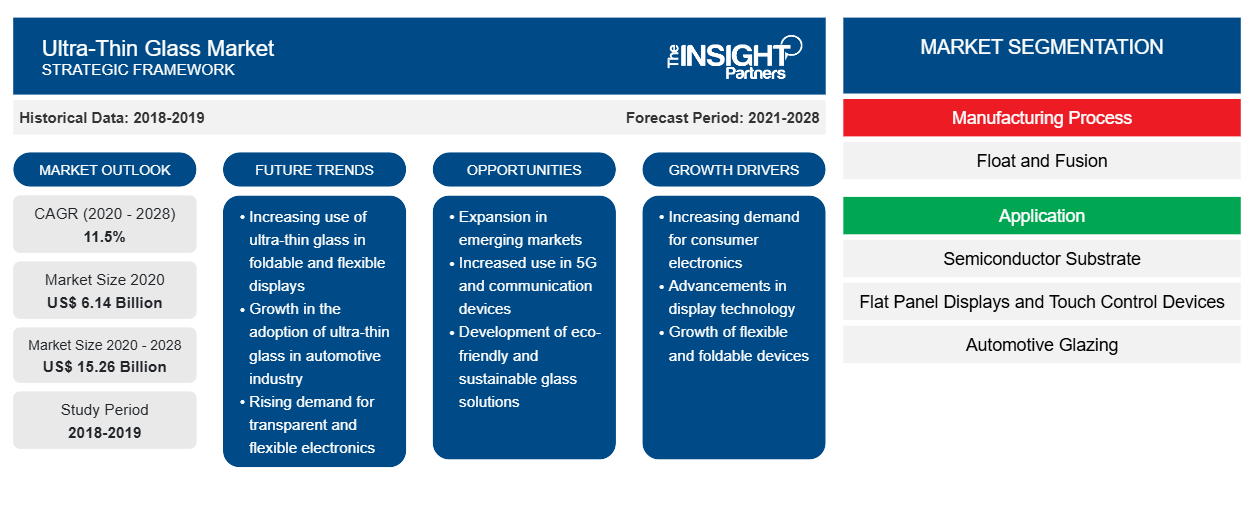

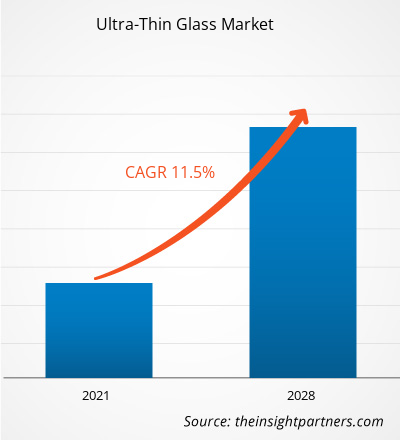

[Informe de investigación] El mercado de vidrio ultrafino se valoró en US$ 6.139,56 millones en 2020 y se proyecta que alcance los US$ 15.264,74 millones en 2028; se espera que crezca a una CAGR del 11,5% entre 2021 y 2028.

El vidrio ultrafino es aquel cuyo espesor es inferior a 1-2 mm. El refuerzo químico mediante intercambio iónico se utiliza habitualmente para reforzar el vidrio ultrafino utilizado para aplicaciones de alta tecnología. El vidrio ultrafino endurecido es resistente a los arañazos y se puede doblar hasta un radio de unos pocos milímetros. Las propiedades del vidrio ultrafino, como la resistencia a la corrosión, la transparencia, la flexibilidad, la excelente barrera al gas y al agua y la alta resistencia al impacto, lo hacen adecuado para diversas aplicaciones, como pantallas planas, acristalamiento de automóviles, entre otras. En 2020, Asia Pacífico tuvo la mayor participación en los ingresos del mercado mundial de vidrio ultrafino . China es el mayor consumidor de vidrios ultrafinos, lo que representa más del 50% de la participación de mercado en Asia Pacífico. El país es el principal centro de fabricación de todo tipo de productos electrónicos de consumo, como teléfonos inteligentes y LCD.

La actual pandemia de COVID-19 ha alterado drásticamente el estado del sector de productos químicos y materiales y ha afectado negativamente al crecimiento del mercado del vidrio ultrafino. La implementación de medidas para combatir la propagación del nuevo coronavirus ha agravado la situación y ha afectado negativamente al crecimiento de varios sectores. Industrias como la automotriz y la electrónica de consumo se han visto afectadas negativamente por la repentina distorsión en las eficiencias operativas y las interrupciones en las cadenas de valor debido al cierre repentino de las fronteras nacionales e internacionales. La disminución del crecimiento de varios sectores afectó negativamente la demanda de vidrio ultrafino en el mercado global. Sin embargo, como las economías planean reactivar sus operaciones, se espera que la demanda de vidrio ultrafino aumente a nivel mundial en los próximos años. Debido a la pandemia, la adopción de la cultura del trabajo remoto y la educación en línea está creciendo. Por lo tanto, la demanda de productos como computadoras portátiles, teléfonos inteligentes y otros dispositivos de telecomunicaciones está creciendo. Se espera que la creciente demanda de vidrio ultrafino en diversas industrias, como la automotriz y la electrónica de consumo, junto con importantes inversiones por parte de fabricantes destacados, impulsen el crecimiento del mercado de vidrio ultrafino durante el período de pronóstico.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

- Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Perspectivas del mercado

Creciente industria de la electrónica de consumo

La industria de la electrónica de consumo está en auge debido al creciente uso de aparatos electrónicos, como teléfonos inteligentes, computadoras portátiles, televisores y otros productos electrónicos. Los bienes electrónicos de consumo se han convertido en una necesidad en el mundo tecnológico. Las personas de todas las generaciones dependen de alguna manera de sus teléfonos inteligentes, relojes inteligentes y computadoras portátiles. Con el crecimiento de la industria de la electrónica de consumo, los fabricantes se centran continuamente en proporcionar productos avanzados y de alta calidad. El vidrio ultrafino juega un papel importante en la industria de la electrónica de consumo. Se utiliza en paneles táctiles y de visualización, sensores y sistemas de cámara. Varias propiedades del vidrio ultrafino, como la resistencia a la corrosión, la transparencia, la flexibilidad y la capacidad de barrera de gas, lo hacen adecuado para numerosas aplicaciones en la industria de la electrónica de consumo. China domina la industria de bienes electrónicos de consumo. El país es uno de los principales fabricantes de pantallas planas. Existe una demanda en rápido aumento de teléfonos inteligentes, rastreadores de actividad física, televisores y otros productos electrónicos chinos, lo que brinda oportunidades lucrativas a los fabricantes de vidrio ultrafino. China ha fortalecido la construcción de nueva infraestructura; promovido la construcción de inteligencia artificial, internet industrial e Internet de las cosas; y aceleró el ritmo de comercialización de 5G, lo que impulsa la industria de fabricación de información electrónica a una nueva etapa de desarrollo y promueve aún más el desarrollo de alta gama de industrias relacionadas. Según World Population Review, China tiene 1.600 millones de usuarios de teléfonos móviles y la India tiene 1.280 millones de usuarios de teléfonos móviles. En 2018, Apple registró alrededor de 22,5 millones de envíos de relojes inteligentes. Esta cifra ha aumentado con respecto a 2017, ya que la empresa vendió 17,7 millones de unidades en 2017. En 2018, Fitbit envió alrededor de 5,5 millones de unidades de relojes inteligentes, mientras que Samsung envió alrededor de 5,3 millones de unidades. Por lo tanto, la industria de electrónica de consumo en rápido crecimiento impulsa la demanda de gafas ultradelgadas.

Perspectivas de la industria de uso final

El segmento de electrónica de consumo tuvo la mayor participación del mercado mundial de vidrio ultrafino en 2020.El vidrio ultrafino se utiliza ampliamente en la fabricación de productos electrónicos, como pantallas planas y pantallas táctiles para diversos dispositivos, como LCD, OLED, teléfonos inteligentes y dispositivos portátiles. Con la creciente demanda de productos electrónicos innovadores y tecnológicamente avanzados en todo el mundo, se espera que la demanda de vidrios ultrafinos aumente en los próximos años.

Perspectivas del proceso de fabricación

En cuanto al proceso de fabricación, el segmento de fusión dominó el mercado de vidrio ultrafino en términos de ingresos en 2020. El proceso de fusión, a menudo conocido como método de extracción por desbordamiento, se utiliza ampliamente para fabricar vidrios planos ultrafinos para paneles de visualización. Corning fue la primera empresa en crear un vidrio especializado que se suspendía en el aire, lo que es una característica clave del método de fusión. El vidrio no entra en contacto con el metal fundido, lo que constituye una ventaja fundamental del método de fusión sobre el método del vidrio flotado.

Algunos de los actores clave del mercado que operan en el mercado del vidrio ultrafino son Corning Incorporated; AGC Inc.; Nippon Electric Glass Co., Ltd.; SCHOTT AG; Central Glass Co., Ltd.; CSG Holding Co., Ltd.; Emerge Glass; Nippon Sheet Glass Co., Ltd; Xinyi Glass Holdings Limited; y Luoyang Glass Co., Ltd. Los principales actores del mercado están adoptando estrategias como fusiones y adquisiciones y lanzamientos de productos para expandir su presencia geográfica y su base de consumidores.

Perspectivas regionales del mercado de vidrio ultrafino

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de vidrio ultrafino durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de vidrio ultrafino en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de vidrio ultrafino

Alcance del informe de mercado de vidrio ultrafino

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2020 | 6.140 millones de dólares estadounidenses |

| Tamaño del mercado en 2028 | US$ 15,26 mil millones |

| Tasa de crecimiento anual compuesta (CAGR) global (2020-2028) | 11,5% |

| Datos históricos | 2018-2019 |

| Período de pronóstico | 2021-2028 |

| Segmentos cubiertos | Por proceso de fabricación

|

| Regiones y países cubiertos | América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de vidrio ultrafino está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de vidrio ultrafino son:

- Corning Incorporated

- Compañía: AGC Inc.

- Vidrio eléctrico Nippon Co., Ltd.

- SCHOTT AG

- Compañía de vidrio central, Ltd.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de vidrio ultrafino

Informe Destacado

- Tendencias progresivas en la industria del vidrio ultrafino para ayudar a los actores a desarrollar estrategias efectivas a largo plazo

- Estrategias de crecimiento empresarial adoptadas por las empresas para asegurar el crecimiento en los mercados desarrollados y en desarrollo

- Análisis cuantitativo del mercado mundial de vidrio ultrafino de 2019 a 2028

- Estimación de la demanda de vidrio ultrafino en diversas industrias

- Análisis de Porter para ilustrar la eficacia de los compradores y proveedores que operan en la industria para predecir el crecimiento del mercado

- Desarrollos recientes para comprender el escenario competitivo del mercado y la demanda de vidrio ultrafino

- Tendencias y perspectivas del mercado junto con los factores que impulsan y restringen el crecimiento del mercado del vidrio ultrafino

- Comprensión de las estrategias que sustentan el interés comercial en relación con el crecimiento del mercado mundial de vidrio ultrafino, lo que ayuda en el proceso de toma de decisiones.

- Tamaño del mercado de vidrio ultrafino en varios nodos del mercado

- Descripción detallada y segmentación del mercado mundial de vidrio ultrafino, así como su dinámica industrial

- Tamaño del mercado de vidrio ultrafino en varias regiones con oportunidades de crecimiento prometedoras

Mercado de vidrio ultrafino, por proceso de fabricación

- Flotar

- Fusión

Mercado de vidrio ultrafino por aplicación

- Sustrato semiconductor

- Pantallas planas y dispositivos de control táctil

- Acristalamiento para automóviles

- Otros

Mercado de vidrio ultrafino, por industria de uso final

- Electrónica de consumo

- Automotor

- Medicina y atención sanitaria

- Otros

Perfiles de empresas

- Corning Incorporated

- Compañía: AGC Inc.

- Vidrio eléctrico Nippon Co., Ltd.

- SCHOTT AG

- Compañía de vidrio central, Ltd.

- Compañía holding CSG, Ltd.

- Vidrio emergente

- Nippon Sheet Glass Co., Ltd

- Xinyi Glass Holdings Limited

- Co., Ltd. de vidrio de Luoyang

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado Valor/volumen: global, regional, nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Preguntas frecuentes

Asia-Pacific is estimated to register the fastest CAGR in the market over the forecast period. The rising demand for LED and OLED televisions is boosting the market growth across the region. Manufacturers of flat panel displays in China, South Korea, and Taiwan are dominating the global marketplace in terms of production and supply of flat panel displays. These displays can be found in cars, industrial equipment, personal computers, smartphones, and a variety of other goods. Liquid crystal displays are used in the majority of TV screens (LCDs). Other display types used in televisions include organic light-emitting diodes (OLEDs) and quantum dots. LCDs and OLEDs are used in smartphone displays. Thus, the high concentration of flat panel display manufacturers in Asia-Pacific, coupled with the high utilization of ultra-thin glass in designing flat panel displays, is the crucial factor anticipated to further drive the market in the coming years. Furthermore, the growing application of ultra-thin glass by automobile manufacturers in China, India, and South Korea is driving the market. China, as one of the significant producers of automobiles, has a high need for ultra-thin glass for use in various automotive interior panels. Furthermore, the existence of significant players such as AGC Inc. and Nippon Electric Glass Co., Ltd is projected to fuel the market expansion.

Based on end use, consumer electronics segment led the global ultra-thin glass market during the forecasted period. Consumer electronics is one of the prominent end-use industries contributing a major share in the growth of the ultra-thin glass market. Ultra-thin glass is widely used to manufacture electronic goods such as flat panel display devices, smartphones, wearable devices, and touch screen devices. It is extremely thin and flexible. Therefore, it is ideal for devices with wider displays and touch screen features. Moreover, it is used in microprocessors of smartphones as a substrate. Using ultra-thin glass in semiconductor substrates ensures the increased performance of microprocessors, which enables high data transfer rates. The growing utilization of ultra-thin glass in consumer electronic devices is expected to boost the market growth. Moreover, the rising demand for electronic gadgets such as smartphones, laptops, tablets, and televisions in emerging economies, owing to rise in disposable income, significant economic development, increase in adoption of emerging technologies, and improved lifestyles of people, is expected to boost the growth of global ultra-thin glass market in the coming years. Manufacturers of ultra-thin glass are focusing on launching innovative products. Recently, foldable ultra-thin glass was developed by Schott AG which is a Germany-based manufacturer of specialty glass products. This foldable glass was used by Samsung in its Z-fold 3 smartphone which is gaining huge popularity among people worldwide. Such innovations by the prominent manufactures of ultra-thin glass are expected to boost the consumer electronics segment’s growth.

On the basis of manufacturing process, fusion segment is leading the ultra-thin glass market during the forecast period. The fusion process, often known as the overflow downdraw method, is widely used to manufacture flat ultra-thin glass for display panels. Corning was the first company to create specialized glass that was suspended in mid-air, which is a key trait of the fusion method. Glass is not contacted by molten metal, which is a fundamental advantage of the fusion method over the float glass method. The raw materials, including pure sand and other inorganic elements, are fed into a massive melting tank that is heated to temperatures beyond 1000â° Celsius. The molten glass is homogenized and conditioned before being discharged into an isopipe, a huge collection trough with a V-shaped bottom. The isopipe is carefully heated to ensure optimum viscosity of the mixture and consistent flow. The molten glass flows uniformly over the isopipe's top edges, generating two thin, sheet-like streams along the outer surfaces. The two sheets meet at the bottom of the isopipe and are fused into a single glass sheet. As the sheet lengthens and cools in mid-air, it feeds into drawing equipment while still linked to the bottom of the isopipe. With precise control of the fusion glass process parameters, thinner glass panels can be produced. Commercial manufacturers such as Corning, Schott, AGC, and Nippon Electric Glass use the drawdown or fusion process for producing ultra-thin glass.

Based on application, flat-panel display segment is expected to grow at the fastest CAGR from 2021 to 2028. Flat panel displays are video devices that replace the conventional cathode ray tube (CRT) with a thin panel design. Ultra-thin glass is widely used to manufacture flat panel displays such as LCD, LED, OLED screens, smartphone displays, and monitor screens. Moreover, ultra-thin glass is used in the touch module of touch screen devices such as smartphones, tablets, and laptops. It provides fundamental functions for flat-panel display and touch screen devices such as high definition (HD) display, touch-control and scratch resistance, and protection to the screens. Consumer electronic goods are being upgraded at a faster rate as the technological landscape is changing rapidly. Panel display components used in flat-panel display and touch-control devices have emerged as the most important downstream application products for ultra-thin glass substrates with the highest market demand. The need for ultra-thin glass substrate is predicted to rise since it is a crucial component and key fundamental material for flat-panel display and touch-control systems. Moreover, ultra-thin glass substrates are non-substitutable and have a promising future as the entire electronic device market develops.

The major players operating in the ultra-thin glass market are Corning Incorporated; AGC Inc.; Nippon Electric Glass Co., Ltd.; SCHOTT AG; Central Glass Co., Ltd.; CSG Holding Co., Ltd.; Emerge Glass; Nippon Sheet Glass Co., Ltd; Xinyi Glass Holdings Limited; and Luoyang Glass Co., Ltd.

In 2020, Asia Pacific held the largest revenue share of the global ultra-thin glass market and is also expected to register the highest CAGR during the forecast period. The ultra-thin glass market across the region is projected to witness remarkable growth, owing to the rapidly expanding consumer electronics industry in countries such as China, Japan, and South Korea. China is one of the largest consumer electronics markets across the world, along with Japan and South Korea. Due to the high concentration of consumer electronics manufacturers in Asia-Pacific, the demand for ultra-thin glass from the manufacturers of electronic goods across the region is expected to grow significantly over the forecast period. Moreover, China and Japan are the leading exporters of semiconductor components used in electronic gadgets. Many leading manufacturers of smartphones and electronic gadgets heavily rely on Asia-Pacific countries for sourcing semiconductor components. For chip packing and interposer applications, the semiconductor industry is progressively designing products using thin glass substrates. When organic substrate materials are employed, the locally generated heat of the small core parts of mobile devices causes deflection and reliability issues. Ultra-thin glass has excellent dimensional stability over a wide range of temperatures while also providing the foundation for an exceedingly flat chip package. Thus, the increasing utilization of ultra-thin glass for designing electronic goods across the region is projected to potentially drive the market over the forecast period.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Ultra-thin Glass Market

- Corning Incorporated

- AGC Inc.

- Nippon Electric Glass Co., Ltd.

- SCHOTT AG

- Central Glass Co., Ltd.

- CSG Holding Co., Ltd.

- Emerge Glass

- Nippon Sheet Glass Co., Ltd

- Xinyi Glass Holdings Limited

- Luoyang Glass Co., Ltd.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenga una muestra gratuita de este informe

Obtenga una muestra gratuita de este informe