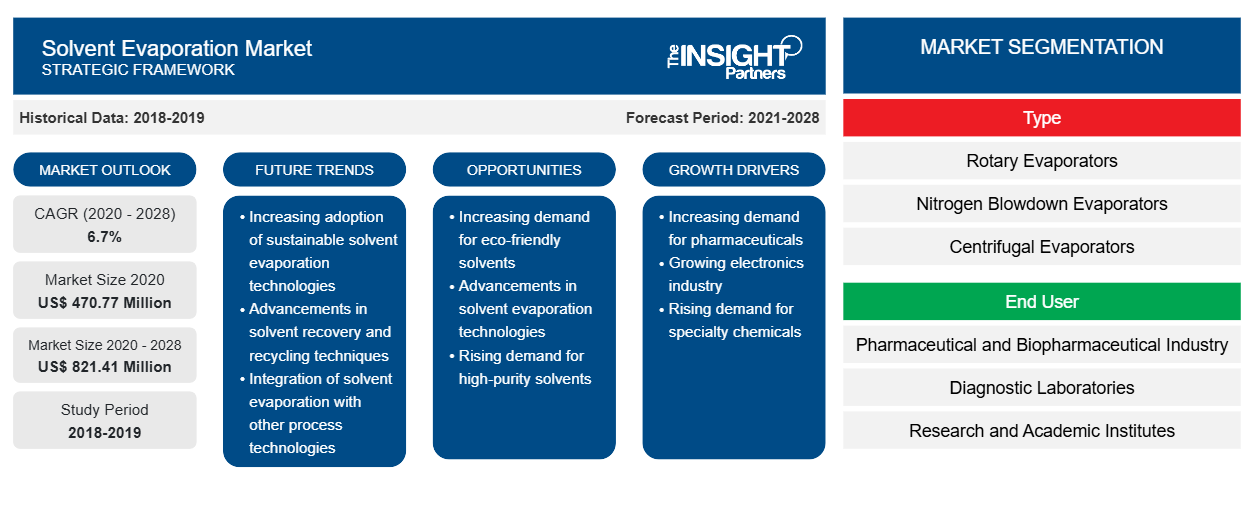

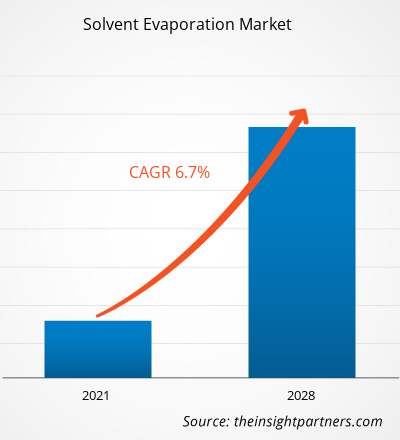

El mercado de evaporación de solventes se valoró en US$ 470,77 millones en 2020 y se proyecta que alcance los US$ 821,41 millones para 2028; se espera que crezca a una CAGR del 6,7% durante 2021-2028.

La evaporación de disolventes implica la emulsión de polímeros en fase acuosa y su dispersión en un disolvente volátil como diclorometano, cloroformo y acetato de etilo. A continuación, el disolvente se evapora utilizando alta temperatura, vacío o agitación continua. El tamaño de las partículas se puede controlar ajustando parámetros como manipulando la temperatura de evaporación, controlando la velocidad de evaporación, manipulando la velocidad de agitación, etc. Este método se está practicando para las nanopartículas desarrolladas utilizando polímeros respectivos como PLA, PLGA, PCL, polihidroxibutirato, etc. cargados con varios fármacos como toxoide tetánico, testosterona, loperamida, ciclosporina A e indometacina. Los evaporadores de disolventes se utilizan ampliamente en procesos como la microencapsulación y son necesarios para preparar nanopartículas poliméricas para varias formulaciones farmacéuticas. Los avances tecnológicos en los sistemas de evaporación de disolventes, como la concentración centrífuga, la liofilización y las trampas de frío de alta potencia, han llevado a una evaporación mejorada y una mejor recuperación de disolventes, con un menor impacto ambiental.

Factores como el aumento del gasto en I+D, el creciente desarrollo de productos biofarmacéuticos de moléculas grandes y la creciente demanda de muestras puras en los mercados de uso final impulsan el crecimiento del mercado de evaporación de disolventes. Sin embargo, las imprecisiones en los resultados y el desperdicio de recursos debido a la inquietud asociada con la evaporación de disolventes obstaculizan el crecimiento del mercado de evaporación de disolventes .

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

- Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Perspectivas del mercado

Aumento del gasto en I+D en la industria farmacéutica

Las sustancias activas de evaporación de disolventes son un paso esencial en el proceso de descubrimiento de fármacos, ya que se utilizan en etapas como la síntesis, la preparación de muestras y el reciclaje de disolventes, así como en la ampliación de la producción de nuevas terapias. Muchas empresas farmacéuticas invierten enormes cantidades en procesos de investigación y desarrollo (I+D) que giran principalmente en torno al descubrimiento y desarrollo de moléculas innovadoras. Según un informe publicado en Statista, el gasto mundial en I+D farmacéutica ascendió a unos 181.000 millones de dólares en 2018, y se espera que alcance los 223.000 millones de dólares en 2026. Según la India Brand Equity Foundation, las empresas farmacéuticas indias invirtieron aproximadamente el 7,0% de sus ingresos en el proceso de I+D en 2015 y la inversión en I+D creció un 8,6% en 2019. Por tanto, el aumento del gasto en I+D está impulsando el crecimiento del mercado de evaporación de disolventes.

Perspectivas basadas en tipos

Según el tipo, el mercado de evaporación de disolventes se segmenta en evaporadores rotativos, evaporadores con purga de nitrógeno, evaporadores centrífugos y evaporadores de flujo de aire en espiral. El segmento de evaporadores rotativos tuvo la mayor participación del mercado en 2020. Sin embargo, se estima que el segmento de evaporadores con purga de nitrógeno registrará la CAGR más alta del mercado del 7,4% durante el período de pronóstico. El evaporador rotativo juega un papel importante en la extracción eficiente de disolventes a través de la evaporación, lo que es un paso importante en el desarrollo de muestras puras en varias industrias. Los factores como el aumento de los gastos de I+D y varios beneficios asociados con esta técnica están impulsando el crecimiento del mercado de evaporación de disolventes.

Información basada en el usuario final

Según el usuario final, el mercado de evaporación de disolventes se segmenta en la industria farmacéutica y biofarmacéutica, los laboratorios de diagnóstico y los institutos de investigación y académicos. El segmento de la industria farmacéutica y biofarmacéutica tuvo la mayor participación del mercado en 2020. Sin embargo, se estima que el segmento de institutos de investigación y académicos registrará la CAGR más alta del mercado del 7,7 % durante el período de pronóstico, debido a factores como el aumento de los estudios de desarrollo de fármacos y la creciente demanda de innovación continua y mejora de los productos existentes.

Varias empresas que operan en el mercado de evaporación de solventes utilizan estrategias como lanzamientos de productos, fusiones y adquisiciones, colaboraciones, innovaciones de productos y expansiones de carteras de productos para expandir su presencia en todo el mundo, mantener la marca y satisfacer la creciente demanda de los usuarios finales.

Perspectivas regionales del mercado de evaporación de disolventes

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de evaporación de solventes durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de evaporación de solventes en América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de evaporación de solventes

Alcance del informe de mercado sobre evaporación de disolventes

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2020 | US$ 470,77 millones |

| Tamaño del mercado en 2028 | US$ 821,41 millones |

| Tasa de crecimiento anual compuesta (CAGR) global (2020-2028) | 6,7% |

| Datos históricos | 2018-2019 |

| Período de pronóstico | 2021-2028 |

| Segmentos cubiertos | Por tipo

|

| Regiones y países cubiertos | América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

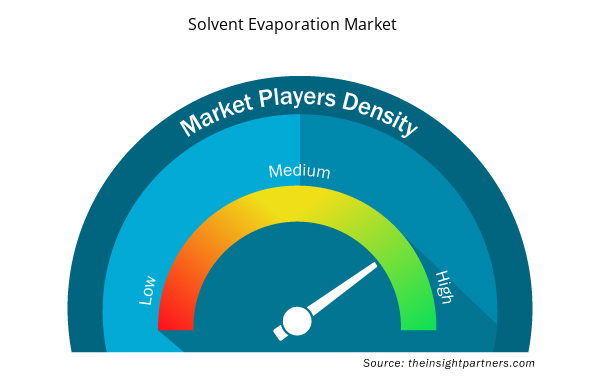

Densidad de los actores del mercado de evaporación de disolventes: comprensión de su impacto en la dinámica empresarial

El mercado de evaporación de solventes está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de evaporación de disolventes son:

- BUCHI LABORTECHNIK AG

- BIOTAGE AB

- CORPORACIÓN LABCONCO

- INSTRUMENTOS HEIDOLPH GMBH & CO. KG

- Compañía científica Yamato, Ltd.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de evaporación de solventes

Mercado de evaporación de disolventes por tipo

- Evaporadores rotativos

- Evaporadores de purga de nitrógeno

- Evaporadores centrífugos

- Evaporadores de flujo de aire en espiral

Mercado de evaporación de disolventes: por usuario final

- Industria farmacéutica y biofarmacéutica

- Laboratorios de diagnóstico

- Institutos de investigación y académicos

Mercado de evaporación de disolventes por geografía

América del norte

- A NOSOTROS

- Canadá

- México

Europa

- Francia

- Alemania

- Italia

- Reino Unido

- España

- Resto de Europa

Asia Pacífico (APAC)

- Porcelana

- India

- Corea del Sur

- Japón

- Australia

- Resto de Asia Pacífico

Oriente Medio y África (MEA)

- Sudáfrica

- Arabia Saudita

- Emiratos Árabes Unidos

- Resto de Oriente Medio y África

América del Sur (SAM)

- Brasil

- Argentina

- Resto de América del Sur y Central

Perfiles de empresas

- BUCHI LABORTECHNIK AG

- BIOTAGE AB

- CORPORACIÓN LABCONCO

- INSTRUMENTOS HEIDOLPH GMBH & CO. KG

- Compañía científica Yamato, Ltd.

- PLC PORVAIR

- IKA WERKE GMBH Y CO. KG

- ESTEROGLASS SRL

- ASOCIADOS DE ORGANOMACIÓN, INC.

- KNF NEUBERGER, INC.

- Raykol

- DISEÑOS DE ALBARICOQUE, INC.

- LABTECH SRL

- MEDIA LUNA CIENTÍFICA

- Compañía SCINCO, LTD.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado Valor/volumen: global, regional, nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

- Explosion-Proof Equipment Market

- Medical Enzyme Technology Market

- Industrial Inkjet Printers Market

- Real-Time Location Systems Market

- Hydrocephalus Shunts Market

- Europe Surety Market

- Sports Technology Market

- Intraoperative Neuromonitoring Market

- Military Rubber Tracks Market

- Retinal Imaging Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Preguntas frecuentes

Increasing R&D expenditure, a growing development of large-molecule biopharmaceuticals, increasing demand for pure samples in end use markets fuels the market growth and various technological advancements. As the solvent evaporation technique is widely used in sample preparation across pharmaceutical industries thus with the increasing use of this technology coupled with growing development in the novel drug is propelling the market.

Inaccuracies in results and wastage of resources due to uneasiness associated with solvent evaporation hinders the growth of the solvent evaporation market.

Solvent evaporation involves emulsification of polymer in aqueous phase and dispersion in a volatile solvent like dichloromethane, chloroform, and ethyl acetate. Then the solvent is evaporated using high temperature, vacuum, or by continuous stirring. Size of the particles can be controlled by adjusting parameters like manipulating evaporation temperature, controlling the rate of evaporation, manipulating stirring rate, etc. This method is being practiced for the nanoparticles developed using respective polymers such as, PLA, PLGA, PCL, polyhydroxybutyrate, etc. loaded with various drugs like tetanus toxoid, testosterone, loperamide, cyclosporin A, and indomethacin. Solvent evaporators are widely used in processes such as microencapsulation and are required to prepare polymeric nanoparticles for various pharmaceutical formulations. Technological advancements in solvent evaporation systems, such as centrifugal concentration, freeze-drying, and high-power cold traps, have led to enhanced evaporation and improved solvent recovery, with lesser environmental impact.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Solvent Evaporation Market

- BUCHI LABORTECHNIK AG

- BIOTAGE AB

- LABCONCO CORPORATION

- HEIDOLPH INSTRUMENTS GMBH & CO. KG

- YAMATO SCIENTIFIC CO., LTD.

- PORVAIR PLC

- IKA WERKE GMBH AND CO. KG

- STEROGLASS SRL

- ORGANOMATION ASSOCIATES, INC.

- KNF NEUBERGER, INC.

- RAYKOL

- APRICOT DESIGNS, INC.

- LABTECH S.R.L.

- CRESCENT SCIENTIFIC

- SCINCO CO.,LTD

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenga una muestra gratuita de este informe

Obtenga una muestra gratuita de este informe