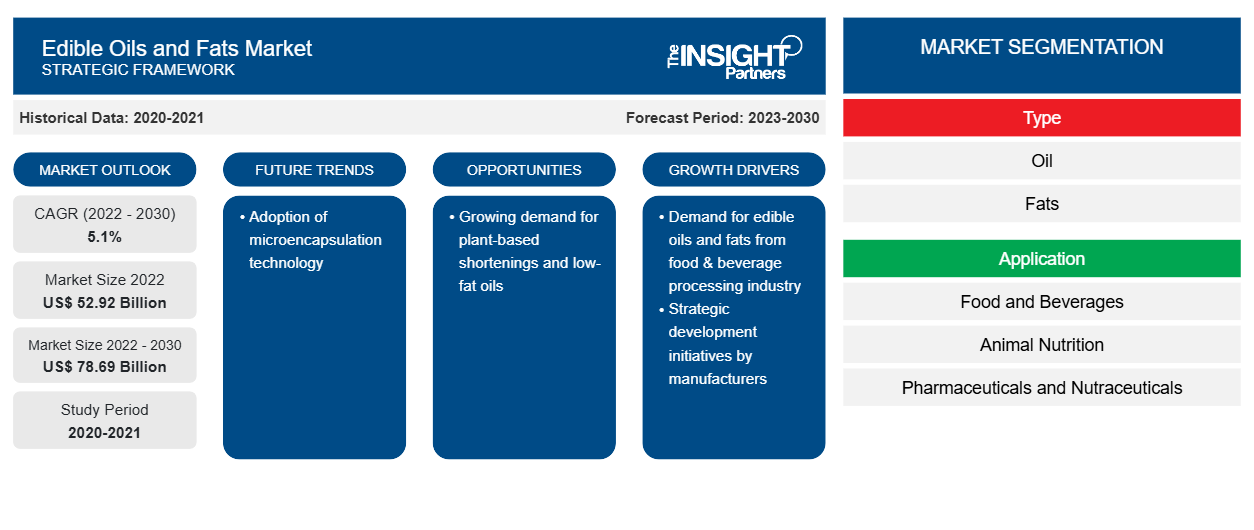

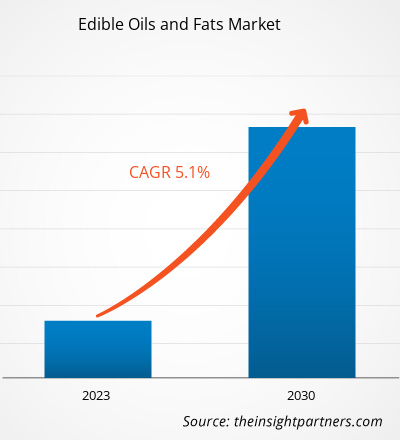

[Rapport de recherche] Le marché des huiles et graisses comestibles devrait passer de 52 920,00 millions USD en 2022 à 78 686,61 millions USD d'ici 2030 ; il devrait enregistrer un TCAC de 5,1 % de 2023 à 2030.

Informations sur le marché et point de vue des analystes :

Les graisses alimentaires sont obtenues à partir de matières premières d'origine animale telles que la graisse de porc (saindoux) et le suif ou d'origine végétale. Les transformateurs de viande sont les fournisseurs de matières premières des fabricants de graisses animales comestibles. Les fabricants ont des accords à long terme avec les industries de transformation de la viande pour un approvisionnement ininterrompu de matières premières. Les tissus adipeux de porc ou de bœuf sont coupés en petits morceaux et bouillis dans des digesteurs à vapeur, où la graisse est libérée dans l'eau. La graisse flotte à la surface de l'eau et est recueillie par écrémage. La matière membranaire des tissus animaux est pressée dans une presse hydraulique où l'on obtient de la graisse supplémentaire. La graisse est séparée de la phase liquide dans une centrifugeuse de désembouage.

Les graisses végétales telles que la margarine sont obtenues par hydrogénation d'huiles de soja, de maïs ou de carthame. L'huile est d'abord blanchie avec de la terre décolorante ou du charbon de bois pour éliminer l'odeur et la couleur indésirables. Elle est ensuite passée dans du gaz hydrogène sous haute pression, ce qui solidifie l'huile pour obtenir de la margarine. Il existe différents procédés de fabrication d'huiles et de graisses végétales.

Les huiles et graisses alimentaires raffinées sont conditionnées dans des conteneurs et envoyées aux utilisateurs finaux tels que les industries agroalimentaires, de nutrition animale, pharmaceutiques et nutraceutiques par l'intermédiaire de distributeurs et de fournisseurs. Cargill Incorporated, Bunge Limited, ADM, Fuji Oil Co Ltd et Kao Corporation figurent parmi les principaux fabricants d'huiles et de graisses alimentaires dans le monde.

Moteurs de croissance et défis :

Selon le ministère américain de l'Agriculture (USDA), l'huile de soja est la deuxième huile végétale la plus consommée. Elle est largement utilisée pour la friture, la cuisine, la préparation de shortening et la margarine. Selon l'Organisation de coopération et de développement économiques (OCDE), en 2022, la consommation d'huile végétale a atteint 249 millions de tonnes métriques, le secteur alimentaire représentant la part la plus importante. De plus, l'industrie de la confiserie utilise de manière significative le beurre comme ingrédient principal, suivi de la margarine. Les huiles et graisses comestibles de haute qualité sont utilisées dans la boulangerie et la confiserie, les produits laitiers et les desserts glacés, les snacks, les plats prêts à consommer (RTE) et prêts à cuire (RTC), ainsi que d'autres produits alimentaires et boissons. Les huiles et graisses raffinées sont une riche source de lipides. Ainsi, leur utilisation augmente en raison de l'augmentation des applications et de la croissance de la population mondiale.

L'industrie agroalimentaire dans diverses régions telles que l'Amérique du Nord et l'Asie-Pacifique est en croissance continue en raison d'une tendance croissante vers la durabilité, de la préférence pour les produits pratiques et prêts à consommer et de l'adoption croissante de produits biologiques et à base de plantes. L'industrie connaît une évolution substantielle avec l'innovation dans les processus, les produits et les services pour répondre aux préférences des consommateurs en évolution rapide. Selon le Bureau du recensement des États-Unis, les États-Unis comptaient 39 646 usines de fabrication d'aliments et de boissons en 2020. La Californie, le Texas et New York en comptaient respectivement 6 116, 2 625 et 2 600. De même, l'industrie agroalimentaire est l'un des contributeurs importants à l'économie européenne. Ainsi, la croissance de l'industrie agroalimentaire à travers le monde stimule la demande d'huiles et de graisses comestibles.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

- Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Segmentation et portée du rapport :

Le « marché mondial des huiles et graisses comestibles » est segmenté en fonction du type, de l'application et de la géographie. En fonction du type, le marché est divisé en huiles et graisses. En fonction de l'application, les huiles et graisses comestibles mondiales sont divisées en aliments et boissons, nutrition animale et produits pharmaceutiques et nutraceutiques. Le segment des huiles détenait une part plus importante du marché mondial

marché des huiles et graisses alimentaires

en 2022. Sur la base de la géographie, le marché des huiles et graisses comestibles est segmenté en Amérique du Nord (États-Unis, Canada et Mexique), Europe (Allemagne, France, Italie, Royaume-Uni, Russie et reste de l'Europe), Asie-Pacifique (Australie, Chine, Japon, Inde, Corée du Sud et reste de l'Asie-Pacifique), Moyen-Orient et Afrique (Afrique du Sud, Arabie saoudite, Émirats arabes unis et reste du Moyen-Orient et de l'Afrique) et Amérique du Sud et centrale (Brésil, Chili et reste de l'Amérique du Sud et centrale).

Analyse segmentaire :

En fonction du type, le marché des huiles et graisses comestibles est divisé en huiles et graisses. Le segment des huiles détenait une part plus importante du marché des huiles et graisses comestibles en 2022 et devrait enregistrer un TCAC plus élevé au cours de la période de prévision. Les huiles végétales peuvent être dérivées de graines, de céréales, de noix et de fruits. Les huiles d'olive, de tournesol, de palme, de canola, de noix de coco, de carthame, de maïs, d'arachide, de coton, de palmiste et de soja sont parmi les huiles les plus consommées. En général, les huiles végétales sont utilisées dans la préparation des aliments et de l'huile brute est ajoutée pour la saveur. L'huile végétale est également utilisée dans la production d'aliments pour animaux. Les huiles de palme sont faciles à stabiliser et elles maintiennent la qualité et la cohérence de la saveur dans les aliments transformés. Par conséquent, elles sont fréquemment privilégiées par les fabricants de produits alimentaires. L'Indonésie, la Malaisie, la Thaïlande et le Nigéria comptent parmi les plus grands producteurs et exportateurs d'huile de palme. La sensibilisation croissante aux problèmes de santé associés aux gras trans dans les huiles végétales hydrogénées propulse l'utilisation de l'huile de palme dans l'industrie alimentaire. L'industrie agroalimentaire est un consommateur important d'huile de palme, car elle est principalement utilisée dans les produits de boulangerie industriels, les produits à base de chocolat, les confiseries, les glaces et même les substituts de repas diététiques. L'huile de palme est une riche source de tocophérols et de caroténoïdes, qui lui confèrent une stabilité naturelle contre la détérioration oxydative. Ainsi, les avantages et les applications des huiles de palme dans diverses industries d'utilisation finale stimulent leur demande dans le monde entier.

Analyse régionale :

Le marché des huiles et graisses alimentaires est segmenté en cinq régions clés : l'Amérique du Nord, l'Europe, l'Asie-Pacifique, l'Amérique du Sud et centrale, et le Moyen-Orient et l'Afrique. Le marché mondial des huiles et graisses alimentaires était dominé par l'Amérique du Sud et centrale et était estimé à environ 4 500 milliards de dollars américains en 2022. Le marché des huiles et graisses alimentaires en Amérique du Sud et centrale est segmenté en Brésil, en Argentine et dans le reste de l'Amérique du Sud et centrale. Le secteur des snacks de la région est en pleine expansion en raison de la préférence croissante des consommateurs pour différentes options de snacks telles que les snacks surgelés, les snacks salés, les snacks aux fruits, les snacks de confiserie et les snacks de boulangerie. Les huiles et graisses comestibles jouent un rôle essentiel, car elles apportent des saveurs distinctives aux aliments et offrent des fonctions uniques et souhaitables dans la fabrication de snacks. Par exemple, les huiles sont le milieu de friture des aliments frits, et dans les pâtisseries, des shortenings à base d'huile végétale sont ajoutés pour empêcher la farine et d'autres ingrédients de s'agglutiner. Par conséquent, la demande croissante de différentes collations et les avantages associés aux huiles et graisses comestibles propulsent la demande d’huiles et de graisses comestibles dans le secteur des collations en Amérique du Sud et en Amérique centrale.

En outre, la demande d’huiles et de graisses alimentaires dans les industries d’utilisation finale telles que la nutrition animale a connu une augmentation en Amérique du Sud et en Amérique centrale. Selon Oil World, en 2022, la Chine a acheté environ 70 % de l’huile de soja brésilienne, principalement pour la consommation de protéines animales. De plus, l’expansion des industries de la nutrition animale, des produits pharmaceutiques et des nutraceutiques stimule la demande d’huiles et de graisses alimentaires spécialisées. Ces industries ont besoin de types spécifiques d’huiles pour diverses applications, comme dans les formulations d’aliments pour animaux et les formulations pharmaceutiques. À mesure que ces secteurs se développent et se diversifient, la demande pour leurs besoins spécifiques augmente, alimentant la croissance du marché des huiles et graisses alimentaires en Amérique du Sud et en Amérique centrale.

Développements de l'industrie et opportunités futures :

Diverses initiatives prises par les principaux acteurs opérant sur le marché mondial des huiles et graisses comestibles sont énumérées ci-dessous :

- En octobre 2021, ADM, l'un des principaux fabricants de graisses et d'huiles comestibles aux États-Unis, a annoncé son intention de construire la toute première usine de broyage et de raffinerie de soja dédiée au Dakota du Nord afin de répondre à la demande croissante d'huile de soja des industries alimentaires et animales.

- En décembre 2021, ITOCHU Corporation, dont le siège social est au Japon, a annoncé son accord par l'intermédiaire d'ITOCHU International Inc., dont le siège social est à New York, aux États-Unis, pour la création de Fuji Oil International Inc. aux États-Unis. Avec cet accord, l'entreprise prévoit de renforcer ses activités dans le secteur des huiles et des graisses en Amérique du Nord.

Aperçu régional du marché des huiles et graisses alimentaires

Les tendances et facteurs régionaux influençant le marché des huiles et graisses comestibles tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des huiles et graisses comestibles en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des huiles et graisses comestibles

Portée du rapport sur le marché des huiles et graisses comestibles

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2022 | 52,92 milliards de dollars américains |

| Taille du marché d'ici 2030 | 78,69 milliards de dollars américains |

| Taux de croissance annuel moyen mondial (2022-2030) | 5,1% |

| Données historiques | 2020-2021 |

| Période de prévision | 2023-2030 |

| Segments couverts | Par type

|

| Régions et pays couverts | Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

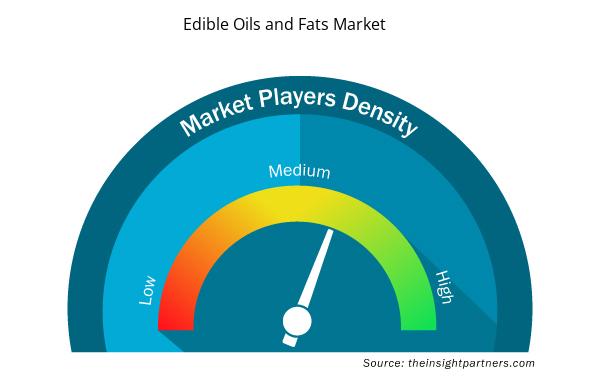

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché des huiles et graisses comestibles connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des huiles et graisses comestibles sont :

- Bunge Ltée

- Comté d'Archer-Daniels-Midland

- Fuji Oil Co., Ltd.

- Kao Corp

- AAK AB

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des huiles et graisses comestibles

Impact de la pandémie de COVID-19 :

La pandémie de COVID-19 a affecté les économies et les industries de divers pays. Les confinements, les interdictions de voyager et les fermetures d'entreprises dans les principaux pays d'Amérique du Nord, d'Europe, d'Asie-Pacifique (APAC), d'Amérique du Sud et d'Amérique centrale, ainsi que du Moyen-Orient et d'Afrique (MEA) ont eu un impact négatif sur la croissance de diverses industries, notamment celle de l'alimentation et des boissons. La fermeture des unités de fabrication a perturbé les chaînes d'approvisionnement mondiales, les activités de fabrication, les calendriers de livraison et les ventes de divers produits essentiels et non essentiels. Diverses entreprises ont annoncé des retards possibles dans les livraisons de produits et une baisse des ventes futures de leurs produits en 2020. En outre, les interdictions imposées par divers gouvernements en Europe, en Asie et en Amérique du Nord sur les voyages internationaux ont obligé les entreprises à suspendre temporairement leurs projets de collaboration et de partenariat. Tous ces facteurs ont entravé l'industrie de l'alimentation et des boissons en 2020 et au début de 2021, freinant ainsi la croissance du marché des huiles et graisses comestibles.

Paysage concurrentiel et entreprises clés :

Bunge Ltd, Archer-Daniels-Midland Co., Fuji Oil Co Ltd, Kao Corp, AAK AB, J-Oil Mills Inc, Cargill Inc, Olam Group Ltd, ConnOils LLC et Louis Dreyfus Co BV comptent parmi les principaux acteurs opérant sur le marché mondial des huiles et graisses alimentaires. Ces fabricants d'huiles et de graisses alimentaires proposent des solutions d'extraction de pointe avec des fonctionnalités innovantes pour offrir une expérience supérieure aux consommateurs.

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWO

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Questions fréquemment posées

Manufacturers of edible fats and oils invest significantly in the expansion of business and production capacity to serve their customer base better and meet their consumer requirements. In December 2021, ITOCHU Corporation, headquartered in Japan, announced their agreement through ITOCHU International Inc., headquartered in New York, US, for the establishment of Fuji Oil International Inc. in the US. With this agreement, the firm plans to strengthen the oil and fat business in North America.

Based on type, oil segment mainly has the largest revenue share. Vegetable oils can be derived from seeds, cereal grains, nuts, and fruits. The most consumed oils are olive, sunflower, palm, canola, coconut, safflower, corn, peanut, cottonseed, palm kernel, and soybean. Generally, vegetable oils are used in food preparation, and crude oil is added for flavor. Vegetable oil is also used in the production of animal feed.

The major players operating in the global edible oils and fats market are are Bunge Ltd, Archer-Daniels-Midland Co, Fuji Oil Co Ltd, Kao Corp, AAK AB, J-Oil Mills Inc, Cargill Inc, Olam Group Ltd, ConnOils LLC, and Louis Dreyfus Co BV.

Consumers consider plant-based products healthier than conventional products. Rising health consciousness among consumers propels the demand for plant-based and low-fat products. Thus, manufacturers develop plant-based shortenings and low-fat oils to cater to the rising demand. Plant-based shortenings are non-hydrogenated and do not contain cholesterol and trans-fat. Thus, it is considered a healthier alternative to conventional shortenings. Moreover, the increasing prevalence of cardiovascular diseases, obesity, and diabetes over the years is expected to boost the demand for low-fat products such as low-fat oils among various industries, including bakery & confectioneries, dairy & frozen desserts, and snacking.

Asia Pacific accounted for the largest share of the global edible oils and fats market. The market growth is attributed to increasing demand for bakery products, especially breads, cakes, pastries, and muffins, coupled with the growing influence of Western culture on the millennial and Gen-z population in the region. The bakery sector in China witnessed tremendous growth, with retail sales of bakery products accounting for US$ 34 billion in 2020, according to the United States Department of Agriculture (USDA). Moreover, manufacturers of edible oils and fats actively operate across the region and offer edible oils and fats made with fine-quality oil or its fractions. Distinct melting profiles of butter and margarines, packaging types, and the expansion of antifoaming or antioxidant agents of edible oils and fats are available across the region and widely applicable in many end-use industries such as confectionery, bakery, dairy, and infant nutrition.

Based on the application, food and beverages segment is hold a significant share in the market. The demand for edible oils and fats, such as shortenings, is gradually increasing in bakery and confectionery segment as they lubricate the structure of bakery products and shorten or tender flour proteins. Fats and oils in the mixture hold many air cells incorporated during creaming, making the products smooth and creamy. Fats act as enriching agents, add calorie value to baked foods, and develop flakiness in products. The rising demand for baked products, including cakes, breads, cookies, and biscuits, significantly drives edible oils and fats utilization.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Edible Oils and Fats Market

- Bunge Ltd

- Archer-Daniels-Midland Co

- Fuji Oil Co Ltd

- Kao Corp

- AAK AB

- J-Oil Mills Inc

- Cargill Inc

- Olam Group Ltd

- ConnOils LLC

- Louis Dreyfus Co BV

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenez un échantillon gratuit pour ce rapport

Obtenez un échantillon gratuit pour ce rapport