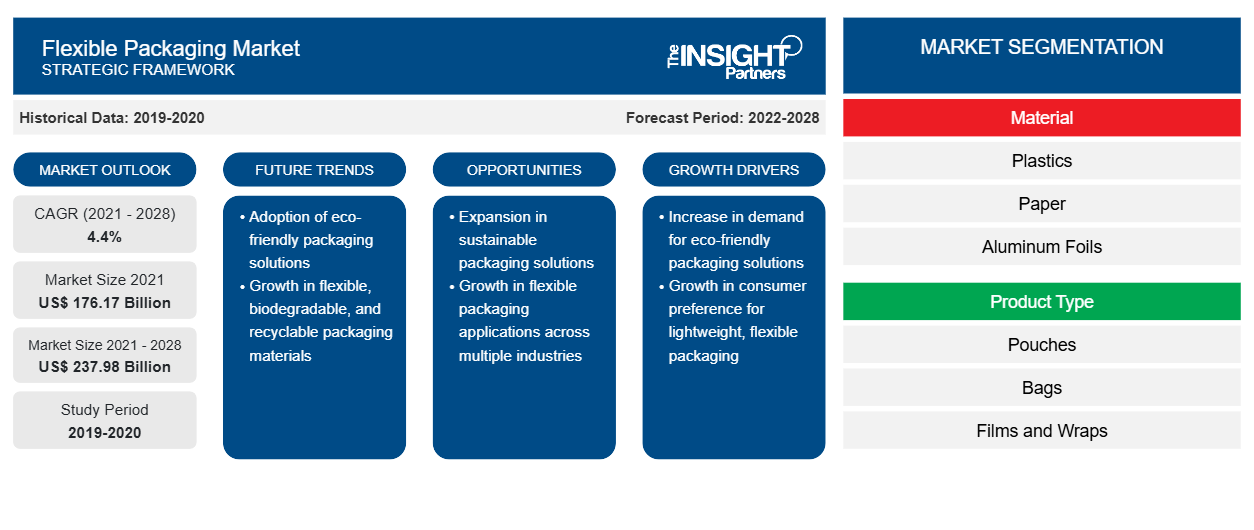

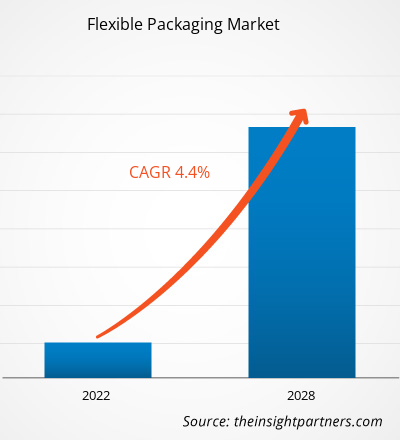

Le marché des emballages flexibles devrait atteindre 237 975,67 millions USD d'ici 2028, contre 176 173,61 millions USD en 2021 ; il devrait croître à un TCAC de 4,4 % de 2021 à 2028.

Les emballages souples comprennent les doublures, les sachets, les joints, les sachets d'échantillons et les sacs. Ils peuvent être composés de film, de plastique, de papier, de feuille, etc. Ils sont utilisés pour divers produits alimentaires et boissons, produits de consommation, CD de musique, produits pharmaceutiques, progiciels informatiques et nutraceutiques. La durabilité offerte par les emballages souples permet aux fabricants d'imprimer des designs personnalisés accrocheurs et de haute qualité, qui augmentent la visibilité du produit dans un environnement de vente au détail.

En 2020, l'Asie-Pacifique détenait la plus grande part de revenus du marché mondial des emballages souples . Selon la Coopération économique Asie-Pacifique, l'Australie est l'un des pays développés de l'APAC. Le secteur de l'alimentation et des boissons est la plus grande industrie manufacturière d'Australie, représentant 32 % du chiffre d'affaires manufacturier total du pays. Selon le rapport 2019 sur l'état de l'industrie de l'alimentation et des boissons de l'Australian Food and Grocery Council, le secteur de l'alimentation et des boissons, de l'épicerie et des produits frais représente 85,32 milliards USD. L'industrie est composée de 15 000 entreprises de toutes tailles qui emploient plus de 273 000 personnes. L'industrie croissante de l'alimentation et des boissons stimule le marché de l'emballage souple.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

- Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Impact de la pandémie de COVID-19 sur le marché des emballages flexibles

La fermeture des unités de fabrication, les difficultés d’approvisionnement en matières premières et les restrictions logistiques ont eu un impact négatif sur le marché des emballages souples. Cependant, la COVID-19 a provoqué une augmentation massive des livraisons de produits d’épicerie en ligne. En outre, les industries des aliments et des boissons emballés connaissent une augmentation de la demande d’aliments et de boissons de longue conservation, y compris les produits laitiers, alors que les consommateurs se précipitent pour remplir les garde-manger. Des millions de ménages ont commencé à acheter des produits d’épicerie en ligne pour les récupérer ou les livrer à domicile, et beaucoup continueront à utiliser les options de commerce électronique une fois la crise passée. En outre, la demande croissante de produits alimentaires transformés tels que les aliments de commodité qui utilisent généralement des matériaux d’emballage de qualité supérieure à haute barrière pour une durée de conservation plus longue est sur le point d’encourager le besoin d’emballages souples.

Informations sur le marché

Augmentation de la consommation d'aliments et de boissons transformés

Selon le rapport d'Anu Food Brazil, le chiffre d'affaires total du secteur brésilien de la vente au détail de produits alimentaires s'élevait à 96 milliards de dollars US en 2019. L'industrie des aliments et des boissons au Brésil a enregistré une croissance de 6,7 % en 2019 et de 12,8 % en 2020. Le marché des aliments surgelés prospère au Brésil. Le marché des aliments surgelés prospère au Brésil en raison de l'expansion de la classe moyenne, de l'augmentation du pouvoir d'achat et de l'augmentation du nombre de personnes travaillant à temps plein. Par conséquent, la préférence croissante des consommateurs pour les aliments prêts à consommer stimule le marché des emballages flexibles.

Informations sur l'industrie des matériaux

En fonction du matériau, le marché mondial des emballages souples est segmenté en plastiques, papier, feuilles d'aluminium, etc. Le segment des plastiques détenait la plus grande part du marché mondial des emballages souples en 2020. Les emballages en plastique souple impliquent différents types de matières plastiques utilisées pour l'emballage de différents produits. Le type de matériau utilisé dans l'emballage dépend de l'application et du type de produit à emballer. En général, des matières plastiques, telles que le polyéthylène, le polypropylène, le polystyrène et le polychlorure de vinyle, sont utilisées dans les emballages en plastique souple. L'emballage souple est considéré comme le moyen le plus pratique et le plus économique de conserver, de distribuer et d'emballer des aliments, des boissons, des produits pharmaceutiques et plusieurs consommables.

Quelques-uns des principaux acteurs opérant sur le marché mondial de l'emballage flexible comprennent Amcor plc, Huhtamaki, Mondi, Berry Global Inc., Sealed Air, Sonoco Products Company, Coveris, Constantia Flexibles, Flexpak services et Transcontinental Inc. Les acteurs opérant sur le marché sont fortement concentrés sur le développement d'offres de produits de haute qualité et innovantes pour répondre aux exigences des clients.

Aperçu régional du marché des emballages flexibles

Les tendances régionales et les facteurs influençant le marché de l’emballage flexible tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché de l’emballage flexible en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des emballages flexibles

Portée du rapport sur le marché des emballages flexibles

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2021 | 176,17 milliards de dollars américains |

| Taille du marché d'ici 2028 | 237,98 milliards de dollars américains |

| Taux de croissance annuel moyen mondial (2021-2028) | 4,4% |

| Données historiques | 2019-2020 |

| Période de prévision | 2022-2028 |

| Segments couverts | Par matériau

|

| Régions et pays couverts | Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

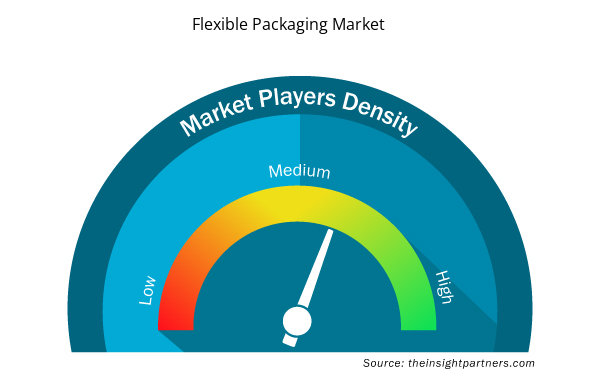

Densité des acteurs du marché de l'emballage souple : comprendre son impact sur la dynamique commerciale

Le marché des emballages flexibles connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché de l'emballage flexible sont :

- Amcor plc

- Huhtamaki

- Mondi

- Berry Global Inc.

- Air scellé

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché de l'emballage flexible

Rapports en vedette

- Tendances progressistes dans le secteur de l'emballage flexible pour aider les acteurs à développer des stratégies efficaces à long terme

- Stratégies de croissance des entreprises adoptées par les acteurs du marché dans les pays développés et en développement

- Analyse quantitative du marché de l'emballage flexible de 2019 à 2028

- Estimation de la demande mondiale en emballages souples

- Analyse des cinq forces de Porter pour illustrer l'efficacité des acheteurs et des fournisseurs opérant dans l'industrie

- Développements récents pour comprendre le scénario concurrentiel du marché

- Tendances et perspectives du marché ainsi que facteurs qui stimulent et freinent la croissance du marché de l'emballage flexible

- Aide à la prise de décision en mettant en évidence les stratégies de marché qui sous-tendent l'intérêt commercial, conduisant à la croissance du marché

- La taille du marché de l'emballage flexible à différents niveaux

- Aperçu détaillé et segmentation du marché, ainsi que de la dynamique du secteur

- Taille du marché de l'emballage flexible dans diverses régions avec des opportunités de croissance prometteuses

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWO

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

- Antibiotics Market

- Aircraft Landing Gear Market

- Lyophilization Services for Biopharmaceuticals Market

- 3D Mapping and Modelling Market

- Greens Powder Market

- Medical Audiometer Devices Market

- Batter and Breader Premixes Market

- Advanced Planning and Scheduling Software Market

- Foot Orthotic Insoles Market

- Authentication and Brand Protection Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Questions fréquemment posées

The major players operating in the global flexible packaging market are Amcor plc; Huhtamaki; Mondi; Berry Global Inc.; Sealed Air; Sonoco Products Company; Coveris; Constantia Flexibles; Flexpak services; Transcontinental Inc.

In 2020, Asia-Pacific accounted for the largest share of the global flexible packaging market. The market for flexible packaging across Asia-Pacific has witnessed notable growth owing to the rapidly expanding packaging industry, growth of the food retail sector, and rising consumer awareness about sustainable packaging solutions across the region. The foodservice sector in Asia-Pacific is rapidly expanding owing to rapid economic growth, growth of the tourism sector, improving lifestyles of consumers, and rising disposable income levels. The region's food & beverage market is witnessing significant growth due to ample availability of various varieties of functional food and drinks and their growing demand among the millennial population. According to The Annual Report on Catering Industry Development of China 2019 (ARCIDC), China is the second-largest food and beverage economy across the world. The food and beverage revenue in China was over US$ 620 billion in 2018. The report further states that the online sales of food and beverages increased by US$ 44 billion from 2011 to 2017. Hence the growing demand for food & beverage in the region drives the flexible packaging market.

In 2020, the plastics segment accounted for the largest market share. Flexible plastic packaging delivers a wide range of protective properties while ensuring a minimum amount of material being used. It is made from high-grade polymers such as PVC, polyamide, polypropylene, and polyethylene. These polymers are FDA-approved and are contaminant-free. They can take on extreme temperatures and pressures. Furthermore, they also act as a protective layer for the food and beverage by protecting it from micro-organisms, UV rays, moisture, and dust.

The bags segment held the largest share of the market in 2020. These are commonly made of metal foil, plastic, and occasionally, paper. These bags are used in various packaging applications including food products, confectionery products, biscuits, coffee, powdered milk, snacks, etc. Also, these bags are easy for transport, material savings, and repeated use.

In 2020, Asia-Pacific is the fastest-growing region in the global flexible packaging market. According to Asia-Pacific Economic Cooperation, Australia is one of the developed countries in APAC. The food & beverage sector is Australia’s largest manufacturing industry, accounting for 32% of the country’s total manufacturing turnover. According to the Australian Food and Grocery Council’s 2019 State of the Industry Report, the food & beverage, grocery, and fresh produce sector is worth $122 billion. The industry is made up of 15,000 businesses of all sizes that employ over 273,000 people. The growing food & beverage industry drives the flexible packaging market.

The food and beverages segment held the largest share of the market in 2020. Flexible packaging is widely used for packaging food products such as eggs, fresh fruits and vegetables, and salad, among others. Flexible packaging protects products from moisture, UV rays, mold, dust, and other environmental contaminants that can negatively affect the product, thereby maintaining its quality and extending its shelf life. Also, with the growth of online food delivery channels the demand for flexible, affordable, and recyclable packaging is also on a rise.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Flexible Packaging Market

- Amcor plc

- Huhtamaki

- Mondi

- Berry Global Inc.

- Sealed Air

- Sonoco Products Company

- Coveris

- Constantia Flexibles

- Flexpak services

- Transcontinental Inc.

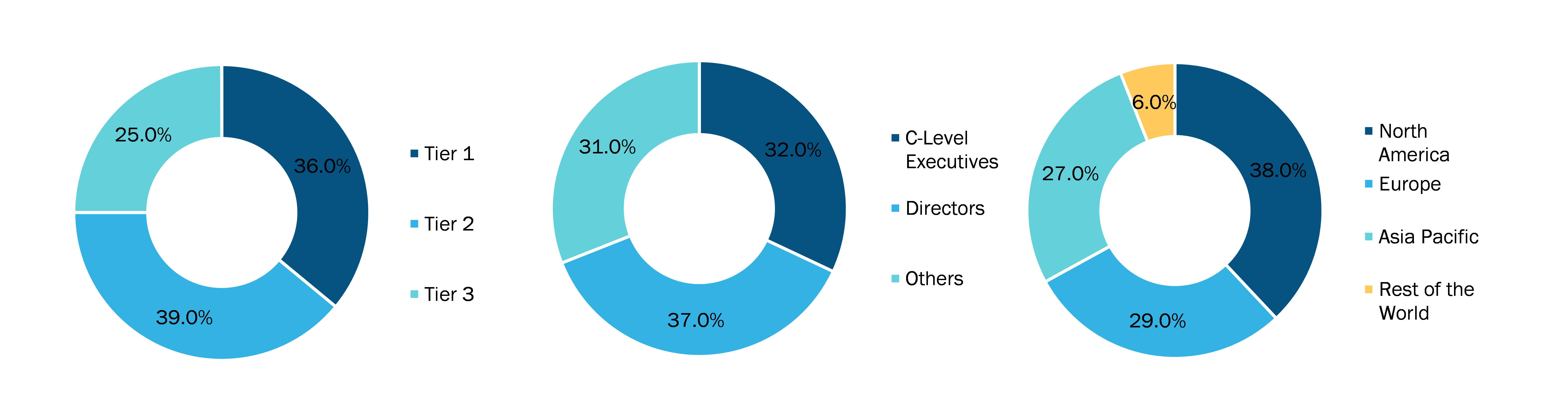

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Obtenez un échantillon gratuit pour ce rapport

Obtenez un échantillon gratuit pour ce rapport