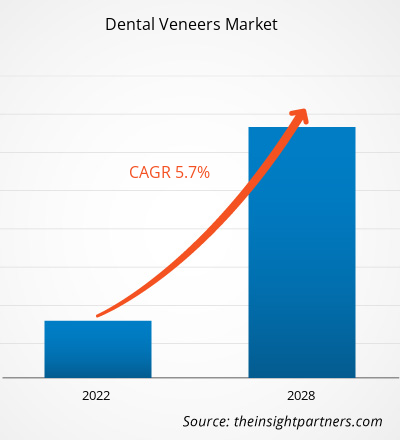

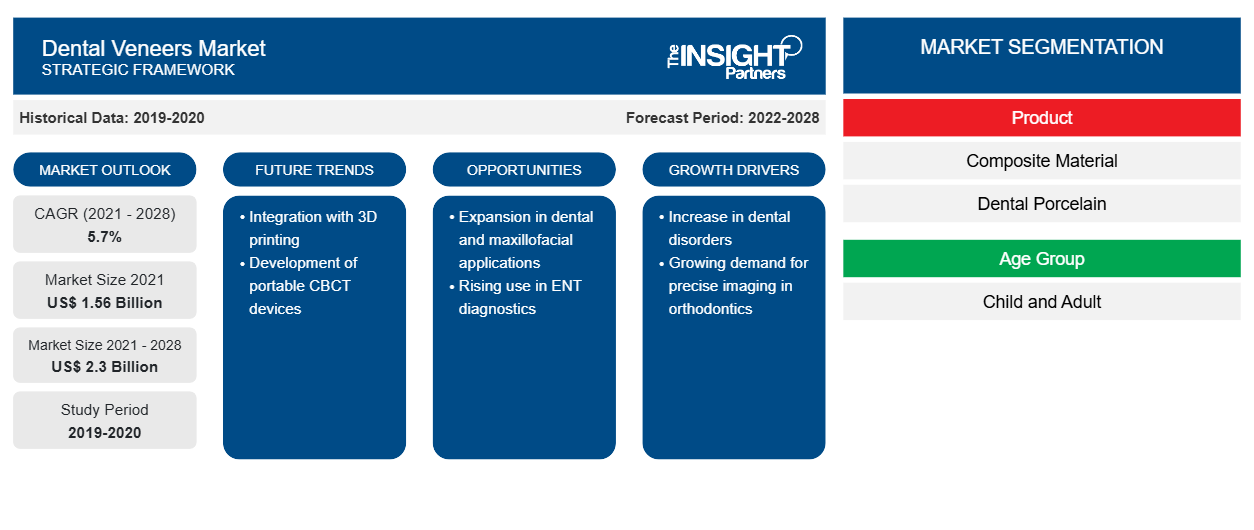

Le marché des facettes dentaires devrait passer de 1 559,28 millions USD en 2021 à 2 302,60 millions USD en 2028 ; il devrait croître à un TCAC de 5,7 % au cours de la période 2021-2028.

Les facettes dentaires, également appelées facettes en porcelaine ou laminés en porcelaine dentaire , sont des coques ultra-fines fabriquées sur mesure à partir de matériaux de la couleur des dents, destinées à recouvrir la surface avant des dents pour en améliorer l'apparence. Ces coques sont placées devant les dents pour en modifier la couleur, la forme, la taille ou la longueur. Le traitement de chaque patient est personnalisé en fonction de ses besoins. Le collage des facettes dentaires se fait avec du ciment résine.

La croissance du marché des facettes dentaires est due à l'augmentation des cas de troubles dentaires, à la sensibilisation croissante des consommateurs aux soins dentaires et à l'importance croissante accordée à l'esthétique. Cependant, le coût élevé des procédures dentaires esthétiques freine la croissance du marché.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

- Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Perspectives du marché

Augmentation des cas de troubles dentaires

Le besoin mondial de facettes dentaires augmente en raison de l'augmentation des problèmes dentaires tels que la décoloration, les anomalies, les dents ébréchées et l'espacement irrégulier entre les dents. Les facettes dentaires sont utilisées dans divers contextes, tels que les institutions dentaires, les hôpitaux et les cliniques dentaires, ce qui conduit à des statistiques de croissance positives pour le marché des facettes dentaires. Les facettes en porcelaine peuvent gagner une part de marché substantielle en raison d'avantages tels que la durabilité du matériau et la capacité d'améliorer l'apparence des dents. De plus, les facettes dentaires n'imposent aucun entretien spécifique ; elles nécessitent une hygiène bucco-dentaire de base pour les maintenir en bon état. Par conséquent, ces variables peuvent contribuer à l'augmentation du taux de croissance du marché. Selon une étude récente de l'American Academy of Cosmetic Dentistry (AACD), la demande de facettes en porcelaine a augmenté plus que jamais. En fait, en termes de popularité aux États-Unis, cette procédure de dentisterie esthétique ne concerne que le blanchiment des dents. Selon l'Organisation mondiale de la santé en 2019, les maladies bucco-dentaires ont touché près de 3,5 milliards de personnes. Selon l'enquête de 2018 de la Société internationale de chirurgie plastique esthétique (ISAPS), les 5 pays qui pratiquent le plus de chirurgies esthétiques sont les États-Unis, le Brésil, le Mexique, l'Allemagne et l'Inde. Les États-Unis et le Brésil ont représenté 28,4 % de toutes les interventions esthétiques - chirurgicales et non chirurgicales - dans le monde en 2018. Selon Cosmetic Surgery Solicitors, une société leader dans le domaine de la chirurgie esthétique, le Brésil et les États-Unis ont pratiqué autant d'interventions esthétiques (1,5 million d'interventions chacun). Plus de trois fois plus de personnes aux États-Unis ont subi des interventions non chirurgicales qu'au Brésil - 2,8 millions de traitements esthétiques ont été effectués aux États-Unis contre 769 000 au Brésil. L'enquête annuelle de l'ISAPS a révélé que les traitements non invasifs ont augmenté de 10,2 % dans le monde en 2020. Les diverses offres et remises des dentistes peuvent aider le marché des facettes dentaires à se développer.AACD), demand for porcelain veneers has increased more than ever before. In fact, in terms of popularity in the US, this cosmetic dentistry procedure is only for teeth whitening. According to the World Health Organization in 2019, oral diseases affected nearly 3.5 billion people. According to the International Society of Aesthetic Plastic Surgery (ISAPS) survey of 2018, the top 5 countries that perform the most cosmetic surgeries are the US, Brazil, Mexico, Germany, and India. The US and Brazil accounted for 28.4% of all cosmetic procedures - surgical and nonsurgical - in the world in 2018. According to Cosmetic Surgery Solicitors, a leading cosmetic surgery company, Brazil and the US performed equal cosmetic surgeries (1.5 million procedures each). More than three times the number of people in the US underwent nonsurgical procedures than in Brazil - 2.8 million cosmetic treatments were carried out in US compared to 769,000 in Brazil. The annual survey from ISAPS found that noninvasive treatments increased by 10.2% worldwide in 2020. Dentists' various offers and discounts may assist the dental veneers market to grow.

Informations basées sur les produits

Le marché mondial des facettes dentaires, en fonction du produit, est segmenté en matériaux composites , en porcelaine dentaire et autres. Le segment des matériaux composites détenait la plus grande part du marché en 2021. Cependant, le segment de la porcelaine dentaire devrait enregistrer un TCAC de 6,4 % sur le marché au cours de la période de prévision. CAGR of 6.4% in the market during the forecast period.

Informations basées sur l'utilisateur final

En fonction de l'utilisateur final, le marché mondial des facettes dentaires est segmenté en hôpitaux, cliniques dentaires et autres. Le segment des cliniques dentaires détenait la plus grande part du marché en 2021 en raison du nombre croissant d'établissements de cliniques dentaires à travers le monde. Selon les Centers for Disease Control and Prevention (CDC), en 2020, environ 63,0 % des adultes âgés de 18 ans et plus ont visité les cliniques dentaires. De plus, le même segment devrait enregistrer un TCAC de 5,8 % sur le marché au cours de la période de prévision.CAGR of 5.8% in the market during the forecast period.

Les lancements et les approbations de produits sont des stratégies couramment adoptées par les entreprises pour étendre leur présence mondiale et leurs portefeuilles de produits afin de dominer le marché des facettes dentaires. De plus, les acteurs du marché se concentrent sur la stratégie de partenariat pour élargir leur clientèle, ce qui, à son tour, leur permet de maintenir leur nom de marque à l'échelle mondiale. Le marché des facettes dentaires devrait prospérer dans les années à venir en raison du développement de produits innovants par les acteurs du marché.

Aperçu régional du marché des facettes dentaires

Les tendances régionales et les facteurs influençant le marché des facettes dentaires tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des facettes dentaires en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des facettes dentaires

Portée du rapport sur le marché des facettes dentaires

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2021 | 1,56 milliard de dollars américains |

| Taille du marché d'ici 2028 | 2,3 milliards de dollars américains |

| Taux de croissance annuel moyen mondial (2021-2028) | 5,7% |

| Données historiques | 2019-2020 |

| Période de prévision | 2022-2028 |

| Segments couverts | Par produit

|

| Régions et pays couverts | Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des facettes dentaires : comprendre son impact sur la dynamique commerciale

Le marché des facettes dentaires connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des facettes dentaires sont :

- Glisserwell

- Amann Girrbach AG

- 3M

- VladMiVa

- Céramiques en zircone

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des facettes dentaires

Profils d'entreprise

- Dentsply Sirona

- Glisserwell

- Produits Ultradent, Inc.

- Amann Girrbach AG

- 3M

- VladMiVa

- Céramiques en zircone

- Den-Mat Holdings, LLC

- Planmeca Oy

- Soins dentaires Lion

- Biolase, Inc.

- Ivoclar Vivadent AG

- Henkel AG & Company, KGAA

- Aligner la technologie

- Société Colgate-Palmolive

- Royal Philips NV

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des facettes dentaires

Obtenez un échantillon gratuit pour - Marché des facettes dentaires