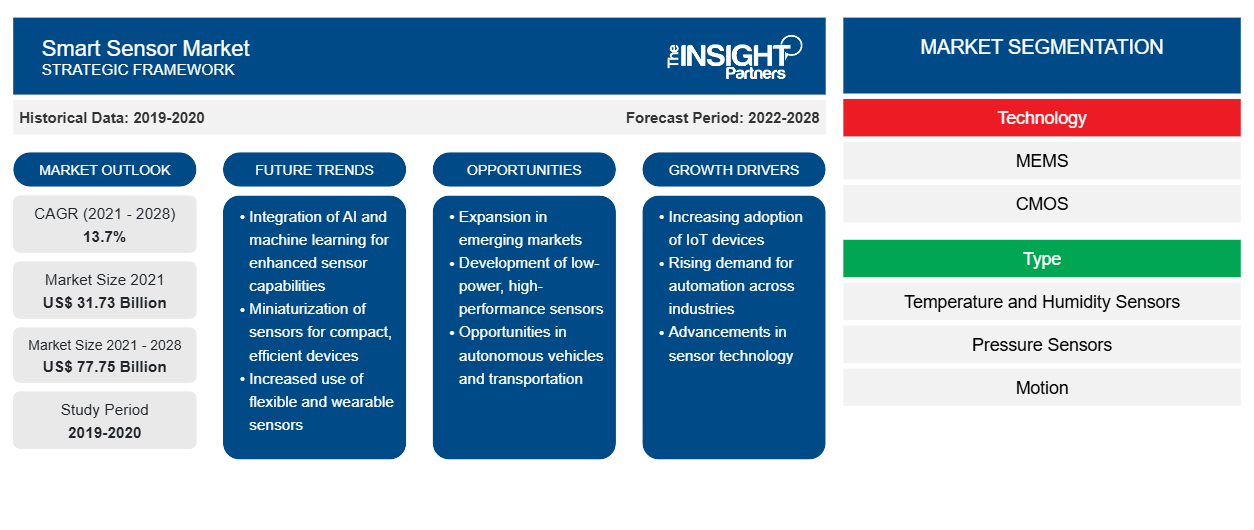

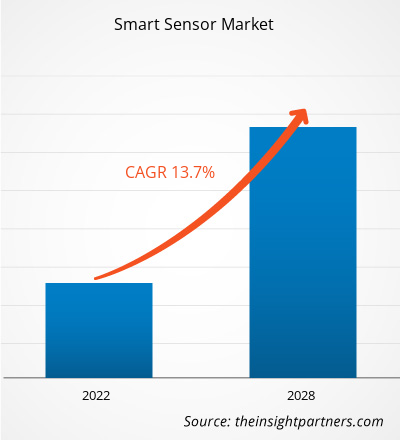

Se espera que el mercado de sensores inteligentes crezca de 31.731,1 millones de dólares en 2021 a 77.747,6 millones de dólares en 2028. Se estima que crecerá a una CAGR del 13,7 % entre 2021 y 2028.

Los sensores inteligentes son más rápidos y precisos que los sensores tradicionales. Estos sensores son más pequeños y consumen menos energía que los sensores convencionales. El uso de la tecnología de sensores inteligentes en dispositivos basados en IoT y productos electrónicos de consumo y su aplicación en las industrias aeroespacial y de defensa, automotriz, biomédica y de atención médica, automatización industrial, automatización de edificios, electrónica de consumo, educación, robótica, agricultura y transporte han atraído mucho interés en los últimos años. El aumento en el uso de sensores inteligentes en todas las aplicaciones es un factor clave que impulsa el tamaño del mercado de sensores inteligentes .

Con el aumento de las preocupaciones por la seguridad, la demanda de sensores inteligentes en los productos electrónicos de consumo está aumentando, lo que repercute en el mercado de sensores inteligentes. En la automatización del hogar se utilizan diversos sensores, como sensores infrarrojos de visión nocturna, sensores de sonido o micrófonos e inodoros inteligentes. Las empresas incorporan diversas funciones, como limpieza automática, descarga automática, control de fugas de tanques, protección contra desbordamiento de agua y control de la salud, en sus sensores inteligentes. Las luces y los ventiladores se pueden controlar con un sistema automático que utiliza sensores infrarrojos o de movimiento.

Además, con el cambio de estilo de vida y el nuevo estándar de vida moderno, la demanda de cocinas modulares integradas con automatización del hogar está experimentando un crecimiento exponencial, lo que impacta positivamente en el mercado de sensores inteligentes. Los fabricantes están desarrollando dispositivos basados en sensores sintéticos para monitorear vibraciones, sonidos de la cocina, luz, gas, temperatura, calor y temperatura y ruido electromagnéticos, lo que aumenta el tamaño del mercado de sensores inteligentes. Por ejemplo, Analog Devices, Inc. ofrece sensores pHEMT de GaAs HMC1126. Es un amplificador de bajo ruido que opera en un rango de 400 MHz a 52 GHz y se utiliza en varias aplicaciones, como radios de microondas, terminales de apertura muy pequeña (VSAT), equipos de prueba y comunicación 5G.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

- Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

La tecnología de sensores inteligentes ha dado lugar a rápidos avances tecnológicos en los teléfonos inteligentes y los dispositivos portátiles. Los fabricantes de automóviles exigen cada vez más sensores inteligentes para mejorar la seguridad y la comodidad. El uso de tecnología inalámbrica para supervisar y controlar dispositivos de seguridad equipados con sensores inteligentes es cada vez más común. En medio de la COVID-19, el aumento de la demanda de dispositivos portátiles con sensores inteligentes, el apoyo constante del gobierno a la construcción de edificios ecológicos y el mantenimiento predictivo ofrecen oportunidades lucrativas para los actores del mercado de sensores inteligentes.

El aumento de la penetración de los teléfonos inteligentes ha impulsado sustancialmente el crecimiento del mercado de sensores inteligentes. Los sensores inteligentes incluyen sensores populares, como los de movimiento, posición, luz ambiental, acelerómetro y giroscopio . Los sensores de tasa de absorción específica (SAR) mejoran la conectividad para una amplia gama de tecnologías inalámbricas, como 5G sub-6/4G/Wi-Fi en teléfonos inteligentes, tabletas y computadoras portátiles. SEMTECH, un proveedor líder de semiconductores, ofrece sensores PerSeTM Connect, PerSe Connect Pro y PerSe Control, que se pueden utilizar en varias aplicaciones, como teléfonos inteligentes, computadoras portátiles, tabletas y dispositivos portátiles.

Muchas empresas están desarrollando sensores inteligentes nuevos y avanzados que combinan microcontroladores en un solo paquete. Las tecnologías modernas, como la IA (inteligencia artificial) y la IoT, permiten esta combinación en un paquete pequeño. Por ejemplo, el BHA250 de Bosch Sensortec puede combinar un microcontrolador de 32 bits con un sensor de aceleración de 14 bits en un paquete de 2,2 x 2,2 x 0,95 mm3. Además, la empresa TE Connectivity ha integrado sensores con conectores para agrupar la funcionalidad en un espacio pequeño. Estos avances en la tecnología de sensores inteligentes están teniendo un impacto positivo en el crecimiento del mercado de sensores inteligentes. Con el crecimiento de la industria electrónica de consumo, como las máquinas expendedoras de bebidas inteligentes, los sistemas de automatización del hogar inteligente, las computadoras simples, los asistentes digitales (como Alexa) y los dispositivos portátiles humanos, la demanda de sensores inteligentes ha aumentado en el mercado de sensores inteligentes. Los productos de consumo tradicionales, como las computadoras portátiles, los teléfonos inteligentes y los televisores, continúan superando las expectativas a medida que los consumidores continúan adoptando productos nuevos y emergentes, incluidos los wearables, los parlantes inteligentes activados por voz y los dispositivos domésticos inteligentes.

Según varios estudios, decenas de miles de millones de dispositivos IoT se conectarán a Internet en los próximos años, lo que tendrá un gran impacto en el mercado de sensores inteligentes. La COVID-19 está impulsando las agendas de resiliencia urbana y estrategia de transformación digital a medida que los gobiernos municipales se adaptan a una nueva realidad.

Impacto de la pandemia de COVID-19 en el mercado de sensores inteligentes

La aparición de la COVID-19 ha puesto de manifiesto la necesidad de aprovechar la infraestructura digital para el seguimiento remoto de los pacientes. Debido al lento desarrollo de las pruebas y vacunas virales actuales, se ha determinado que existe una mayor necesidad de una detección y un seguimiento más sólidos de la enfermedad y de la salud de los individuos y la población, para lo cual los sensores portátiles podrían ayudar. Si bien la utilidad de esta tecnología se ha utilizado para correlacionar métricas fisiológicas con la vida diaria y el rendimiento humano, todavía es necesario aplicarla para predecir la aparición de la COVID-19.

La creciente demanda de dispositivos de ahorro de energía está impulsando la demanda de sensores inteligentes en el mercado de sensores inteligentes en América del Norte. Las empresas están optando por equipos de ahorro de energía de bajo consumo, ya que el escenario cambiante requiere equipos y productos de bajo consumo. Además, la demanda de sensores en el mercado de sensores inteligentes ha aumentado en una variedad de industrias con el levantamiento de las estrictas regulaciones de los gobiernos, que están ganando terreno en las industrias de automatización. Además, la demanda de sensores en el sector automotriz está siendo impulsada por el deseo de reducir el peso promedio de un automóvil. Los automóviles livianos ayudan tanto a la eficiencia del combustible como a la optimización energética.

Perspectivas regionales del mercado de sensores inteligentes

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de sensores inteligentes durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sensores inteligentes en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de sensores inteligentes

Alcance del informe sobre el mercado de sensores inteligentes

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 31,73 mil millones |

| Tamaño del mercado en 2028 | US$ 77,75 mil millones |

| CAGR global (2021-2028) | 13,7% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos | Por tecnología

|

| Regiones y países cubiertos | América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

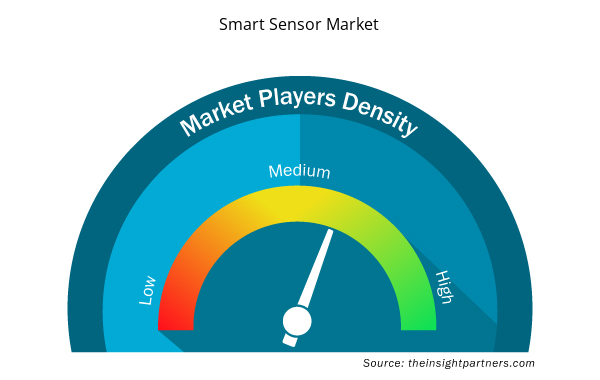

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de sensores inteligentes está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de sensores inteligentes son:

- Dispositivos analógicos Inc.

- Tecnologías Infineon Inc.

- STMicroelectrónica

- Conectividad TE

- Tecnologías de microchip

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de sensores inteligentes

Segmentación del mercado de sensores inteligentes

Según la tecnología, el mercado de sensores inteligentes se segmenta en MEMS, CMOS y otros. En 2021, el segmento MEMS lideró el mercado. Según el tipo, el mercado de sensores inteligentes se segmenta en sensores de temperatura y humedad, sensores de presión, sensores de movimiento, sensores de posición y otros. En 2021, el segmento de sensores de temperatura y humedad representó la mayor participación de mercado. Según la industria de uso final, el mercado de sensores inteligentes se segmenta en electrónica de consumo, automoción, atención médica, fabricación, venta minorista y otros.

Entre los actores clave del mercado de sensores inteligentes se encuentran Analog Devices Inc., Infineon Technologies Inc., STMicroelectronics, TE Connectivity, Microchip Technologies, NXP Semiconductor, Siemens AG, ABB Ltd., Robert Bosch GmbH y Honeywell International. Además de estos, se analizaron otros actores para comprender la dinámica general del mercado global de sensores inteligentes.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado Valor/volumen: global, regional, nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Preguntas frecuentes

The Internet of Things (IoT) has accelerated the evolution of sensors to new heights. With the industry 4.0-powered cyber-physical transformation of manufacturing industries, many production facilities are taking up smart sensors. IoT platforms use a variety of sensors to deliver intelligence and data, allowing devices to function autonomously and the entire ecosystem to become more intelligent. Devices share information and improve their efficiency and functionality by combining a set of sensors and a communication network. The demand for IoT is growing in various industrial verticals, which, in turn, is supporting the growth of the smart sensor market.

In 2021, the market for temperature & humidity sensors held the largest market share. The demand for dependable, high-performance, low-cost sensors is growing, fueling the development of new technologies such as micro-and nanotechnology. Stick-on or printed sensors can be attached to equipment as labels to measure physical factors such as humidity, temperature, and gas pressure. Because of their inexpensive cost, compact size, and ease of use, the sensors are widely used in various sectors, including automobiles, homes, medical devices, the environment, food processing, and chemical. A temperature sensor's primary application is in a smart thermostat, a smart home device. Because of significant consumer interest, incremental technology breakthroughs, and increased accessibility, the total market for smart homes is expected to expand fast. Analog Devices, Inc., STMicroelectronics, TE Connectivity Corporation, Microchip Technology Inc., NXP Semiconductors, and other firms provide a wide range of temperature and humidity sensors to the global market.

MEMS is expected to dominate the smart sensor market during the forecast period. MEMS uses small miniaturized electromechanical and mechanical systems of actuators, sensors, and microelectronics. This technology is expected to continue to dominate the market for smart sensors in the coming years and to be the fastest-growing technology during the forecast period, owing to the numerous benefits it provides, including fast operations, high reliability, improved accuracy, easy maintenance, and replacement, and low energy and material consumption. This technology enables the sensor to perform intelligently by allowing them to store a significant quantity of data in the blink of an eye. The typical data obtained by the sensor is processed by the microprocessor, which erases or saves the data based on an advanced computation. The primary benefits of MEMS technology are reduced energy and material consumption, higher repeatability, increased accuracy, and increased sensitivity and selectivity. The MEMS segment is expected to have the most significant CAGR during the anticipated period. It is due to the increased use of IoT and wearable devices such as smartwatches. Smartwatches include tiny sensors, which contributes to an increase in the demand for MEMS technology for use in these devices. As a result, rising sales of smartwatches are likely to increase demand for MEMS technology throughout the forecasted period. Furthermore, the growing preference for smart homes would fuel the need for MEMS technology throughout the forecast period.

Many automotive manufacturers are coming up with new intelligent vehicles. They are more inclined toward cutting-edge smart sensors. APAC is expected to be the most important market for smart sensors vendors over the coming years in the automotive, infrastructure, consumer electronics, and pharmaceuticals industries, with China, India, and Japan demonstrating a significantly high demand. As the global manufacturing hub for various industries, including semiconductor and automotive, which produce home appliances, smartphones, computers, and peripheral devices, China's manufacturing sector has seen massive growth over the last few years. As a result, an enormous increase in the production and sale of sensing devices can be seen in this region. Long-range low-power wide-area network (LPWAN) technologies, such as NB-IoT, LoRa, LTE-M, and Sigfox, are fueling IoT vehicle connectivity innovation. LPWANs for IoT sensors allow low-power devices to wirelessly stream data packets over longer distances, as required in the automotive industry.

APAC dominated the smart sensor market in 2020. The APAC's vertical growth in the automotive, infrastructure, consumer electronics, and pharmaceuticals industries has positively impacted the smart sensor market. As the global manufacturing hub for various industries, such as semiconductor—which produces home appliances, smartphones, computers, and peripheral devices—and automotive, China's and India’s manufacturing sectors have seen massive growth. Consequently, an enormous increase in the sale and production of sensing devices can be seen in APAC. The growing population, low cost of smart sensors, the prominent existence of several manufacturing facilities, and rapid technological advancements in emerging markets are further contributing to the growth of the APAC smart sensor market.

Best-in-class sensors are highly secure and designed for indoor occupant analytics and energy savings, providing unprecedented precision in occupant detection, count, and movements and accurate reading of ambient lighting and motion sensing. These smart sensors can work as standalone devices or be integrated into other infrastructure appliances, such as thermostats or lighting fixtures, in keeping with the edge computing approach. As these intelligent building sensors can perform all analytics in-house, images are never stored or transmitted over the network, ensuring that occupants' privacy is fully protected. Biosensors and electronic, chemical, and smart grid sensors are in high demand in smart cities.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Smart Sensor Market

- Analog Devices Inc.

- Infineon Technologies Inc.

- STMicroelectronics

- TE Connectivity

- Microchip Technologies

- NXP Semiconductor

- Siemens AG

- ABB Ltd.

- Robert Bosch GmbH

- Honeywell International Inc.

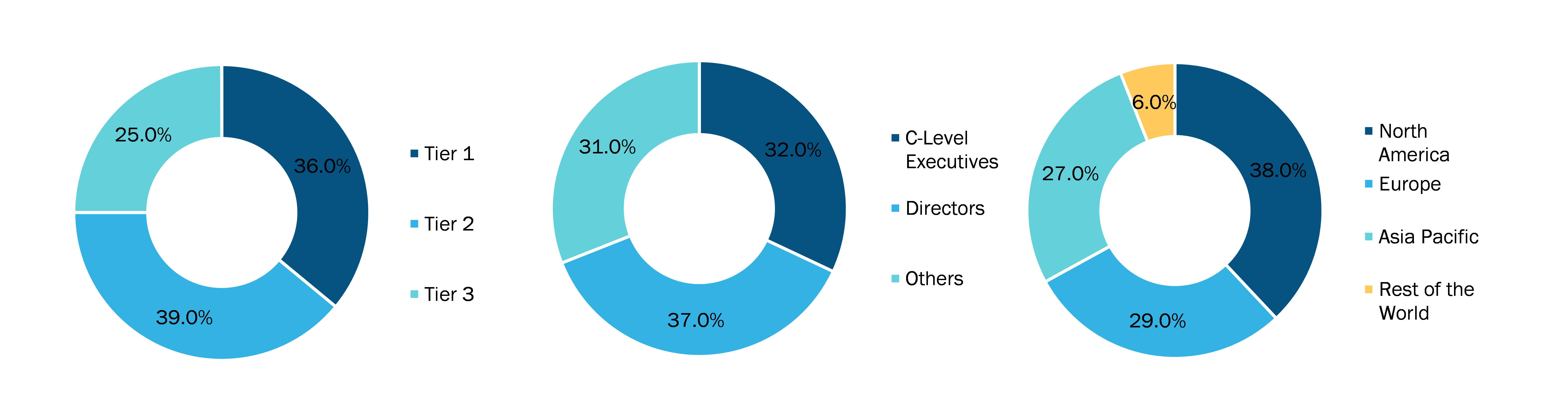

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenga una muestra gratuita de este informe

Obtenga una muestra gratuita de este informe