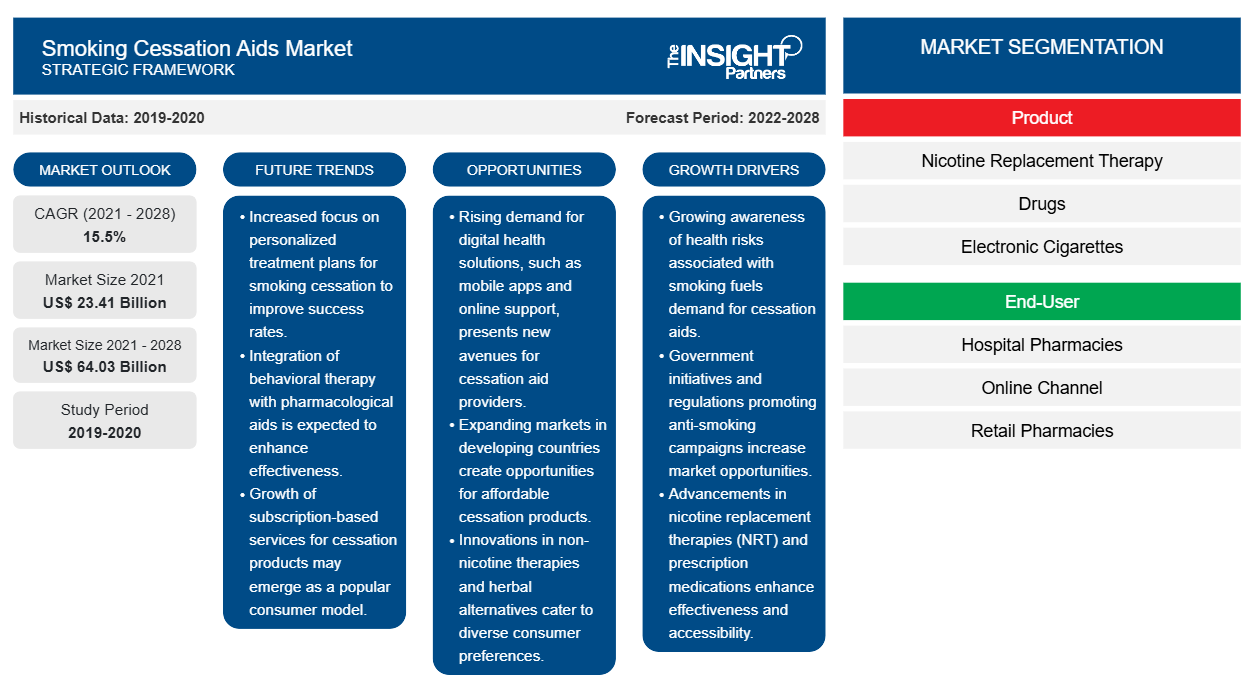

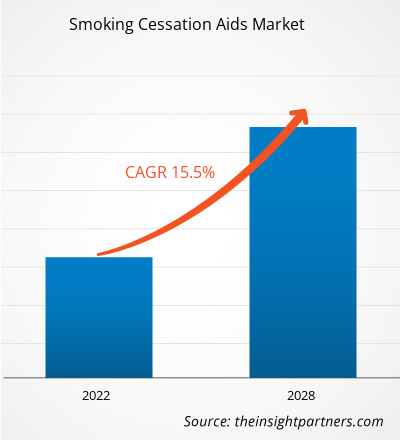

Se espera que el mercado de productos para dejar de fumar alcance los 64.032,30 millones de dólares en 2028, frente a los 23.413,08 millones de dólares en 2021. Se estima que el mercado crecerá a una tasa compuesta anual del 15,5 % entre 2021 y 2028.

Los factores clave que impulsan el crecimiento de este mercado de ayudas para dejar de fumar son la creciente adicción al tabaco y el aumento del número de campañas para reducir el tabaquismo y la dependencia del tabaco. Sin embargo, es probable que el aumento de los costos para el desarrollo de terapias de reemplazo de nicotina limite en cierta medida el crecimiento del mercado en los próximos años.

Perspectivas del mercado

La creciente adicción al tabaco

La nicotina es una sustancia altamente adictiva que se encuentra en la planta del tabaco. Se ha demostrado que fumar tabaco es peligroso en todas sus formas, ya que puede provocar enfermedades crónicas, enfermedades prevenibles, muertes y discapacidades. Según la Organización Mundial de la Salud (OMS), los trastornos relacionados con el tabaquismo provocan alrededor de 435.000 muertes al año en los EE. UU., lo que equivale a alrededor de 1 de cada 5 del total de muertes en el país. Según los Centros para el Control y la Prevención de Enfermedades (CDC), en 2018, casi 40 millones de adultos en los EE. UU. fumaron cigarrillos. Además, alrededor de 4,7 millones de estudiantes de secundaria y preparatoria usaron al menos un producto de tabaco y alrededor de 1.600 jóvenes menores de 18 años en los EE. UU. fumaron sus primeros cigarrillos. Cada año, casi medio millón de pacientes mueren debido a enfermedades causadas por el tabaquismo. El gobierno de los EE. UU. gasta aproximadamente US$ 225 mil millones en atención médica para tratar a pacientes que padecen afecciones asociadas al tabaquismo en los EE. UU. Por lo tanto, la prevalencia del tabaquismo es alta en varios países del mundo.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

- Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

El escenario es similar en varios países europeos y asiáticos. Grecia, Bulgaria, Francia y Croacia comprenden las poblaciones de mayor consumo de tabaco en Europa. Según el Instituto de Métricas y Evaluación de la Salud, fumar es una adicción muy común en Europa, ya que más del 20% de los adultos mayores de 15 años fuman todos los días. Además, según el World Population Review, las tasas de tabaquismo más altas se encuentran en el sudeste asiático y los Balcanes en Europa. El WPR también sugiere que en varios países del sur y sudeste asiático, las tasas de tabaquismo tienden a ser altas entre los hombres. Por ejemplo, en Indonesia, la tasa de tabaquismo entre los hombres fue del 76,20% en 2018. Por lo tanto, el creciente número de poblaciones de fumadores en todo el mundo impulsa el crecimiento del mercado mundial de ayudas para dejar de fumar.

Perspectivas basadas en productos

Según el producto, el mercado de ayudas para dejar de fumar se segmenta en terapia de reemplazo de nicotina, medicamentos, cigarrillos electrónicos y otros. Los cigarrillos electrónicos se consideran una alternativa saludable a los cigarrillos de tabaco y se estima que será el segmento de más rápido crecimiento durante el período de pronóstico. Los cigarrillos electrónicos son una alternativa eficaz para reducir las condiciones de salud asociadas con el tabaco, mientras que las terapias de reemplazo de nicotina funcionan mejor para dejar de fumar. Los cigarrillos electrónicos son una amenaza potencial para los cigarrillos a base de tabaco. Además, el consumo de cigarrillos electrónicos es menos dañino en comparación con los cigarrillos normales, no produce humo y no hay riesgo de tabaquismo pasivo, se permite su uso incluso en lugares para no fumadores, los diferentes niveles de nicotina y la disponibilidad en varios sabores son algunos de los principales factores impulsores del mercado de cigarrillos electrónicos. Además, la creciente popularidad de los cigarrillos electrónicos respaldada por su característica electrónica es el factor principal que contribuye a su creciente demanda.

Información basada en el usuario final

Según el usuario final, el mercado de ayudas para dejar de fumar se segmenta en farmacias hospitalarias, canal en línea, farmacias minoristas y otros usuarios finales. Es probable que el segmento de farmacias minoristas tenga la mayor participación del mercado en 2021, sin embargo, se anticipa que el segmento del canal en línea registre la CAGR más alta del mercado durante el período de pronóstico.

Los actores clave como Pfizer Inc.; GlaxoSmithKline plc.; Dr. Reddy's Laboratories; Johnson and Johnson Services, Inc.; Cipla Inc.; Perrigo Company plc; Bausch Health Companies Inc.; Glenmark; NJOY; y Juul Labs adoptan varias estrategias orgánicas e inorgánicas para mejorar sus ingresos y posiciones en el mercado. Por ejemplo, en julio de 2020, Dr Reddy's Laboratories lanzó pastillas de venta libre de nicotina Polacrilex en el mercado estadounidense en concentraciones de 2 mg y 4 mg. Además, en noviembre de 2020, Perrigo Company plc completó el cuarto año de su campaña "Quitting is Better" en asociación con la Sociedad Estadounidense del Cáncer (ACS).

Perspectivas regionales del mercado de ayudas para dejar de fumar

Los analistas de Insight Partners han explicado detalladamente las tendencias y los factores regionales que influyen en el mercado de ayudas para dejar de fumar durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de ayudas para dejar de fumar en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de ayudas para dejar de fumar

Alcance del informe de mercado de ayudas para dejar de fumar

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 23,41 mil millones |

| Tamaño del mercado en 2028 | US$ 64.03 mil millones |

| CAGR global (2021-2028) | 15,5% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos | Por producto

|

| Regiones y países cubiertos | América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

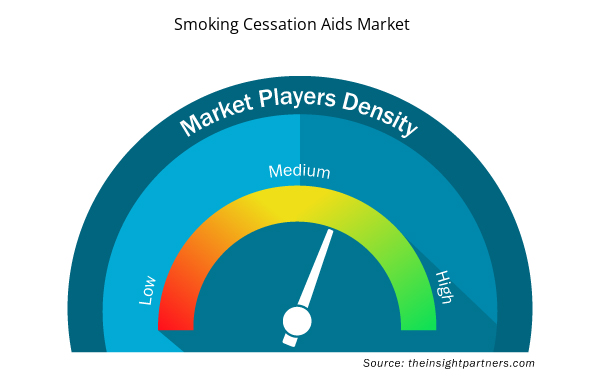

Densidad de actores del mercado de ayudas para dejar de fumar: comprensión de su impacto en la dinámica empresarial

El mercado de productos para dejar de fumar está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de ayudas para dejar de fumar son:

- Pfizer Inc.

- Compañía: GlaxoSmithKline plc.

- Laboratorios del Dr. Reddy

- Servicios Johnson y Johnson, Inc.

- Compañía Cipla Inc.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de ayudas para dejar de fumar

Mercado de ayudas para dejar de fumar (por producto)

- Terapia de reemplazo de nicotina

- Drogas

- Cigarrillos electrónicos

- Otros

Mercado de ayudas para dejar de fumar: por usuario final

- Farmacias hospitalarias

- Canal en línea

- Farmacias minoristas

- Otros

Mercado de ayudas para dejar de fumar por geografía

América del norte

- A NOSOTROS

- Canadá

- México

Europa

- Francia

- Alemania

- Italia

- Reino Unido

- España

- Resto de Europa

Asia Pacífico (APAC)

- Porcelana

- India

- Japón

- Australia

- Corea del Sur

- Resto de Asia Pacífico

Oriente Medio y África (MEA)

- Sudáfrica

- Arabia Saudita

- Emiratos Árabes Unidos

- Resto de Oriente Medio y África

América del Sur y Central (SCAM)

- Brasil

- Argentina

- Resto de América del Sur y Central

Perfiles de empresas

- Pfizer Inc.

- Compañía: GlaxoSmithKline plc.

- Laboratorios del Dr. Reddy

- Servicios Johnson y Johnson, Inc.

- Compañía Cipla Inc.

- Compañía Perrigo plc

- Empresas de salud Bausch Inc.

- Marca Glen

- NJOY

- Laboratorios Juul

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado Valor/volumen: global, regional, nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Preguntas frecuentes

The Smoking Cessation Aids Market majorly consists of the players such as Pfizer Inc., GlaxoSmithKline plc., Dr. Reddy's Laboratories, Johnson and Johnson Services, Inc., Cipla Inc., Perrigo Company plc, Bausch Health Companies Inc., Glenmark, NJOY, Juul Labs among others amongst others.

The US is the largest market for Smoking Cessation Aids at a global level. The market's growth is attributed to the Increasing implementation of various tobacco control programs, high expenditure in healthcare and wellness by the countries in the region and launch of new and innovative products by market players for smoking cessation are some of the factors likely to drive the Smoking Cessation Aids market in the region. According to CDC, in 2017, 14 of every 100 US adults aged 18 years or older (14.0%) currently smoke cigarettes. This hints at a high usage of de-addiction products. Also, this depicts the growing awareness of the people and their readiness to quit smoking. There are also non-government and government establishments working to educate and help people quit smoking that is engaged dedicatedly, to bring the number of smokers down.

Asia Pacific is expected to be the fastest-growing region and is likely to expand at a high growth rate due to increasing awareness about the smoking cessation and nicotine de-addiction products, and a huge population base in the region. For instance, an international collaboration of researchers, led by those from Vanderbilt University in the United States, studied the trends in tobacco use in China, Japan, South Korea, Singapore, Taiwan, and India in Tobacco Smoking and Mortality in Asia, a pooled meta-analysis published by JAMA Network in March 2019. By 2030, it is anticipated that 8.3 million fatalities would be due to smoking. China, India, and Indonesia account for half of the world's male smokers, and Asia is the world's largest tobacco user and production.

The global Smoking Cessation Aids market based on product is segmented into nicotine replacement therapy, drugs, electronic cigarettes, and others. In 2021, the electronic cigarettes segment held the largest share of the market, by product. The electronic cigarettes segment of Smoking Cessation Aids Market is also expected to witness fastest CAGR during 2021 to 2028.The increasing number of campaigns to reduce smoking and tobacco dependence are likely to increase the demand for the above-mentioned products. Therefore, it is expected that market is likely to propel during the forecast period.

The factors that are driving and restraining factors that will affect Smoking Cessation Aids Market in the coming years. Factors such as rising addiction toward tobacco smoking, increasing number of campaigns to reduce smoking and tobacco dependence. However, steeping costs for development of nicotine replacement therapies are likely to restrain the market growth in the future years to some extent.

Smoking cessation lowers the risk of cancer and other serious health problems. Some products contain nicotine as an active ingredient and others do not. Counseling, behavior therapy, medicines, and nicotine-containing products, such as nicotine patches, gum, lozenges, inhalers, and nasal sprays, may be used to help a person quit smoking.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Smoking Cessation Aids Market

- Pfizer Inc.

- GlaxoSmithKline plc.

- Dr. Reddy's Laboratories

- Johnson and Johnson Services, Inc.

- Cipla Inc.

- Perrigo Company plc

- Bausch Health Companies Inc.

- Glenmark

- NJOY

- Juul Labs

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

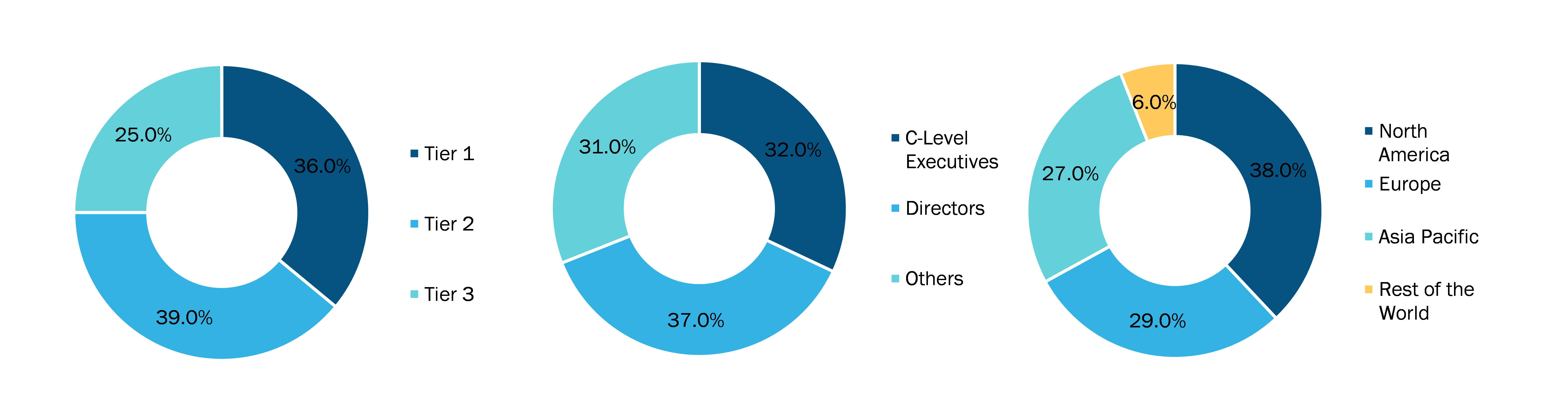

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenga una muestra gratuita de este informe

Obtenga una muestra gratuita de este informe