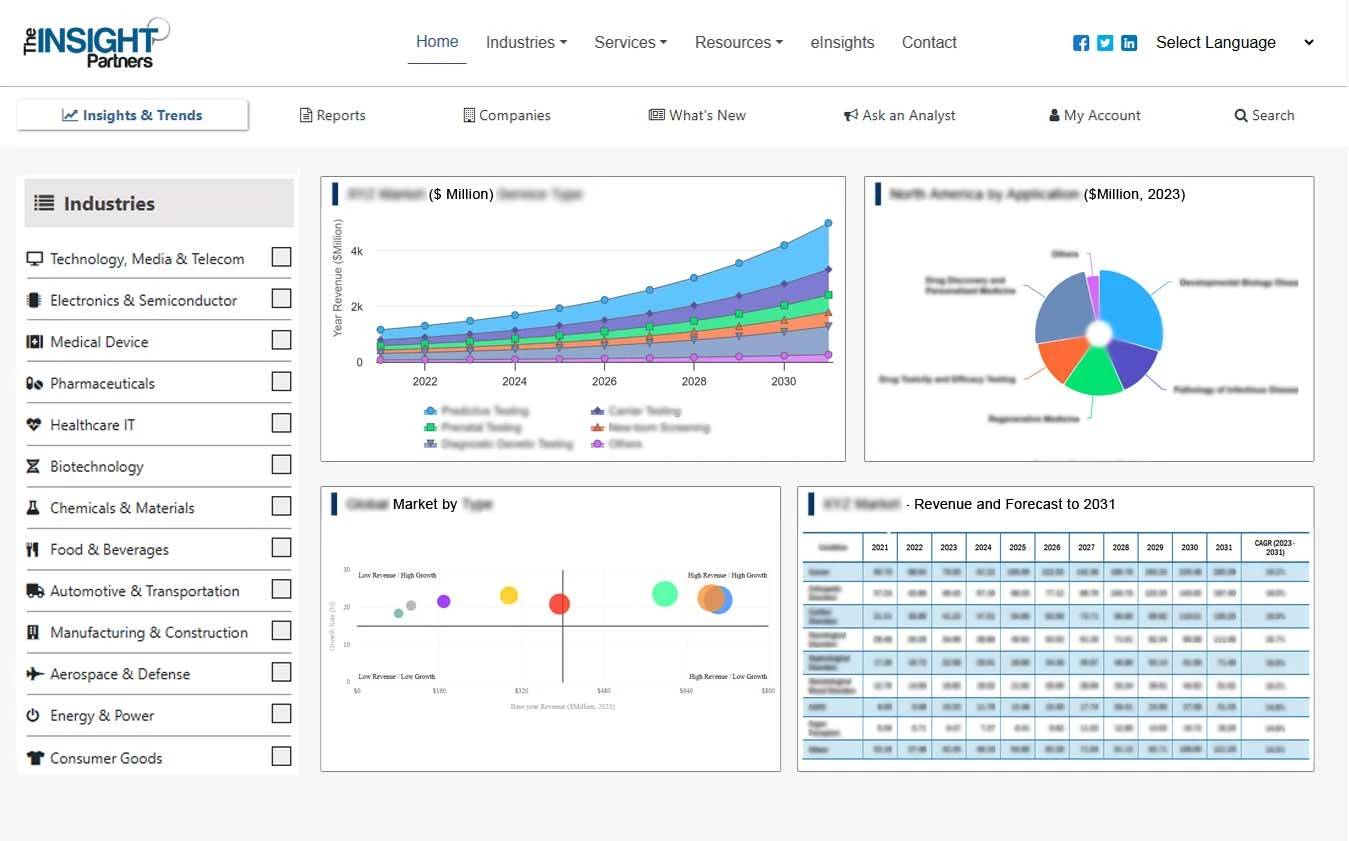

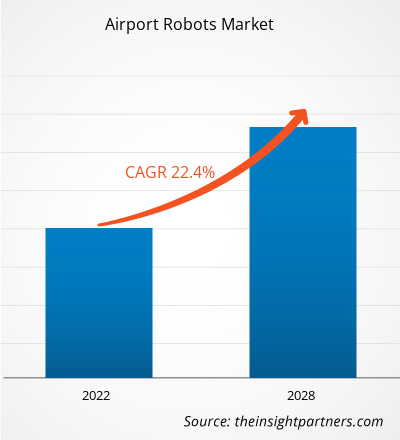

[Rapport de recherche] Le marché des robots aéroportuaires devrait passer de 512,56 millions de dollars américains en 2021 à 2 108,29 millions de dollars américains d'ici 2028 ; on estime qu’il connaîtra une croissance à un TCAC de 22,4 % de 2021 à 2028.

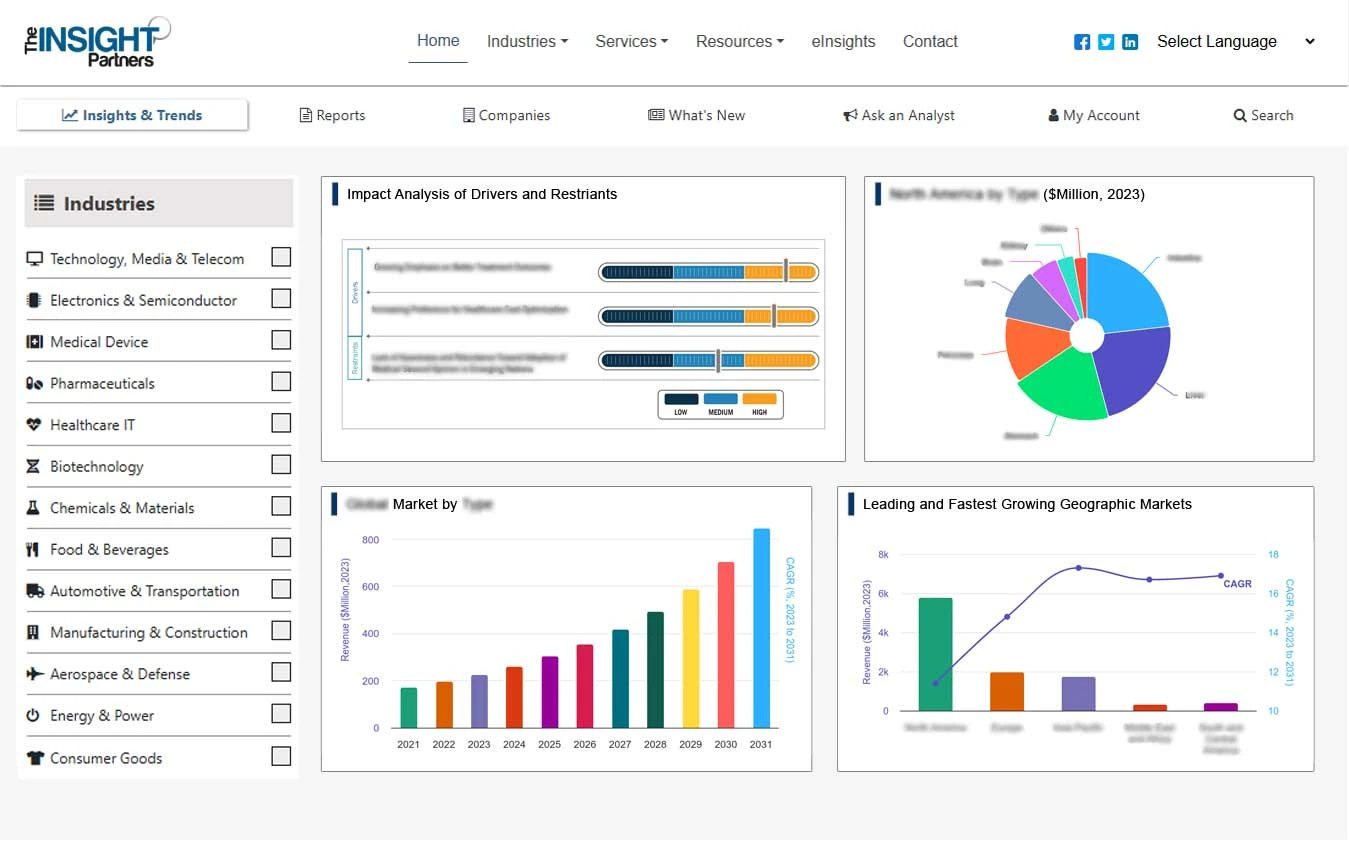

Face à l’augmentation des menaces réelles et perçues pour la sécurité nationale, des efforts continus sont déployés pour proposer des approches innovantes d’interrogatoire actif afin d’identifier ces menaces. Les menaces perçues le plus instantanément et leurs éléments essentiels comprennent les explosifs conventionnels, les armes, les agents chimiques et la contrebande. Dans le but de prévenir des événements incertains, les autorités du monde entier se concentrent activement sur le déploiement de systèmes avancés, notamment des robots, pour renforcer la sécurité dans les aéroports. Les robots utilisés pour les applications de sécurité dans les aéroports sont intégrés à des fonctionnalités telles que des systèmes de reconnaissance faciale, des capteurs et des caméras pour mesurer la fréquence cardiaque à distance, ce qui leur permet de détecter les personnes suspectes, les devises, les armes et explosifs, les objets abandonnés et autres matériels illicites sans perturber les opérations ou le flux des passagers dans les aéroports. En outre, les gouvernements de divers pays investissent dans le développement de leurs infrastructures de transport, notamment dans la construction de nouveaux aéroports. Par exemple, le gouvernement chinois prévoit de construire 215 aéroports supplémentaires d’ici 2035. En outre, le gouvernement indien prévoit de construire 100 nouveaux aéroports à travers le pays d’ici 2024.

Personnalisez la recherche en fonction de vos besoins

Nous pouvons optimiser et adapter l’analyse et la portée qui ne sont pas satisfaites par nos offres standard. Cette flexibilité vous aidera à obtenir les informations exactes nécessaires à la planification de votre entreprise et à la prise de décision.

Marché des robots aéroportuaires : perspectives stratégiques

TCAC (2021 - 2028)22,4%- Taille du marché 2021

512,56 millions de dollars américains - Taille du marché 2028

2 108,29 millions de dollars américains

Dynamique du marché

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

Joueurs clés

- ROBOT YUJIN Co., Ltd.

- Avidbots Corp.

- CYBERDYNE INC.

- Robotique SoftBank

- Stanley Robotique SAS

- SITA

- ABB SA

- Groupe ECA

- LG Électronique

Aperçu régional

- Amérique du Nord

- L'Europe

- Asie-Pacifique

- Amérique du Sud et Centrale

- Moyen-Orient et Afrique

Segmentation du marché

Application

Application- Parking côté ville/avec voiturier et terminal

Géographie

Géographie- Amérique du Nord

- L'Europe

- Asie-Pacifique

- Moyen-Orient et Afrique

- Amérique du Sud et Centrale

- L'exemple de PDF présente la structure du contenu et la nature des informations avec une analyse qualitative et quantitative.

Impact de la pandémie de COVID-19 sur le marché des robots aéroportuaires

La pandémie de COVID-19 et les mesures de confinement qui en ont découlé ont eu un impact marginal sur le marché des robots aéroportuaires en 2020, car elles ont entraîné des arrêts temporaires des processus de fabrication. Cependant, avec la reprise progressive des processus de fabrication à partir du troisième trimestre 2020, la demande de robots aéroportuaires a commencé à augmenter ; ainsi, les fabricants ont réussi à stabiliser leurs revenus et leurs flux de trésorerie globaux.

Aperçu du marché des robots aéroportuaires

L’augmentation de la demande de robots avancés alimente la croissance du marché des robots aéroportuaires

Les équipementiers ont investi dans la R&D pour développer les meilleurs robots avancés de leur catégorie. L’énorme trafic piétonnier quotidien connu par les aéroports au cours de la dernière décennie les oblige à optimiser diverses opérations dans les aéroports. Alors que de nombreuses entreprises proposent des robots aéroportuaires pour simplifier ces opérations, les aéroports se concentrent désormais sur l'adoption de robots autonomes pour optimiser le travail, améliorer les performances opérationnelles, atténuer les risques et améliorer l'expérience des voyageurs. En conséquence, beaucoup d’entre eux sont impatients de s’associer avec des fournisseurs de robots capables de proposer les meilleurs robots avancés de leur catégorie pour des applications telles que la sécurité, la gestion des bagages, le guidage des passagers et le nettoyage.

Informations sur le marché basées sur les applications

Le marché des robots aéroportuaires, par application, est segmenté en parking terrestre/avec voiturier et en terminal. Le segment des terminaux a dominé le marché des robots aéroportuaires en 2020. Un terminal d'aéroport est un bâtiment dans un aéroport où les passagers arrivent à l'atterrissage et partent également sur un vol. En règle générale, les terminaux disposent de plusieurs portes divisées en sections appelées halls qui regorgent de boutiques, de restaurants, de toilettes, de salons et d'autres installations. Les passagers dans les terminaux peuvent acheter des billets, s'enregistrer pour le vol prévu, enregistrer ou récupérer leurs bagages, passer les contrôles de sécurité ou les douanes, trouver des vols de correspondance, etc.

Les acteurs opérant sur le marché des robots aéroportuaires se concentrent sur des stratégies telles que les fusions et acquisitions et les initiatives de marché pour maintenir leur position sur le marché. Quelques développements réalisés par des acteurs clés sont répertoriés ci-dessous :

- En 2021, SITA a annoncé avoir achevé l'installation de son infrastructure de traitement des passagers de nouvelle génération à l'aéroport Václav Havel de Prague, ouvrant la voie à un futur voyage de passagers entièrement mobile et sans contact.

- En 2020, le déploiement du premier parking extérieur au monde entièrement exploité par des robots, construit par Stanley Robotics et VINCI Airports, se poursuit à l'aéroport de Lyon, avec un nombre de places accessibles prévu passer de 500 à 2 000. Sept robots autonomes assureront le service en même temps, avec 28 cabines accessibles pour déposer et récupérer les véhicules.

Portée du rapport sur le marché des robots aéroportuaires

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2021 | 512,56 millions de dollars américains |

| Taille du marché d’ici 2028 | 2 108,29 millions de dollars américains |

| TCAC mondial (2021 - 2028) | 22,4% |

| Données historiques | 2019-2020 |

| Période de prévision | 2022-2028 |

| Segments couverts | Par candidature

|

| Régions et pays couverts | Amérique du Nord

|

| Leaders du marché et profils d’entreprises clés |

|

- L'exemple de PDF présente la structure du contenu et la nature des informations avec une analyse qualitative et quantitative.

Le marché mondial des robots aéroportuaires a été segmenté comme suit :

Marché des robots d’aéroport – par application

- Parking côté ville/avec voiturier

- Terminal

Marché des robots d’aéroport – par géographie

Amérique du Nord

- NOUS

- Canada

- Mexique

L'Europe

- France

- Allemagne

- Italie

- Russie

- ROYAUME-UNI

- Le reste de l'Europe

Asie-Pacifique (APAC)

- Chine

- Inde

- Japon

- Australie

- Corée du Sud

- Reste de l'APAC

Moyen-Orient et Afrique (MEA)

- Arabie Saoudite

- Émirats arabes unis

- Afrique du Sud

- Reste de la MEA

Amérique du Sud (SAM)

- Brésil

- Reste de SAM

Profils d'entreprise

- ROBOT YUJIN Co., Ltd.

- Avidbots Corp.

- Cyberdyne Inc.

- Robotique SoftBank

- Stanley Robotique SAS

- SITA

- ABB SA

- Groupe ECA

- LG Électronique

- Robots UVD

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWO

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

- Glycomics Market

- Medical Enzyme Technology Market

- Single Pair Ethernet Market

- Oxy-fuel Combustion Technology Market

- Health Economics and Outcome Research (HEOR) Services Market

- Aerosol Paints Market

- Wire Harness Market

- Aquaculture Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Fishing Equipment Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Questions fréquemment posées

Original equipment manufacturers (OEMs) have been investing in research and development (R&D) to develop best in class and advanced robots. Enormous daily foot traffic experienced by airports over the last decade is compelling them to optimize various operations at airports. With many companies offering airport robots for simplifying these operations, = airports are shifting their focus on adopting autonomous = robots to optimize labor, enhance operational performance, mitigate risk, and improve traveler experiences. As a result, many of them are looking forward to partnering with robot suppliers that can offer the best in class advanced robots for applications such as security, luggage handling, passenger guidance, and cleaning. Moreover, airports are facing issues in terms of significantly rising labor costs as well as the shortage of qualified, experienced, and reliable employees. Thus, the burgeoning complexity of airport operations is resulting in overburdening of existing personnel, compelling them to make tradeoffs between the quantity and quality of their work, which might hamper their reputation. To address this issue, airports are switching toward more advanced and autonomous robots that not only reduce the burden on personnel, but also work more efficiently than humans, without facing the issues such as excessive workload and fatigue.

Developing countries have become a hub of opportunities for various markets, including airport robots market. Government authorities in these countries are planning and investing huge amount in the advancement of technologies to improve the overall infrastructure. Transportation and logistics activities are huge contributors to the development of any country, and therefore, developing countries are extensively focusing on enhancing and improving their transportation and logistics infrastructure, including air, road, and sea transport. Airways is an important mode of transportation; hence, governments of developing countries have planned development and revamping of various mid-size and large airports. For instance, in India, Netaji Subhas Chandra Bose International Airport in Kolkata has laid down expansion plan of the airport. Similarly, Vietnam is planning to build one of the largest airports near its economic hub Ho Chi Minh City. Other developing countries including the Philippines and Kuwait are also expanding and revamping airports. As a part of expansion and revamping strategy, these airports would also be passing tenders on acquiring technologically advanced equipment including robots for ensuring convenience and providing superior experience to passengers. Hence, the airport robot market players have huge opportunities to offer best-in-class, and highly reliable and cost-efficient robots for such new airport projects.

The terminal segment led the airport robots market with a share of 74.8% in 2020. It is further expected to account for 77.0% of the total market by 2028.

The airport robots market is led by terminal segment with highest share and is expected to dominate in the forecast period. An airport terminal is a building at an airport where passenger arrive upon landing and depart on a flight. Typically, terminals have several gates divided into sections known as concourses that are filled with shopping, dining, restroom, lounge, and other facilities. Passengers at terminals can purchase tickets, check in for the scheduled flight, check or collect luggage, pass through security or customs, find connecting flights, and others.

ABB Ltd; Cyberdyne Inc.; LG Electronics Inc.; SoftBank Corp.; and Stanley Robotics SAS are among the key companies with significant market share.

The overall cost of procuring and maintaining advanced robots is quite high, which limits their adoption at airport, especially in cost-sensitive countries. These robots require frequent maintenance and servicing, which adds to the overall operating cost of running an airport. Airport deploy a large number of such advanced systems for various operations, based on the size and the requirement of the airport, and with the multiple deployments, the overall procurement and maintenance cost increases further. Small airports, operating in developed and developing countries, therefore, resist deploying such high-end robots and rely on conventional practices. Considering this restraint, airport robot manufacturers need to focus on offering a range of robots, starting from low end to high end, without compromising on the incorporation of the necessary and vital features in the low- and mid-range robots. The COVID-19 pandemic has changed the ways of operations of various sectors, including the transportation sector and airport industry. Airport authorities are willing to deploy autonomous robots to, ultimately, meet the social distancing norms imposed by the respective governments; however, the initial costs and maintenance costs are limiting their investments in robotic solutions.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Airport Robots Market

- YUJIN ROBOT Co., Ltd.

- Avidbots Corp.

- CYBERDYNE INC.

- SoftBank Robotics

- Stanley Robotics SAS

- SITA

- ABB Ltd

- ECA Group

- LG Electronics

- UVD ROBOTS

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenez un échantillon gratuit pour ce rapport

Obtenez un échantillon gratuit pour ce rapport