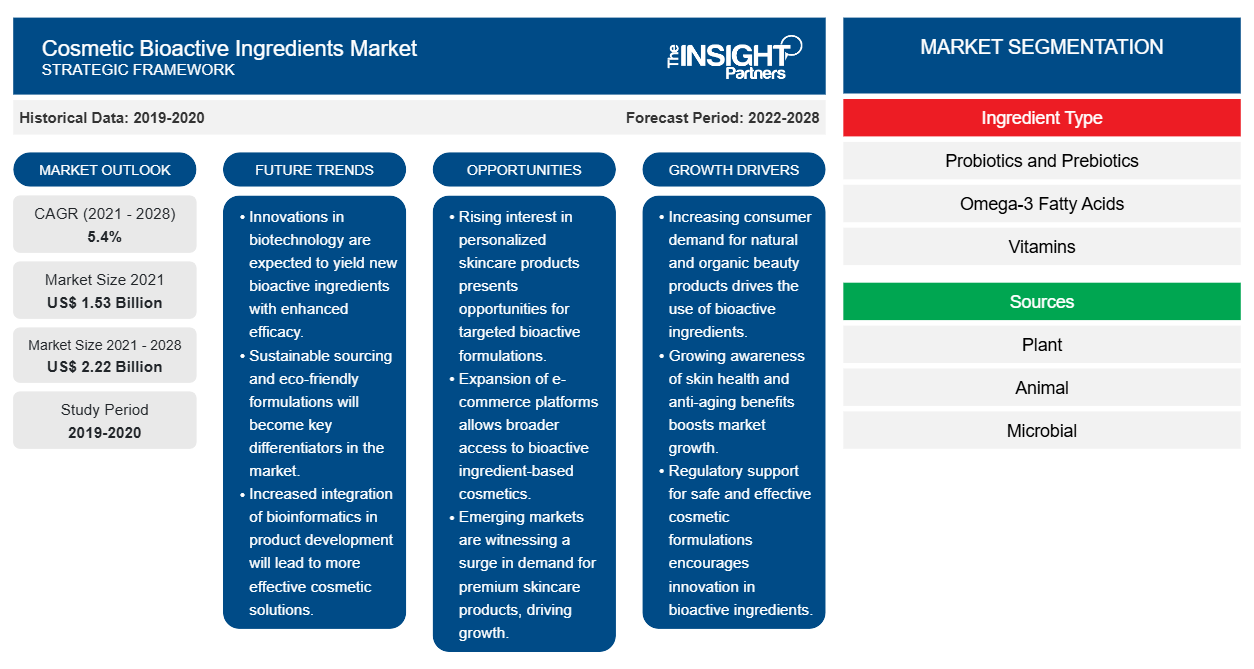

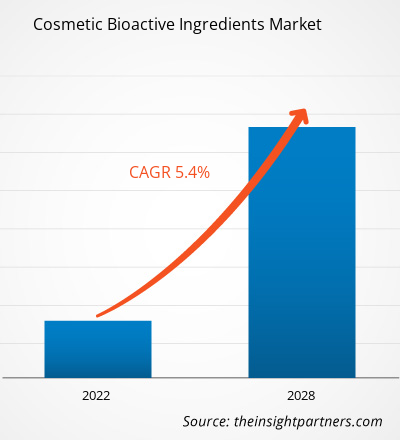

Le marché des ingrédients bioactifs cosmétiques devrait atteindre 2 215,96 millions USD d'ici 2028, contre 1 529,91 millions USD en 2021 ; il devrait croître à un TCAC de 5,4 % de 2021 à 2028.

Les cosmétiques sont des produits conçus pour être appliqués sur la peau et les cheveux pour les nettoyer, les embellir, favoriser l'attractivité ou améliorer l'apparence. Parmi les ingrédients actifs habituellement utilisés dans ce type de préparation, il existe une tendance mondiale à incorporer des produits d'origine végétale en raison de leur attrait commercial, de leur sécurité et de leur composition riche, souvent liés à un effet synergique ou multifonctionnel. Les extraits botaniques sont riches en métabolites secondaires qui existent dans les plantes à forte diversité structurelle. Les flavonoïdes et les non-flavonoïdes sont tous deux liés à des propriétés cosmétiques intéressantes comme la photoprotection, l'anti-âge, l'hydratation, l'antioxydant, l'astringent, l'anti-irritant et l'activité antimicrobienne. Avec leurs composants bioactifs et leurs actions pharmacologiques, il a été démontré que ces ingrédients bioactifs offrent des avantages dermatologiques avec des applications potentielles pour le rajeunissement de la peau, la photoprotection, la cicatrisation des plaies, etc. La croissance du marché des ingrédients bioactifs cosmétiques est principalement attribuée à la préférence croissante pour les ingrédients naturels dans les produits cosmétiques et au nombre croissant d'ingrédients bioactifs lancés. Cependant, des cadres réglementaires stricts limitent la croissance du marché des ingrédients bioactifs cosmétiques .

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

- Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Informations sur le marché

La demande croissante des consommateurs pour des produits naturels alimente la recherche liée aux substances bioactives pouvant être utilisées dans les cosmétiques. L’Europe abrite quelques-uns des plus grands fabricants d’ingrédients bioactifs et de marques de soins personnels, tels que BASF et DSM. Le lancement d’ingrédients bioactifs pour l’industrie des soins personnels stimule la croissance du marché. En juin 2019, BASF Care Creations a lancé trois nouveaux ingrédients actifs pour le marché de la beauté, qui utilisent des arbres ramboutans qui hydratent et rajeunissent la peau. De même, en avril 2019, Lonza a lancé l’ingrédient bioactif H2OBioEV, qui est une combinaison unique d’ingrédients d’origine naturelle – les polysaccharides d’Aphanothece Sacrum et le galactoarabinane – avec de l’eau et de la glycérine. L’ingrédient confère des capacités d’hydratation en reconstituant les humectants essentiels, ce qui facilite un environnement optimal pour la formation et le maintien d’une barrière protéique épidermique solide.

Informations basées sur le type d'ingrédients

En fonction du type d'ingrédient, le marché des ingrédients bioactifs cosmétiques est divisé en probiotiques et prébiotiques, acides gras oméga-3, vitamines, caroténoïdes et antioxydants, extraits de plantes, minéraux, acides aminés, protéines et peptides, etc. Le segment des acides aminés devrait détenir la plus grande part du marché en 2021. Cependant, le segment des extraits de plantes devrait enregistrer le TCAC le plus élevé du marché au cours de la période de prévision.

Informations basées sur des sources

Le marché des ingrédients bioactifs cosmétiques, par sources, est segmenté en végétaux, animaux et microbiens. Le segment végétal devrait détenir la plus grande part du marché en 2021. Cependant, le segment microbien devrait enregistrer le TCAC le plus élevé du marché au cours de la période de prévision.

Les entreprises opérant sur le marché des ingrédients bioactifs cosmétiques adoptent des stratégies telles que les lancements de produits, les fusions et acquisitions, les collaborations, les innovations de produits et le portefeuille de produits pour étendre leur empreinte dans le monde entier, maintenir la marque et répondre à la demande croissante des utilisateurs finaux.

Aperçu régional du marché des ingrédients bioactifs cosmétiques

Les tendances et facteurs régionaux influençant le marché des ingrédients bioactifs cosmétiques tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des ingrédients bioactifs cosmétiques en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des ingrédients bioactifs cosmétiques

Portée du rapport sur le marché des ingrédients bioactifs cosmétiques

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2021 | 1,53 milliard de dollars américains |

| Taille du marché d'ici 2028 | 2,22 milliards de dollars américains |

| Taux de croissance annuel moyen mondial (2021-2028) | 5,4% |

| Données historiques | 2019-2020 |

| Période de prévision | 2022-2028 |

| Segments couverts | Par type d'ingrédient

|

| Régions et pays couverts | Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

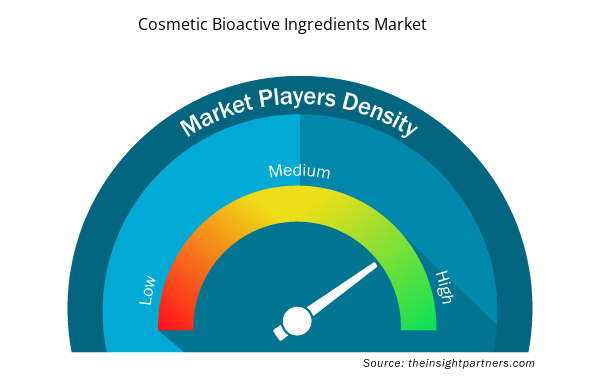

Densité des acteurs du marché des ingrédients bioactifs cosmétiques : comprendre son impact sur la dynamique commerciale

Le marché des ingrédients bioactifs cosmétiques connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des ingrédients bioactifs cosmétiques sont :

- Royal DSM NV

- Ajinomoto Co., Inc.

- Roquette Frères

- SMA

- BASF SE

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des ingrédients bioactifs cosmétiques

Marché des ingrédients bioactifs cosmétiques – parType d'ingrédient

- Probiotiques et prébiotiques

- Acides gras oméga-3

- Vitamines

- Caroténoïdes et antioxydants

- Extraits de plantes

- Minéraux

- Acides aminés

- Protéines et peptides

- Autres

Marché des ingrédients bioactifs cosmétiques – par source

- Usine

- Animal

- Microbien

Marché des ingrédients bioactifs cosmétiques – par géographie

Amérique du Nord

- NOUS

- Canada

- Mexique

Europe

- France

- Allemagne

- Italie

- ROYAUME-UNI

- Espagne

- Reste de l'Europe

Asie-Pacifique (APAC)

- Chine

- Inde

- Corée du Sud

- Japon

- Australie

- Reste de l'Asie-Pacifique

Moyen-Orient et Afrique (MEA)

- Afrique du Sud

- Arabie Saoudite

- Émirats arabes unis

- Reste du Moyen-Orient et de l'Afrique

Amérique du Sud (SAM)

- Brésil

- Argentine

- Reste de l'Amérique du Sud et de l'Amérique centrale

Profils d'entreprise

- Royal DSM NV

- Ajinomoto Co., Inc.

- Roquette Frères

- SMA

- BASF SE

- Société FMC

- Biotechnologie Vytrus

- Cargill, Inc.

- Société Sensient Technologies

- DUPONT

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWO

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

- Oxy-fuel Combustion Technology Market

- Virtual Production Market

- Small Internal Combustion Engine Market

- Electronic Data Interchange Market

- Sexual Wellness Market

- Non-Emergency Medical Transportation Market

- Artwork Management Software Market

- Online Recruitment Market

- Print Management Software Market

- Malaria Treatment Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Questions fréquemment posées

Global cosmetic bioactive ingredients market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In North America, the U.S. is the largest market for cosmetic bioactive ingredients. The growth of the region is attributed to increasing product launches coupled with increasing adoption of cosmetics.

The Europe region is expected to account for the fastest growth in the cosmetic bioactive ingredients market. Technological advancement for extraction of bioactive ingredients in this region contribute to this dominant share. Additionally, rising preference for natural ingredients in cosmetic products are said to be responsible for this growth.

The cosmetic bioactive ingredients market majorly consists of the players such BASF SE, DuPont de Nemours, Inc., FMC CORPORATION, Cargill, Incorporated, Sensient Technologies Corporation, DSM, Ajinomoto Co. Inc., Roquette Frères, ADM, and Vytrus Biotech amongst others.

The plant segment dominated the global cosmetic bioactive ingredients market and accounted for the largest revenue share of 62.50% in 2021.

The amino acids segment dominated the global cosmetic bioactive ingredients market and held the largest revenue share of 20.81% in 2021.

Key factors that are driving the growth of this market is rising preference for natural ingredients in cosmetic products and increasing launch of bioactive ingredients.

Cosmetics are products made to apply to the skin and hair to cleansing, beautifying, promoting attractiveness, or improving appearance. Amid the active ingredients usually used in this type of preparation, there is a global trend of incorporating vegetable source products due to their commercial appeal, safety, and rich composition, often related with a synergistic or multifunctional effect. Botanical extracts are high in secondary metabolites that exist in plants with high structural diversity. Both flavonoids and non-flavonoids are related to interesting cosmetic properties like photoprotection, anti-aging, moisturizing, antioxidant, astringent, anti-irritant, and antimicrobial activity. With their bioactive components and pharmacologic actions, these bioactive ingredients have been shown to provide dermatologic benefits with potential applications for skin rejuvenation, photoprotection, wound healing, and more.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Cosmetic Bioactive Ingredients Market

- Koninklijke DSM N.V.

- Ajinomoto Co., Inc.

- Roquette Freres

- ADM

- BASF SE

- FMC Corporation

- Vytrus Biotech

- Cargill, Inc.

- Sensient Technologies Corporation

- DUPONT

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenez un échantillon gratuit pour ce rapport

Obtenez un échantillon gratuit pour ce rapport