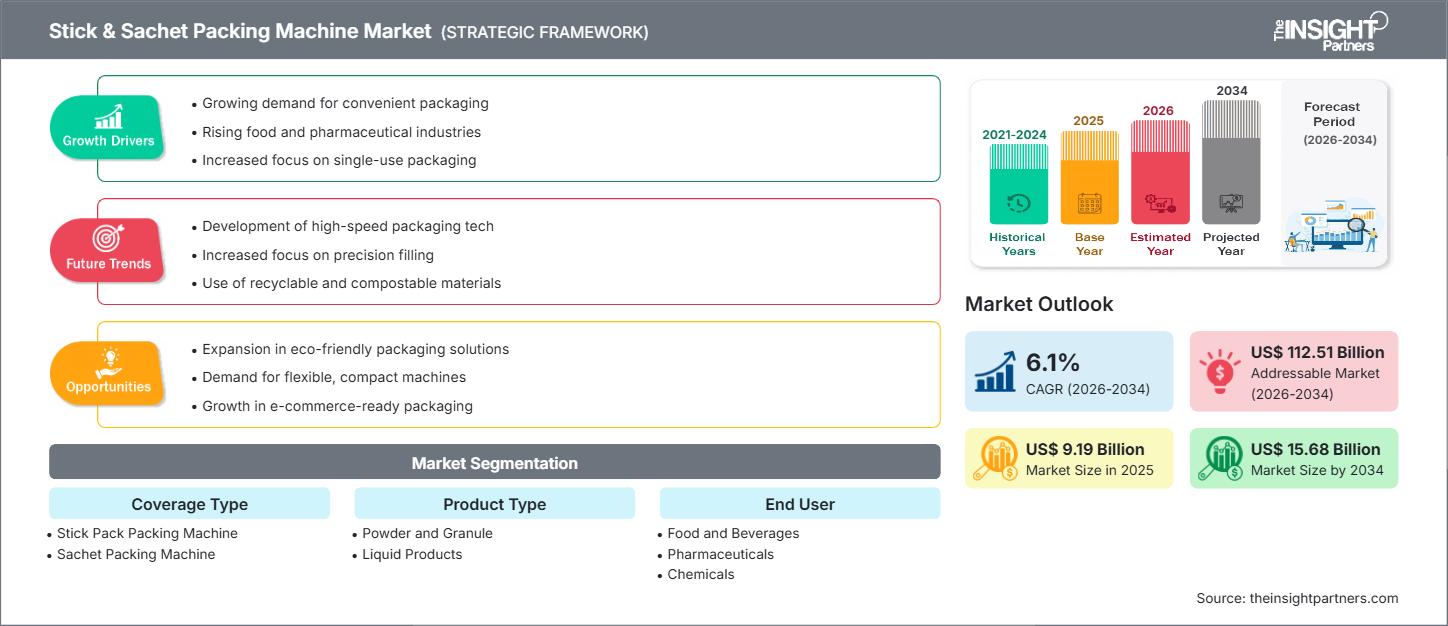

Se espera que el tamaño del mercado de máquinas envasadoras de barras y sobres alcance los 15.680 millones de dólares estadounidenses en 2034, frente a los 9.190 millones de dólares estadounidenses de 2025. Se prevé que el mercado registre una tasa de crecimiento anual compuesta (TCAC) del 6,1 % entre 2026 y 2034.

Análisis del mercado de máquinas envasadoras de palos y bolsitas

El mercado de máquinas empacadoras de sticks y sachets está creciendo rápidamente, impulsado por la creciente demanda global de soluciones de envasado prácticas, monodosis y con control de porciones. Estos formatos compactos de envasado gozan de una amplia aceptación en industrias clave como la de alimentos y bebidas, farmacéutica, cosmética y química. Las mejoras tecnológicas, combinadas con la automatización, los sistemas servoaccionados y las configuraciones para la operación en múltiples carriles, son la base del crecimiento del mercado, lo que, en consecuencia, tiene un impacto positivo significativo en el aumento de la tasa de producción, la precisión y la OEE. Los factores clave que impulsan el mercado incluyen el creciente interés en materiales de envasado ecológicos y flexibles, además de la necesidad de soluciones de envasado rápidas y económicas, no solo para grupos de bajos ingresos debido a su menor costo unitario, sino también para la producción a gran escala.

Descripción general del mercado de máquinas empacadoras de barras y bolsitas

Las máquinas envasadoras de sticks y sachets son fundamentales en las líneas de producción modernas, donde se realiza eficientemente el llenado y sellado a alta velocidad de una amplia gama de productos en polvo, gránulos, líquidos o pastas. Estas máquinas ofrecen una dosificación precisa y un envasado higiénico, fundamental en las industrias farmacéutica y de alimentos y bebidas. Todos estos factores convierten a los sticks y sachets en un factor clave, ya que ofrecen ventajas como la comodidad, la facilidad de uso, la portabilidad, la reducción del consumo de material y los menores costes de envío. La adopción de operaciones de envasado eficientes, especialmente con el auge del comercio electrónico y la necesidad de un suministro continuo de medicamentos, fortalece aún más el mercado de estas máquinas especializadas.

Personalice este informe según sus necesidades

Obtenga PERSONALIZACIÓN GRATUITAMercado de máquinas envasadoras de palos y bolsitas: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de máquinas envasadoras de palos y bolsitas

Factores impulsores del mercado:

- Creciente demanda de envases monodosis y de porciones controladas: Los consumidores se sienten cada vez más atraídos por los envases monodosis de conveniencia, diseñados para el consumo en marcha, el control de porciones y la higiene, especialmente en alimentos, bebidas y cuidado personal. Esta tendencia genera una gran demanda de envases en stick y sobre.

- Avances tecnológicos e integración de la automatización: la adopción de automatización avanzada, sistemas servoaccionados y máquinas de múltiples carriles mejora la eficiencia operativa, el rendimiento y la precisión, lo que hace que las líneas de envasado sean más rápidas y rentables.

- Expansión de industrias clave para usuarios finales: el crecimiento continuo de las industrias farmacéutica y de alimentos y bebidas, en particular en economías en desarrollo específicas, creará una demanda constante de máquinas de envasado confiables y de alta capacidad.

Oportunidades de mercado:

- Adopción de tecnologías de la Industria 4.0: La integración de soluciones de embalaje inteligente basadas en IoT e IA ofrece monitoreo en tiempo real, mantenimiento predictivo y optimización de los procesos de embalaje, lo que puede reducir significativamente el tiempo de inactividad y el desperdicio.

- Creciente demanda de soluciones de embalaje sostenibles: el enfoque en la sostenibilidad está impulsando la demanda de máquinas compatibles con materiales de embalaje ecológicos y biodegradables, lo que presenta una oportunidad clave para que los fabricantes innoven sus líneas de productos.

- Incorporación de la impresión digital: La tecnología de impresión digital permite una mayor personalización y adaptación de los diseños de bolsitas y stick packs, lo que resulta muy valorado para campañas de branding y marketing específicas.

Análisis de segmentación del informe de mercado de máquinas empacadoras de barras y bolsitas

La cuota de mercado de las máquinas envasadoras de sticks y sachets se analiza en varios segmentos para comprender mejor su estructura, potencial de crecimiento y tendencias emergentes. A continuación, se presenta el enfoque de segmentación estándar utilizado en la mayoría de los informes del sector:

Por tipo:

- Máquina envasadora tipo stick pack: máquinas diseñadas para crear bolsas cilíndricas y alargadas (stick packs), que suelen dominar el mercado debido a su diseño que ahorra espacio y sus capacidades de alto rendimiento, especialmente para polvos y gránulos.

- Máquina envasadora de sobres: Máquinas diseñadas para crear bolsas (sobres) planas, cuadradas o rectangulares, a menudo utilizadas para líquidos, pastas y varias porciones individuales.

Por tipo de producto:

- Polvo y gránulos: el segmento que generalmente tiene la mayor participación de mercado y abarca productos como café, azúcar, especias, productos farmacéuticos y proteínas en polvo.

- Productos líquidos: Incluye productos como salsas, medicamentos líquidos, champús, aceites y otros productos viscosos.

Por usuario final:

- Alimentos y bebidas: el segmento de usuarios finales más grande, impulsado por la demanda de productos instantáneos, condimentos y bebidas en porciones individuales.

- Productos farmacéuticos: Impulsados por la necesidad de envases higiénicos, precisos y a prueba de manipulaciones para medicamentos y suplementos en dosis unitarias.

- Cosméticos: Se centra en muestras de un solo uso o envases de tamaño de viaje para cremas, lociones y productos de cuidado personal.

- Productos químicos: Incluye envases para pequeñas dosis de productos químicos industriales, pigmentos y otros productos especializados.

Por geografía:

- América del norte

- Europa

- Asia-Pacífico

- América del Sur y Central

- Oriente Medio y África

Perspectivas regionales del mercado de máquinas envasadoras de barras y bolsitas

Los analistas de The Insight Partners han explicado detalladamente las tendencias y los factores regionales que influyen en el mercado de máquinas empacadoras de barras y sobres durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de máquinas empacadoras de barras y sobres en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de máquinas empacadoras de barras y bolsitas

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2025 | US$ 9.19 mil millones |

| Tamaño del mercado en 2034 | US$ 15.68 mil millones |

| CAGR global (2026-2034) | 6,1% |

| Datos históricos | 2021-2024 |

| Período de pronóstico | 2026-2034 |

| Segmentos cubiertos |

Por tipo de cobertura

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de máquinas empacadoras de barras y bolsitas: comprensión de su impacto en la dinámica empresarial

El mercado de máquinas empacadoras de sticks y sachets está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias del consumidor, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades del consumidor y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores del mercado de máquinas empacadoras de palos y bolsitas

Análisis de la cuota de mercado de las máquinas envasadoras de palos y bolsitas por geografía

Norteamérica posee una cuota de mercado significativa, impulsada por su avanzada infraestructura de fabricación, la alta adopción de tecnologías de automatización y la sólida presencia de actores clave de la industria. Se prevé que Asia-Pacífico (APAC) sea el mercado regional de más rápido crecimiento. Este crecimiento se ve impulsado por la rápida industrialización, la creciente demanda de bienes de consumo envasados debido al aumento de la población y la renta disponible, y el aumento de las inversiones en automatización de la fabricación en diversas industrias de consumo final.

El mercado de máquinas envasadoras de sticks y sachets muestra una trayectoria de crecimiento diferente en cada región debido a factores como la rápida industrialización global, la creciente preferencia de los consumidores por los productos envasados y el crecimiento de la industria de alimentos y bebidas. A continuación, se presenta un resumen de la cuota de mercado y las tendencias por región:

1. América del Norte

- Cuota de mercado: Participación dominante en los ingresos, debido a la adopción de tecnología avanzada y sectores manufactureros maduros.

- Factores clave: Alta adopción de sistemas de envasado automatizados; Fuerte presencia de actores clave de la industria a nivel mundial; Alta preferencia de los consumidores por alimentos envasados y convenientes.

- Tendencias: Centrarse en soluciones de embalaje flexibles, de múltiples carriles y de alta velocidad para satisfacer los requisitos de producción a gran escala.

2. Europa

- Cuota de mercado: Cuota de mercado sustancial, con un crecimiento influenciado por estrictos estándares regulatorios y un fuerte enfoque en la sostenibilidad.

-

Factores clave:

- Estrictas regulaciones de seguridad alimentaria y farmacéutica, que exigen máquinas de alta precisión e higiene; énfasis en materiales de embalaje sostenibles y ligeros.

- Tendencias: Adopción de automatización avanzada (Industria 4.0) y máquinas diseñadas para manejar películas biodegradables y ecológicas.

3. Asia Pacífico

- Cuota de mercado: Mercado regional de más rápido crecimiento, impulsado por la rápida industrialización y la creciente demanda de los consumidores.

-

Factores clave:

- El aumento de los ingresos disponibles y la urbanización impulsan la demanda de bienes de consumo de rápido movimiento envasados; apoyo gubernamental a programas de manufactura y economía digital.

- Tendencias: Uso de motores de recomendación impulsados por IA, chatbots localizados y modelos dinámicos de colaboración con personas influyentes.

4. América del Sur y Central

- Cuota de mercado: Región emergente con potencial de crecimiento estable.

-

Factores clave:

- Creciente modernización de los procesos de envasado; creciente adopción de la automatización del envasado en el sector de alimentos y bebidas.

- Tendencias: Centrarse en soluciones rentables y de múltiples carriles para mejorar la eficiencia de la producción.

5. Oriente Medio y África

- Cuota de mercado: Mercado emergente con fuerte potencial, impulsado por iniciativas nacionales de transformación digital e industrial.

-

Factores clave:

- Creciente necesidad de productos farmacéuticos y productos envasados; las inversiones en los sectores de logística y transporte están impulsando la demanda de envases.

- Tendencias: Creciente demanda de embalajes que garanticen la integridad del producto en climas difíciles, lo que lleva a la adopción de máquinas envasadoras de bolsitas robustas y de alta barrera.

Densidad de actores del mercado de máquinas empacadoras de barras y bolsitas: comprensión de su impacto en la dinámica empresarial

El mercado de máquinas empacadoras de sticks y sachets es moderadamente competitivo, con la participación tanto de grandes conglomerados globales de maquinaria de envasado como de fabricantes de nichos altamente especializados. Las empresas compiten activamente innovando en velocidad, flexibilidad y compatibilidad con nuevos materiales.

El panorama competitivo está impulsando a los proveedores a diferenciarse a través de:

- Los fabricantes se están centrando en la tecnología de múltiples carriles para maximizar la producción y mejorar el rendimiento, reduciendo así el coste por paquete para sus clientes.

- Ofrecemos máquinas que se integran perfectamente con los equipos de procesamiento ascendentes y las máquinas de embalaje/encartonado descendentes, a menudo a través de estándares de IoT/Industria 4.0.

- Desarrollo de máquinas que cumplen con estrictas regulaciones en las industrias farmacéutica y alimentaria, incluidas características para una fácil limpieza y cambios.

Oportunidades y movimientos estratégicos

- Adquisiciones y asociaciones estratégicas: los grandes actores están participando en fusiones y adquisiciones de empresas especializadas regionales o centradas en la tecnología para expandir sus carteras de productos y su alcance geográfico.

- I+D en sostenibilidad: inversión significativa en I+D para desarrollar componentes de máquinas y tecnologías de sellado que manipulen de manera eficiente materiales de embalaje sostenibles como papel, películas biodegradables y monomateriales.

- Penetración de mercado en regiones emergentes: Apuntar a mercados de alto crecimiento, particularmente en Asia-Pacífico y Oriente Medio y África, estableciendo redes locales de ventas y soporte de servicios.

Las principales empresas que operan en el mercado de máquinas envasadoras de palos y bolsitas son:

- Maquinaria de Embalaje ARANOW, SL

- Ingeniería de Envasado Vertical S.L.

- IMA-Ilapak

- Körber AG

- Maquinaria de embalaje Matrix, LLC

- MESPACK, SL

- OMAG Srl

- Máquinas de embalaje SmartPac GmbH

- Syntegon Technology GmbH

Descargo de responsabilidad: Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

Noticias y desarrollos recientes del mercado de máquinas empacadoras de palos y bolsitas

- Por ejemplo, el 7 de agosto de 2025, Syntegon participará en Anuga FoodTec India en el Centro de Exposiciones de Bombay. Este evento, anteriormente conocido como PackEx India, se ha consolidado como la principal plataforma del sur de Asia para innovaciones en procesamiento, envasado y automatización de alimentos. Syntegon presentará en el stand L02 dos sistemas de envasado avanzados diseñados para satisfacer las necesidades dinámicas del creciente mercado de snacks y galletas de la India.

- En marzo de 2024, Manter International BV, fabricante líder de soluciones de pesaje y envasado, IMA Ilapak Italia e IMA Record, reconocida por su maquinaria de envasado de alta gama, y ambas parte del FLX HUB de IMA Group, unieron fuerzas oficialmente en una asociación estratégica destinada a redefinir el sector de productos agrícolas frescos, con un enfoque en frutas y verduras frescas como patatas, zanahorias, cebollas, remolacha, ajo, rábano, coles de Bruselas, pimientos, cítricos, manzanas y peras.

Informe de mercado de máquinas empacadoras de palos y bolsitas: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de máquinas empacadoras de palos y bolsitas (2021-2034)" ofrece un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado de máquinas empacadoras de bolsitas y palos y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de máquinas empacadoras de palos y bolsitas, así como dinámicas del mercado como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallado

- Análisis del mercado de máquinas empacadoras de palos y bolsitas que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama industrial y de la competencia, que abarca la concentración del mercado, el análisis de mapas de calor, los actores principales y la evolución reciente del mercado de máquinas empacadoras de barras y sobres. Perfiles detallados de las empresas.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de máquinas envasadoras de palos y bolsitas

Obtenga una muestra gratuita para - Mercado de máquinas envasadoras de palos y bolsitas