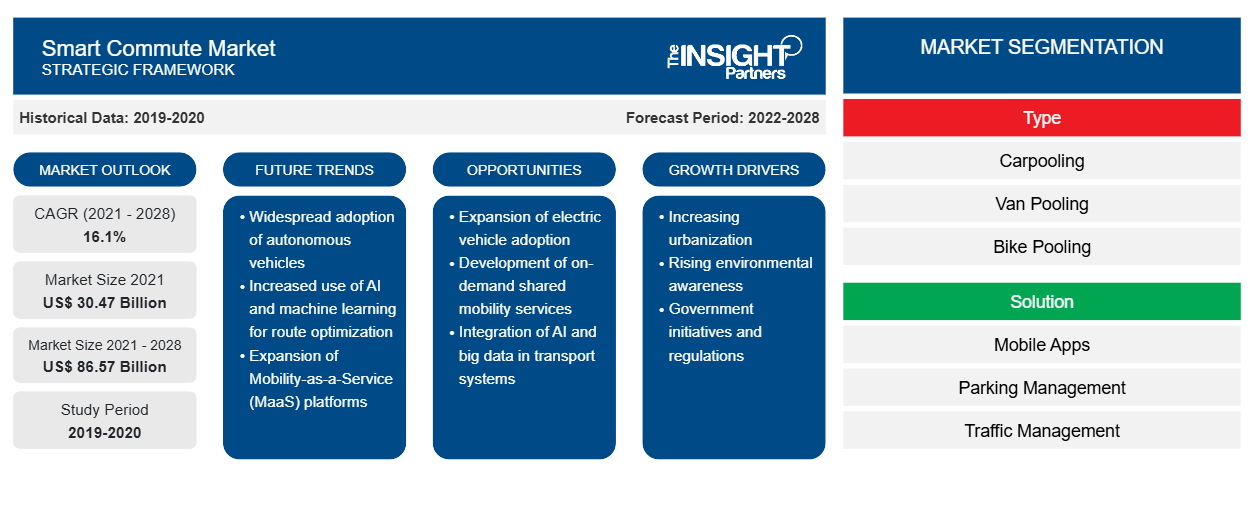

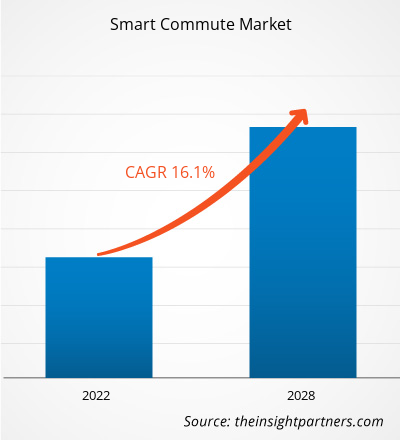

Se espera que el mercado de viajes inteligentes crezca de US$ 30.469,49 millones en 2021 a US$ 86.568,73 millones en 2028; se estima que crecerá a una CAGR del 16,1% entre 2021 y 2028.

El desplazamiento inteligente se define como el desplazamiento habitual en coche compartido, furgoneta compartida, bicicleta, ciclista o en metro. Las empresas de transporte público, los gobiernos y otras partes interesadas han desarrollado una estrategia completa que tiene en cuenta el desplazamiento inteligente y la comparten con el público para construir un transporte más potente en las regiones metropolitanas. El desplazamiento inteligente tiene un impacto positivo en el medio ambiente al reducir la congestión del tráfico y las emisiones de gases de efecto invernadero.

Los servicios de transporte inteligente ofrecen la posibilidad de compartir el coche, la bicicleta o la furgoneta, entre otras opciones respetuosas con el medio ambiente. Estos servicios ofrecen a los trabajadores de oficina la posibilidad de elegir una ruta de viaje más eficaz que reduzca la congestión del tráfico y los gastos de transporte. Uno de los factores que impulsa el crecimiento del mercado de los viajes inteligentes es el creciente número de habitantes de las ciudades, lo que lleva a un aumento de las tasas generacionales. Los servicios de transporte compartido han ganado una aceptación universal y los gobiernos y los organismos medioambientales los están fomentando, ya que ayudan a reducir las emisiones. Permiten un menor número de automóviles privados, lo que se espera que impulse el crecimiento del mercado de los viajes inteligentes en los próximos años.

En América del Norte, la necesidad de desplazamientos inteligentes se ha visto impulsada por una creciente preferencia por los servicios de coche compartido entre los trabajadores de oficina, lo que aliviaría la congestión del tráfico y evitaría daños medioambientales. Además, el auge de la industria del turismo, los avances tecnológicos y las políticas gubernamentales favorables son otros factores que impulsan el crecimiento del mercado de desplazamientos inteligentes en América del Norte . En Europa, se espera que el aumento de la tendencia de la movilidad como servicio y el aumento de la base de usuarios de los servicios de transporte compartido creen oportunidades lucrativas para los actores del mercado.

En Europa, debido a la creciente preocupación por el calentamiento global, la congestión vial y la dependencia de energía extranjera, los desplazamientos inteligentes están ganando popularidad. La práctica de cobrar peajes a los automóviles con un solo ocupante, que se impuso en 2012, ha dado lugar a un enorme aumento del uso de los desplazamientos inteligentes por parte de los consumidores europeos.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

- Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

:

Impacto de la pandemia de COVID-19 en el mercado de los viajes inteligentes

El brote de COVID-19 tuvo un impacto significativo en el sector del transporte. La demanda de servicios de viajes compartidos en coche y furgoneta se redujo a nivel mundial en 2020 debido al COVID-19. El mercado mundial de viajes inteligentes experimentó una disminución considerable en la generación de ingresos en 2020 en comparación con 2019, en parte debido a los confinamientos y la reticencia de los clientes a utilizar servicios de viajes compartidos incluso después de que se levantaran las regulaciones. Las empresas de viajes compartidos siempre intentan mantener la confianza de los conductores y pasajeros en términos de seguridad y saneamiento.

Perspectivas de mercado: mercado de desplazamientos inteligentes

Tendencia creciente de la movilidad como servicio

Las personas que no pueden comprar un coche pueden disfrutar de una experiencia de viaje sin problemas gracias a los servicios de movilidad. Según la Oficina de Estadísticas de Transporte, el coste medio de poseer y operar un vehículo es de unos 8.858 dólares, suponiendo que se recorren 15.000 kilómetros al año. La movilidad como servicio reduce estos costes para el usuario maximizando el uso de servicios de transporte como el coche compartido y el transporte con conductor. También reduce la congestión del tráfico y las emisiones totales de los automóviles en las ciudades. Como resultado, el coche compartido y el transporte con conductor habilitados digitalmente gestionan de forma eficiente las demandas de transporte y ofrecen una alternativa cómoda y respetuosa con el medio ambiente a la propiedad de un automóvil privado. Además, según las estadísticas, el 55% de la población mundial vive actualmente en ciudades, y las estimaciones sugieren que para 2050, aproximadamente el 68% de la población vivirá en ciudades. El rápido ritmo de urbanización ya está provocando congestiones de tráfico. El concepto de movilidad como servicio (MaaS) puede ser una mejor opción para reducir la congestión del tráfico haciendo un mayor uso de la infraestructura de transporte público y privado existente. Se espera que la demanda urgente de soluciones efectivas para gestionar el tráfico en ciudades inteligentes de una manera más rápida, menos costosa y más conveniente impulse el crecimiento del mercado MaaS para 2028. Por lo tanto, se espera que la creciente tendencia de la movilidad como servicio (MaaS) impulse el crecimiento del mercado global de viajes inteligentes.

Perspectivas del mercado de los desplazamientos inteligentes basados en tipos de vehículos

Según el tipo, el mercado de viajes inteligentes se segmenta en viajes compartidos en coche, furgonetas compartidas, bicicletas compartidas, metro y otros. Se prevé que el segmento de viajes compartidos en coche tenga una participación significativa en el mercado global de viajes inteligentes en coche, y se espera que crezca a la tasa de crecimiento anual compuesta más alta. El viaje inteligente en coche se define como viajar regularmente de un punto a otro en coche compartido, furgonetas compartidas, bicicleta, ciclistas o tomando el metro.

Perspectivas del mercado de los desplazamientos inteligentes basados en soluciones

Según la solución, el mercado de los viajes inteligentes se segmenta en aplicaciones móviles, gestión de aparcamientos , gestión del tráfico y otros. Se prevé que el segmento de las aplicaciones móviles tenga una participación significativa en el mercado global de viajes inteligentes y se espera que crezca a la tasa de crecimiento anual compuesta más alta. Existe un uso creciente de aplicaciones móviles en el modo de viaje en automóvil para reducir el tiempo de viaje, el costo y las emisiones del vehículo.CAGR. There is a growing usage of mobile applications in automobile travel mode to reduce travel time, cost, and vehicle emissions.

Perspectivas del mercado de viajes inteligentes basados en el usuario final

Según el usuario final, el mercado de viajes inteligentes se divide en segmentos personales y empresariales. Se prevé que el segmento empresarial ocupe una cuota significativa en el mercado global de viajes inteligentes y que crezca a una tasa de crecimiento anual compuesta (CAGR) más alta.CAGR.

Perspectivas regionales del mercado de viajes inteligentes

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de los viajes diarios inteligentes durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de los viajes diarios inteligentes en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de viajes inteligentes

Alcance del informe de mercado de los desplazamientos inteligentes

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 30,47 mil millones |

| Tamaño del mercado en 2028 | US$ 86,57 mil millones |

| CAGR global (2021-2028) | 16,1% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos | Por tipo

|

| Regiones y países cubiertos | América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

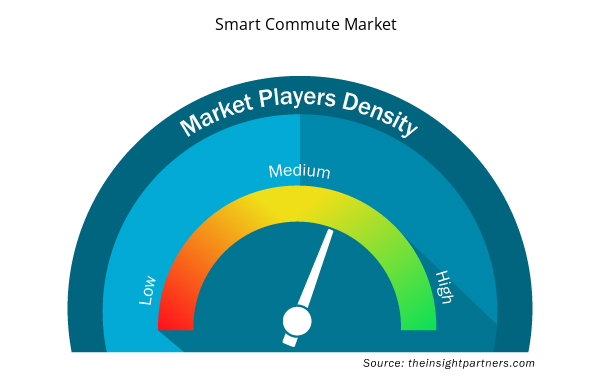

Densidad de actores del mercado de los desplazamientos inteligentes: comprensión de su impacto en la dinámica empresarial

El mercado de los viajes inteligentes está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de viajes inteligentes son:

- BlaBlaCar

- Viaje inteligente

- Empresas Holdings Inc.

- ePoolers Technologies Pvt. Ltd

- Golden Concord Holdings Limited

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de Smart Commute

Los actores que operan en el mercado de viajes inteligentes se centran principalmente en el desarrollo de productos avanzados y eficientes.

- En enero de 2022, Tummoc, una empresa de movilidad multimodal, tiene la intención de expandir sus operaciones a otras diez ciudades para 2022, incluidas Delhi y Mumbai.

- En abril de 2021, una empresa de movilidad urbana creó una plataforma de aplicaciones que integra rutas con precios por primera vez, combinando autobús, metro, Uber, Yulu y otras opciones de última milla.

Perfil de la empresa

:

- BlaBlaCar

- Viaje inteligente

- Empresas Holdings Inc.

- ePoolers Technologies Pvt. Ltd

- Golden Concord Holdings Limited

- Viajes inteligentes en Oakland

- Paseo rápido

- Transhelp Technologies Pvt Ltd

- Tecnologías Uber Inc.

- Viaje inteligente

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado Valor/volumen: global, regional, nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Preguntas frecuentes

Based on type, the global Smart Commute market is segmented into carpooling, van pooling, bike pooling, metro, and others. The Smart Commute market was dominated by the carpooling segment in 2020.

North America dominated the Smart Commute market in 2020 with a share of 43.9%. Asia Pacific is expected to grow at a fastest CAGR accounting for 40.0% share by 2028, followed by Europe.

The major companies in Smart Commute market are Enterprise Holdings, Inc.; BlaBlaCar; CommuteSmart; ePoolers Technologies Pvt. Ltd.; Smart Commute; Oakland Smart Commute; Quick Ride; Tummoc (Transhelp Technologies Pvt. Ltd.); Uber Technologies, Inc.; and GCL Smart Commute Co., Ltd.

The major end user in Smart Commute includes personal, and enterprises. In terms of market share, the market was dominated by the enterprises segment in 2020.

IoT devices can be used to make daily commutes more enjoyable. These technologies also help reduce overall transport costs while being environmentally beneficial. The best IoT option for the last-mile journey could be connected bicycles. Citizens have already begun to benefit from combined bike-sharing possibilities provided by market players. Users may keep track of bike availability, usage, and trip details. The only stumbling block for linked bike-sharing programs is integrating them into today's traffic. Governments must ensure that designated bike lanes exist to maintain a smooth traffic flow. In some areas, connected electric scooters are also available for rent. Some firms even offer complimentary helmets to electric scooter riders for a minimal shipping fee. By providing alternate commute options, these businesses contribute to a better future for our world. Apps for taxi commuting are already widespread among today's youth. Rather than driving their car, many commuters use taxi services such as Uber and Lyft. This is a more cost-effective and environmentally responsible solution than single-user rides. These businesses have access to a wealth of data that may be monitored and studied to improve cab-sharing services. Unlike most public transit, they can function similarly to public transportation, but they can provide a comprehensive commute option.

The key element driving the expansion of smart commutes is a rapid increase in the adoption of carpool and bike pool services among regular office commuters. Prominent market players such as Uber and Ola offer convenient pick-up and drop-off services, attracting consumers to use ride-sharing services. Furthermore, services such as short-distance travel, intercity ride-sharing, bus-sharing, bike-sharing, and auto-sharing are available, which stimulates the expansion of smart commute demand. Many prominent Indian corporations proactively push employees to use carpool and bike pool services. Organizations with large workforces, such as Infosys, Capgemini, Cognizant, HCL, Amazon, Flipkart, Siemens, L&T, Biocon, and HDFC Bank, as well as several smaller businesses, are launching awareness campaigns and digital platforms to help employees better plan their commutes. Moreover, organizations are rewarding top carpoolers to keep employees engaged and motivated to reduce carbon emissions and traffic jams across cities. New York, Seoul, and Shanghai are among the top 10 cities with the highest carbon footprint. Governments and businesses are encouraging carpooling to commute in cities to reduce emissions. Countries have established specific targets for reducing carbon footprints by 2030 as part of the Paris climate agreement. In Delhi, India, the government implemented an odd-even strategy to control traffic density and reduce carbon emissions in the city.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - Smart Commute Market

- BlaBlaCar

- CommuteSmart

- Enterprise Holdings Inc

- ePoolers Technologies Pvt. Ltd

- Golden Concord Holdings Limited

- Oakland Smart Commute

- Quick Ride

- Transhelp Technologies Pvt Ltd

- Uber Technologies Inc.

- Smart Commute

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenga una muestra gratuita de este informe

Obtenga una muestra gratuita de este informe