Les kiosques bancaires sont de petits stands connectés à Internet placés par les banques à différents endroits (comme les guichets automatiques) pour offrir des services bancaires sans avoir besoin de se rendre à la banque. L'adoption croissante des technologies avancées par le secteur bancaire a entraîné une croissance des kiosques bancaires. Ces équipements offrent ainsi aux clients un libre-service 24 heures sur 24 et 7 jours sur 7, augmentant ainsi la satisfaction des clients ainsi qu'une réduction considérable des coûts opérationnels.

DYNAMIQUE DU MARCHÉ

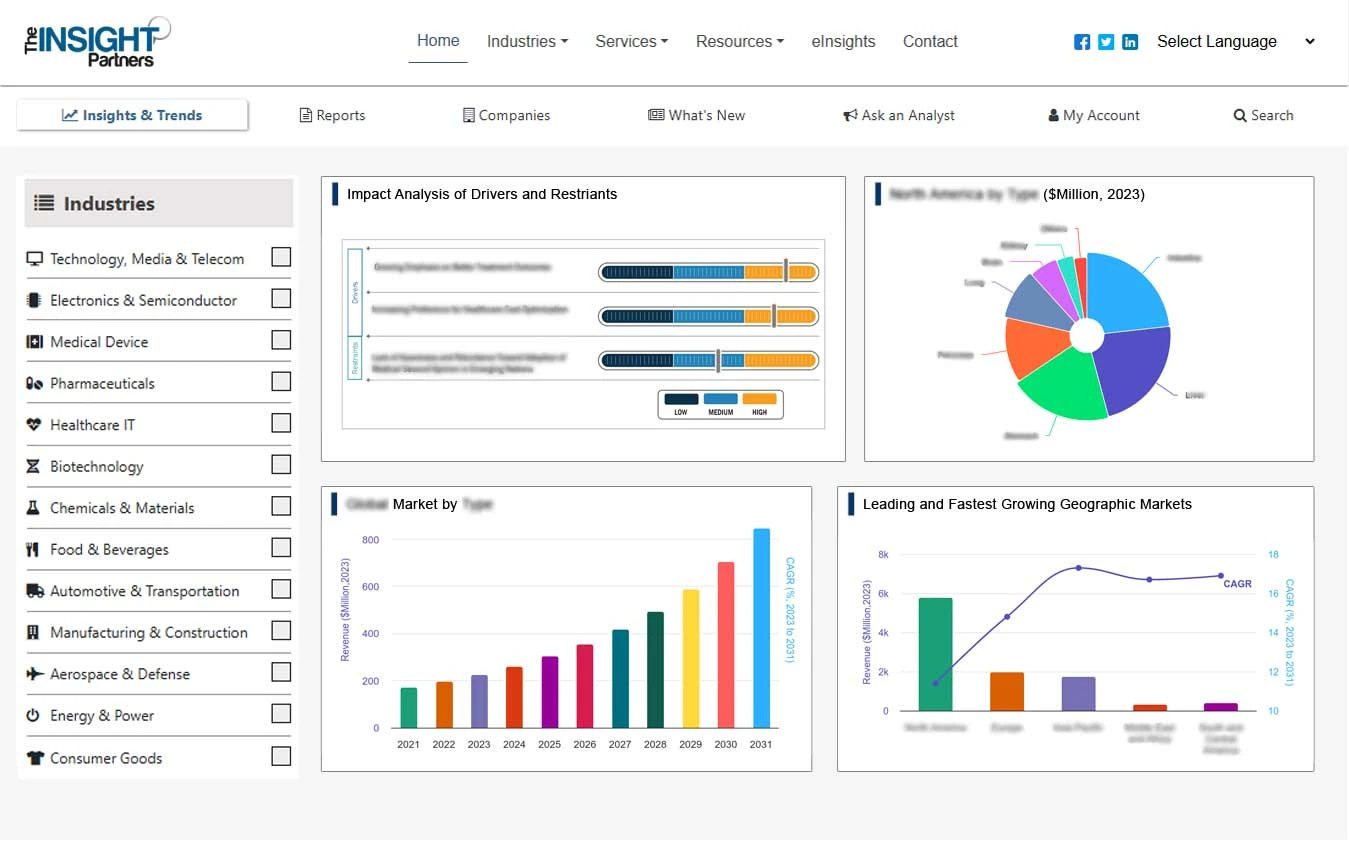

Le marché des kiosques bancaires est stimulé par des facteurs tels que l'augmentation des initiatives gouvernementales pour le déploiement de kiosques bancaires. L'émergence de la technologie de communication en champ proche et son intégration avec les options de paiement sans contact dans le secteur bancaire des économies en développement du monde entier offrent de nouvelles opportunités aux acteurs opérant sur le marché des kiosques bancaires. Cependant, les coûts d’installation élevés ainsi que l’utilisation croissante des services bancaires mobiles sont des facteurs qui peuvent entraver dans une certaine mesure la croissance du marché des kiosques bancaires.

ÉTENDUE DU MARCHÉ

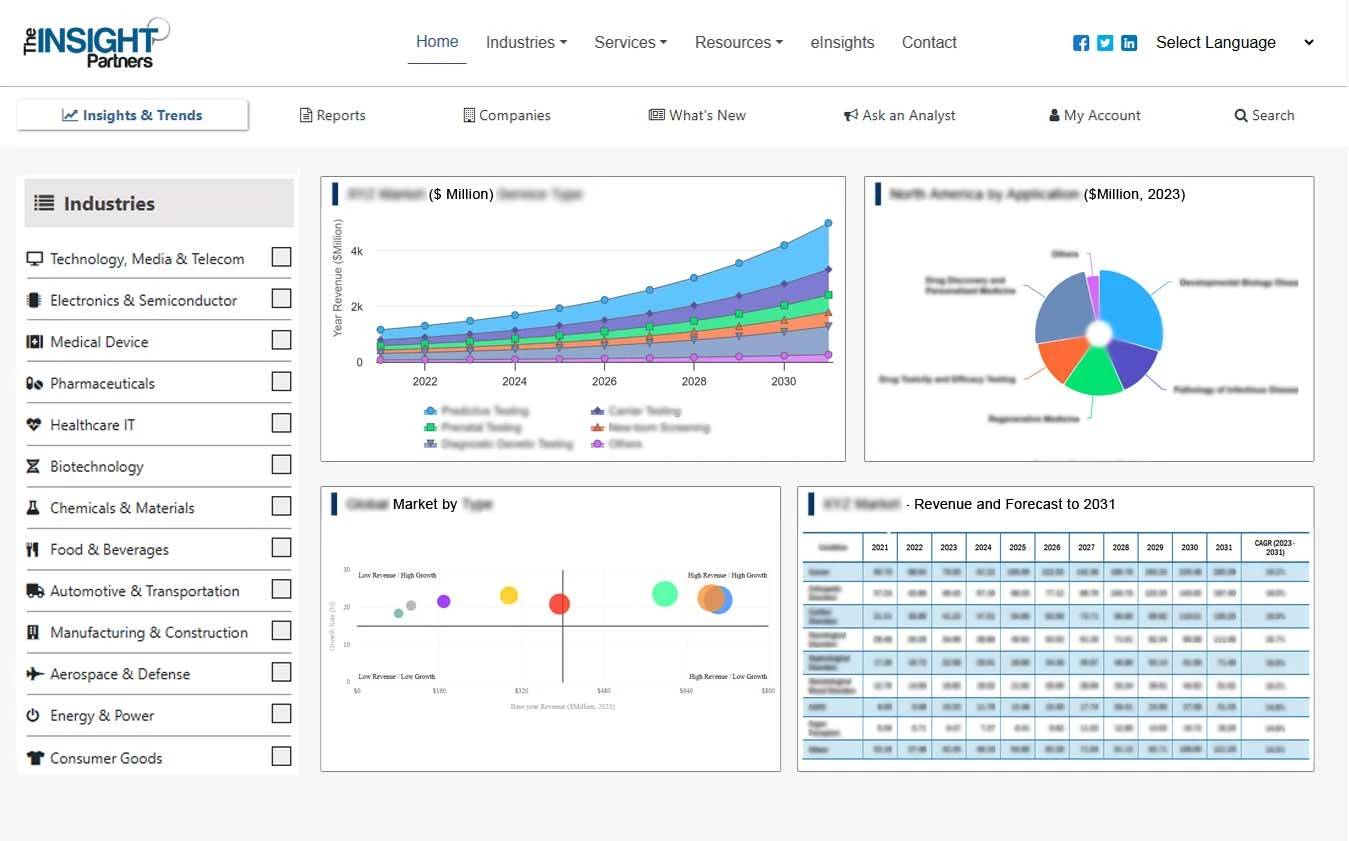

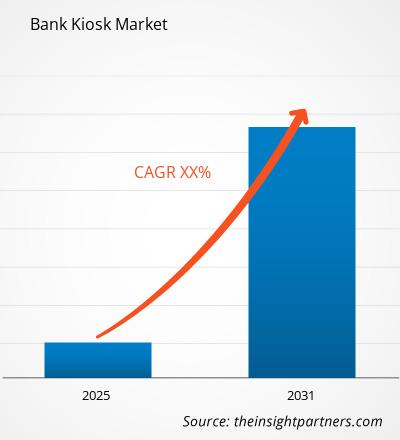

L'analyse du marché mondial des kiosques bancaires jusqu'en 2031 est une étude spécialisée et approfondie du secteur des kiosques bancaires, avec un accent particulier sur le analyse des tendances du marché mondial. Le rapport vise à fournir un aperçu du marché des kiosques bancaires avec une segmentation détaillée du marché par type, composant et géographie. Le marché mondial des kiosques bancaires devrait connaître une forte croissance au cours de la période de prévision. Le rapport fournit des statistiques clés sur l’état du marché des principaux acteurs du marché des kiosques bancaires et présente les principales tendances et opportunités du marché.

SEGMENTATION DU MARCHÉ

Le marché mondial des kiosques bancaires est segmenté en fonction du type et du composant. En fonction du type, le marché est segmenté en kiosque à fonction unique, kiosque multifonction et guichet automatique virtuel/vidéo. Sur la base de ce composant, le marché des kiosques bancaires est classé en matériel, logiciels et services.

Le rapport fournit un aperçu détaillé du secteur. comprenant des informations à la fois qualitatives et quantitatives. Il fournit un aperçu et des prévisions du marché mondial des kiosques bancaires en fonction de divers segments. Il fournit également la taille du marché et des estimations prévisionnelles pour la période 2021 à 2031 pour cinq grandes régions, à savoir : Amérique du Nord, Europe, Asie-Pacifique (APAC), Moyen-Orient et Amérique du Nord. Afrique (MEA) et Amérique du Sud (SAM). Le marché des kiosques bancaires de chaque région est ensuite sous-segmenté par pays et segments respectifs. Le rapport couvre l'analyse et les prévisions de 18 pays dans le monde ainsi que la tendance actuelle et les opportunités qui prévalent dans la région.

Le rapport analyse les facteurs affectant le marché des kiosques bancaires du côté de la demande et de l'offre et évalue plus en détail le marché. dynamique affectant le marché au cours de la période de prévision, c’est-à-dire les moteurs, les contraintes, les opportunités et les tendances futures. Le rapport fournit également une analyse PEST exhaustive pour les cinq régions, à savoir : Amérique du Nord, Europe, APAC, MEA et SAM après avoir évalué les facteurs politiques, économiques, sociaux et technologiques affectant le marché des kiosques bancaires dans ces régions.

ACTEURS DU MARCHÉ

Les rapports couvrent les développements clés du marché des kiosques bancaires en tant que stratégies de croissance organique et inorganique. Diverses entreprises se concentrent sur des stratégies de croissance organique telles que les lancements de produits, les approbations de produits et d'autres telles que les brevets et les événements. Les activités de stratégies de croissance inorganiques observées sur le marché étaient des acquisitions et des partenariats et des partenariats. collaborations. Ces activités ont ouvert la voie à l’expansion des activités et de la clientèle des acteurs du marché. Les payeurs du marché des kiosques bancaires devraient bénéficier d’opportunités de croissance lucratives à l’avenir avec la demande croissante de kiosques bancaires sur le marché mondial. Vous trouverez ci-dessous la liste de quelques entreprises engagées sur le marché des kiosques bancaires.

Le rapport comprend également les profils des principales sociétés de kiosques bancaires ainsi que leur analyse SWOT et leurs stratégies de marché. En outre, le rapport se concentre sur les principaux acteurs du secteur avec des informations telles que les profils d'entreprise, les composants et les services proposés, les informations financières des 3 dernières années, les développements clés des cinq dernières années.

- Auriga SPA

- Cisco Systems, Inc.

- Diebold, Inc.

- Glory Limited

- GRG Banking

- Hitachi-Omron Terminal Solutions, Corp.

- Korala Associates Limited

- NCR Corporation

- OKI Electric Industry Co., Ltd.

- Shenzhen Yi de Computer Co., Ltd

< div>

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWO

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

- Parking Management Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Wind Turbine Composites Market

- 3D Audio Market

- Virtual Production Market

- Industrial Valves Market

- Electronic Shelf Label Market

- Adaptive Traffic Control System Market

- Medical Audiometer Devices Market

- Lymphedema Treatment Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Questions fréquemment posées

The global bank kiosk market was estimated to grow at a CAGR of 15.2% during 2023 - 2031.

Growing consumer demand for self-service banking and the need for financial inclusion are the major factors that propel the global Bank Kiosk market.

Technological advancements and reduced operational cost is expected to play a substantial role in the global bank kiosk market during the forecast period.

Asia Pacific is anticipated to grow with a high growth rate during the forecast period.

The major players holding majority shares are NCR Corporation, Diebold Nixdorf Incorporated, Nautilus Hyosung America, Inc., OKI Electric Industry Co. Ltd. Euronet, and Worldwide, Inc.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

1. Auriga SPA

2. Cisco Systems, Inc.

3. Diebold, Inc.

4. Glory Limited

5. GRG Banking

6. Hitachi-Omron Terminal Solutions, Corp.

7. Korala Associates Limited

8. NCR Corporation

9. OKI Electric Industry Co., Ltd.

10. Shenzhen Yi of Computer Co., Ltd

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenez un échantillon gratuit pour ce rapport

Obtenez un échantillon gratuit pour ce rapport