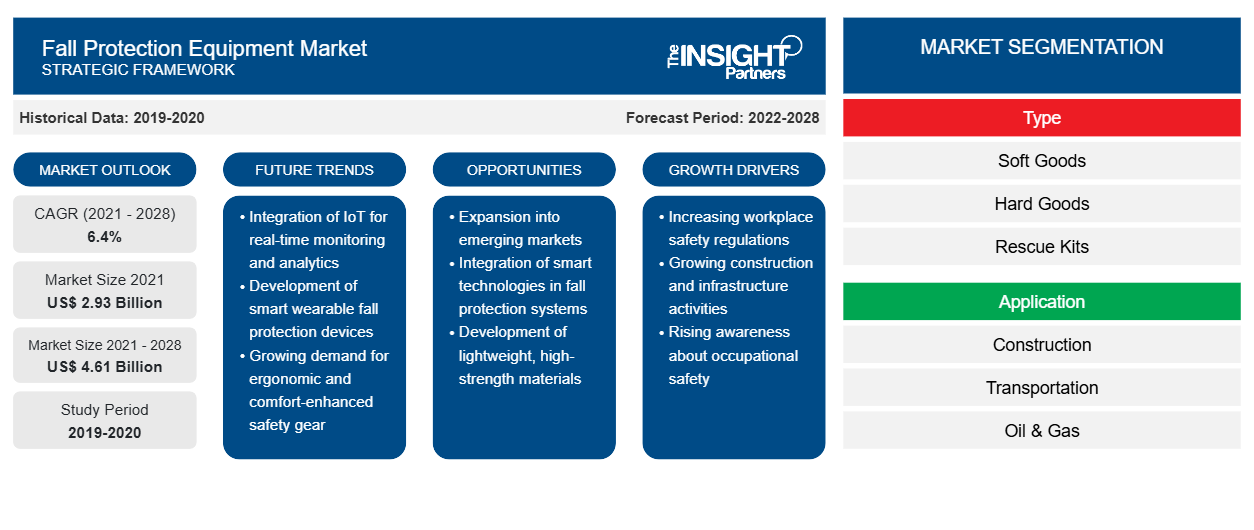

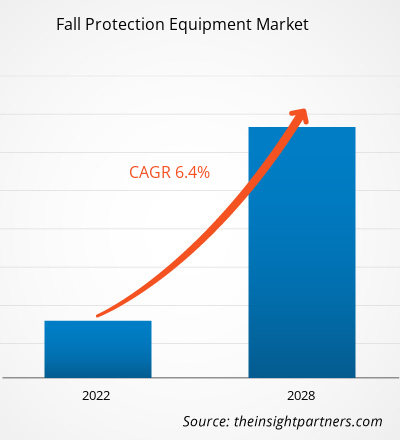

Le marché des équipements de protection contre les chutes devrait passer de 2 934,86 millions USD en 2021 à 4 606,61 millions USD en 2028 ; il devrait croître à un TCAC de 6,4 % au cours de la période 2021-2028.

Français L'industrialisation rapide des pays développés et en développement est l'un des principaux facteurs à l'origine de l'expansion du marché. Les risques professionnels sont de plus en plus répandus en raison du manque de procédures de sécurité adéquates sur divers sites de fabrication, d'exploitation minière et autres sites industriels. Par rapport à d'autres pays, les États-Unis sont plus préoccupés par la sécurité et la santé de ses travailleurs, ce qui favorise l'adoption d'équipements de protection contre les chutes dans le pays. Pour superviser les normes et procédures de sécurité, le pays a créé certaines autorités telles que l'Occupational Safety and Health Administration (OSHA) et l'American National Standards Institute (ANSI). L'OSHA est une organisation de réglementation et de conformité en matière de santé et de sécurité qui dispense aux travailleurs une formation de sensibilisation de 10 heures et de 30 heures sur les réglementations et normes OSHA applicables à diverses professions sur le lieu de travail. Cependant, l'accent croissant mis sur les pratiques de sécurité au travail et l'amélioration des réglementations gouvernementales pour la sécurité des travailleurs en Europe et en Asie ont stimulé le marché. L'augmentation des activités de construction et la croissance du secteur pétrolier et gazier dans les pays asiatiques tels que l'Inde et la Chine, en raison de la croissance de la population, devraient soutenir la croissance du marché au cours de la période de prévision. L’augmentation de l’urbanisation et la croissance de l’industrie pétrolière et gazière sont parmi les facteurs clés qui soutiennent la croissance du marché des équipements de protection contre les chutes dans les régions MEA (Moyen-Orient et Afrique) et SAM (Amérique du Sud).

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que d'offres et de remises exceptionnelles pour les start-ups et les universités.

- Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Impact de la pandémie de COVID-19 sur le marché des équipements de protection contre les chutes

L'épidémie de COVID-19 a continué à avoir des effets néfastes dans plusieurs pays en 2021 également. Les fermetures d'usines de production ou les opérations commerciales limitées, les confinements et les restrictions de voyage ont entravé la production et la chaîne d'approvisionnement d'équipements de protection contre les chutes. La demande constante d'équipements de protection contre les chutes a connu une légère baisse en 2020, en raison du confinement imposé par le gouvernement et d'un faible nombre de projets de construction. Cependant, en 2021, en raison d'une augmentation des activités de construction, de l'exploration pétrolière et gazière et des projets de télécommunications, il existe une demande d'équipements de protection contre les chutes pour assurer la sécurité des employés. Les entreprises de commerce électronique ont également contribué à accroître le besoin d'équipements de protection contre les chutes dans le secteur de la construction.

Aperçu du marché des équipements de protection antichute

Hausse des activités de construction

L’augmentation des activités de construction dans le monde entier est un élément essentiel du marché des équipements de protection contre les chutes. Alors que les pays asiatiques tels que l’Inde et la Chine connaissent une croissance démographique importante, la demande d’espaces commerciaux et résidentiels dans ces pays ne cesse d’augmenter. L’économie mondiale connaît actuellement un ralentissement sévère en raison d’une contrainte de crédit croissante qui empêche les économies du monde entier de réaliser leurs ambitions de développement. Les infrastructures restent une priorité majeure pour combler les écarts de développement dans le scénario actuel, car elles sont considérées comme omnipotentes et capables de sortir les économies de la tourmente financière. Les gouvernements du monde entier injectent de l’argent dans les infrastructures physiques et sociales pour accroître la demande de produits et de services en créant des emplois.

Informations sur le marché basées sur les types

En fonction du type, le marché des équipements de protection antichute est segmenté en produits souples, produits rigides, kits de sauvetage, ceintures de sécurité, harnais de sécurité complets et autres. Le segment des produits rigides est le segment leader car il offre une sécurité renforcée. De plus, l'innovation croissante dans ce segment est censée stimuler la croissance du marché. Cependant, la demande croissante de systèmes de harnais de sécurité complets de tous les utilisateurs industriels aide le segment à croître au TCAC le plus élevé.

Informations sur le marché basées sur les applications

En termes d'application, le marché des équipements de protection antichute est divisé en construction, pétrole et gaz, transport, énergie et services publics et télécommunications. Pour assurer le bon déroulement des activités et maintenir la sécurité des travailleurs, chaque industrie a besoin d'équipements de protection antichute dans ses installations. En 2020, le segment de la construction représentait la plus grande part de marché.

Les acteurs opérant sur le marché des équipements de protection antichute adoptent des stratégies telles que les fusions, les acquisitions et les initiatives de marché pour maintenir leurs positions sur le marché. Quelques développements des principaux acteurs sont énumérés ci-dessous :

- En mai 2021, Pure Safety Group a regroupé sa gamme de marques de sécurité en hauteur (Stronghold by PSG, Ty-Flt, Checkmate et HART) sous la bannière Guardian. Cette expansion fait désormais de Guardian la plus grande marque indépendante de protection et de prévention des chutes au monde.

- 3M Fall Protection a inventé et inclus des sangles de sécurité contre les traumatismes par suspension sur tous les harnais 3M DBI SALA certifiés ANSI et CSA d'ici la fin mars 2021.

Aperçu régional du marché des équipements de protection contre les chutes

Les tendances et facteurs régionaux influençant le marché des équipements de protection antichute tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des équipements de protection antichute en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des équipements de protection contre les chutes

Portée du rapport sur le marché des équipements de protection contre les chutes

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2021 | 2,93 milliards de dollars américains |

| Taille du marché d'ici 2028 | 4,61 milliards de dollars américains |

| Taux de croissance annuel moyen mondial (2021-2028) | 6,4% |

| Données historiques | 2019-2020 |

| Période de prévision | 2022-2028 |

| Segments couverts | Par type

|

| Régions et pays couverts | Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché des équipements de protection antichute connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des équipements de protection contre les chutes sont :

- 3M

- Technologie de chute

- Production de French Creek

- En première ligne

- Protection antichute Guardian

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des équipements de protection contre les chutes

Le marché mondial des équipements de protection contre les chutes a été segmenté comme indiqué ci-dessous :

Par type

- Produits textiles

- Biens durables

- Kits de secours

- Ceintures de sécurité

- Harnais de sécurité complet

- Autres

Par application

- Construction

- Transport

- Pétrole et gaz

- Exploitation minière

- Énergie et services publics

- Télécom

- Autres

Par géographie

Amérique du Nord

- NOUS

- Canada

- Mexique

Europe

- France

- Allemagne

- Italie

- ROYAUME-UNI

- Russie

- Reste de l'Europe

Asie-Pacifique (APAC)

- Chine

- Inde

- Corée du Sud

- Japon

- Australie

- Reste de l'APAC

Moyen-Orient et Afrique (MEA)

- Afrique du Sud

- Arabie Saoudite

- Émirats arabes unis

- Reste de la MEA

Amérique du Sud (SAM)

- Brésil

- Argentine

- Reste de SAM

Profils d'entreprise

- 3M

- Technologie de chute

- Production de French Creek

- En première ligne

- Protection antichute Guardian

- Sécurité Kee

- KwikSécurité

- Sécurité MSA Incorporated

- Honeywell International Inc.

- Protection antichute Tritech

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWO

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Questions fréquemment posées

3M; Falltech; French Creek Production; Frontline; Gravitec Systems, Inc.; Guardian Fall (Pure Safety Group, Inc.); Honeywell International Inc; Kwiksafety; Kee Safety, Inc; and Msa are the key companies in the fall protection equipment market.

APAC led the global fall protection equipment market with the highest growth rate in 2020, followed by North America and Europe. In the coming years, the market in Asia would witness a massive growth in demand for fall protection equipment, owing to the rise in population of countries in the region, coupled with various government initiatives to attract private investments in construction and infrastructure development. Moreover, the surging number of commercial and industrial end users is inclined to use fall protection equipment to keep their workers safe from hazards.

The construction segment led the fall protection equipment market globally with a highest market share in the year 2020 and is expected to continue its dominance during the forecast period till 2028. The construction sector is the most common end user of fall prevention systems, as it has the highest annual injury rate. The global construction sector is responsible for more than a third of all workplace deaths each year. Due to a large number of planned building projects, the US is one of the most important countries for safety equipment on construction sites. As mandated by administrations in several states across the US, the use of fall protection systems to reduce the number of accidents and fatalities during building activities is expected to fuel the growth of this market. The US country is one of the major construction industry markets, with a spending worth of ~1.5 trillion in June 2021. Recent advancements in construction technologies and rising demand for worker safety solutions have driven the market growth. However, the shutdown of construction projects and delayed residential projects investments due to the COVID - 19 pandemic has severely impacted the market growth as the demand for fall protection equipment has been lowered.

The fall protection equipment market by product type was led by hard goods which held a market share of 36.8% in the year 2020 and is anticipated to continue its dominance during the forecast period to account for 37.8% share of the fall protection equipment market by the year 2028. The development of hard good (those made from metal or other non-synthetic materials) fall equipment is focused on adaptability and efficiency. Anchors, carabiners, rope grabs, and retractable blocks are examples of hard goods. Anchors are extremely capable of supporting intended weights and assisting in the prevention of falls. The use of hard goods is important in the mining sector since it increases worker flexibility and convenience. The growth of the mining sector in the US is expected to boost the demand for these products. Rope grabs are the ideal alternative for vertical and horizontal lifeline systems used in construction and mining industries because they enable level and inertial locking to prevent the fall. Today's hard goods have various capacities, and they reduce the amount of equipment required at the workplace. Self-retracting lifelines with a built-in rescue system are a newer addition. Depending on the surroundings, these devices, which may be programmed to automatically lower a worker in the event of a fall, can obviate the need for a separate rescue system on site.

With the rising speed and progress of structure and building design, the problems and hazards associated with it are also increasing. To maintain safety requirements, the safety equipment must also be upgraded over time. As a result of changing patterns, governments across the world have revised their fall protection requirements. Current fall prevention equipment has undergone adjustments as a result of the revised standard. The standard mandates that gate strength requirements for snap hooks and carabiners be doubled to 3,600 pounds in all directions of possible loading. The old ANSI standard demanded 220 pounds on the gate's face and 350 pounds on the gate's side, even though many manufacturers were already fulfilling the new standard's criteria when it was approved. To optimize fall arrest, harnesses must now include D-rings in the front and rear, and twin-leg lanyards must be tested before use and have cautions on product labels on how to use them appropriately. As a result, fall protection equipment suppliers will see creating adjustable fall protection equipment as a prime opportunity.

The rise in construction activities around the world is a primary element driving the fall protection equipment market. As Asian countries such as India and China are witnessing significant population growth, the demand for commercial and residential spaces in these countries is constantly expanding. The global economy is currently experiencing a severe slowdown due to a developing credit constraint that is causing economies around the world to miss their developmental ambitions. Infrastructure remains a major priority for addressing developmental gaps in the current scenario, as it is seen as omnipotent and capable of bringing economies out of financial upheaval. Governments all over the world are pumping money into physical and social infrastructure to increase the demand for products and services by creating jobs. During COVID, Construction is more important than ever in this difficult time. The sector has played a crucial role in responding to the crisis and in the recovery, from erecting hospitals in a matter of days to giving lifesaving equipment. The construction industry accounts for 13% of global GDP, and the increasing worker availability could assist recovery while tackling the most pressing issues. Despite challenges in 2020, the oil industry is finally starting to recover. As a consequence, the economy is boosting. The aforementioned factors are expected to fuel the need for fall protection equipment worldwide.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of companies - Fall Protection Equipment Market

- 3M

- Falltech

- French Creek Production

- Frontline

- Guardian Fall Protection

- Kee Safety

- KwikSafety

- MSA Safety Incorporated

- Honeywell International Inc.

- Tritech Fall Protection

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenez un échantillon gratuit pour ce rapport

Obtenez un échantillon gratuit pour ce rapport