, circuitos de protección para vehículos y otros sistemas debido a su compacidad, confiabilidad y capacidad de restablecerse efectivamente a un estado de baja resistencia cuando se enfrían.

Personalice este informe según sus necesidades

Obtenga PERSONALIZACIÓN GRATUITAMercado de termistores PTC: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de termistores PTC

Factores impulsores del mercado:

- Protección en electrónica miniaturizada: la demanda de dispositivos más pequeños y eficientes (por ejemplo, teléfonos inteligentes) impulsa el uso de termistores PTC para proteger circuitos sensibles.

- Electrificación en la industria automotriz: a medida que aumenta la adopción de vehículos eléctricos, también aumenta la demanda de termistores PTC en sistemas de gestión de baterías, protección de motores y circuitos de sobrecorriente.

- Automatización y calefacción industrial: Los termistores PTC sirven como elementos de calefacción autorreguladores y dispositivos de protección en procesos industriales, maquinaria y electrodomésticos.

Oportunidades de mercado:

- Innovación en materiales avanzados: existe margen para desarrollar nuevos materiales PTC cerámicos y poliméricos con mejor rendimiento (respuesta más rápida, mayor estabilidad).

- Mercados emergentes: A medida que la fabricación se traslada a las economías en desarrollo, se espera que aumente la demanda de termistores PTC para productos electrónicos y vehículos eléctricos de mercado masivo.

- Integración con sistemas inteligentes: los termistores PTC podrían integrarse en sistemas inteligentes habilitados para IoT para automonitoreo y protección contra fallas, creando valor en el mantenimiento predictivo.

- Aplicaciones sanitarias: El uso en dispositivos médicos como elementos de detección de temperatura o de protección contra sobrecorriente podría expandirse, particularmente en equipos de diagnóstico o terapéuticos portátiles.

Análisis de segmentación del informe de mercado de termistores PTC

El mercado de termistores PTC, según el informe de The Insight Partners, está segmentado de la siguiente manera:

-

Por tipo

- PTC de cerámica

- PTC de polímero

-

Por modo

- Modo de autocalentamiento

- Modo sensor

-

Por aplicación

- Telecomunicaciones y redes

- Sistemas automotrices

- Electrónica industrial

- Electrónica de consumo y electrodomésticos

- Instrumentos médicos

-

Por geografía

- América del norte

- Europa

- Asia Pacífico

- Oriente Medio y África

- América del Sur y Central

Perspectivas regionales del mercado de termistores PTC

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de termistores PTC durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de termistores PTC en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica y Centroamérica.

Alcance del informe de mercado de termistores PTC

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2025 | US$ 555,1 millones |

| Tamaño del mercado en 2034 | US$ 946,3 millones |

| CAGR global (2026-2034) | 6,1% |

| Datos históricos | 2021-2024 |

| Período de pronóstico | 2026-2034 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de termistores PTC: comprensión de su impacto en la dinámica empresarial

El mercado de termistores PTC está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de las ventajas del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de termistores PTC

Análisis de la cuota de mercado de termistores PTC por geografía

- Asia Pacífico: Se espera que muestre un fuerte crecimiento, impulsado por grandes centros de fabricación de productos electrónicos (China, Japón, Corea del Sur), la creciente electrificación automotriz y la automatización industrial.

- América del Norte: También es una región importante, con adopción tanto en protección automotriz como en electrónica de consumo; relativamente madura pero que continúa innovando.

- Europa, Oriente Medio y África, América Latina: Estas regiones presentan oportunidades de crecimiento, especialmente a medida que la protección térmica y la calefacción adquieren mayor importancia tanto en el sector de consumo como en el industrial. El informe de Insight Partners analiza en detalle estas dinámicas regionales.

Densidad de actores del mercado de termistores PTC: comprensión de su impacto en la dinámica empresarial

El mercado de termistores PTC está moderadamente fragmentado. Los principales actores compiten en materiales, formato, fiabilidad y aplicaciones específicas. Las principales tendencias competitivas incluyen:

- Desarrollo de termistores PTC cerámicos de alta estabilidad frente a variantes de polímero flexible.

- Escalado de termistores PTC para calentadores autorreguladores en dispositivos compactos.

- Proporcionamos soluciones integradas para protección contra sobrecorriente en vehículos eléctricos y otros dominios de alto voltaje.

- Aprovechar asociaciones y alianzas con fabricantes de productos electrónicos para incorporar termistores PTC en el diseño.

Algunos actores destacados identificados o relevantes para el mercado de termistores PTC incluyen:

- Compañía de fabricación Murata, Ltd.

- Corporación TDK

- Conectividad TE

- Vishay Intertechnology

- Sensores avanzados Amphenol

- Texas Instruments Incorporated

- ZIEHL industrie-elektronik GmbH + Co. KG

- KRIWAN Industrie-Elektronik GmbH

- Semiconductores NXP

Otras empresas analizadas durante el curso de la investigación:

- Littelfuse, Inc.

- Compañía General Electric

- Honeywell International Inc.

- Zhejiang Kejie Electronics Co., Ltd.

- Pensando en la electrónica industrial Co., Ltd.

- Corporación KOA

- Shibaura Electronics Co., Ltd.

Noticias y novedades del mercado de termistores PTC

- Según el comunicado de prensa de Insight Partners, los fabricantes de dispositivos móviles utilizan cada vez más termistores PTC para la protección contra sobrecorriente en dispositivos electrónicos compactos.

- Innovación en materiales PTC: se están realizando investigaciones para desarrollar nuevos compuestos PTC cerámicos (por ejemplo, basados en titanato de bario) para mejorar el rendimiento y ampliar los rangos de temperatura.

- Interés de mercado más amplio: a medida que los fabricantes de automóviles aceleran la producción de vehículos eléctricos, la demanda de termistores PTC para protección y gestión térmica está aumentando.

Informe de mercado sobre termistores PTC: cobertura y resultados

Se espera que el informe de mercado de termistores PTC de The Insight Partners incluya:

- Tamaño detallado del mercado y pronóstico (global, regional) para el período 2021-2034.

- Análisis de tendencias y dinámicas del mercado (impulsores, restricciones, oportunidades)

- Análisis PEST y FODA para el mercado de termistores PTC

- Panorama competitivo: actores clave, mapa de calor, concentración del mercado

- Desarrollos recientes y factores regulatorios

- Perfiles detallados de empresas de los principales fabricantes de termistores PTC

- Análisis de segmentación por tipo, modo, aplicación y geografía

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de termistores PTC

Obtenga una muestra gratuita para - Mercado de termistores PTC